Market Overview

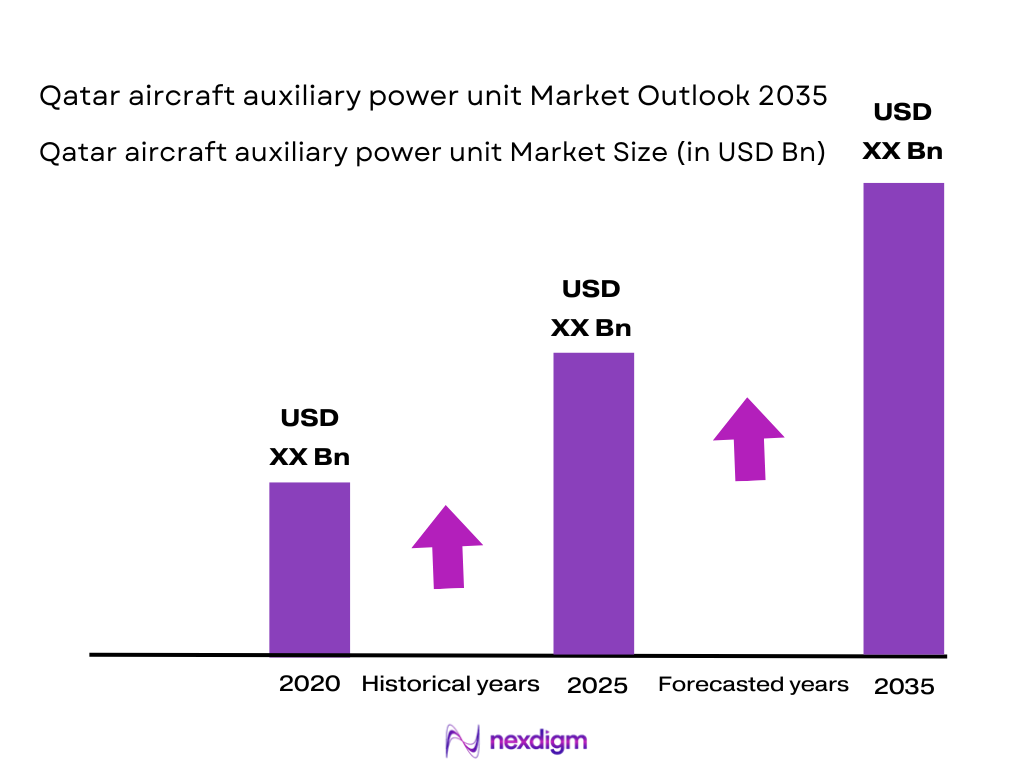

The Qatar Aircraft Auxiliary Power Unit (APU) market is projected to experience substantial growth in the coming years, driven by the country’s booming aviation industry and the increasing adoption of APUs for operational efficiency. The market size for the APU sector in Qatar is estimated at USD ~ million in 2024, supported by Qatar Airways’ extensive fleet expansion and continuous demand for advanced auxiliary power solutions. APUs are essential for providing power during ground operations, reducing aircraft fuel consumption, and enhancing overall efficiency. The increasing focus on fuel efficiency and environmental standards further accelerates the growth of this market. Additionally, the MRO (Maintenance, Repair, and Overhaul) sector has witnessed a rise in APU maintenance, which further supports market expansion.

Qatar, with its strategic geographic location and highly developed aviation infrastructure, is a dominant player in the APU market, particularly in the Middle East. Doha, the capital of Qatar, houses Hamad International Airport, a hub for Qatar Airways and a major point for APU installations and maintenance. The government’s investments in the aviation sector and the robust expansion plans of Qatar Airways have propelled the demand for APUs in the region. Moreover, the region’s continued push toward sustainability and fuel-efficient aircraft also solidifies Qatar’s position as a leader in the APU market.

Market Segmentation

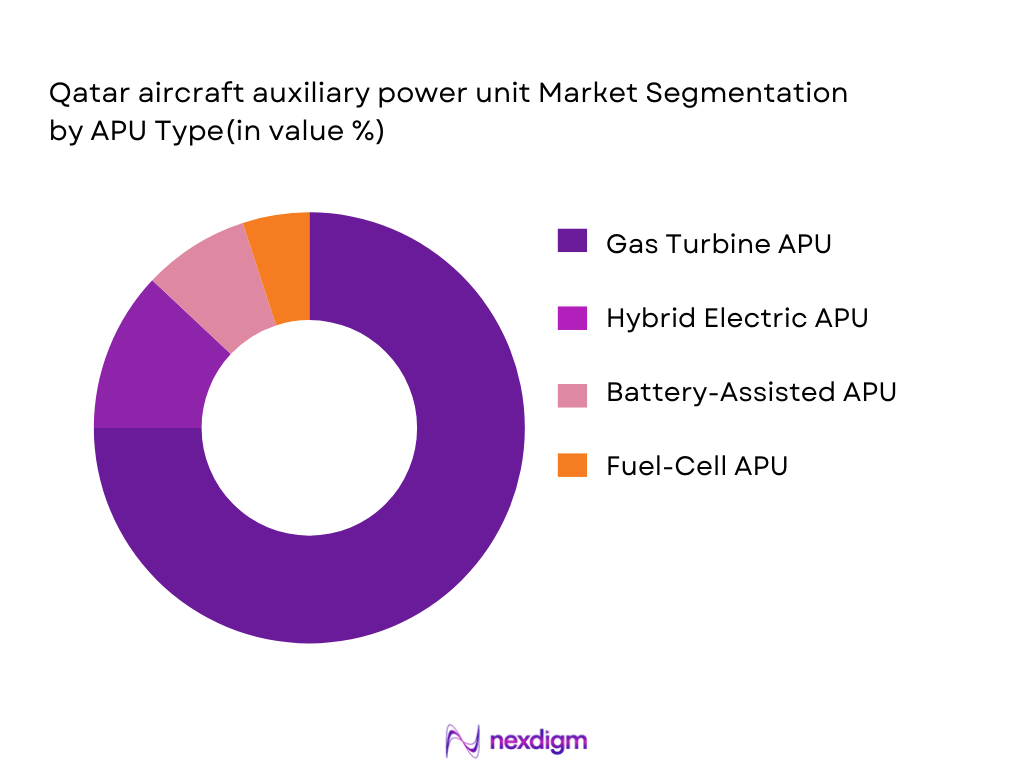

By APU Type

The Qatar Aircraft APU market is segmented by APU type, which includes Gas Turbine APUs, Hybrid Electric APUs, Battery-Assisted APUs, and Fuel-Cell APUs. Among these, Gas Turbine APUs dominate the market due to their proven reliability, high power output, and established usage in most commercial aircraft. These units are commonly used by major airlines like Qatar Airways for their large fleet of wide-body aircraft, contributing significantly to market growth.

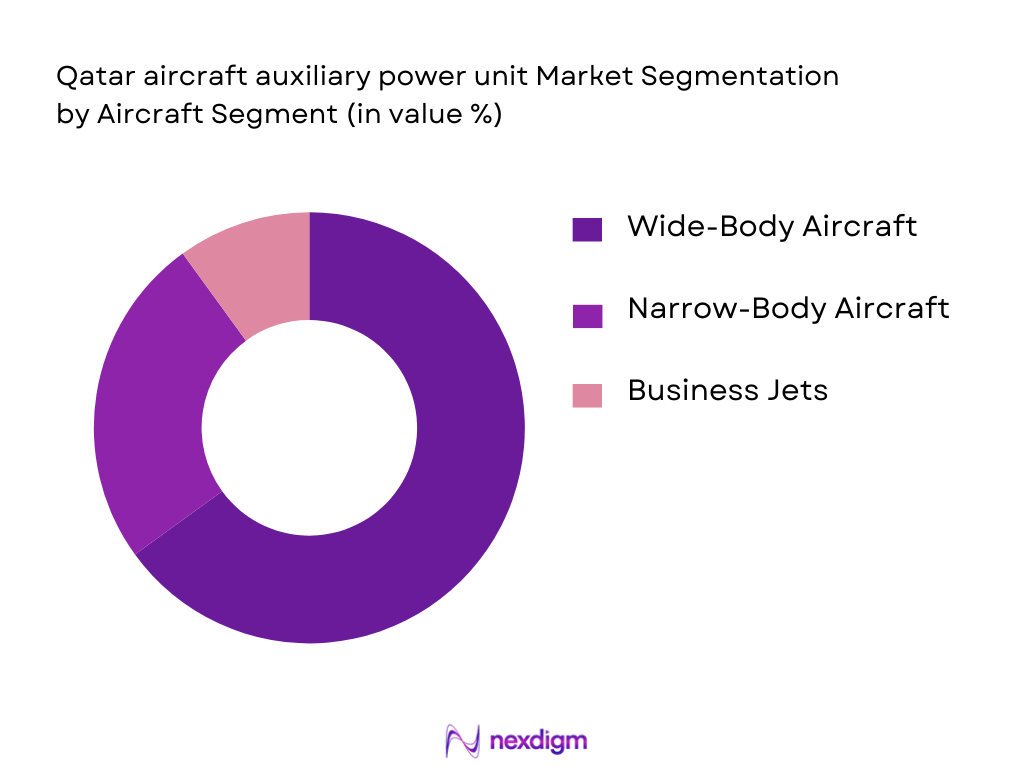

By Aircraft Segment

The Qatar APU market is also segmented by aircraft type, which includes Narrow-Body, Wide-Body, and Business Jets. Wide-Body aircraft hold the dominant share of the market. This is largely due to the high number of long-haul flights operated by Qatar Airways, which predominantly uses wide-body aircraft like the Airbus A350 and Boeing 777, both of which rely heavily on APUs for auxiliary power during ground operations.

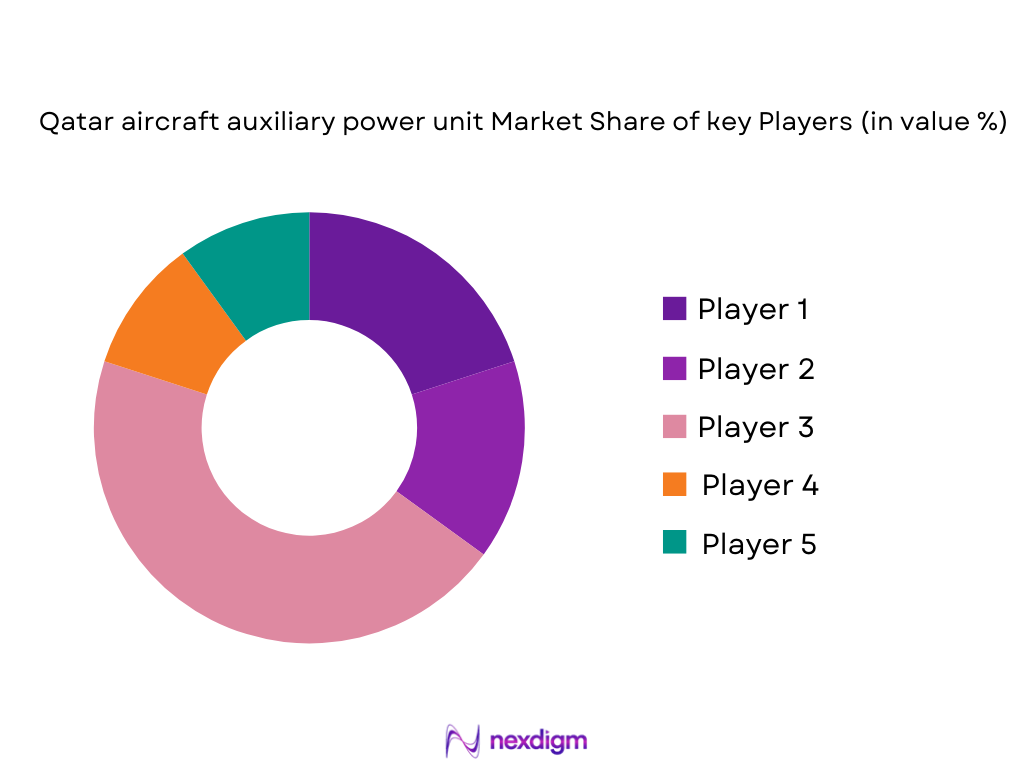

Competitive Landscape

The Qatar APU market is characterized by the presence of both local and international players. Global leaders in the APU manufacturing and servicing space, such as Honeywell Aerospace, Pratt & Whitney, Safran Power Units, Rolls-Royce, and MTU Aero Engines have established a strong presence in Qatar due to their advanced technology, global reach, and local partnerships.

| Company Name | Establishment Year | Headquarters | Technology Expertise | APU Type Focus | Market Share Focus | Regional Presence |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | USA | ~ | ~ | ~ | ~ |

| Safran Power Units | 2005 | France | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Germany | ~ | ~ | ~ | ~ |

Qatar Aircraft Auxiliary Power Unit (APU) Market Analysis

Growth Drivers

Urbanization

The rapid urbanization in Qatar plays a significant role in driving the demand for aviation services, and consequently, for Aircraft Auxiliary Power Units (APUs). As of 2024, Qatar’s urbanization rate stands at ~ %, reflecting the highly concentrated population in cities such as Doha, which houses critical infrastructure like Hamad International Airport. With the growing number of passengers and an expanding fleet of commercial and cargo aircraft, the need for efficient ground power solutions like APUs has surged. This urban concentration of aviation activity directly supports the demand for APUs in the region, as more flights require reliable auxiliary power during ground operations.

Industrialization

Qatar’s industrialization, particularly in the aviation and energy sectors, significantly influences the demand for APUs. As of 2024, Qatar’s industrial sector contributed around ~ % to the national GDP, driven by both energy exports and large-scale infrastructure projects. The aviation sector, which is part of this industrial boom, has seen a rise in aircraft demand, thus propelling the need for APUs to optimize ground operations and energy consumption. Furthermore, the government’s investments in infrastructure, such as the expansion of Hamad International Airport and the construction of new terminals, directly fuel demand for APUs, as these require auxiliary power solutions for operational efficiency.

Restraints

High Initial Costs

The high initial cost of aircraft auxiliary power units remains a key restraint in the market. The price for an APU system can range from USD ~ to over USD ~ million depending on the type and aircraft size. As of 2024, the upfront investment required for new technology APUs—especially hybrid or electric models—remains a significant barrier for small and medium airlines in Qatar, which have limited capital to invest in new aircraft or retrofitting their existing fleets. The aviation industry’s financial concerns, exacerbated by global economic uncertainties, limit the broader adoption of advanced APU technologies, especially for smaller fleet operators.

Technical Challenges

The technical complexity associated with modern APUs can limit their adoption in Qatar’s rapidly expanding fleet. Advanced APUs, such as those with hybrid or fuel-cell technology, require complex integration with aircraft systems, which can pose maintenance challenges. Qatar Airways and other regional airlines face technical hurdles in training maintenance personnel to handle the latest APU technologies. This challenge is compounded by the lack of skilled technicians capable of managing these systems, which can result in high operational downtime and increased maintenance costs. These factors hinder the rapid adoption of newer APU technologies in the region.

Opportunities

Technological Advancements

Technological advancements in APUs, particularly with hybrid and electric models, offer substantial opportunities for growth in Qatar’s APU market. As of 2024, the aviation sector in Qatar is actively pursuing greener technologies, with Qatar Airways looking to implement more fuel-efficient aircraft by incorporating advanced APUs into their fleet. The shift towards electric APUs, capable of reducing carbon emissions during ground operations, has gained momentum. This aligns with Qatar’s National Vision 2030, which prioritizes sustainability across all sectors. Qatar’s continuous push toward cleaner, more efficient aviation solutions opens doors for advanced APU technologies to capture a larger market share.

International Collaborations

International collaborations are expected to play a significant role in advancing the APU market in Qatar. With Qatar Airways expanding its global operations and pursuing fleet modernization strategies, the airline is expected to continue forging partnerships with global APU manufacturers. As of 2024, Qatar Airways has entered joint ventures and collaborations with industry leaders like Rolls-Royce and Honeywell for aircraft engines and auxiliary systems. These partnerships not only facilitate the exchange of technology but also encourage the local manufacturing and servicing of APUs in Qatar. Such collaborations enhance the technological expertise of local MRO providers and strengthen the region’s role in the global aviation supply chain.

Future Outlook

The Qatar Aircraft Auxiliary Power Unit market is expected to experience significant growth over the next 5 to 6 years. With Qatar’s aviation sector continuing to expand and adapt to global environmental standards, the demand for advanced, fuel-efficient, and low-emission APUs is projected to rise. The integration of electric and hybrid APUs, which offer reduced fuel consumption and environmental benefits, will also contribute to the future growth. This growth will be underpinned by government initiatives, including investments in green technologies, and the increasing fleet size of Qatar Airways, which will further boost the demand for high-quality APUs.

Major Players in the Market

- Honeywell Aerospace

- Pratt & Whitney

- Safran Power Units

- Rolls-Royce

- MTU Aero Engines

- Collins Aerospace

- GE Aviation

- PBS Group

- Elbit Systems

- Liebherr Aerospace

- AEGIS Power Systems

- Dewey Electronics Corporation

- BAE Systems PLC

- AMETEK Airtechnology Group

- Kinetics Ltd.

Key Target Audience

- Commercial Airlines

- MRO Service Providers

- Aircraft OEMs

- Defense and Military Agencies (e.g., Qatar Armed Forces)

- Aviation Regulatory Authorities (e.g., Civil Aviation Authority of Qatar)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Qatar Ministry of Transport and Communications)

- Aircraft Leasing Companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that influence the Qatar APU market, such as fleet size, fuel consumption trends, and APU technology preferences. Desk research and secondary data sources, such as aviation and regulatory reports, are employed to compile this information.

Step 2: Market Analysis and Construction

A thorough analysis of Qatar’s APU market is carried out, examining historical data on aircraft fleets, APU maintenance cycles, and demand trends. This includes studying growth drivers such as fuel efficiency standards and government policies on sustainability.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics, such as APU demand in Qatar, are validated through expert consultations. These interviews provide insights into the operational practices of key market players and help refine market assumptions.

Step 4: Research Synthesis and Final Output

Finally, market data is synthesized from both the top-down and bottom-up research approaches. Insights gathered from industry leaders are integrated to ensure the accuracy and relevance of the findings, providing a comprehensive overview of the Qatar APU market.

- Executive Summary

- Research Methodology (Market Definitions & Scope [APU Types, Application Boundaries], Data Sources [Aviation Registries], Primary Research [MRO/Operator Interviews], Modeling Approaches [Top‑Down/Bottom‑Up], Assumptions [Fuel Price Elasticity, Aircraft Utilization Rates], Limitations [APU Confidentiality], Forecast Confidence)

- Ecosystem Context: Qatar’s aviation cluster (airlines, MRO, OEM supply)

- APU Role in Aircraft Operations (ground/flight power roles)

- Installed Base Dynamics (narrowbody/widebody fleet APU units)

- Definition & Scope

- Industry Genesis & Qatar Evolution

- APU Business Cycle Dynamics

- APU Value Chain & Supply Dynamics

- Growth Drivers

Qatar’s Fleet Expansion & Hub Traffic Density

MRO Licensing for APU MRO (HGT1700)

APU Emissions & Airport APU‑Off Policies

Electrification & Hybrid APU Adoption

- Market Challenges

Certification Complexities

Component Supply Chain Constraints

Fuel Price Volatility

Replacement Cost Thresholds

- Market Opportunities

Predictive Health Monitoring Services

Regional APU Test & Bench Capabilities

Defense Modernization Contracts

Electric APU Ecosystem Build‑Out

- Key Industry Trends

Digital APU Performance Analytics

Electrified Ground Operations

Lightweight Power Systems

Fuel‑Cell/Hybrid APU Proof‑Of‑Concept Deployments

- Regulatory, Standards & Compliance Landscape

Civil Aviation Requirements (ICAO, EASA, GCAA)

APU Environmental & Emissions Standards

Airport Operational Policies (APU‑Off Gate Power Guidelines)

Defense Procurement Standards

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By APU Type (In Value %)

Gas Turbine APU [Power Output Metrics]

Hybrid Electric APU [Operational Efficiency Ratios]

Battery‑Assisted APU [Battery Energy Density]

Fuel‑Cell APU [Emissions Footprint]

Retrofit APU Kits [Lifecycle Cost Metrics]

- By Aircraft Segment (In Value %)

Narrow‑Body Commercial [Seat Config/Wheel Cycles]

Wide‑Body Commercial [Range Utilization]

Business/Private Jets [Mission Profiles]

Rotary‑Wing Platforms [Power vs. Weight]

UAV/Drone Heavy Lift (Qatar Defense) [Endurance Loads]

- By Application (In Value %)

New OEM Installations [Carrier Orders]

MRO Overhaul & Refurbishment [Turnaround Indicators]

Retrofitting Solutions [Fleet Modernization Rates]

Spare Part Sales [Inventory Turnover]

APU Performance Monitoring & Software Services

- By Distribution & Service Channel (In Value %)

Direct OEM Sales

Authorized MRO Channels (e.g., Qatar Airways MRO APU Services)

Independent MRO Providers

Aftermarket Distributors

Digital/Remote Condition‑Based Contracts

- Qatar Market Share by Value & Volume (APUs Installed/Serviced)

- Cross Comparison Parameters (Company Overview, APU Product Portfolio, APU Power Levels Supported, Recent Innovations, Maintenance Footprint, Certification Sets, Aftermarket Services, Regional Support Hubs, Contract Backlogs)

- SWOT Analyses of Major Competitors

- Qatar APU Pricing & Contract Benchmarking

- Detailed Company Profiles

Honeywell Aerospace

Pratt & Whitney

Safran Power Units

Rolls‑Royce PLC

MTU Aero Engines AG

Raytheon Technologies (Collins Aerospace)

PBS Group a.s.

Elbit Systems

Liebherr‑Aerospace

AEGIS Power Systems

Dewey Electronics Corporation

BAE Systems PLC

AMETEK Airtechnology Group

Kinetics Ltd.

Safran/Hamilton Sundstrand JV

- Aircraft manufacturers (OEMs)

- Maintenance, repair, and overhaul (MRO) providers

- Military and defense aviation units

- Business and general aviation operators

- Airport operators

- Commercial airlines

- Aircraft leasing companies

- Aviation training and simulation centers

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035