Market Overview

The Qatar air crane helicopter market is valued at approximately USD ~ million, driven by its essential role in the offshore oil & gas sector, large infrastructure projects, and disaster response. Qatar’s growing energy sector, supported by the rising demand for emergency services, has fueled the need for specialized heavy-lift helicopters. With major ongoing and upcoming projects, such as the expansion of the North Field and significant infrastructure developments, the market is poised to expand. Regulatory frameworks, such as the Civil Aviation Authority’s (CAA) aviation safety regulations and environmental requirements, further drive operational standards in this sector.

Qatar, particularly Doha, dominates the market due to its strategic location in the Gulf and its pivotal role in the global energy market. The country’s significant investments in infrastructure, oil & gas projects, and emergency management drive the demand for air crane helicopters. Additionally, other Gulf nations like the UAE and Saudi Arabia are key players, but Qatar’s market is more concentrated due to its targeted development strategies in energy infrastructure and civil engineering, leading to sustained demand for specialized aerial lifting services.

Market Segmentation

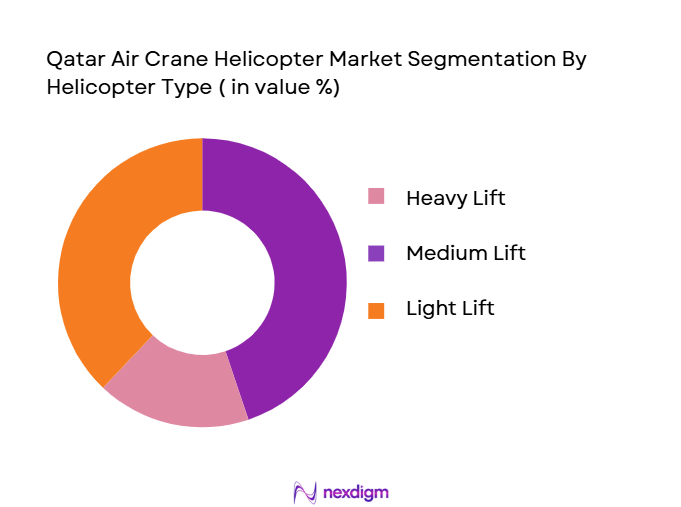

By Helicopter Type

The Qatar air crane helicopter market is segmented by helicopter type into heavy-lift, medium-lift, and light-lift helicopters. Heavy-lift helicopters dominate the market, primarily due to their unparalleled capability to carry extremely heavy loads to remote and challenging locations, a necessity for the oil and gas industry, and large construction projects. These helicopters, such as the CH-47 Chinook and Sikorsky S-64, have seen increased demand for lifting large equipment like generators, turbines, and construction materials that cannot be transported by conventional means. The versatility of heavy-lift helicopters, coupled with their critical role in ensuring operational efficiency for major projects, has made them the most sought-after in the region.

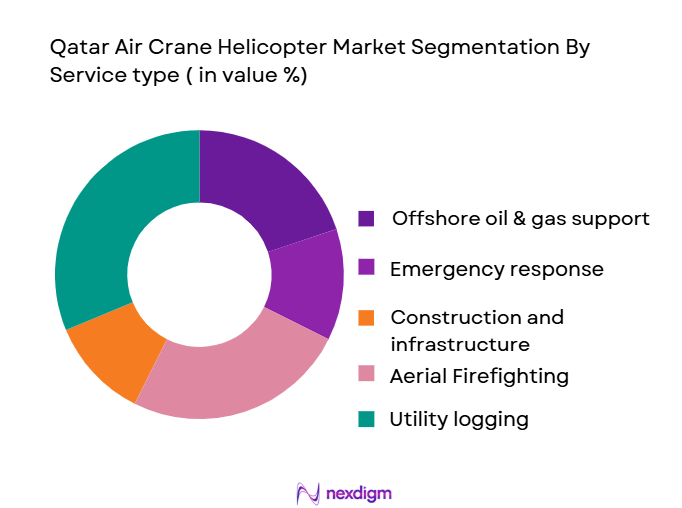

By Service Type

The service type segmentation includes offshore oil & gas support, construction and infrastructure, aerial firefighting, emergency response, and utility/logging. Offshore oil and gas support is the dominant segment, driven by Qatar’s vast offshore oil fields and its strategic role in global energy supply chains. These helicopters are essential for transporting workers, equipment, and supplies to offshore platforms, which are often located far from shore in the Persian Gulf. The growing number of oil field expansions in Qatar and the surrounding region ensures continuous demand for these services, making it the primary service type for air crane helicopter operators in the country.

Competitive Landscape

The Qatar air crane helicopter market is concentrated around a few major players, both international and regional. Companies like Gulf Helicopters, a key local player, dominate the market due to their established presence in Qatar’s aviation sector. International players such as Airbus Helicopters, Sikorsky, and Bell Helicopter also compete for major contracts, leveraging their advanced technology and experience in handling complex air crane operations. The competition is mainly centered around service quality, fleet size, and the ability to handle specialized heavy-lift tasks.

| Company Name | Establishment Year | Headquarters | Fleet Size | Market Focus | Specialization | Safety Standards Compliance |

| Gulf Helicopters | 1970 | Doha, Qatar | ~ | ~ | ~ | ~ |

| Sikorsky Aircraft | 1923 | USA | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | USA | ~ | ~ | ~ | ~ |

| Kaman Corporation | 1945 | USA | ~ | ~ | ~ | ~ |

Qatar Air Crane Helicopter Market Analysis

Growth Drivers

Offshore Oil & Gas Lift Requirements

Qatar’s oil and gas sector remains a foundational pillar of the national economy, with total petroleum and other liquids production reaching approximately ~ million barrels per day in current reporting, supported by both crude and condensate output essential for global energy supply chains and export commitments. The shared North Field gas complex supplies vast quantities of feedstock that often require offshore platforms and subsea infrastructure support, necessitating heavy‑lift aerial operations for transporting equipment, modules, and maintenance crews to remote rigs. The reliance on helicopter logistics for offshore activity is underscored by sustained high production, which drives continual demand for air crane services capable of handling large payloads above water.

Mega Project Infrastructure Demand

Qatar’s large‑scale infrastructure initiatives, including expansions at port facilities, energy terminals, and industrial zones, involve extensive civil engineering and heavy equipment installation. For example, infrastructure investment contributes significantly to the country’s GDP—the latest available World Bank data indicates that Qatar maintains one of the highest GDP per capita figures in the region, reflecting ongoing capital projects that rely on heavy‑lift support. Additionally, the country’s ~ registered domestic heliports serve as critical nodes for helicopter operations, facilitating rapid deployment of materials and personnel to construction sites inaccessible by road, especially in desert terrains or offshore transition zones, thereby boosting air crane activity.

Market Challenges

High Capital Expenditure & Operational Expenditure

Acquiring and operating heavy‑lift air crane helicopters entails substantial capital expenditure, with modern platforms often valued in the tens of millions of dollars and requiring continuous maintenance regimes due to intensive usage patterns. In addition to acquisition costs, operators must manage ongoing operational expenditures associated with fuel, specialized ground support equipment, and highly skilled maintenance crews. Support infrastructure such as helipads and dedicated maintenance facilities further increases total cost burdens. These high fixed and variable costs limit the number of operators and can delay fleet expansion or modernization, especially for smaller local service providers with constrained financial capacity.

Pilot Availability

A critical operational constraint in Qatar’s air crane helicopter sector is the limited number of certified pilots qualified to execute complex offshore and heavy‑lift missions. Current aviation ecosystem insights indicate there are approximately ~ certified helicopter pilots and rescue technicians, a workforce size that is strained by increasing demand from both commercial and emergency service sectors. This shortage can lead to scheduling bottlenecks, elevated labor costs due to competition for qualified personnel, and potential delays in contract fulfillment. The challenge is compounded by the specialized training required for heavy‑lift operations, which involves advanced skill sets beyond basic rotorcraft certification.

Opportunities

Fleet Expansion

Current macroeconomic indicators reveal that Qatar’s infrastructure and energy sectors continue to advance, sustained by high volumes of petroleum liquids production and export activity. This expanding economic activity presents opportunities for helicopter operators to increase their fleet counts, particularly in specialized heavy‑lift configurations. The presence of ~ domestic heliports suggests an existing foundation for expanded operations, not only for offshore support but also for inland logistics applications tied to rapid urban development zones. Increasing fleet size with modern airframes enhances service capacity and response times for both scheduled industrial lifts and unplanned emergency operations, making fleet expansion a strategic growth avenue.

Specialized Lift Contracts

There is strong potential for operators to secure long‑term contracts with major energy and infrastructure players based in Qatar, given ongoing offshore activity and upcoming expansion projects. The high volume of hydrocarbon liquids production, combined with large‑scale construction programs and institutional demand for emergency readiness, underpins recurring requirements for heavy‑lift missions. By negotiating multi‑year agreements for dedicated air crane services, operators can secure steady revenue streams and optimize resource allocation for maintenance, crew scheduling, and operational planning. Such contracts also strengthen operator positioning against seasonally variable demand cycles.

Future Outlook

Over the next decade, the Qatar air crane helicopter market is expected to experience steady growth. This growth will be largely driven by continued investments in infrastructure, expansion of oil & gas projects, and the increasing need for rapid disaster response capabilities. Technological advancements in helicopter design and operational efficiency will further improve the attractiveness of air crane services, while government regulations aimed at ensuring higher operational standards and safety will continue to influence market dynamics. The market is expected to grow at a compound annual growth rate (CAGR) of ~% from 2026 to 2035, driven by both regional demand for heavy-lift services and international expansion.

Major Players in the Market

- Gulf Helicopters

- Sikorsky Aircraft

- Airbus Helicopters

- Bell Helicopter

- Kaman Corporation

- Erickson Incorporated

- Columbia Helicopters

- Lockheed Martin

- Russian Helicopters

- Textron Aviation Inc.

- High Performance Helicopters Corp.

- Helicopter Corporation Ltd.

- Bristow Group

- Abu Dhabi Aviation

- Falcon Aviation Services

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Civil Aviation Authority, Ministry of Transport and Communications, Ministry of Energy and Industry)

- Oil and Gas Operators

- Infrastructure Development Companies

- Emergency Response Services

- Large-scale Construction Contractors

- Helicopter Service Operators

- Insurance Firms (Aviation and Heavy-Lift Insurance)

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the key variables in the air crane helicopter market, including helicopter fleet composition, market demand by industry (oil and gas, construction, etc.), and technological advancements. Secondary research sources, such as industry reports and databases, are used to define these variables and assess market drivers and constraints.

Step 2: Market Analysis and Construction

Market size estimates are compiled based on historical data and projected growth patterns. This includes assessing demand from key sectors like offshore oil & gas and infrastructure, and understanding the operational costs associated with air crane services. This phase involves in-depth analysis of market penetration and service provider presence.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through structured interviews to validate the findings from desk research. Experts from helicopter service operators, oil & gas companies, and aviation regulators provide operational insights that help refine market models and validate revenue and growth projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the information from primary and secondary research and expert consultations. This includes refining segment-specific insights, competitor analysis, and future outlook based on real-time data from industry operators. The final report is developed with a focus on actionable insights for stakeholders in the air crane helicopter market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions [Heavy‑lift Helicopter Definitions, Air‑Crane Operational Parameters], Abbreviations, Market Sizing Approach [Revenue & Flight Hours], Data Triangulation Method, Primary and Secondary Data Sources, Limitations)

- Definition and Scope

- Industry Genesis and Evolution

- Historical Adoption of Air Crane Helicopter

- Technology in Qatar & Middle East

- Helicopter Lift Value Chain and Service Delivery Ecosystem

- Airspace Regulatory Environment

- Infrastructure & Support Helipads

- Growth Drivers

Offshore Oil & Gas Lift Requirements

Mega Project Infrastructure Demand

Extreme Weather

Response Needs - Market Challenges

High CapEx & OpEx

Pilot Availability

Regulatory Compliance - Opportunities

Fleet Expansion

Specialized Lift Contracts

Technological Upgrades

Electrification/Hybrid Tech - Emerging Trends

AI‑Assisted Lift Precision

Predictive Maintenance

Extended Range Operations - Government Regulations & Safety Standards

- SWOT Analysis (Qatar Air Crane Market

- Porter’s Five Forces

- Ecosystem Mapping

- By Market Value, 2020-2025

- By Fleet Count, 2020-2025

- By Flight Hours ,2020-2025

- By Average Rate Structures , 2020-2025

- By Helicopter Type (In value %)

Heavy‑Lift

Medium‑Lift

Light‑Lift - By Endurance Class (In value %)

Up to 5,000 ft Orbits

Up to 10,000 ft Orbits

Above 10,000 ft Orbits

- By Lift Capacity (In value %)

Up to 3,000 lb

3,001–6,000 lb

6,001–12,000 lb

12,001+ lb - By Service Type (In value %)

Offshore Oil & Gas Support

Construction & Infrastructure Lift

Aerial Firefighting, Emergency & Disaster Response

Logging & Utility Support - By Operator Type (In value %)

Commercial Contract Operators

Government/Defense Units,

Shared Services - By Helicopter Ownership Model (In value %)

Owned Fleet

Lease & Contract

Wet Lease

- Market Share by Deployment (Fleet Size & Flight Hours)—2024/Latest

- Cross‑Comparison Parameters (Company Ownership & Structure, Fleet Composition [Capacity/Endurance], Services Offered, Pricing/Rate Cards, Operational Footprint [Domestic/Offshore], Contract Backlog, Compliance & Safety Ratings, Maintenance & MRO Capabilities)

Competitive Benchmarking by Technical & Operational Performance - SWOT Analysis of Key Players

- Pricing Analysis Basis SKUs for Major Players in the ACMI Market

- Detailed Profiles of Key Competitors

Aircrane, Inc.

Erickson Incorporated

Airbus Helicopters S.A.S.

Columbia Helicopters, LLC

KAMAN Corporation

Lockheed Martin Corporation

Russian Helicopters

Textron Aviation Inc.

High Performance Helicopters Corp.

Helicopter Corporation Ltd.

Bristow Group

Abu Dhabi Aviation

Gulf Helicopters Company

Falcon Aviation Services (VIP & Utility Services

ERA Helicopters

- Utilization Patterns (Oil & Gas, Construction, Emergency Response, Energy Infrastructure)

- Procurement Policies (Government Procurement, OEM Long‑Term Contracts)

- Budget Allocations and Cost Structure Benchmarks

- Pain Points & unmet needs

- Decision Making and Procurement Cycles

- By Market Value (USD) ,2026-2035

- By Fleet Count ,2026-2035

- By Flight Hours & Utilization ,2026-2035

- By Average Rate Structures, 2026-2035