Market Overview

The Qatar Aircraft Actuators market is driven by the expanding aviation sector, both in commercial and defense aviation. The market is expected to grow substantially, fueled by Qatar Airways’ fleet expansion, as well as military aircraft procurement by the Qatar Armed Forces. Aircraft actuators are integral to flight control, landing gear, cargo systems, and other critical functions, boosting demand for these components. Qatar’s strategy to diversify its aerospace sector and strengthen its defense capabilities is significantly contributing to the market’s growth trajectory. As per the latest reports, the aircraft actuators market size in Qatar is valued at approximately USD ~ million, and is expected to grow rapidly as Qatar continues to invest in its aerospace infrastructure and enhance defense capabilities.

Qatar dominates the aircraft actuators market due to its strategic investments in both the commercial and defense aviation sectors. Key contributors to market dominance include Doha, where Qatar Airways operates one of the world’s largest fleets, and Al Udeid Air Base, which plays a crucial role in military aviation. The country’s robust defense strategy, underpinned by partnerships with global powers like the United States and France, further strengthens Qatar’s position in the global aerospace market. Qatar’s increasing demand for both civil and military aircraft accelerates the need for high-performance actuators, placing it as a regional leader in the aerospace components market.

Market Segmentation

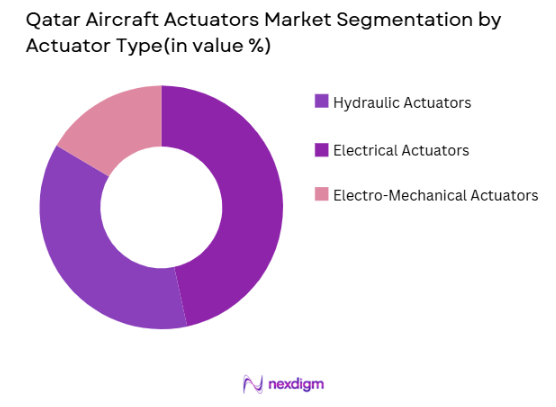

By Actuator Type

The Qatar Aircraft Actuators market is segmented by actuator type into hydraulic actuators, electrical actuators, and electro-mechanical actuators. In recent years, hydraulic actuators have dominated the market due to their extensive use in critical flight control systems, such as wing flaps and landing gears. These systems are known for their reliability and strength, which are necessary for heavy-duty operations in both commercial and military aircraft. As Qatar’s fleet grows, particularly with the induction of larger aircraft like the Boeing 777 and Airbus A350, the demand for hydraulic actuators remains robust, with their reliability in harsh operational conditions making them a preferred choice.

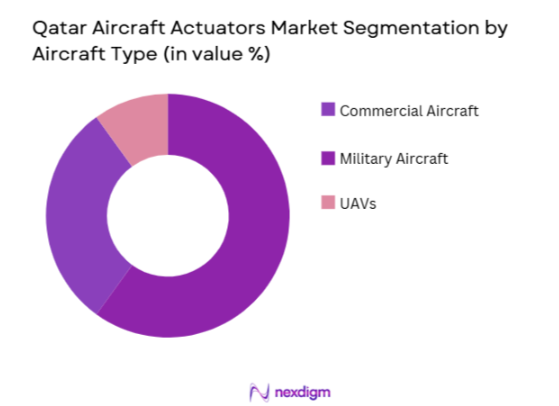

By Aircraft Type

The market is also segmented by aircraft type, which includes commercial aircraft, military aircraft, and UAVs (Unmanned Aerial Vehicles). Among these, commercial aircraft dominate the market, particularly due to Qatar Airways’ expansion, which is one of the world’s fastest-growing airlines. The increasing demand for passenger aircraft has spurred the need for reliable actuators in flight control systems, landing gear, and other mechanisms. As Qatar Airways operates a diverse fleet with advanced aircraft like the A350 and Boeing 787, actuators play a critical role in enhancing the safety and efficiency of these aircraft.

Competitive Landscape

The Qatar Aircraft Actuators market is dominated by global aerospace players who supply critical actuator systems for both commercial and military applications. Key players include companies such as Honeywell, Parker Hannifin, Moog Inc., and Safran, which offer cutting-edge actuator technologies for Qatar’s growing aviation sector. The competitive landscape highlights the influence of these major players who provide both OEM and aftermarket actuator solutions. As Qatar continues to modernize its fleet, these companies are well-positioned to capture significant market share.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Technological Leadership | Global Presence |

| Honeywell International | 1906 | Morris Plains, NJ, USA | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | Cleveland, OH, USA | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, NY, USA | ~ | ~ | ~ | ~ |

| Safran SA | 2005 | Paris, France | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Lindenberg, Germany | ~ | ~ | ~ | ~ |

Qatar aircraft actuators Market Analysis

Growth Drivers

Expansion of Aviation Activity and Fleet Size

Qatar’s aviation sector—central to actuator demand—is supported by a fleet of approximately ~aircraft operated by Qatar Airways, including ~passenger jets and ~cargo aircraft, reflecting growth in aerospace operations. Aircraft actuators are critical for flight controls, landing gear, and cargo systems across this large fleet, thereby driving sustained component demand. Additionally, increased flight movements were recorded with ~aircraft movements in November 2025, up from ~ in the same month the prior year, signaling ongoing utilization and fleet activity that underpin actuator replacement and upgrades.

Robust Air Passenger and Cargo Traffic Growth

Hamad International Airport reported serving ~million passengers in 2025, demonstrating strong passenger throughput that requires reliable aircraft operations supported by high‑performance actuators. The cargo arm, Qatar Airways Cargo, transported over ~million tonnes of freight in the 2024‑25 financial year, further signifying increased aircraft utilization across both passenger and cargo segments. Such high traffic volumes intensify maintenance cycles and actuator replacements, directly influencing market demand for actuator technologies and spares.

Restraints

High Initial Costs of Advanced Actuator Technologies

Actuator systems, especially in modern aircraft, represent high‑value engineering components involving precise hydraulics and electrification. While macro purchasing power is strong, the inherent high unit costs of advanced aerospace actuators—which involve complex materials and certification requirements—can restrain adoption by cost‑sensitive stakeholders such as MRO units and smaller aviation operators. This financial constraint exists even within a strong economic environment like Qatar’s, where GDP per capita exceeds USD ~ an indicator of premium technology adoption capability but not pricing reduction.

Technical Integration Challenges with Diverse Aircraft Fleets

Qatar Airways’ fleet in 2024 comprised a mix of aircraft models from Airbus and Boeing, totaling nearly ~jets including A350, A380, B777, and B787 types. This diversity presents integration challenges for actuator systems since different airframes require distinct specifications, certification protocols, and maintenance standards. Suppliers must tailor actuators to heterogeneous platforms, complicating procurement planning and increasing technical requirements for compatibility and redundancy assurance across varied aircraft types.

Opportunities

Investments in Electrification and Smart Actuator Systems

With increasing focus on advanced aerospace technologies, opportunities in electrical and intelligent actuator systems are expanding. As airlines and defense operators prioritize fuel efficiency and systems health monitoring, ‘fly‑by‑wire’ and ‘more electric aircraft’ trends necessitate electrical actuators with digital diagnostic features. Although specific actuator adoption data is not published, Qatar’s overall aircraft modernization and global aviation trends underscore a pivot toward such technologies, aligning with broader industry innovation pathways. Macroeconomic capacity—illustrated by a high GDP and supportive defense budgets—underpins this shift as operators can fund electrification upgrades.

International Aerospace Collaborations and Procurement

Qatar’s aviation landscape benefits from deep collaboration with major OEMs, highlighted by substantial aircraft orders and partnerships with Boeing and Airbus. Such relationships create opportunities for integrating next‑generation actuator technologies as part of broader platform deals, enabling suppliers to embed advanced actuation systems within new orders and retrofit programs. These global OEM alliances provide Qatar access to cutting‑edge designs and standards, expanding potential market share for integrated actuator offerings.

Future Outlook

Over the next decade, the Qatar Aircraft Actuators market is poised for substantial growth driven by both Qatar Airways’ fleet expansion and increasing investments in military aviation. Qatar’s strategic vision to diversify its defense and aerospace sectors, in conjunction with the country’s push for technological advancements in aircraft systems, will support the continued demand for actuators. Furthermore, as Qatar seeks to bolster its air power through military aircraft procurement and advanced aircraft technologies, the need for high-performance actuators will increase, fostering long-term market growth.

Major Players

- Honeywell International Inc.

- Parker Hannifin Corporation

- Moog Inc.

- Safran SA

- Liebherr Aerospace

- Eaton Corporation

- Raytheon Technologies

- GE Aviation

- Lockheed Martin

- Rolls-Royce

- Airbus Defence & Space

- Boeing Defense

- Curtiss-Wright Corporation

- Rockwell Collins

- Thales Group

Key Target Audience

- Investment and Venture Capitalist Firms

- Qatar Ministry of Defence

- Qatar Civil Aviation Authority

- Qatar Airways

- Qatar Armed Forces Procurement Divisions

- Aerospace OEMs

- MRO Service Providers in Qatar

- Regional Aerospace Companies

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying key variables in the Qatar Aircraft Actuators Market, including aircraft types, actuator technologies, and end-users such as commercial airlines and defense. Comprehensive desk research and data from proprietary sources help outline the core components of the market ecosystem.

Step 2: Market Analysis and Construction

The market analysis includes examining historical data from major sources like Qatar Airways and Qatar Armed Forces, alongside global actuator manufacturers. This phase also assesses market penetration and emerging trends in actuator technologies.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with industry professionals, including engineers from OEMs and MRO service providers, to validate the formulated hypotheses and obtain real-world insights into market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from primary interviews and secondary research, ensuring the market projections align with industry expectations. Validation through expert consultations and data refinement ensures an accurate analysis of the Qatar Aircraft Actuators Market.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, Defence and Commercial Aircraft Procurement Mapping, Data Sources & Validation, Primary Interviews with Key Stakeholders, Market Modelling & Forecasting Methodology, Limitations and Assumptions for Market Predictions)

- Definition and Scope of Aircraft Actuators

- Market Genesis & Policy Evolution in Qatar Aviation

- Technological Timeline

- Aircraft Actuators Value Chain Analysis

- Regulatory & Standards Framework

- Growth Drivers

Expansion of Qatar Airways Fleet

Increased Military Aircraft Procurements

Strategic Vision for Aerospace Industry

Growing Demand for Electrification & Advanced Actuator Systems

- Market Challenges

High Initial Investment & Lifecycle Support Costs

Interoperability with Global Aircraft Systems

Integration Challenges for Older Aircraft Fleets

- Opportunities

Push for Local Manufacturing and Indigenous Solutions

Future Demand for More Electric Aircraft (MEA) and Smart Actuators

Qatar’s Role as a MRO Hub for the Region - Technology & Innovation Trends

Actuators for Autonomous Systems and UAVs

Integration of Digital Twins and Predictive Maintenance

Lightweight & Hybrid Actuators - Regulatory & Defence Standards

Qatar Civil Aviation Authority (QCAA) Certification Process

International Standards - SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats - Porter’s Five Forces Analysis

Competitive Rivalry within Qatar

Threat of New Entrants

Bargaining Power of Suppliers

Bargaining Power of Buyers

Threat of Substitute Technologies

- By Value, 2020-2025

- By Volume, 2020-2025

- By Installed Base and Growth Forecast, 2020-2025

By Actuator Type (In Value %)

Hydraulic Actuators

Electrical Actuators

Electro-Mechanical Actuators

Pneumatic Actuators

Other Specialized Actuators

By Aircraft Type (In Value %)

Commercial Aircraft

Military Aircraft

General Aviation

UAVs (Unmanned Aerial Vehicles)

By Application (In Value %)

Flight Control Systems

Landing Gear Systems

Cargo & Passenger Systems

Environmental Control Systems

Auxiliary Power Systems

By End-User (In Value %)

Qatar Air Force

Qatar Airways (Commercial Sector)

Military Procurement and Export Customers

Other Aviation Entities (Private Operators, Charter Airlines)

By Integration Type (In Value %)

OEM Integrations

Retrofit and Upgrades

Aftermarket Support & Spare Parts

- Market Share Analysis

- Cross-Comparison Parameters for Key Competitors(Product Portfolio & Technology Leadership, Manufacturing and Integration Capability, Global Contract Footprint , MoD & International Certifications, R&D Investment & Innovation Pipeline,Aftermarket Support Network & Spare Parts Ecosystem,Strategic Alliances & Local Partnerships)

- SWOT Analysis of Major Players

- Market Share & Competitive Landscape

Major Players (OEMs, Tier-1 Suppliers) in Qatar Aircraft Actuators Market - Major Players in Qatar Aircraft Actuators Market

Honeywell International Inc.

Eaton Corporation plc

Moog Inc.

Parker Hannifin Corporation

Safran SA

Meggitt plc

Woodward Inc.

Liebherr Aerospace

Raytheon Technologies

Curtiss-Wright Corporation

GE Aviation

Lockheed Martin

Airbus Defence & Space

Hindustan Aeronautics Limited

Local Tier-1 Suppliers

- Qatar Air Force Operational Needs and Procurement Cycles

- Qatar Airways Fleet Demands

- Military Aviation & Defence Budget Considerations

- Government and Strategic Investment Plans in Aerospace

- Strategic Capability Gaps & Procurement Priorities

- By Value, 2026-2035

- By Volume, 2026-2035

- By Technology Share, 2026-2035

- By Aircraft Type Adoption, 2026-2035

- By Actuator Integration, 2026-2035