Market Overview

The Qatar aircraft cameras market is poised for significant growth, driven by the increasing need for enhanced safety and surveillance in aviation. Aircraft cameras are essential for improving security, providing real-time monitoring of both the internal and external environment of the aircraft. These systems help in monitoring flight operations, enhancing situational awareness for pilots, and ensuring passenger safety. With Qatar’s growing aviation industry, including the expansion of Qatar Airways and the development of modern airports, the demand for advanced camera systems continues to rise. These systems are becoming crucial for meeting safety standards and regulatory requirements, further contributing to market growth.

In addition to the rising need for enhanced security, advancements in camera technology are also playing a key role in shaping the market. The integration of high-resolution, thermal, and 360-degree cameras is making monitoring more comprehensive and efficient. Qatar’s push towards modernization and a smart aviation infrastructure, supported by investments in next-generation technologies, is expected to accelerate the adoption of aircraft cameras. With the increase in air traffic, stringent regulations, and a focus on operational efficiency, the demand for aircraft cameras in Qatar will continue to expand significantly, making it a vital segment in the aviation market.

Market Segmentation

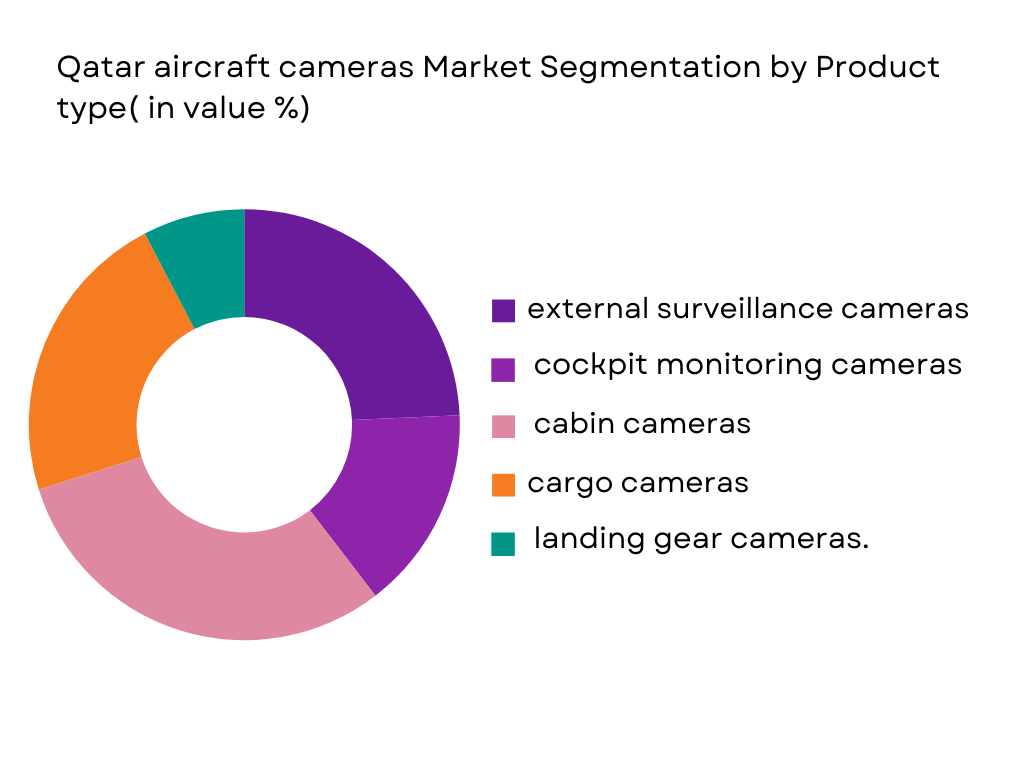

By Product Type

The Qatar Aircraft Cameras market is segmented into external surveillance cameras, cockpit monitoring cameras, cabin cameras, cargo cameras, and landing gear cameras. External surveillance and cockpit vision systems dominate the market due to their critical role in enhancing pilot situational awareness, especially during taxiing, landing, and low-visibility operations. The adoption of enhanced vision systems (EVS) in next-generation aircraft further strengthens this segment’s dominance.

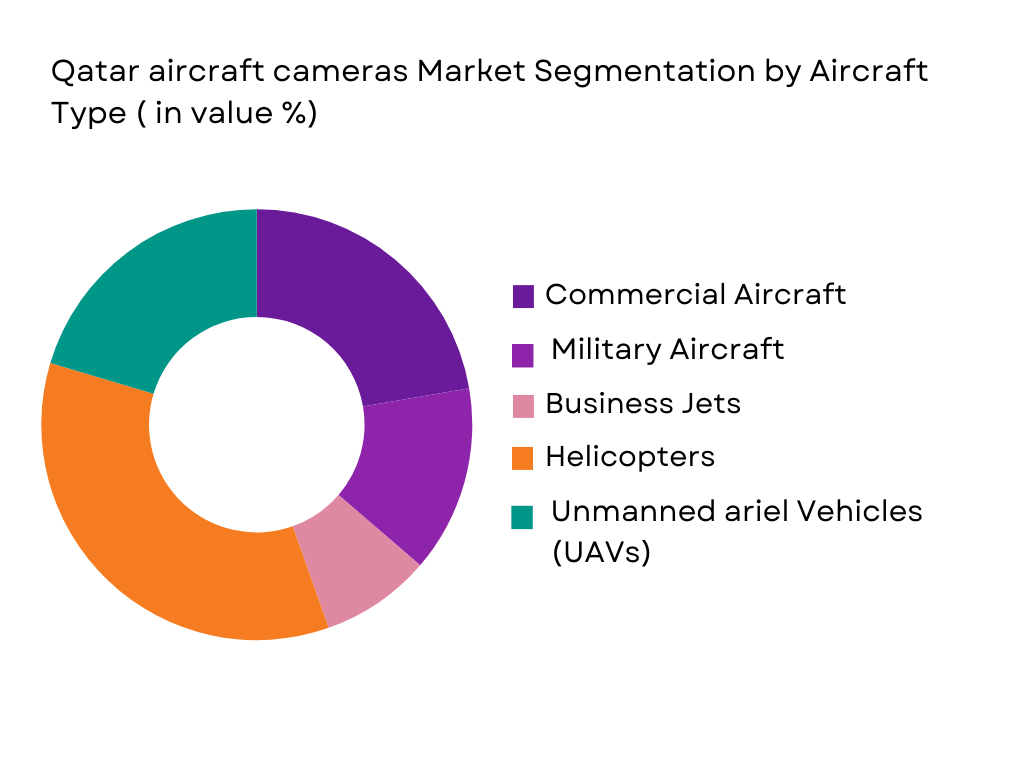

By Aircraft Type

Commercial aircraft represent the largest market share, supported by Qatar Airways’ wide-body fleet and continuous aircraft acquisitions. Military aircraft and UAVs form the second-largest segment, driven by defense modernization programs and surveillance requirements. Business jets and helicopters contribute steadily, particularly in government and VIP aviation.

Competitive Landscape

The Qatar Aircraft Cameras market is moderately consolidated, with global aerospace and defense companies dominating system supply. Major players benefit from long-term OEM relationships, defense contracts, and advanced sensor technologies. Collaboration with aircraft manufacturers and MRO providers remains a key competitive strategy.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Safran Electronics & Defense | 1961 | France | Vision & ISR Systems | Global | Aircraft Camera Systems | – | – |

| Collins Aerospace | 2018 | USA | Avionics & Sensors | Global | EVS Cameras | – | – |

| Thales Group | 1893 | France | Defense Optics | Global | EO/IR Cameras | – | – |

| L3Harris Technologies | 1895 | USA | ISR Solutions | Global | Surveillance Cameras | – | – |

| Honeywell Aerospace | 1906 | USA | Cockpit Systems | Global | Vision Systems | – | – |

Qatar Aircraft Cameras Market Analysis

Growth Drivers

Commercial fleet expansion and safety mandates

Qatar’s aviation sector is undergoing rapid growth with the expansion of its commercial fleet, necessitating greater safety measures, operational efficiency, and passenger satisfaction. The government’s push for safer aviation practices has resulted in the adoption of advanced camera systems across its fleet, improving ground operations and reducing pilot workload. These camera systems support pre-flight inspections, real-time monitoring during ground handling, and flight operations by providing crucial data for maintenance and flight path adjustments. Additionally, international aviation safety standards and regulatory mandates further push for the integration of such technologies, ensuring compliance with established norms. With Qatar’s airport expansion plans and the growing fleet size, these camera systems are crucial for supporting both the operational and safety needs of the aviation sector.

Defense-driven surveillance requirements

Qatar’s defense sector has placed a significant emphasis on advanced surveillance systems, which directly increases the demand for high-quality aircraft cameras. Surveillance, intelligence, and reconnaissance (ISR) missions require robust, high-definition camera systems to enhance situational awareness, border security, and tactical operations. These systems are deployed for both military and homeland security operations, which include monitoring sensitive areas, detecting threats, and providing critical data for strategic decision-making. With Qatar’s continuous defense investments, the country is positioning itself to strengthen its national security capabilities through advanced imaging and sensor technologies. This growing demand for sophisticated camera systems in defense applications presents long-term opportunities for the aviation sector to enhance its military and surveillance capacities, particularly in the face of modern security challenges.

Market Challenges

System integration complexity

Integrating advanced camera systems into existing avionics and flight management systems is a technically demanding process that requires specialized expertise. These camera systems must seamlessly connect with an aircraft’s complex network of sensors, navigation systems, and flight control mechanisms. The difficulty in achieving such integration increases installation time and the associated costs, which can be a barrier for operators seeking efficient and cost-effective solutions. Furthermore, the integration process often requires modifications to aircraft systems, which can lead to unanticipated delays in delivery schedules. As a result, the aviation industry in Qatar faces significant challenges in ensuring smooth integration, requiring ongoing technical support, training, and coordination between suppliers and aircraft manufacturers to minimize disruptions.

Dependence on imported technology

Qatar’s reliance on international suppliers for advanced aircraft camera systems exposes the market to various risks, particularly related to supply chain disruptions, geopolitical tensions, and regulatory dependencies. The technological expertise and cutting-edge components required for these systems are primarily sourced from global leaders in imaging and sensor technologies, which means that Qatar must contend with any challenges these suppliers may face. Delays in deliveries or changes in foreign trade policies could impact the timely acquisition of critical systems. Additionally, fluctuating import duties, changing certification standards, and the complexity of aligning these imported systems with local regulations can pose hurdles. This dependence on foreign technology makes the market vulnerable to external pressures, further complicating the development of an autonomous domestic supply chain for advanced aerospace technologies.

Opportunities

Smart airports and digital aviation initiatives

Qatar’s strategic push towards developing smart airports and digital aviation solutions presents a promising opportunity for the adoption of advanced camera systems. The integration of artificial intelligence (AI) and data analytics with camera technology is transforming the way airports operate. AI-enabled cameras can enhance security by monitoring real-time movements, detecting anomalies, and improving passenger screening processes. Additionally, advanced camera systems support predictive maintenance by detecting faults in airport infrastructure or aircraft earlier than traditional methods. Qatar’s vision for a fully digital aviation ecosystem, supported by automation and intelligent infrastructure, creates significant demand for camera systems that are capable of collecting, analyzing, and transmitting real-time data to improve safety and efficiency across the airport environment.

UAV and unmanned surveillance growth

The increasing deployment of unmanned aerial vehicles (UAVs) for security, monitoring, and defense applications provides a significant growth opportunity for the aircraft camera systems market in Qatar. UAVs require specialized, lightweight camera systems that offer high-resolution imaging capabilities, enabling them to perform surveillance and intelligence gathering over large areas with precision. Qatar’s growing focus on UAV technology, especially for defense, border security, and environmental monitoring, significantly expands the addressable market for these camera systems. As UAVs become more integral to military and civilian operations, the demand for high-quality camera systems that can be integrated into these unmanned platforms will continue to grow, offering substantial opportunities for innovation in both the private and defense sectors.

Future Outlook

The Qatar Aircraft Cameras market is expected to witness steady growth through 2035, supported by fleet expansion, defense procurement, and technological advancements in vision systems. The integration of AI-enabled imaging, enhanced vision systems, and multi-sensor platforms will define the next phase of market evolution. Strong government backing and Qatar’s strategic role in regional aviation ensure a positive long-term outlook.

Major Players

- Safran Electronics & Defense

- Collins Aerospace

- Thales Group

- FLIR Systems

- L3Harris Technologies

- Honeywell Aerospace

- Elbit Systems

- Leonardo S.p.A.

- Hensoldt

- Rafael Advanced Defense Systems

Key Target Audience

- Aircraft OEMs and system integrators

- Defense and military aviation agencies

- Commercial airlines and business jet operators

- MRO service providers

- Government and regulatory authorities

- Aerospace investors and strategic partners

Research Methodology

Step 1: Identification of Key Variables

In this step, key variables affecting the Qatar Aircraft Cameras market are identified, including technological advancements in imaging systems, regulatory and certification requirements, defense and commercial aviation demand drivers, and procurement patterns. Extensive desk research is conducted to gather market insights, assess aircraft fleet trends, and identify influential market growth factors across commercial, military, and business aviation segments.

Step 2: Market Analysis and Construction

This phase involves analyzing historical market data, including aircraft camera adoption rates, installed base across different aircraft types, procurement volumes, and pricing trends. The focus is on evaluating market dynamics, assessing the impact of fleet modernization and defense investments, and understanding historical growth patterns within Qatar’s aviation ecosystem.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including aircraft camera system manufacturers, avionics integrators, MRO service providers, airline technical teams, and defense aviation officials. This step ensures the accuracy, reliability, and relevance of market estimates and qualitative insights.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing findings from all research stages, engaging with key stakeholders, and validating data points against industry benchmarks and aviation trends. The consolidated analysis forms the basis for the final Qatar Aircraft Cameras Market Outlook to 2035.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Aviation Infrastructure Growth

- Growth Drivers

Expansion of commercial aviation and fleet modernization

Rising defense and security investments

Technological advancements in vision and sensor system - Market Challenges

High cost of advanced camera systems

Regulatory and certification complexities

- Market Opportunities

Growth in MRO and retrofit market

Integration of AI-enabled vision systems - Trends

Increasing adoption of 4K and infrared camera systems

Integration of camera feeds into flight management and cockpit displays - Government Regulations

Qatar Civil Aviation Authority (QCAA) Certification Standards

Military Aviation and Defense Procurement Regulations

Import Compliance and Technology Transfer Guidelines

- By Market Value 2020–2025

- By Installed Units 2020–2025

- By Average Camera System Price 2020–2025

- By Camera System Complexity Tier 2020–2025

- By Camera Type (In Value %)

External Surveillance Cameras

Cockpit Vision & Monitoring Cameras

Cabin Monitoring Cameras

Cargo & Belly Cameras

Landing Gear & Tail Cameras - By Aircraft Type (In Value %)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value %)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Upgrade Fitment

Custom Mission Fitment - By End User Segment (In Value %)

Commercial Airlines

Military & Defense Forces

Government & VIP Aviation

Business Jet Operators

MRO Service Providers - By Procurement Channel (In Value %)

Direct OEM Procurement

Government Defense Contracts

Third-Party Integrators

MRO-Based Procurement

Private Aviation Procurement

- Market Share Analysis

- Cross Comparison Parameters (Technology Innovation, System Integration Capability, Certification & Compliance Strength, Defense, Contract Portfolio, Regional Market Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces Analysis

- Detailed Company Profiles

Safran Electronics & Defense

Collins Aerospace

Thales Group

FLIR Systems (Teledyne Technologies)

L3Harris Technologies

Honeywell Aerospace

Elbit Systems

Leonardo S.p.A.

Hensoldt

Rafael Advanced Defense Systems

- Commercial Airlines

- Military & Defense Aviation Units

- Government & VIP Aviation Fleets

- Business Jet Operators

- MRO and Retrofit Service Providers

- Forecast Market Value 2026–2035

- Forecast Installed Units 2026–2035

- Price Forecast by Camera System Tier 2026–2035

- Future Demand by Aircraft Type 2026–2035