Qatar Airborne SATCOM Market Overview

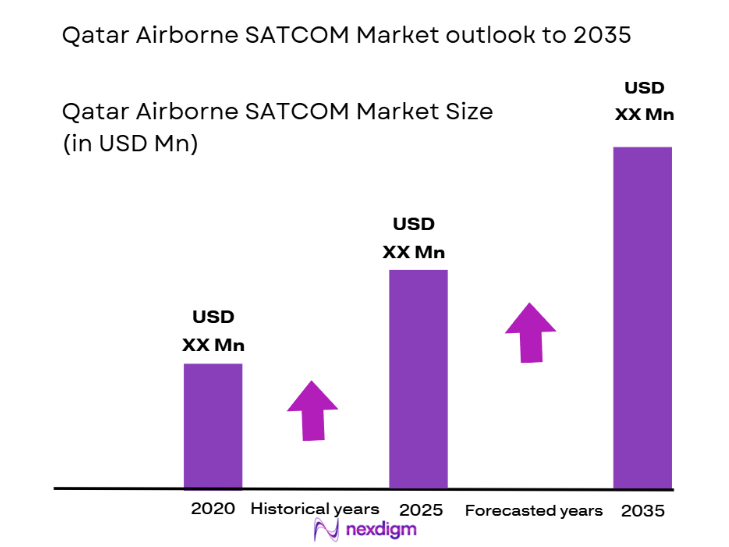

The Qatar Airborne Satcom market is expected to grow significantly, with a projected market size reaching USD ~ million in 2025. The market’s expansion is primarily driven by increasing demand for secure communication systems in military and defense applications, as well as rising connectivity needs in commercial aviation. Qatar’s robust investments in defense infrastructure, coupled with the continuous growth in air traffic, drive the demand for advanced airborne satellite communication technologies. The military sector’s modernization plans, alongside the growing focus on in-flight connectivity for both passenger and cargo aircraft, further fuel market growth.

Qatar, being a central hub for aviation and defense in the Middle East, is a dominant player in the airborne satcom market. The country’s significant investments in infrastructure, particularly in aviation and military sectors, position it as a leader. Cities such as Doha serve as key operational hubs for both commercial and military aviation, attracting global aerospace companies. Qatar’s strategic location, along with its political and economic stability, has led to its dominance in the Middle Eastern airborne satellite communication market, further amplified by government initiatives and procurement projects targeting satellite-based communication systems.

Market Segmentation

By System Type

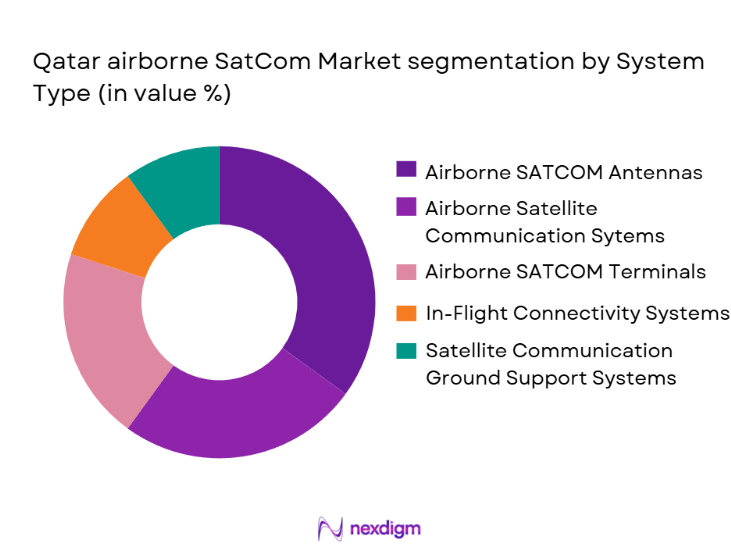

The Qatar Airborne Satcom market is segmented by system type into Airborne Satellite Communication Systems, Airborne SATCOM Antennas, Airborne SATCOM Terminals, In-Flight Connectivity Systems, and Satellite Communication Ground Support Systems. Among these, Airborne SATCOM Antennas hold a dominant share in the market. This dominance can be attributed to the increasing adoption of satellite antennas across military, commercial, and private aviation sectors, driven by the need for high-speed data transmission and robust connectivity. Additionally, advancements in antenna technology, such as phased-array antennas, are making these systems more efficient and effective for both aircraft communication and surveillance operations.

By Platform Type

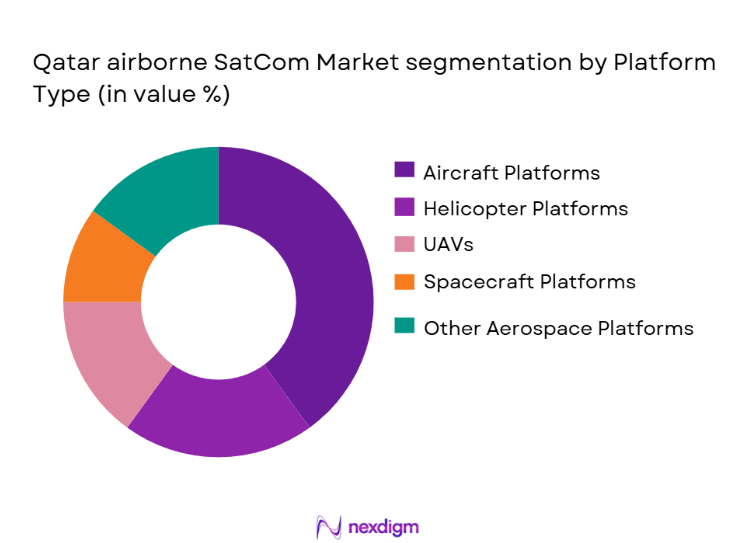

The market is also segmented by platform type, which includes Aircraft Platforms, Helicopter Platforms, UAV Platforms, Spacecraft Platforms, and Other Aerospace Platforms. Aircraft Platforms dominate this segment, accounting for the largest market share. This is largely due to the increasing demand for satellite communication systems in both commercial and military aircraft, where secure and reliable in-flight communication is critical. Additionally, the rapid expansion of commercial aviation in Qatar and neighboring regions has driven the demand for advanced satellite communication systems integrated into aircraft platforms.

Competitive Landscape

The Qatar Airborne Satcom market is dominated by key players who have a strong presence due to their extensive technology portfolio, established brand loyalty, and wide geographic reach. The competitive landscape features a mix of global aerospace and defense companies, including both regional and international players. These companies are engaged in continuous innovation, aiming to meet the growing demand for high-bandwidth satellite communication solutions for military, commercial, and private aviation sectors.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technological Innovation | Regional Presence | Clientele |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | USA | ~ | ~ | ~ | ~ |

| Viasat | 1986 | USA | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | UK | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | USA | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Rising Demand for In-Flight Connectivity

The growing demand for high-speed internet and communication systems in commercial aircraft is driving the adoption of airborne satcom systems. As passenger expectations for better in-flight services increase, airlines are investing heavily in satellite communication technology to improve connectivity.

Government Defense Spending

Increased defense budgets in Qatar and neighboring countries are boosting the demand for secure satellite communication systems for military operations. The ongoing modernization of military fleets and the need for advanced communication solutions are key growth drivers in the region.

Market Challenges

High Cost of Implementation

The initial investment required for airborne satcom systems, including satellite terminals and antennas, is relatively high, making it a challenge for smaller aviation operators and companies with limited budgets to adopt these systems.

Regulatory Hurdles

The regulatory environment for satellite communication can be complex, especially in terms of licensing, certification, and compliance with international aviation and defense standards. These challenges can delay the deployment and integration of airborne satcom systems.

Opportunities

Advancements in Low Earth Orbit (LEO) Satellites

The development and launch of low earth orbit (LEO) satellites provide a significant opportunity for the airborne satcom market. These satellites offer lower latency, better coverage, and reduced costs, which can make airborne communication more efficient and affordable.

Expansion of Commercial Aviation

As Qatar and neighboring regions continue to expand their commercial aviation networks, the demand for reliable satellite communication systems on aircraft will increase. This provides an opportunity for companies to tap into the growing airline industry and offer advanced communication services.

Competitive Landscape

The Qatar Airborne Satcom market is characterized by a few dominant players such as Thales Group, L3 Technologies, and Viasat. These players hold significant market share due to their advanced product offerings, innovation, and extensive global presence. The market sees intense competition as these players continue to innovate and expand their portfolio to cater to both military and commercial aviation sectors. Companies are also investing heavily in R&D to provide advanced solutions that ensure secure and uninterrupted communication in airborne operations.

Over the next five years, the Qatar Airborne Satcom market is expected to show substantial growth, driven by the increasing demand for high-speed, reliable satellite communication systems. This growth is fueled by the continuous expansion of commercial aviation, increasing defense budgets, and the development of next-generation satellite technologies. The adoption of low earth orbit (LEO) satellites, offering faster and more affordable connectivity, is also likely to drive future demand for airborne satcom systems. Furthermore, advancements in satellite antenna and terminal technologies will further enhance system capabilities, supporting growth across multiple aviation sectors.

Major Players

- Thales Group

- L3 Technologies

- Viasat

- Inmarsat

- Honeywell Aerospace

- Rockwell Collins

- Cobham

- Hughes Network Systems

- SES S.A.

- Intelsat

- ViaSat

- EchoStar

- General Electric Aviation

- Sierra Nevada Corporation

- SATCOM Direct

Key Target Audience

- Aviation OEMs

- Military and Defense Agencies

- Commercial Airlines Operators

- Aerospace & Aviation Regulatory Bodies

- Satellite Communication Service Providers

- Aircraft Fleet Operators

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical variables that impact the Qatar Airborne Satcom market. This will be achieved through extensive secondary research, utilizing industry databases, reports, and expert publications to establish a detailed map of market variables.

Step 2: Market Analysis and Construction

In this phase, historical market data for airborne satellite communication systems will be gathered and analyzed. The focus will be on assessing market dynamics, such as the adoption rate of new technologies, penetration rates in various sectors, and the growth of military and commercial aviation in Qatar.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through direct consultations with key industry experts, including manufacturers and service providers in the airborne satellite communication industry. Expert opinions will be used to refine data and gain a deeper understanding of market forces.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the insights gained from both secondary research and expert consultations. This step will help refine market data, validate assumptions, and finalize the comprehensive analysis of the Qatar Airborne Satcom market, leading to a clear forecast for future growth.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in demand for in-flight connectivity

Government investments in aerospace and defense technologies

Expansion of commercial aviation in the Middle East region - Market Challenges

High cost of airborne satellite communication systems

Regulatory hurdles and certification delays

Limited coverage in remote areas - Market Opportunities

Expansion of satellite bandwidth and low-orbit satellites

Growing demand for secure military communication systems

Increasing use of UAVs and drones in various applications - Trends

Shift towards Ka-band and Q-band satellite frequencies

Increased adoption of IP-based communication technologies

Development of more compact and efficient satellite terminals

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Airborne Satellite Communication Systems

Airborne SATCOM Antennas

Airborne SATCOM Terminals

In-Flight Connectivity Systems

Satellite Communication Ground Support Systems - By Platform Type (In Value%)

Aircraft Platforms

Helicopter Platforms

UAV Platforms

Spacecraft Platforms

Other Aerospace Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Modular Fitment

Standard Fitment - By EndUser Segment (In Value%)

Military & Defense

Commercial Aviation

Private & Corporate Aviation

Search and Rescue Operations

Governmental Organizations - By Procurement Channel (In Value%)

Direct Sales

Distributor Sales

Online Sales

Third-party Procurement

OEM Procurement

- Market Share Analysis

- CrossComparison Parameters (Market Share, Product Innovation, Geographic Reach, Pricing Strategies, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Group

L3 Technologies

Viasat

Harris Corporation

Honeywell Aerospace

Rockwell Collins

Cobham

Hughes Network Systems

Inmarsat

SES S.A.

Intelsat

ViaSat

EchoStar

General Electric Aviation

Sierra Nevada Corporation

- Increased demand for in-flight connectivity in commercial aviation

- Government defense contracts for secure communication systems

- Rising interest in satellite-based communication in private aviation

- Adoption of new technologies by helicopter operators for safety and communication

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035