Market Overview

The Qatar Aircraft Battery market is valued at USD ~ billion, supported by the increasing demand for modernized aviation systems and the country’s ambitious infrastructure development in aviation. With Qatar’s growth as a global aviation hub, driven by national carrier Qatar Airways’ expansion and strategic government investments, the demand for advanced aircraft technologies, including batteries, has surged. Additionally, sustainable aviation solutions, such as electric propulsion, are gaining traction, contributing to the growth of this market. As aircraft manufacturers and airlines seek to adopt more efficient and eco-friendly systems, the demand for high-performance batteries in aircraft continues to rise, with a focus on lightweight, durable, and fast-charging solutions.

Qatar is emerging as a dominant player in the Middle Eastern aircraft battery market, with Doha serving as a central hub for aviation. The dominance is primarily attributed to the country’s strategic investments in its aviation infrastructure, including the expansion of Hamad International Airport and the continuous fleet upgrades of Qatar Airways. Furthermore, Qatar’s proactive approach in adopting green technologies, such as electric and hybrid aircraft, has further boosted the demand for aircraft batteries. Other key cities in the region, like Dubai and Abu Dhabi, also contribute significantly to the demand due to their booming aviation sectors and extensive aircraft fleets, but Qatar’s concentrated market focus and international connectivity place it at the forefront in terms of aircraft battery needs.

Market Segmentation

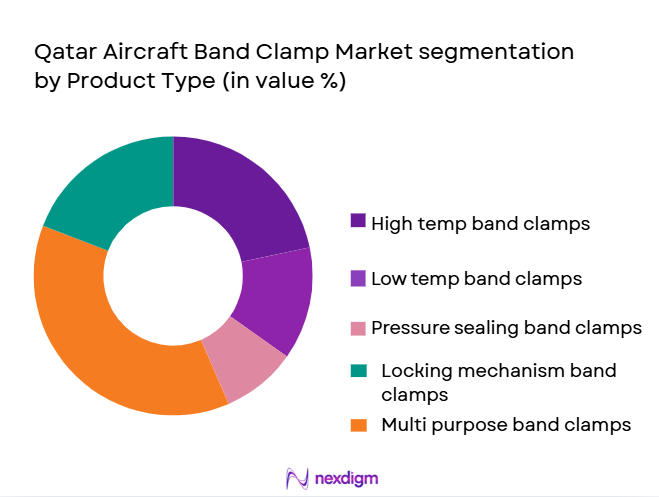

By Product Type

The Qatar Aircraft Battery market is segmented by system type into lithium-ion batteries, lead-acid batteries, nickel-cadmium batteries, solid-state batteries, and fuel cell batteries. Among these, lithium-ion batteries have the dominant market share in 2024, owing to their higher energy density, longer lifespan, and lightweight characteristics. These batteries are increasingly being adopted in commercial and military aircraft to support the demand for more fuel-efficient and eco-friendly solutions. Lithium-ion batteries’ rapid adoption is also supported by the advancements in charging technology, making them the preferred choice for OEMs. The ability of lithium-ion batteries to efficiently store and release energy, coupled with their relatively lower maintenance costs compared to traditional lead-acid batteries, has solidified their position as the leading system type in the market.

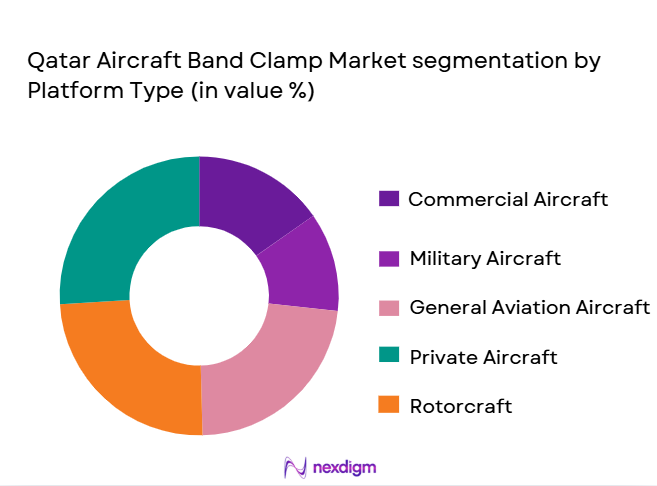

By Platform Type

The market is also segmented by platform type, including commercial aircraft, military aircraft, general aviation aircraft, unmanned aerial vehicles (UAVs), and helicopters. Commercial aircraft account for the largest share in 2024. This dominance can be attributed to the rapid growth of international and domestic air travel, driven by Qatar Airways’ expansive fleet and the continued expansion of Qatar’s aviation sector. The demand for commercial aircraft is high due to their large-scale operations and long-range flights, requiring efficient, reliable, and high-capacity batteries. Additionally, the commercial sector’s ongoing shift towards more sustainable aviation technologies has increased the need for advanced battery solutions that are both environmentally friendly and performance driven.

Competitive Landscape

The Qatar Aircraft Battery market is dominated by a few major players, including global battery manufacturers and niche companies specializing in aviation-grade batteries. These players are focusing on innovations in battery technology, such as enhancing energy density and improving the safety and reliability of batteries for high-demand aviation applications. Companies such as Saft, Honeywell, and A123 Systems are at the forefront of developing cutting-edge battery solutions, leveraging their global presence and significant investments in research and development to maintain competitive advantages.

| Company | Establishment Year | Headquarters | Battery Technology | Key Applications | Market Focus | R&D Investment |

| Saft | 1918 | Paris, France | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | Charlotte, USA | ~ | ~ | ~ | ~ |

| A123 Systems | 2001 | Michigan, USA | ~ | ~ | ~ | ~ |

| Leclanché | 1909 | Yverdon-les-Bains, Switzerland | ~ | ~ | ~ | ~ |

| Amperex Technology Ltd. | 1990 | Hong Kong | ~ | ~ | ~ | ~ |

Qatar Aircraft Battery Market Dynamics

Growth Drivers

Growing Demand for Electric Propulsion in Aircraft

The global push toward sustainable aviation solutions has led to a significant rise in the demand for electric propulsion systems. In 2024, the International Air Transport Association (IATA) projects that the global aviation industry will need to reduce its carbon emissions by ~% by 2050. To achieve this goal, the industry is increasingly investing in electric and hybrid propulsion systems for aircraft. These systems require high-performance batteries, which drives the demand for aircraft batteries. Qatar, as a leading global aviation hub, is aligning with this trend by pushing for the integration of electric propulsion systems in its fleet. Qatar Airways has already taken steps toward a more sustainable future, supporting electric propulsion research and the implementation of electric engines in commercial aircraft. This trend is expected to continue, especially with the country’s focus on reducing its carbon footprint through technological innovations.

Expansion of Commercial Aviation Industry in Qatar

Qatar’s aviation industry is expanding rapidly, driven by government initiatives to position Doha as a global transportation hub. The expansion is marked by substantial investments in airport infrastructure, such as the ongoing development of Hamad International Airport, which is set to increase capacity by 50% by 2025. The demand for aircraft and their components, including batteries, is naturally growing as Qatar Airways continues to increase its fleet, aiming to operate more than ~ aircraft by 2025. This expansion is fueled by Qatar’s strategic geographical location, which connects it to major international markets in Asia, Europe, and the Americas. In 2024, Qatar Airways expects to deliver significant growth in passenger traffic, further bolstering the demand for advanced aviation technologies like aircraft batteries that support both current and future fleet needs.

Market Challenges

High Cost of Advanced Battery Technologies

One of the major challenges facing the Qatar Aircraft Battery market is the high cost associated with advanced battery technologies such as lithium-ion and solid-state batteries. In 2024, the cost of lithium-ion batteries remains high due to the expensive materials required for their production, such as lithium and cobalt. Despite the decline in costs over the years, these batteries still represent a significant investment for airlines and aircraft manufacturers. Furthermore, the development of next-generation battery technologies, like solid-state batteries, is still in its early stages, requiring substantial R&D investments, which adds to the overall cost. As battery technology improves, the costs are expected to decrease, but the current economic conditions in 2024 make it challenging for smaller and less capitalized aviation companies to adopt these advanced systems.

Limited Battery Life and Energy Density

Battery life and energy density continue to be critical barriers for the widespread adoption of electric aircraft. In 2024, the energy density of lithium-ion batteries is still limited, which means that electric propulsion systems cannot yet fully match the range of traditional jet fuel-powered aircraft. For commercial airlines like Qatar Airways, the need for long-range aircraft is crucial, and the current battery technology does not provide the necessary endurance for long-haul flights without frequent recharging. Moreover, the limited battery life also impacts operational efficiency, as frequent battery replacements or upgrades are required, adding to operational costs. These limitations are a significant challenge for airlines looking to transition toward sustainable aviation solutions without compromising performance or profitability.

Market Opportunities

Development of Next-Generation Solid-State Batteries

The development of next-generation solid-state batteries represents a major opportunity for the Qatar Aircraft Battery market. Solid-state batteries offer significant advantages over traditional lithium-ion batteries, including higher energy density, longer lifespan, and greater safety. Currently, solid-state batteries are being tested for various applications, including electric vehicles and aircraft. In 2024, major players in the global battery market, such as Quantum cape and Toyota, are ramping up their R&D efforts to bring solid-state batteries to market. These batteries are expected to become a key component in the transition toward electric aircraft in Qatar. As the technology matures and production scales up, it is anticipated that solid-state batteries will significantly lower the weight and cost of battery systems while improving performance, driving the adoption of electric propulsion systems in the aviation industry.

Increase in Demand for Electric and Hybrid Aircraft

The demand for electric and hybrid aircraft is on the rise, driven by the aviation industry’s commitment to reducing its carbon footprint. Qatar Airways, which continues to expand its fleet, is expected to play a pivotal role in adopting hybrid and electric aircraft. As of 2024, Qatar Airways has committed to exploring electric propulsion in its new fleet, looking to implement greener technologies in both its commercial and cargo operations. The global shift toward decarbonizing the aviation industry, supported by governments’ green initiatives, is expected to further fuel the adoption of electric and hybrid aircraft. Qatar’s position as a global aviation hub gives it an advantage in adopting these technologies early, establishing itself as a leader in sustainable aviation.

Future Outlook

Over the next ~ years, the Qatar Aircraft Battery market is expected to show significant growth driven by continuous government support for aviation infrastructure, the rapid adoption of electric and hybrid aircraft, and technological advancements in battery systems. The market will likely see increased demand from commercial and military aviation sectors, with advancements in energy storage technologies leading to lighter, more efficient, and cost-effective battery systems. Furthermore, as Qatar positions itself as a global aviation hub, the need for more sustainable and reliable battery systems will be crucial to meeting the rising expectations of both commercial airlines and governmental aviation agencies.

Major Players

- Saft

- Honeywell

- A123 Systems

- Leclanché

- Amperex Technology Ltd.

- Aker BP

- Lithium Balance

- Power Systems International

- Toshiba Corporation

- Dynon Avionics

- EaglePicher Technologies

- Textron Aviation

- Eaton Corporation

- Thales Group

- Rolls-Royce

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Qatar Civil Aviation Authority)

- Commercial Airlines (e.g., Qatar Airways)

- Aircraft Manufacturers (e.g., Airbus, Boeing)

- Military and Defense Organizations (e.g., Qatar Armed Forces)

- Battery Technology Providers

- Aviation Equipment Distributors

- Aviation Maintenance, Repair, and Overhaul (MRO) Service Providers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will identify all relevant stakeholders within the Qatar Aircraft Battery Market. This will be done through extensive desk research, utilizing a combination of secondary and proprietary databases to understand the influence of various market drivers, such as technological advancements, policy changes, and market dynamics.

Step 2: Market Analysis and Construction

We will analyze historical data to evaluate the market penetration of various battery types, such as lithium-ion, lead-acid, and nickel-cadmium. The analysis will focus on the performance of these batteries in both commercial and military applications. This step will also assess market adoption rates for electric and hybrid aircraft, examining the revenue generation within each segment.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through primary research, including interviews with industry experts from battery manufacturers, aircraft operators, and aviation service providers. These consultations will help validate the assumptions and provide insights into current trends, technological advancements, and customer preferences.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data to deliver a comprehensive analysis of the Qatar Aircraft Battery Market. Insights will be cross-checked and validated through direct engagement with manufacturers and key stakeholders to ensure the accuracy of market estimates, segment growth forecasts, and competitive dynamics. This step will provide an in-depth view of the market’s trajectory and future outlook.

- Executive Summary

- Qatar Aircraft Battery Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for electric propulsion in aircraft

Expansion of commercial aviation industry in Qatar

Government investments in sustainable aviation technologies - Market Challenges

High cost of advanced battery technologies

Limited battery life and energy density

Regulatory and certification hurdles for new technologies - Market Opportunities

Development of next-generation solid-state batteries

Increase in demand for electric and hybrid aircraft

Government incentives for sustainable aviation solutions - Trends

Rising adoption of eco-friendly aviation technologies

Advancements in battery charging infrastructure

Integration of AI and IoT for battery monitoring and management

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Lithium-ion Batteries

Lead-acid Batteries

Nickel-cadmium Batteries

Solid-state Batteries

Fuel Cell Batteries - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Replacement Systems

Hybrid Systems

Integrated Power Systems - By EndUser Segment (In Value%)

Commercial Airlines

Private Aircraft Owners

Military and Defense

UAV Manufacturers

Aircraft Maintenance Providers - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Through OEMs

Distributors & Resellers

Online Procurement Platforms

Third-party Service Providers

- Market Share Analysis

- Cross Comparison Parameters

(Battery technology innovation, Market penetration by segment, Pricing strategies, Regulatory compliance, Supply chain efficiency) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saft

AeroVironment

Sichuan Changhong Electric Co., Ltd.

Honeywell International Inc.

Leclanché

OXYGEN Aviation

Lithium Balance

Power Systems International

Toshiba Corporation

Amperex Technology Limited

Dynon Avionics

Wittmann Battenfeld

Eagle-Picher Technologies

A123 Systems LLC

Textron Aviation

Eaton Corporation

- Increased demand from commercial airlines for eco-friendly battery solutions

- Military and defense sector seeking reliable and durable battery systems

- Private aircraft owners focusing on cost-effective battery maintenance

- Growing interest in UAVs and the need for specialized power solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035