Market Overview

The Qatar Airborne Situational Awareness Systems market is valued at USD ~billion, driven by robust investments in the defense and aerospace sectors. Increased demand for enhanced security measures, coupled with the rapid technological evolution in situational awareness systems, is propelling the market forward. Qatar’s strategic focus on modernizing its military and defense infrastructure, combined with the expansion of unmanned aerial vehicle (UAV) deployments, has been a significant factor in the growth of this market.

Qatar leads the market due to its ongoing defense modernization plans and substantial defense expenditure. The country’s strategic location in the Middle East, with heightened security concerns, positions it as a key player in defense technologies, including airborne situational awareness systems. Additionally, Qatar’s investment in cutting-edge military technology and partnerships with international defense contractors further reinforces its dominance in the regional market.

Market Segmentation

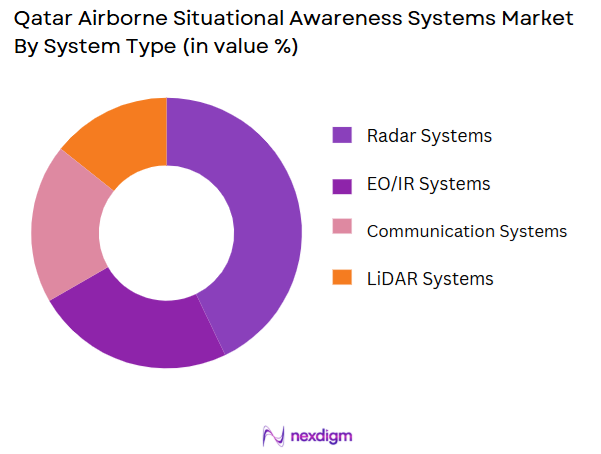

By System Type

The market for airborne situational awareness systems in Qatar is segmented into radar systems, electro-optical/infrared (EO/IR) systems, communication systems, and LiDAR systems. Among these, radar systems dominate the market, contributing significantly to its overall market share. This is largely due to their long-standing use in defense and military applications, where they provide essential real-time tracking and surveillance capabilities. Radar systems are particularly valued for their ability to operate in diverse weather conditions, ensuring optimal performance in the region’s challenging environments.

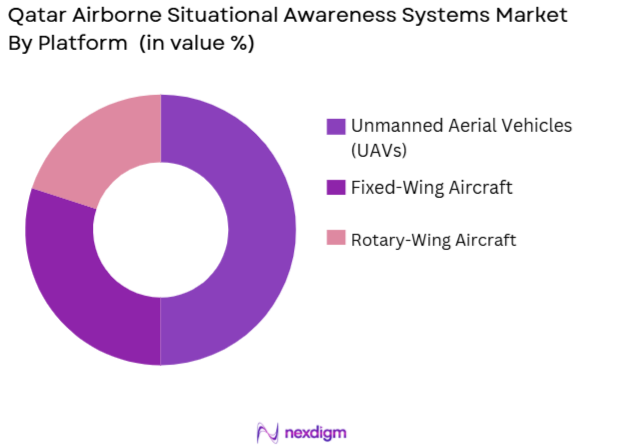

By Platform

The airborne situational awareness systems market is also segmented by platform into fixed-wing aircraft, rotary-wing aircraft, and unmanned aerial vehicles (UAVs). UAVs are the leading segment in Qatar, driven by their increased utilization for surveillance, reconnaissance, and border security. UAVs offer cost-effective solutions and the flexibility to be deployed in high-risk areas, making them the preferred choice for defense and security operations in Qatar.

Competitive Landscape

The Qatar Airborne Situational Awareness Systems market is dominated by key players in both the local and international defense sectors. The market is highly consolidated with a few major players who offer state-of-the-art solutions. The presence of global defense giants, such as Lockheed Martin and Northrop Grumman, coupled with regional players that provide customized solutions for Qatar’s specific needs, drives market competition.

| Company | Establishment Year | Headquarters | Technological Focus | Key Product Offering | R&D Investment | Revenue Growth |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | United States | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

Qatar Airborne Situational Awareness Systems Market Analysis

Growth Drivers

Urbanization

The rapid pace of urbanization is driving the demand for airborne situational awareness systems in Qatar. With the urban population expected to exceed ~% of the total population by 2025, urban expansion will significantly enhance the need for advanced surveillance and monitoring technologies to ensure safety and security. The increasing density of population in urban centers also intensifies the demand for high-tech security systems, especially in critical infrastructure such as airports, borders, and government facilities. The expansion of urban areas has resulted in an increased focus on surveillance technologies for public safety and defense.

Industrialization

Qatar’s rapid industrialization, marked by increased investments in infrastructure, energy, and defense sectors, has been a significant growth driver for airborne situational awareness systems. As industrial hubs expand, the need for robust monitoring and security systems grows to protect critical infrastructure from emerging threats. Industrial projects like those in the oil and gas sectors, as well as large-scale construction projects, require continuous surveillance to ensure security. The state’s industrial development strategy focuses on increasing industrial outputs, which has, in turn, raised the demand for security systems that can track and monitor such activities.

Restraints

High Initial Costs

The high initial cost of airborne situational awareness systems remains one of the key barriers in Qatar’s market. Advanced radar systems, UAVs, and sensor technologies require substantial capital investments for procurement and installation, which can be prohibitive, particularly for smaller defense contractors and non-governmental entities. For instance, while the Qatar government has allocated significant funds for defense, the overall budget dedicated to these systems in the first phase of implementation has been limited due to cost concerns. Many players in the market have pointed to the significant financial burden that such technologies impose on budgets, restricting the speed of adoption.

Technical Challenges

Despite technological advancements, the implementation of airborne situational awareness systems in Qatar faces technical challenges. Integration of multiple system components, including radar, communication, and EO/IR systems, often presents difficulties, particularly with interoperability between older and newer technologies. Furthermore, maintaining the systems, especially UAVs and drones, requires highly specialized knowledge and the availability of spare parts and technical support. The complexity of these systems in challenging desert environments also raises concerns over long-term operational stability and system calibration. These technical barriers delay large-scale deployments in critical areas.

Opportunities

Technological Advancements

Technological advancements offer substantial opportunities for the expansion of the airborne situational awareness systems market in Qatar. The ongoing development of more compact, cost-effective, and high-performance radar systems, sensors, and UAVs has created opportunities for further integration of these systems in defense operations. Moreover, advancements in AI and machine learning algorithms are improving the predictive capabilities of these systems, allowing them to perform real-time analysis and decision-making with greater precision. For instance, AI-based data fusion is increasingly being used to improve situational awareness, helping operators make faster and more informed decisions, particularly in complex military environments.

International Collaborations

International collaborations present a significant opportunity for Qatar to advance its airborne situational awareness systems market. Through partnerships with global defense companies, Qatar can access the latest technologies and innovations in radar, sensor, and UAV systems. Collaborations with leading defense contractors, such as Boeing and Lockheed Martin, provide the Qatari military with cutting-edge systems that can be tailored to meet regional security needs. Moreover, partnerships with foreign governments enhance knowledge exchange and lead to better interoperability between Qatar’s defense systems and those of its allies.

Future Outlook

Over the next 5 years, the Qatar Airborne Situational Awareness Systems market is expected to exhibit substantial growth driven by increasing defense modernization, the integration of advanced radar and sensor systems, and a rising demand for UAV-based surveillance. With growing geopolitical concerns and an ever-evolving threat landscape, Qatar’s focus on securing its airspace and maritime borders will lead to further investments in cutting-edge airborne technologies. Additionally, the strategic role of unmanned aerial systems in military and civilian operations will continue to reshape the market.

Major Players

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Boeing Defense

- Elbit Systems

- Raytheon Technologies

- General Dynamics

- L3Harris Technologies

- Leonardo S.p.A.

- Airbus Defence and Space

- BAE Systems

- Saab Group

- Honeywell International

- Rockwell Collins

- Rheinmetall Defence

Key Target Audience

- Defense and Aerospace Manufacturers

- Government Agencies (Qatar Ministry of Defence, Qatar Armed Forces)

- Investments and Venture Capitalist Firms

- Military Procurement Officers

- Government and Regulatory Bodies (Qatar Civil Aviation Authority)

- Research and Development Divisions in Defense Companies

- Airborne Systems Integrators

- Border and National Security Authorities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the critical variables that influence the Qatar Airborne Situational Awareness Systems market. This includes evaluating technological advancements, defense budgets, and regulatory policies. Secondary research sources, including databases from defense ministries and aerospace reports, are used to gather comprehensive insights.

Step 2: Market Analysis and Construction

In this phase, historical data related to market size, segmentation, and major technological trends are collected. A comprehensive analysis of system types and platforms is conducted to determine the market dynamics. Additionally, an understanding of the regional deployment of airborne systems is incorporated into the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, government agencies, and defense contractors. These discussions provide qualitative insights, which are critical for verifying and refining the market data collected from secondary research sources.

Step 4: Research Synthesis and Final Output

The final step involves consolidating all data points and conducting a bottom-up analysis with feedback from key market participants. This ensures the accuracy of the forecasted market trends and validates the segmentation analysis.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Market Structure and Ecosystem

- Timeline of Major Technological Advancements

- Supply Chain and Value Chain Analysis

- Key Regulatory and Compliance Standards

- Growth Drivers

Increasing Demand for National Security and Defense

Rising Investments in Defense Infrastructure

Technological Advancements in Sensors and Communication Systems

Integration of AI and Machine Learning for Real-Time Situational Awareness - Market Challenges

High Cost of Advanced Airborne Systems

Regulatory and Policy Constraints in Defense Spending

Integration Complexities Across Multiple Platforms - Trends

Adoption of Autonomous Airborne Platforms

Shift Towards Integrated Communication Systems

Focus on Multi-Functional and Compact Systems

- Opportunities

Growth in Military Modernization Programs

Increasing Collaboration Between Military and Civil Sectors

Expansion of Surveillance and Border Security Initiatives - Government Regulation

National and International Defense and Security Regulations

Export and Import Restrictions for Airborne Systems

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value 2020-2025

- By Volume 2020-2025

- By Average Price 2020-2025

- By Platform Contribution 2020-2025

- By End-User 2020-2025

- By System Type (In Value %)

Radar Systems

Electro-optical/Infrared (EO/IR) Systems

LiDAR Systems

Communication Systems

Data Fusion Systems - By Platform( In Value %)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aerial Vehicles (UAVs) - By Application (In Value %)

Defense and Military Operations

Border Security and Surveillance

Search and Rescue Operations

Disaster Management and Relief - By End-User Industry (In Value %)

Defense and Government Agencies

Commercial Sector

Civilian Safety and Rescue Operations - By Region (In Value %)

Central Qatar

Northern Qatar

Western Qatar

Southern Qatar

- Market Share Analysis

- Cross Comparison Parameters(Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by System Type, Number of Aircraft Integrations, Technological Advancements, R&D Investments, Production Facilities, Market Penetration, Unique Value Propositions, Distribution Network)

- SWOT Analysis of Major Players

- Pricing Analysis Basis for Major Players in Qatar Airborne Situational Awareness Systems Market

- Detailed Profiles of Major Companies

Raytheon Technologies

Lockheed Martin

Northrop Grumman

Thales Group

Boeing Defense, Space & Security

L3Harris Technologies

General Dynamics

Elbit Systems

Leonardo S.p.A.

Saab Group

Harris Corporation

Airbus Defence and Space

Iveco Defence Vehicles

Honeywell International

Rheinmetall Defence

- Market Demand and Utilization in Various Sectors

- Purchasing Power and Budget Allocations for Airborne Systems

- Decision-Making and Procurement Strategies

- Operational Requirements for Key End-Users

- Security Threats and Response Needs

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035