Market Overview

The Qatar Aircraft Braking Systems market is experiencing robust growth, driven by the increasing demand for advanced safety features in aviation and the expansion of Qatar’s aviation industry. In 2023, the market size reached approximately USD ~ million, and it is projected to grow significantly through 2024, driven by the expansion of airports and rising investments in aircraft safety technologies. The growth is propelled by the high volume of air traffic in the region, bolstered by the country’s role as a hub for international air travel, with major players like Qatar Airways investing in fleet modernization. Furthermore, the increased focus on environmentally friendly and energy-efficient braking systems further accelerates market growth.

Qatar dominates the aircraft braking systems market primarily due to the rapid expansion of its aviation sector, which is supported by major airlines like Qatar Airways. Doha, the capital city, is a central hub for air travel in the Middle East, making it a key player in the global aviation infrastructure. Qatar’s strategic investments in airport modernization and aircraft fleet expansion fuel demand for high-tech braking systems. Additionally, the government’s focus on enhancing aviation safety standards and regulatory frameworks further strengthens Qatar’s position as a dominant player in the regional aircraft braking systems market.

Market Segmentation

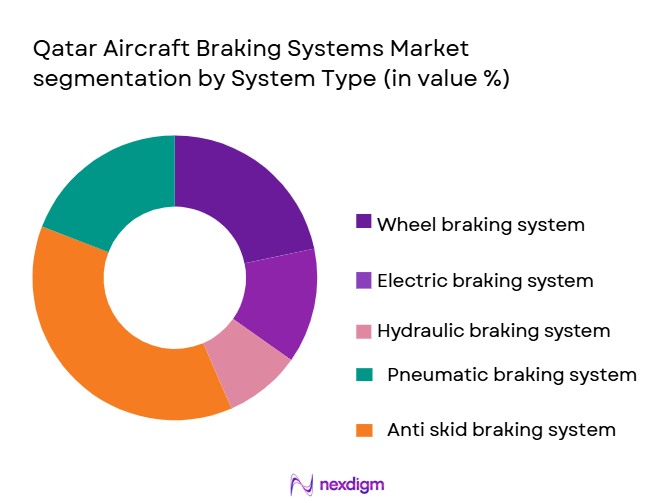

By System Type

The Qatar Aircraft Braking Systems market is segmented by system type into wheel braking systems, electric braking systems, hydraulic braking systems, pneumatic braking systems, and anti-skid braking systems. Wheel braking systems hold the largest market share due to their widespread use in various aircraft types, driven by their proven reliability and effectiveness in providing consistent performance in both commercial and military aircraft. Their dominance is further supported by their established presence in the market and continued technological advancements aimed at enhancing braking efficiency and reducing maintenance costs. Moreover, advancements in carbon-carbon and ceramic materials for braking systems are expected to further cement their position as the preferred choice for numerous aircraft models.

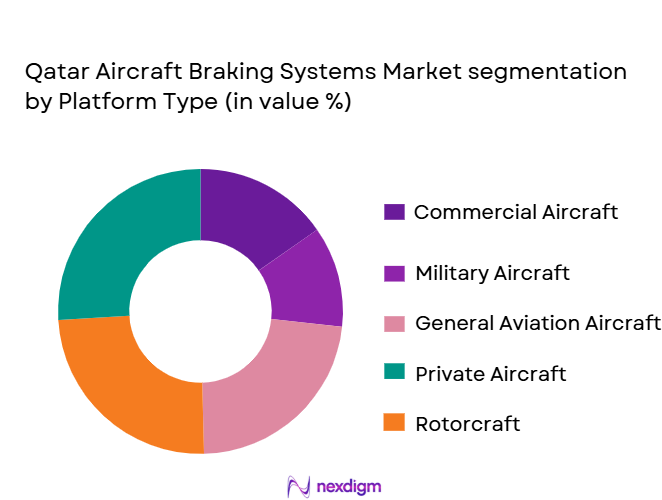

By Platform Type

The market is segmented by platform type into commercial aircraft, military aircraft, cargo aircraft, private jets, and helicopters. Commercial aircraft dominate the market share due to the continuous growth in global air travel and the significant fleet size of commercial airlines in the Middle East. Qatar Airways, one of the largest global carriers, is continuously expanding its fleet, driving the demand for state-of-the-art braking systems to enhance passenger safety and optimize operational efficiency. The high frequency of commercial air travel in Qatar and the region, combined with technological innovations, ensures commercial aircraft remain the largest platform type in terms of braking system usage.

Competitive Landscape

The Qatar Aircraft Braking Systems market is dominated by a few key players who are responsible for most of the technological advancements in the sector. The competitive landscape is marked by the presence of global leaders in aerospace technology and braking systems. Companies like Honeywell Aerospace, Safran Landing Systems, and UTC Aerospace Systems are key players in the market, given their extensive expertise in developing and supplying advanced braking technologies tailored for the aviation sector. These companies also benefit from strong partnerships with aircraft manufacturers, contributing to their dominant positions in the market.

| Company | Establishment Year | Headquarters | Product Innovation | Technological Advancements | Market Penetration | Partnerships with Airlines | Manufacturing Capacity | Customer Base | R&D Investment | Global Reach | Regulatory Compliance |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Landing Systems | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| UTC Aerospace Systems | 1934 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Meggitt | 1947 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1931 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Braking Systems Market Dynamics

Growth Drivers

Increasing Air Travel Demand

Qatar’s aviation industry continues to experience growth, supported by increasing global air traffic and the expansion of Qatar Airways, which serves over ~ destinations worldwide. In 2024, air traffic in Qatar is expected to grow by ~% as the country benefits from strategic investments in the aviation sector. Qatar’s expansion of Hamad International Airport, which has seen a ~% increase in capacity over the last decade, is also expected to accommodate growing passenger numbers. As more airlines opt for modern, fuel-efficient aircraft, the demand for advanced braking systems is expected to rise accordingly, ensuring safety and performance at scale.

Technological Advancements in Braking Systems

Advancements in braking technologies, such as electric and carbon-carbon braking systems, are driving market growth. In 2024, technological innovations like lighter materials and energy-efficient solutions will be crucial as aircraft manufacturers look to reduce operational costs. The global aviation industry is also witnessing an increase in adoption of electric braking systems, which are expected to contribute to improved fuel efficiency. These technologies are gaining traction in regions like the Middle East, where operational efficiency is a key focus. In addition, Qatar’s investments in technology innovation are expected to significantly boost demand for high-performance braking systems in both commercial and military aircraft.

Market Challenges

High Initial Cost of Advanced Braking Systems

One of the key challenges faced by the aircraft braking systems market in Qatar is the high initial cost of advanced braking systems. The installation of modern braking systems, such as electric braking systems or high-performance carbon-carbon brakes, requires significant capital investment. The upfront costs of these technologies, including installation and training for maintenance personnel, can be a barrier for smaller airlines or military operators. However, with rising fuel costs and the push for fuel-efficient solutions, the long-term savings in terms of fuel efficiency and reduced maintenance costs may justify these initial expenses.

Regulatory Compliance and Certification Hurdles

Aviation regulatory bodies in Qatar, such as the Qatar Civil Aviation Authority (QCAA), impose stringent requirements on braking systems to ensure passenger safety and reliability. The process of gaining approval for new braking technologies involves a long and costly certification process, which can delay the adoption of newer technologies in the market. These regulatory challenges are exacerbated by the complex nature of global aviation standards, with alignment required between Qatari regulations and international aviation bodies like the FAA and EASA. Compliance with these regulations can result in increased development costs and extended time-to-market for new braking systems.

Market Opportunities

Growth in Aircraft Fleet Size

Qatar’s aircraft fleet size continues to expand, with Qatar Airways increasing its fleet by more than ~% over the past five years. In 2024, the airline is expected to continue acquiring more than ~ aircraft per year, including wide-body aircraft and fuel-efficient models, such as the Boeing ~ and Airbus A350. As Qatar Airways and other regional airlines grow their fleets, the demand for advanced braking systems will increase in tandem. Additionally, the government’s efforts to modernize and expand Hamad International Airport will provide further opportunities for the growth of this market, with an estimated increase in airport traffic expected to reach ~ million passengers annually by 2025. This expansion necessitates new aircraft models, all of which will require advanced braking systems.

Rising Demand for Eco-friendly Braking Solutions

With the increasing global focus on sustainability, there is a growing demand for eco-friendly braking systems in the aviation sector. Qatar is committed to reducing carbon emissions and promoting environmental sustainability in its aviation industry. This is expected to drive the adoption of lightweight and energy-efficient braking systems, such as electric brakes and carbon-carbon braking systems. Qatar Airways has already committed to reducing its carbon footprint by ~% by 2030, which will likely influence the choice of braking systems. As airlines around the world adopt more eco-friendly practices, the demand for innovative braking systems in the region will rise.

Future Outlook

Over the next decade, the Qatar Aircraft Braking Systems market is expected to witness substantial growth. This expansion is primarily driven by the ongoing development of advanced braking technologies that prioritize safety, environmental sustainability, and efficiency. As Qatar continues to strengthen its aviation infrastructure, including the expansion of Hamad International Airport and an increase in aircraft deliveries, the demand for sophisticated braking systems will continue to grow. The market will also benefit from the increasing integration of electric braking systems, which offer enhanced performance, reduced weight, and improved fuel efficiency.

Major Players

- Honeywell Aerospace

- Safran Landing Systems

- UTC Aerospace Systems

- Meggitt

- Collins Aerospace

- Liebherr Aerospace

- Parker Hannifin

- Goodrich Aerospace

- Brembo

- Thales Group

- TRW Automotive

- General Electric

- L3 Technologies

- Airbus

- Boeing

Key Target Audience

- Airlines (e.g., Qatar Airways)

- Military Agencies (e.g., Qatar Armed Forces)

- Aircraft Manufacturers (e.g., Boeing, Airbus)

- Aviation Regulatory Bodies (e.g., Qatar Civil Aviation Authority)

- Airport Operators (e.g., Hamad International Airport)

- Aircraft Maintenance Companies

- Aerospace Component Suppliers

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

This initial phase focuses on constructing a comprehensive ecosystem map that identifies key stakeholders in the Qatar Aircraft Braking Systems market. Desk research and secondary databases are leveraged to gather detailed industry-level information, enabling the identification of critical variables that influence the market’s dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data specific to Qatar’s aviation sector is compiled and analyzed. This includes evaluating aircraft fleet sizes, service provider penetration, and the resulting demand for braking systems. This analysis is used to assess the overall market structure, ensuring the inclusion of all relevant market components in the forecast.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through telephone interviews with industry experts and professionals from various aviation sectors. These consultations provide direct insights into technological advancements, customer preferences, and regulatory issues, which help to refine the market data and projections.

Step 4: Research Synthesis and Final Output

In the final phase, detailed consultations are held with key industry players and suppliers to acquire in-depth data on product segments, sales performance, and trends. This helps in verifying and complementing the data collected during the research process, ensuring that the final report provides a complete and accurate analysis of the Qatar Aircraft Braking Systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air travel demand

Technological advancements in braking systems

Government investments in aviation infrastructure - Market Challenges

High initial cost of advanced braking systems

Regulatory compliance and certification hurdles

Lack of skilled maintenance personnel - Market Opportunities

Growth in aircraft fleet size

Rising demand for eco-friendly braking solutions

Expanding aircraft manufacturing hubs in the Middle East - Trends

Shift towards electric braking systems

Adoption of AI and automation in braking technology

Focus on reducing aircraft maintenance downtime

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Wheel Braking Systems

Electric Braking Systems

Hydraulic Braking Systems

Pneumatic Braking Systems

Anti-Skid Braking Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Cargo Aircraft

Private Jets

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Direct Replacement

Upgrades - By EndUser Segment (In Value%)

Airlines

Military Forces

Cargo Operators

Private Jet Owners

Airports - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Distributors

OEM Partnerships

Government Contracts

Online Sales

- Market Share Analysis

- CrossComparison Parameters

(Market Share, Product Innovation, Technological Advancements, Regional Penetration, Customer Service) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Safran Landing Systems

UTC Aerospace Systems

Boeing

Meggitt

Collins Aerospace

L3 Technologies

Liebherr Aerospace

Goodrich Aerospace

Brembo

Daimler AG

Thales Group

General Electric

Parker Hannifin

TRW Automotive

- Growing demand for advanced safety features in aircraft

- Increased investments by airlines in fleet modernization

- Shift towards reducing operational costs in aircraft maintenance

- Expansion of private jet ownership in the region

- Forecast Market Value, 2026-2035

- Forecast Installed Units , 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035