Market Overview

The Qatar Aircraft Altimeter and Pitot Tube market is primarily driven by the increasing demand for advanced aviation safety systems. The market size is $~ substantial, reflecting growing investments in both commercial and military aviation. Qatar’s strategic location as a hub for international air travel and its expanding military and defense programs further stimulate demand for high-precision flight instrumentation. The region’s rapidly developing aviation infrastructure supports continued growth in altimeter and pitot tube technologies, with increasing investments in modernization and safety features. Market growth is also driven by the country’s commitment to world-class air travel standards and the continued expansion of its aircraft fleet.

The market is dominated by countries like Qatar, the United Arab Emirates, and Saudi Arabia. These countries have significant air traffic and defense sectors that propel demand for advanced aviation systems. Qatar stands out due to its rapidly expanding airline fleet and a growing aerospace industry supported by both government investments and private sector participation. Additionally, these regions are actively involved in the modernization of their military aircraft, leading to increased procurement of avionics and safety equipment such as altimeters and pitot tubes.

Market Segmentation

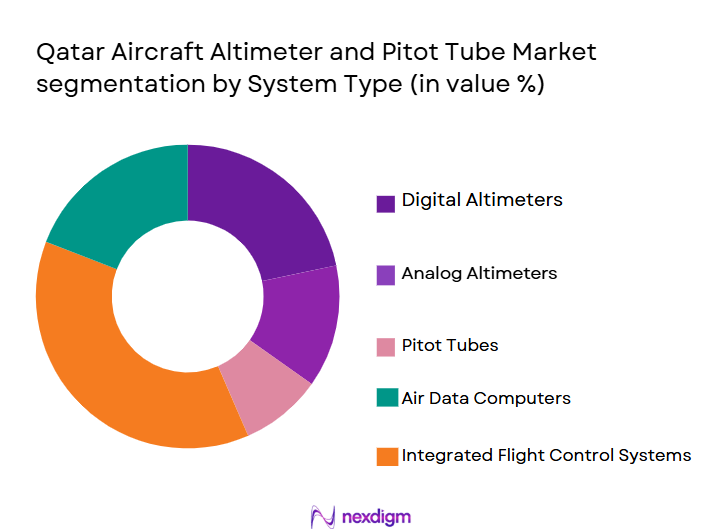

By System Type

The Qatar Aircraft Altimeter and Pitot Tube market is segmented into digital altimeters, analog altimeters, pitot tubes, air data computers, and integrated flight control systems. Among these, digital altimeters dominate the market share, as they are increasingly integrated into modern aircraft due to their higher accuracy, reliability, and the growing demand for automation in flight management systems. Their compatibility with advanced avionics systems, such as air data computers, and the rising trend of integrating digital flight control systems further solidify their market dominance. Digital altimeters offer greater precision in altitude measurement, which is crucial for ensuring aviation safety, especially in crowded airspaces.

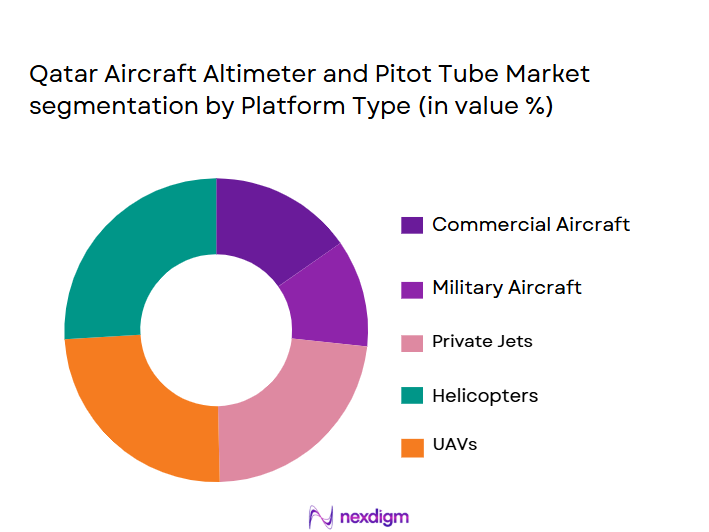

By Platform Type

The market is also segmented by platform type, with the key categories being commercial aircraft, military aircraft, private jets, helicopters, and UAVs. Commercial aircraft hold the largest share due to the rapidly expanding fleet of international airlines operating in and out of Qatar and the wider Middle East. Qatar Airways, as a major global player, significantly drives this demand. Commercial aviation requires advanced safety systems like altimeters and pitot tubes to ensure safe and precise flight operations. Additionally, the growing need for compliance with stringent aviation safety regulations further supports the demand for these systems in commercial aircraft.

Competitive Landscape

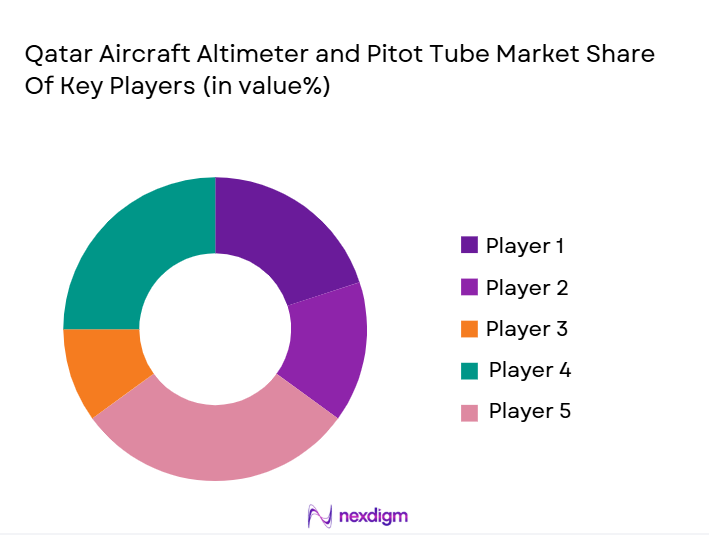

The Qatar Aircraft Altimeter and Pitot Tube market is characterized by a few dominant global players. These companies play a significant role in supplying advanced avionics equipment and maintaining high standards in flight safety. The market is influenced by both international and regional players, which provide cutting-edge technology, such as integrated flight control systems, to meet the increasing safety demands of the aviation industry.

The Qatar Aircraft Altimeter and Pitot Tube market is dominated by major players like Honeywell Aerospace, Rockwell Collins, and Thales Group. These companies have an established presence in the region, supplying avionics systems not only for commercial aircraft but also for military applications. Their advanced technological offerings, strong research and development capabilities, and local support networks make them key players in the competitive landscape.

| Company Name | Establishment Year | Headquarters | R&D Investment

|

Technological Leadership

|

Market Presence

|

Key Products

|

Key Parameter 5 | Global Reach

|

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Altimeter and Pitot Tube Market Dynamics

Growth Drivers

Increase in Air Traffic and Demand for Enhanced Safety Features

Qatar’s aviation sector is expanding, with Qatar Airways reporting over ~ million passengers in 2023. As air traffic increases, the demand for enhanced flight safety systems like altimeters and pitot tubes rises to ensure accurate altitude and speed measurements, especially in crowded airspaces which boosts the market for innovative electronics, enhancing communication, surveillance, and targeting capabilities.

Government Investments in Military and Aerospace Sectors

Qatar’s government is investing heavily in defense, with military spending projected at USD ~ billion in 2024. This includes procurement of advanced aircraft and avionics systems, driving demand for high-precision altimeters and pitot tubes in both commercial and military sectors.

Market Challenges

High Maintenance Costs and Complexity

The maintenance of avionics systems, including altimeters and pitot tubes, is costly and complex. With maintenance accounting for ~% of aircraft operational costs in Qatar, airlines face financial pressure, especially when parts require specialized attention which increases costs and complicates the integration process within existing military infrastructures, limiting broader adoption.

Regulatory Compliance and Certification Hurdles

Qatar must comply with strict international aviation regulations from bodies like EASA and the FAA. The stringent certification processes for altimeters and pitot tubes add complexity and delays in bringing new systems to market and certifications creates barriers, slowing the pace at which advanced systems can be deployed by military forces.

Market Opportunities

Development of More Cost-Effective and Durable Systems

There is a rising demand for avionics systems with longer lifecycles and lower maintenance needs. Manufacturers are focusing on creating more durable altimeters and pitot tubes to meet Qatar’s demand for cost-efficient solutions.

Growing Demand for Retrofit and Replacement Fitments

As Qatar Airways modernizes its fleet, retrofitting and replacing outdated avionics systems, including altimeters and pitot tubes, presents a growing market opportunity for suppliers offering advanced, reliable systems.

Future Outlook

Over the next decade, the Qatar Aircraft Altimeter and Pitot Tube market is expected to experience robust growth. This growth will be primarily driven by continued advancements in aviation safety systems, including more accurate and reliable altimeters and pitot tubes. The rising demand for air travel, both in the commercial and military sectors, will contribute to an increased need for advanced flight instrumentation. Qatar’s strategic investments in defense and aviation infrastructure will provide further impetus to market growth, supporting both domestic and international demand.

Major Players

- Honeywell Aerospace

- Rockwell Collins

- Thales Group

- Safran

- Garmin

- L3 Technologies

- Collins Aerospace

- GE Aviation

- Northrop Grumman

- UTC Aerospace Systems

- Textron Aviation

- Boeing

- Airbus

- Raytheon Technologies

- AeroVironment

Key Target Audience

- Aviation Manufacturers

- Aircraft Operators and Airlines

- Aerospace Equipment Suppliers

- Military & Defense Agencies (Qatar Armed Forces)

- Government Regulatory Bodies (Qatar Civil Aviation Authority)

- Investment and Venture Capitalist Firms

- Aviation Safety Organizations

- MRO (Maintenance, Repair, and Overhaul) Service Providers

Research Methodology

Step 1: Identification of Key Variables

The first phase of this research involves identifying and mapping the key stakeholders in the Qatar Aircraft Altimeter and Pitot Tube market. Extensive desk research, including proprietary industry data, will help identify the critical variables that influence market trends and consumer behavior.

Step 2: Market Analysis and Construction

This phase focuses on compiling historical data on the market, including sales figures, market trends, and growth patterns. Data will be analyzed to build a comprehensive picture of market performance and to estimate future growth.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from initial data analysis will be tested through consultations with industry experts, including manufacturers, suppliers, and regulatory bodies. These consultations will ensure the accuracy and reliability of the initial market assumptions.

Step 4: Research Synthesis and Final Output

The final phase includes validation of the research findings through direct engagement with aviation manufacturers and key stakeholders. The insights gathered will refine the analysis and ensure that the final report accurately reflects the market dynamics.

- Executive Summary

- Qatar Aircraft Altimeter and Pitot Tube Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air traffic and demand for enhanced safety features

Government investments in military and aerospace sectors

Advancements in avionics technology - Market Challenges

High maintenance costs and complexity

Regulatory compliance and certification hurdles

High dependency on limited suppliers - Market Opportunities

Development of more cost-effective and durable systems

Growing demand for retrofit and replacement fitments

Integration with next-generation flight control systems - Trends

Rise of automation in flight control systems

Increased use of digital altimeters in commercial aviation

Growth of military aircraft modernization programs

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Digital Altimeters

Analog Altimeters

Pitot Tubes

Air Data Computers

Integrated Flight Control Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Helicopters

UAVs - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit

Upgrade Fitment

Replacement Fitment - By EndUser Segment (In Value%)

Aircraft Manufacturers

Maintenance, Repair, and Overhaul (MRO) Services

Government & Military

Private Aircraft Operators

Commercial Airlines - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Sales

Retailers

OEM Channels

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Product Innovation, Strategic Partnerships, Pricing Strategies, Geographic Reach Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Rockwell Collins

Garmin

L3 Technologies

Thales Group

Boeing

Northrop Grumman

Safran

AeroVironment

Textron Aviation

Airbus

Collins Aerospace

Raytheon Technologies

GE Aviation

UTC Aerospace Systems

- Growing demand from commercial aviation for advanced systems

- Increase in military expenditure and focus on defense aviation

- Surge in private jet fleet and demand for custom avionics

- Expansion of MRO services in the region

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035