Market Overview

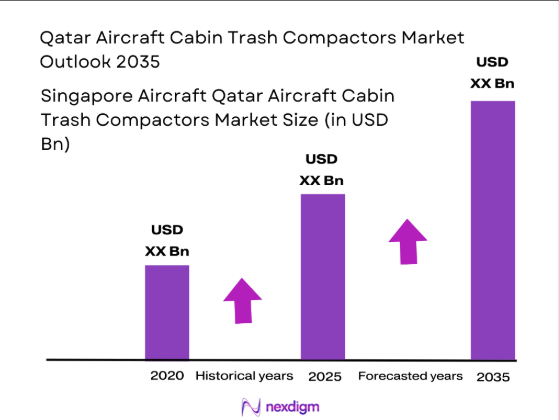

The Qatar Aircraft Cabin Trash Compactors market is witnessing growth driven by the increasing demand for efficient waste management systems in the aviation sector. The market size in 2025 is estimated to be valued at USD ~ million. This market is driven by the expansion of Qatar Airways’ fleet and the rising emphasis on improving operational efficiency and environmental sustainability in aircraft operations. Additionally, the global trend toward implementing eco-friendly technologies has prompted significant investments in waste management solutions for aircraft cabins, further bolstering the market.

Qatar, and specifically its capital Doha, is the dominant player in the Aircraft Cabin Trash Compactors market. Qatar Airways, the flagship carrier, serves as a primary driver of this market, with its modern fleet and its commitment to sustainability. Doha’s strategic location as a global aviation hub contributes to its dominance, with frequent flight connections to numerous international destinations. Qatar’s strong focus on improving its national infrastructure, including the development of advanced waste management systems in the aviation sector, positions the country as a key player in this market.

Market Segmentation

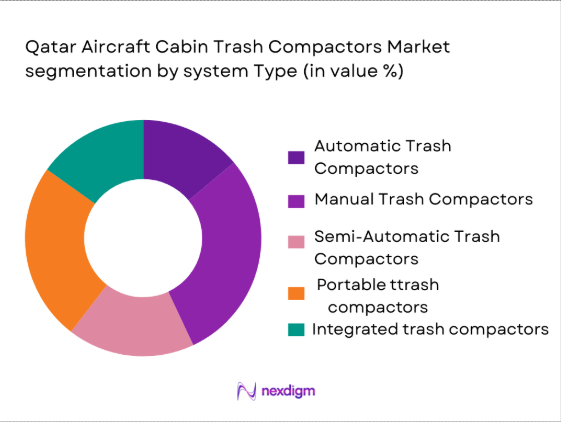

By System Type

The Qatar Aircraft Cabin Trash Compactors market is segmented by system type into automatic trash compactors, manual trash compactors, semi-automatic trash compactors, portable trash compactors, and integrated trash compactors. Among these, automatic trash compactors are currently the dominant subsegment. The increasing demand for automation in aircraft operations is the primary driver behind this. Automatic trash compactors offer enhanced efficiency, reducing labor costs and improving waste processing during flight. Airlines, particularly Qatar Airways, have embraced these systems to streamline cabin operations and improve waste management, ensuring that the systems are capable of handling waste onboard without requiring manual intervention.

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, private aircraft, military aircraft, cargo aircraft. Commercial aircraft dominate this segment due to the growing demand for efficient waste management systems in passenger cabins. As Qatar Airways continues to expand its fleet of commercial aircraft, the need for efficient cabin trash compactors has risen. Commercial aircraft operate in high-capacity environments, making efficient trash management systems crucial for maintaining cleanliness and adhering to sustainability practices. This trend is reflected in the significant investment made by major airlines like Qatar Airways, which has a fleet of over 200 aircraft.

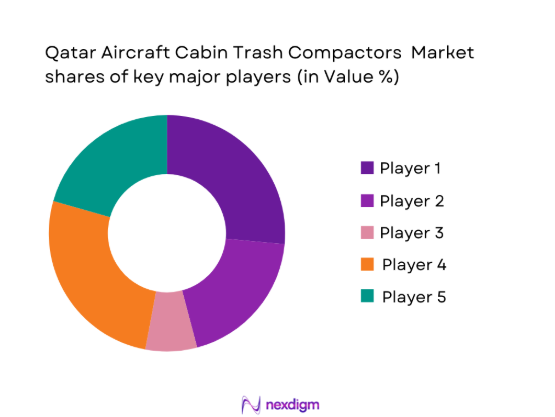

Competitive Landscape

The Qatar Aircraft Cabin Trash Compactors market is characterized by a mix of global and regional players. Major players like Honeywell International, Moog Inc., and Diehl Aerospace dominate the market due to their strong presence in the aerospace sector and their commitment to innovation. These companies provide a wide range of waste management systems for aircraft cabins, catering to the growing needs of airlines for efficient, cost-effective, and sustainable solutions. Qatar Airways’ fleet modernization program also significantly boosts the demand for these systems, creating opportunities for both established and new market entrants.

| Company | Establishment Year | Headquarters | Technology Focus | Key Clients | R&D Investment | Global Presence |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, USA | ~ | ~ | ~ | ~ |

| Diehl Aerospace | 1909 | Überlingen, Germany | ~ | ~ | ~ | ~ |

| Safran Aircraft Interiors | 2005 | Paris, France | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | Plaisir, France | ~ | ~ | ~ | ~ |

Qatar Aircraft Cabin Trash Compactors Market Dynamics

Growth Drivers

Increasing Air Travel and Passenger Volume in the Middle East

The Middle East has seen a significant rise in air travel, with Qatar serving as a major hub for global flights. Qatar Airways has expanded its fleet by over 60 aircraft in recent years, bringing its fleet total to more than 250 aircraft in 2025. This surge in passenger volume directly correlates with the need for improved waste management systems aboard aircraft. As passenger numbers grow, so does the demand for effective and efficient cabin waste management solutions like trash compactors. The growth in the aviation sector in the region is being supported by the expansion of airports, such as the expansion of Hamad International Airport, which saw passenger traffic grow by 8% in 2025

Rising Demand for Waste Management Solutions in Aviation

As environmental awareness increases, airlines, including Qatar Airways, are under pressure to implement more sustainable waste management practices. The need for waste management solutions that handle large volumes of waste efficiently and compact it for proper disposal is rising. In response, Qatar Airways is investing in advanced cabin trash compaction systems. Additionally, Qatar has committed to reducing waste and increasing recycling in the aviation sector, aligning with global sustainability initiatives such as the UN’s Sustainable Development Goals. The Middle East aviation market is leading in the adoption of green technologies to handle in-flight waste, with Qatar playing a critical role.

Market Challenges

High Installation and Maintenance Costs for Aircraft Trash Compactors

The installation of cabin trash compactors in aircraft presents high initial costs due to the complexity of integrating these systems into existing aircraft. In 2025, the cost of installing a state-of-the-art waste compaction system is a significant financial burden for airlines. Qatar Airways, despite being one of the leading adopters of modern systems, faces challenges in justifying the high capital investment required for these solutions. Furthermore, the ongoing maintenance of these systems, particularly in terms of spare parts and servicing, adds to the operational costs for airlines. These high expenses slow the adoption of compactors, especially among smaller carriers in the region.

Regulatory Challenges for Waste Disposal Systems in Aviation

While Qatar has stringent waste disposal regulations for airlines, international regulations also impact the ease of implementing new waste management systems. Airlines must adhere to both local and international aviation waste disposal standards, which can be complex and time-consuming to navigate. In 2023, the International Civil Aviation Organization (ICAO) updated its waste management protocols, requiring all airlines to upgrade their systems. These stringent regulations can delay the rollout of newer, more efficient trash compaction systems, as airlines wait for approval and certification, adding layers of complexity to the adoption process.

Market Opportunities

Adoption of More Compact and Efficient Trash Compaction Systems

As airlines look to optimize cabin space and reduce waste, there is a growing opportunity for more compact and efficient trash compaction systems. In 2023, Qatar Airways began testing smaller, more efficient trash compaction systems designed to fit within existing aircraft structures without compromising space for passengers. These compact systems are able to compress more waste into smaller volumes, freeing up cabin space while improving waste processing efficiency. With increasing demand for these space-saving and efficient systems, manufacturers are expected to innovate further, creating opportunities for growth in the market

Integration of Smart and Automated Trash Management Solutions

The integration of smart technology into waste management systems represents a significant opportunity for the Qatar Aircraft Cabin Trash Compactors market. Airlines are increasingly adopting IoT-enabled systems that allow for real-time monitoring of waste levels and automatic notification for waste collection. This system helps airlines optimize waste management schedules and reduce the operational burden of manual inspections. Qatar Airways, in line with its commitment to innovation, is investing in the development of these smart waste management solutions, which will likely lead to further growth and market expansion.

Future Outlook

The Qatar Aircraft Cabin Trash Compactors market is expected to see steady growth in the coming years, driven by the growing demand for sustainable waste management systems in aviation. With Qatar Airways and other regional airlines expanding their fleets, the need for modern waste management solutions will continue to increase. Additionally, technological advancements in waste compaction and recycling systems, along with the global push towards reducing aviation-related waste, will further propel market growth. Qatar’s investment in airport and aviation infrastructure, particularly at Hamad International Airport, will also contribute to the continued development of this market.

Major Players in the Market

- Honeywell International

- Moog Inc.

- Diehl Aerospace

- Safran Aircraft Interiors

- Zodiac Aerospace

- Rockwell Collins

- Panasonic Avionics

- Collins Aerospace

- ST Engineering

- Lufthansa Technik

- Boeing

- Airbus

- Mitsubishi Heavy Industries

- B/E Aerospace

- Thales Group

Key Target Audience

- Aerospace Manufacturers

- Airline Operators

- Military Operators

- MRO Service Providers

- Aircraft OEMs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Authorities

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on identifying the critical drivers, challenges, and opportunities within the Qatar Aircraft Cabin Trash Compactors market. A thorough review of existing market reports, industry publications, and government regulations forms the basis for mapping out these variables.

Step 2: Market Analysis and Construction

We compile and analyze historical data on the adoption of cabin waste management solutions by airlines operating in Qatar and the broader Middle Eastern region. Key parameters such as fleet expansion rates, airline sustainability initiatives, and regulatory compliance are evaluated to understand market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth drivers and technological trends will be validated through interviews with industry experts, airline executives, and manufacturers of aircraft cabin trash compactors. These consultations help refine the market model and validate assumptions.

Step 4: Research Synthesis and Final Output

Data gathered from primary and secondary research sources is synthesized to generate actionable insights. This final output includes detailed forecasts, market size estimates, and key trends that will guide stakeholders in making informed business decisions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air travel and passenger volume in the Middle East

Rising demand for waste management solutions in aviation

Implementation of eco-friendly waste management regulations in airlines - Market Challenges

High installation and maintenance costs for aircraft trash compactors

Regulatory challenges for waste disposal systems in aviation

Technological limitations of current trash compactor systems - Market Opportunities

Adoption of more compact and efficient trash compaction systems

Integration of smart and automated trash management solutions

Rising demand for sustainable waste management practices in airlines - Trends

Increased focus on green technologies and eco-friendly systems

Growth in the Middle Eastern aviation market driving demand

Technological advancements in waste management automation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Automatic Trash Compactors

Manual Trash Compactors

Semi-Automatic Trash Compactors

Portable Trash Compactors

Integrated Trash Compactors - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Hybrid Fitments

Replacement Units - By End User Segment (In Value%)

Airlines

Private Jet Operators

Military Operators

Aircraft OEMs

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement

OEM Distribution

Third-Party Procurement

Online Procurement

Government Procurement

- Market Share Analysis

- Cross Comparison Parameters (Product innovation, Technological advancement, Market share by region, Regulatory compliance, Customer service capabilities)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed company profiles

Honeywell International

Collins Aerospace

Zodiac Aerospace

Moog Inc.

Diehl Aerospace

Safran Aircraft Interiors

ST Engineering

Panasonic Avionics

Rockwell Collins

Lufthansa Technik

Boeing

Airbus

GE Aviation

SITA

Airbus Cabin Systems

- Airlines adopting advanced waste management systems for operational efficiency

- Private jet operators integrating compactors for luxury travel needs

- Military operators adopting compact systems for logistical advantages

- MRO service providers focusing on cabin waste solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035