Market Overview

The Qatar aircraft band clamp market is valued at approximately USD ~ million in 2024, with growth primarily driven by the country’s expanding aviation sector. The market size is influenced by key factors such as the growing number of aircraft fleets in Qatar, government investments in aviation infrastructure, and increasing aircraft maintenance and repair activities. The demand for high-quality band clamps, essential for various aircraft systems, has surged, especially with Qatar’s rising air traffic and defense spending, further driving market growth.

Qatar dominates the aircraft band clamp market due to its strategic positioning as a major hub for international air travel and military aviation. The country’s capital, Doha, is home to several key airports and military facilities, fueling the demand for aircraft parts and maintenance services. Additionally, Qatar’s robust defense industry and investment in airline fleets, particularly through Qatar Airways, significantly contribute to the dominance of the country in the market. Qatar’s substantial investments in the aviation sector ensure a steady demand for high-performance band clamps.

Market Segmentation

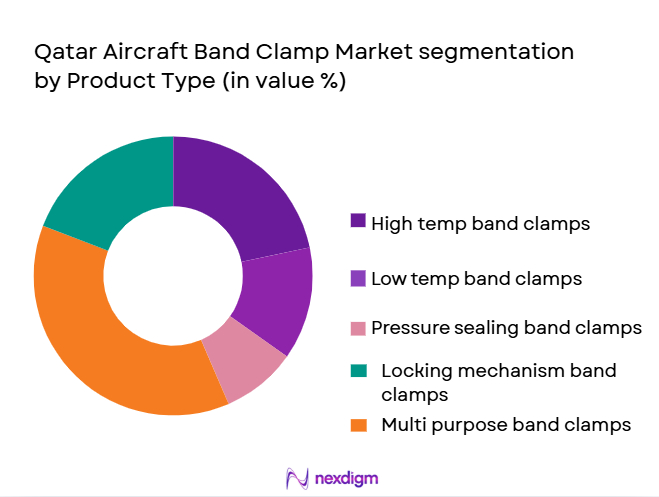

By Product Type

The Qatar aircraft band clamp market is segmented by product type into high-temperature band clamps, low-temperature band clamps, pressure-sealing band clamps, locking mechanism band clamps, and multi-purpose band clamps. Among these, high-temperature band clamps currently dominate the market, driven by their essential role in maintaining engine components and high-performance systems within aircraft. These clamps are widely used in both commercial and military aircraft due to their reliability and durability at elevated temperatures. The growing aviation fleet and increasing demand for high-performance aircraft systems in Qatar contribute to the steady dominance of this sub-segment.

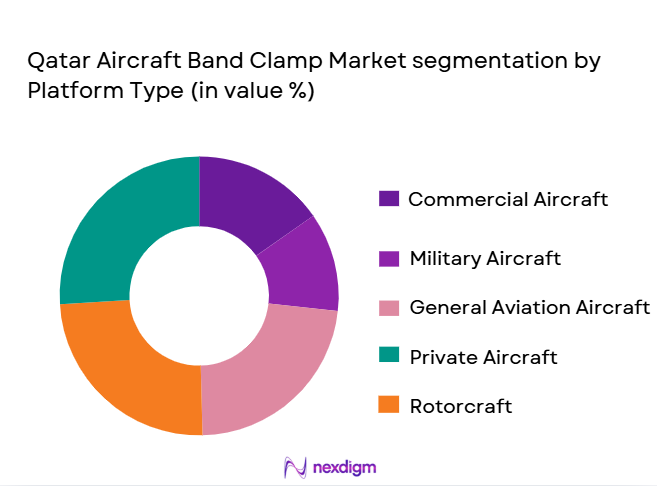

By Platform Type

The Qatar aircraft band clamp market is further segmented by platform type into commercial aircraft, military aircraft, general aviation aircraft, private aircraft, and rotorcraft. Commercial aircraft hold a dominant market share in Qatar, driven by the rapid expansion of Qatar Airways and the increase in global air travel. Qatar’s strong airline presence necessitates the use of a wide range of aircraft components, including band clamps, to maintain high standards of safety and efficiency. The consistent growth in passenger traffic and the expansion of the fleet further solidify the dominance of this segment in the market.

Competitive Landscape

The Qatar aircraft band clamp market is dominated by a mix of established global aerospace companies and specialized local manufacturers. The consolidation of a few major players in the market reflects their ability to supply high-quality components and meet the increasing demand for aircraft parts in Qatar. Key players like Honeywell and Parker Hannifin, among others, are leading the market with their strong technological capabilities and widespread distribution networks. This competitive landscape highlights the importance of product reliability, technological innovation, and strategic partnerships with airlines and defense contractors in the region.

| Company | Establishment Year | Headquarters | Product Range | Market Presence | Key Clients | Innovation Focus |

| Honeywell International Inc. | 1906 | USA | ~ | ~ | ~ | ~ |

| Parker Hannifin Corporation | 1917 | USA | ~ | ~ | ~ | ~ |

| GKN Aerospace | 2000 | UK | ~ | ~ | ~ | ~ |

| Ingersoll Rand | 1905 | USA | ~ | ~ | ~ | ~ |

| Meggitt PLC | 1947 | UK | ~ | ~ | ~ | ~ |

Qatar Aircraft Band Clamp Market Dynamics

Growth Drivers

Increase in Aircraft Fleet Size

The expansion of Qatar’s aircraft fleet is a significant driver for the aircraft band clamp market. According to the International Air Transport Association (IATA), the Middle East region, which includes Qatar, has seen a robust growth in its fleet size, with airlines in the region expected to operate more than ~ aircraft by 2026. Qatar Airways, one of the leading global airlines, has been at the forefront of this growth, with a fleet that includes over ~ aircraft as of 2024. This continuous expansion fuels demand for high-quality aircraft components, including band clamps, as the fleet requires ongoing maintenance, repair, and upgrades. The increasing number of aircraft directly drives the need for components like aircraft band clamps for enhanced performance and reliability.

Rising Aircraft Maintenance and Repair Activities

As Qatar’s airline fleet continues to expand, the need for aircraft maintenance and repair (MRO) services rises accordingly. Qatar’s MRO market has shown consistent growth, driven by both domestic needs and as a regional hub for aviation services. Qatar Airways has increasingly relied on local MRO providers, enhancing the demand for high-quality parts like band clamps. According to the Qatar Civil Aviation Authority (QCAA), the number of aircraft requiring regular maintenance, including structural repairs and upgrades, has surged in recent years. Furthermore, with the increase in long-haul flights, there is a growing focus on ensuring the durability and efficiency of components, which contributes to higher demand for aircraft band clamps.

Market Challenges

High Raw Material Costs

The rising costs of raw materials used in the manufacturing of aircraft components, including band clamps, represent a significant challenge for the market. Materials like titanium and high-grade alloys are essential for manufacturing durable band clamps, but their prices have seen substantial increases. As of 2024, the price of titanium has increased by nearly 10% from the previous year due to supply chain disruptions and increased demand from aerospace manufacturers globally. This cost pressure affects the overall production cost for band clamps, which could impact pricing and availability. Given Qatar’s reliance on imported components, this issue becomes a significant challenge for local manufacturers and suppliers.

Stringent Regulatory Requirements

Stringent regulatory requirements in the aerospace sector pose a challenge to the market. Aircraft components such as band clamps are subject to strict safety and performance regulations set by authorities such as the Qatar Civil Aviation Authority (QCAA) and the European Union Aviation Safety Agency (EASA). Compliance with these regulations requires manufacturers to maintain high-quality standards, which can increase production costs and extend lead times. In 2024, the introduction of more rigorous environmental standards and certifications, especially concerning material sustainability and component safety, adds complexity to the production process. The need to comply with these evolving standards could hinder the growth of the market if manufacturers fail to keep up with the changing landscape.

Market Opportunities

Expansion of Aerospace & Defense Sector in the Middle East

The aerospace and defense sector in the Middle East, particularly in Qatar, presents significant opportunities for the aircraft band clamp market. The Qatar government has committed substantial investments in defense and aviation infrastructure, which drives demand for high-quality components like band clamps. According to the Qatar Ministry of Defense, defense spending is expected to grow by over 5% annually, with a focus on modernizing the air force and expanding military aircraft capabilities. This increase in military spending and aircraft fleet modernization creates substantial demand for components like band clamps, particularly for military-grade aircraft that require more durable and high-performance parts.

Growth in Air Travel Demand

The increasing demand for air travel in the Middle East, including Qatar, is creating a strong market opportunity for aircraft component suppliers. In 2024, Qatar’s air traffic has been rebounding to pre-pandemic levels, with passenger numbers approaching record highs. Qatar Airways, the country’s flagship carrier, has consistently increased its number of routes and destinations. This surge in air traffic results in increased demand for aircraft maintenance, including the need for components like band clamps to ensure aircraft performance and safety. As the number of flights continues to rise, the requirement for durable and efficient aircraft components will continue to grow.

Future Outlook

Over the next decade, the Qatar aircraft band clamp market is expected to experience steady growth, supported by the expansion of both commercial and military aviation. Qatar’s continued investments in its aviation infrastructure, coupled with the rapid development of Qatar Airways’ fleet, will be key drivers of market growth. Additionally, the increasing demand for military aircraft maintenance, repair, and upgrades will fuel further market opportunities. Technological advancements in band clamp materials and designs, focused on improving performance and reducing weight, will also play a crucial role in shaping the market’s future.

Major Players

- Honeywell International Inc.

- Parker Hannifin Corporation

- GKN Aerospace

- Ingersoll Rand

- Meggitt PLC

- UTC Aerospace Systems

- Eaton Corporation

- LORD Corporation

- The Timken Company

- SKF Group

- Collins Aerospace

- Hamilton Sundstrand

- MRO Solutions Qatar

- Aerospace Technologies Qatar

- Qatar Aircraft Maintenance Company (QAMCO)

Key Target Audience

- Aircraft Manufacturers

- Airlines (Qatar Airways, Gulf Air)

- Military and Defense Contractors (Qatar Armed Forces, Qatar Air Force)

- Aviation Component Suppliers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Civil Aviation Authority)

- Procurement Officers at Defense and Airline Companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will map the key variables influencing the Qatar Aircraft Band Clamp market, focusing on stakeholders like commercial airlines, military contractors, and MRO service providers. Secondary research will be used to collect insights from industry reports, market data, and government publications, aiming to identify the most crucial factors shaping the market.

Step 2: Market Analysis and Construction

The analysis will compile historical market data to establish trends in the Qatar Aircraft Band Clamp market. By evaluating the market’s growth trajectory, key factors driving demand, and the balance between supply and demand, this phase aims to predict the potential market size for the forecast period.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including representatives from aircraft manufacturers, MRO providers, and aviation component suppliers, will be interviewed to validate market hypotheses. This step ensures that the data aligns with real-world observations and helps refine the forecast model.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data into a cohesive report. This includes detailed insights into the market’s competitive landscape, key market drivers, and potential future trends. We will collaborate with industry stakeholders to verify the accuracy of findings and ensure the relevance of the data for strategic decision-making.

- Executive Summary

- Qatar Aircraft Band Clamp Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Aircraft Fleet Size

Rising Aircraft Maintenance and Repair Activities

Technological Advancements in Band Clamp Materials - Market Challenges

High Raw Material Costs

Stringent Regulatory Requirements

Long Replacement and Maintenance Cycles - Market Opportunities

Expansion of Aerospace & Defense Sector in the Middle East

Growth in Air Travel Demand

Increase in Government Investments for Aircraft Fleet Modernization - Trends

Shift Toward Lightweight and Durable Materials

Rise in Aircraft Modifications and Customizations

Increased Focus on Sustainable Aviation Practices

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

High-Temperature Band Clamps

Low-Temperature Band Clamps

Pressure-Sealing Band Clamps

Locking Mechanism Band Clamps

Multi-Purpose Band Clamps - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Private Aircraft

Rotorcraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Maintenance & Repair

Replacement - By EndUser Segment (In Value%)

Aircraft Manufacturers

Airlines

MRO Service Providers

Defense Contractors

Private Aircraft Owners - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Distributors & Resellers

Online Platforms

Supply Chain Partners

Procurement through Third-Party Service Providers

- Market Share Analysis

- CrossComparison Parameters

(Material Quality, Pricing, Innovation, Brand Reputation, Service Agreements ) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Aeroflex USA Inc.

BASF Corporation

Dorman Products, Inc.

Goodrich Aerospace

GKN Aerospace

Harris Corporation

Honeywell International Inc.

Ingersoll Rand

Kaman Aerospace

Lisi Aerospace

Meggitt PLC

Parker Hannifin Corporation

Rubbercraft Aerostructures

Smiths Aerospace

Triumph Group

- Airlines Focus on Cost Efficiency and Aircraft Performance

- Military Aircraft Demand for Advanced Band Clamps

- Private Aircraft Owners Prioritize Customization Options

- MRO Providers Investing in High-Quality Aircraft Components

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035