Market Overview

The Qatar Aircraft Antenna market is valued at USD ~ million in 2024. The market is primarily driven by the demand for enhanced communication systems in both commercial and military aviation. As Qatar continues to expand its air transport sector, particularly with Qatar Airways’ increasing fleet, the need for high-performance antennas to support navigation, communication, and connectivity systems is rising. The nation’s commitment to technological advancement and airspace safety further accelerates the demand for advanced antenna solutions, ensuring significant market growth in the coming years.

Qatar dominates the Middle Eastern aircraft antenna market, with Doha serving as the central hub for its aviation industry. The country’s strategic location between Europe, Asia, and Africa makes it an ideal spot for connecting flights, which drives the demand for cutting-edge communication systems on aircraft. Furthermore, Qatar Airways, one of the largest carriers globally, continues to expand its fleet, contributing significantly to the demand for aircraft antennas. Neighboring countries like the UAE and Saudi Arabia also support a growing aviation sector, but Qatar’s strong infrastructure and government investment push it to the forefront of the market.

Market Segmentation

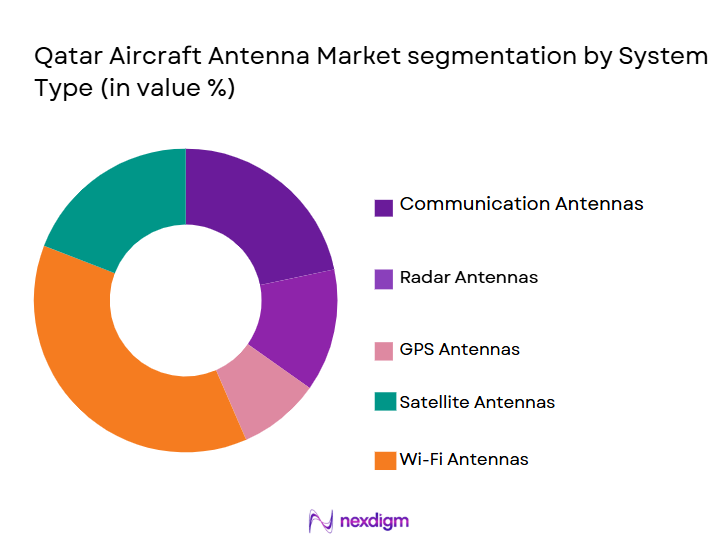

By System Type

The Qatar Aircraft Antenna market is segmented by system type into communication antennas, radar antennas, GPS antennas, satellite antennas, and Wi-Fi antennas. Among these, communication antennas hold the dominant market share due to their essential role in aircraft communication systems. Their widespread use across commercial and military aircraft is driven by the growing demand for seamless air-to-ground communication, particularly in remote regions. The increasing adoption of satellite communication systems by airlines to improve in-flight connectivity is also bolstering the market for communication antennas.

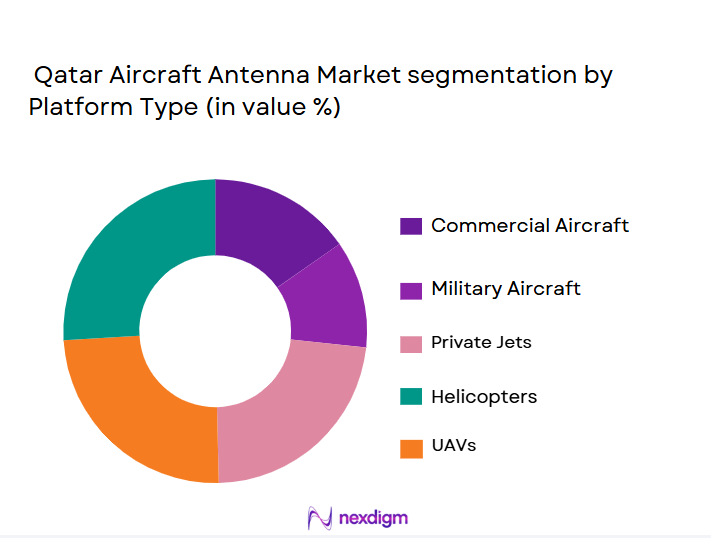

By Platform Type

The market is segmented into commercial aircraft, military aircraft, business jets, helicopters, and UAVs. Commercial aircraft dominate the platform segment due to the increasing demand for both regional and international flights. Airlines such as Qatar Airways and other global carriers are significantly investing in modernizing their fleets, with a focus on incorporating advanced antenna technologies to improve communication and passenger services like in-flight Wi-Fi. Military aircraft also account for a substantial share, driven by the ongoing modernization of defense forces in the region.

Competitive Landscape

The Qatar Aircraft Antenna market is dominated by a mix of global and regional players, each offering a range of advanced products tailored to the aviation industry’s diverse needs. Companies like Raytheon Technologies, Cobham Limited, and Honeywell International play a pivotal role in the market, providing cutting-edge antenna systems designed for both civil and military applications. Their dominance is attributed to their long-standing presence, strong R&D capabilities, and established partnerships with major airlines and defense sectors globally.

| Company | Establishment Year | Headquarters | Key Focus Area | Product Portfolio | R&D Investment |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ |

| Cobham Limited | 1934 | Dorset, UK | ~ | ~ | ~ |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ |

| L3 Technologies | 2017 | New York, USA | ~ | ~ | ~ |

| Viasat | 1986 | Carlsbad, USA | ~ | ~ | ~ |

Qatar aircraft antenna Market Dynamics

Growth Drivers

Increase in Air Travel Demand

The surge in global air travel, particularly in regions like the Middle East, drives the demand for advanced aircraft communication systems. As more people travel by air, airlines need efficient communication solutions for operations, safety, and in-flight connectivity, thus increasing the need for high-performance antennas. These countries prioritize military modernization, which boosts the market for innovative electronics, enhancing communication, surveillance, and targeting capabilities.

Advancements in Aircraft Communication Technologies

Technological innovations, such as the integration of satellite communication systems and 5G technology, are enhancing the capabilities of aircraft antennas. These advancements enable better connectivity, improving flight operations, passenger experience, and air traffic management.

Market Challenges

Regulatory Compliance and Certification Delays

Regulatory approval and certification processes for new aircraft antenna systems can be time-consuming. The delays in meeting these standards can hinder the introduction of innovative antenna solutions, affecting market growth and limiting the speed of technological adoption.

High System Costs for Airlines

The high costs associated with advanced antenna systems can be a significant barrier for airlines, especially budget carriers. The substantial investment required to upgrade or retrofit aircraft with state-of-the-art antenna systems may deter some airlines from making the necessary changes.

Market Opportunities

Expansion of Airport Infrastructure

As Qatar invests in expanding its airport infrastructure, there is a rising demand for advanced communication systems, including aircraft antennas. New terminals and runways will require enhanced antenna systems for air traffic control, communication, and security, thus creating significant market opportunities.

Rising Demand for In-Flight Connectivity

With more passengers seeking in-flight connectivity, airlines are increasingly investing in antenna systems that can support Wi-Fi and other communication services. This trend is accelerating as passengers expect seamless digital experiences during flights, presenting a growth opportunity for advanced antenna technologies.

Future Outlook

Over the next decade, the Qatar Aircraft Antenna market is expected to experience steady growth driven by continuous advancements in antenna technology and the expansion of Qatar Airways’ fleet. With the increasing adoption of satellite communication systems, particularly in long-haul flights, the demand for high-performance antennas is anticipated to rise significantly. Government initiatives focusing on modernizing Qatar’s aviation infrastructure, along with heightened global aviation connectivity, will play a critical role in propelling the market forward.

Major Players in the Market

- Raytheon Technologies

- Cobham Limited

- Honeywell International

- L3 Technologies

- Viasat

- Thales Group

- Intellian Technologies

- Rohde & Schwarz

- General Dynamics

- Satcom Direct

- Telesat

- Gogo Inc.

- Aerospace Systems & Technologies

- Teledyne Technologies

- Airbus

Key Target Audience

- Investment and venture capitalist firms

- Government and regulatory bodies (e.g., Qatar Civil Aviation Authority, FAA)

- Aircraft manufacturers

- Airlines and aviation operators

- OEMs and suppliers of communication systems

- Defense and military organizations

- In-flight service providers

- Commercial aviation infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

In this phase, the key variables impacting the Qatar Aircraft Antenna market are identified, including technological advancements, regulatory frameworks, and demand trends. This is achieved through secondary research and expert consultations.

Step 2: Market Analysis and Construction

Historical data is gathered to analyze the market’s growth trajectory and its segmentation. This involves reviewing past reports, market activities, and industry surveys to assess the performance of different antenna types across various platforms.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews and consultations are conducted to validate the initial hypotheses formed during the previous phases. These experts provide real-time insights into market dynamics, technological challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

The final research output is synthesized using data collected from multiple sources. The comprehensive analysis of the market is based on both qualitative and quantitative data, ensuring that the report offers an accurate reflection of the Qatar Aircraft Antenna market’s current and future potential.

- Executive Summary

- Qatar Aircraft Antenna Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Air Travel Demand

Advancements in Aircraft Communication Technologies

Military Modernization Programs - Market Challenges

Regulatory Compliance and Certification Delays

High System Costs for Airlines

Technological Barriers in Multi-Function Antennas - Market Opportunities

Expansion of Airport Infrastructure

Rising Demand for In-Flight Connectivity

Emerging UAV and Military Aviation Markets - Trends

Integration of 5G Technology in Aircraft Communication Systems

Miniaturization and Lightweighting of Antenna Systems

Increase in Demand for Multi-Function Antennas

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication Antennas

Radar Antennas

GPS Antennas

Satellite Antennas

Wi-Fi Antennas - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

UAVs - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Linefit

System Upgrade - By EndUser Segment (In Value%)

Commercial Aviation

Defense

Private Jets

Leisure Aviation

Government & Regulatory Agencies - By Procurement Channel (In Value%)

Direct Sales

Distributors

OEM Partnerships

Third-Party Vendors

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Product Innovation, Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility Price Point, Customer Support, Geographic Presence) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Raytheon Technologies

Harris Corporation

Cobham Limited

Honeywell International

L3 Technologies

Viasat

Satcom Direct

Gogo Inc.

Telesat

Thales Group

General Dynamics

Aerospace Systems & Technologies

Rohde & Schwarz

Intellian Technologies

Teledyne Technologies

- Growing Demand for Aircraft Connectivity in Commercial Aviation

- Increased Military Investments in Advanced Aircraft Technologies

- Rising Popularity of In-Flight Wi-Fi Services

- Demand for High-Performance Antennas in Private and Business Jets

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035