Market Overview

The Qatar Aircraft Cargo Systems market is valued at USD ~ million, driven by the country’s rapidly expanding aviation sector and strategic position as a logistics and cargo hub in the Middle East. Qatar has heavily invested in enhancing its air cargo infrastructure, particularly through the development of the Hamad International Airport, which has become one of the leading air cargo terminals globally. The growth is further supported by Qatar Airways’ expansion of its cargo fleet, increasing demand for efficient cargo handling, loading, and monitoring systems across its operations. The government of Qatar has provided continuous support to enhance the logistics and aviation sectors, making this a key driver for the market’s growth.

Qatar, particularly Doha, dominates the Aircraft Cargo Systems market due to its position as a global aviation and logistics hub. The Hamad International Airport in Doha serves as a major transshipment center for air cargo, facilitating the movement of goods across continents. The strong infrastructure investment, supported by both the government and private sector, has positioned Qatar as a key player in global air cargo. The strategic geographical location, with easy access to Europe, Asia, and Africa, makes it an attractive gateway for international cargo, fostering the growth of advanced cargo handling systems.

Market Segmentation

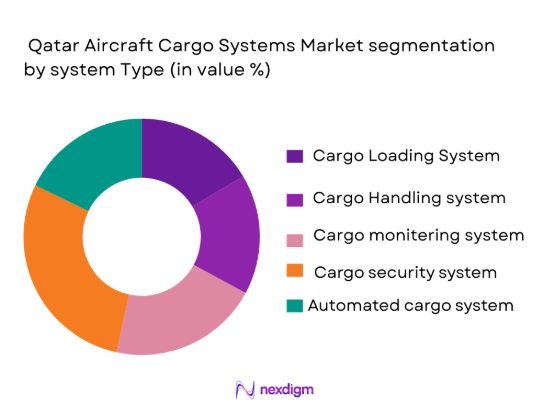

By System Type

The Qatar Aircraft Cargo Systems market is segmented by system type into cargo loading systems, cargo handling systems, cargo monitoring systems, cargo security systems, and automated cargo systems. Cargo loading systems have the dominant market share in Qatar, accounting for approximately 34% in 2024. This is due to the significant demand for efficient and fast loading systems to handle the high volume of cargo flowing through Hamad International Airport, which is one of the busiest cargo hubs globally. These systems are crucial for reducing turnaround time and ensuring smooth operations at major air cargo terminals.

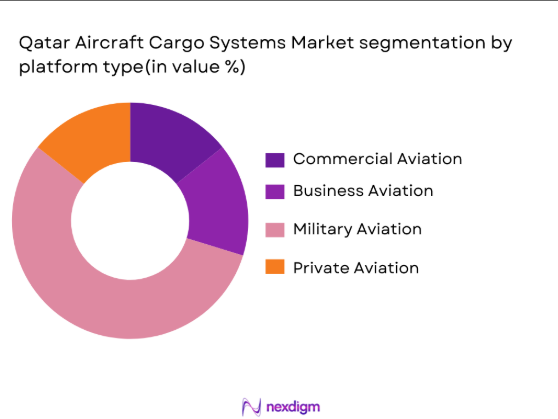

By Platform Type

The market is segmented by platform type into commercial aviation, military aviation, cargo aviation, business aviation, and private aviation. Cargo aviation leads the market, accounting for approximately 38% of the market share in 2024. The dominance of this segment is driven by Qatar’s strong air cargo operations, including Qatar Airways Cargo, which continues to expand its fleet and services. This expansion, combined with the growing demand for airfreight in the Middle East, is driving the adoption of advanced cargo systems in dedicated cargo aircraft, further solidifying cargo aviation’s leading role in the market.

Competitive Landscape

The Qatar Aircraft Cargo Systems market is dominated by a few global and regional players. Companies like Swisslog, Honeywell, and ST Engineering provide cutting-edge cargo systems, capitalizing on Qatar’s robust aviation infrastructure and logistics sector. Their strong brand presence and technological innovation ensure a competitive edge. Qatar Airways, with its massive fleet and investment in cargo services, has also spurred the growth of local suppliers who provide tailored solutions for Qatar’s air cargo operations.

| Company | Establishment Year | Headquarters | Products & Services | Market Reach | Technology Innovation | Key Clients |

| Swisslog | 1900 | Switzerland | – | – | – | – |

| Honeywell | 1906 | USA | – | – | – | – |

| ST Engineering | 1967 | Singapore | – | – | – | – |

| Panasonic | 1918 | Japan | – | – | – | – |

| Siemens | 1847 | Germany | – | – | – | – |

Qatar Aircraft Cargo Systems Market Dynamics

Growth Drivers

Increasing Demand for Cargo Capacity in Qatar’s Expanding Aviation Sector

Qatar’s aviation sector is rapidly growing, with passenger and freight traffic increasing year on year. Hamad International Airport, Qatar’s main aviation hub, handled 1.2 million tonnes of cargo in 2023, marking a year-on-year increase of 5.8%. This growing demand for cargo capacity is driven by the country’s expanding international trade, global position as a transshipment hub, and Qatar Airways’ cargo expansion. Additionally, Qatar’s non-oil economy, particularly its focus on trade diversification, further fuels this growth. The government’s continued focus on infrastructure development and logistics optimization ensures that Qatar remains a key global cargo hub.

Technological Advancements in Cargo Handling and Monitoring Systems

Technological advancements, such as the adoption of AI, IoT, and automation, have significantly enhanced cargo handling and monitoring systems in Qatar’s aviation sector. For instance, in 2023, Qatar Airways Cargo introduced advanced tracking systems for real-time cargo monitoring. These advancements ensure faster, more efficient handling, allowing for increased capacity at Hamad International Airport. The ongoing technological development of automated cargo systems is a response to the growing need for efficient operations as cargo volumes increase. Such technological investments align with Qatar’s Vision 2030, which promotes sustainable and advanced logistics infrastructure.

Market Challenges

High Costs of Advanced Cargo Systems

The implementation of advanced cargo systems in Qatar’s aviation sector faces challenges due to high costs. Automated cargo handling and security systems, such as RFID tracking and AI-driven cargo monitoring, require significant capital investment, making it difficult for smaller operators to compete. Additionally, the cost of system upgrades and maintenance increases as technologies become more sophisticated. As of 2024, the average cost of installing automated systems at major airports in Qatar is estimated to be over USD 10 million per facility, which limits the speed of adoption. This high investment requirement is a barrier for some operators looking to upgrade their systems.

Technological Integration Complexities with Legacy Systems

Integrating new technologies with existing cargo handling systems poses significant challenges in Qatar. Many older systems at Hamad International Airport were designed before the widespread use of automation and AI in logistics. As Qatar ramps up efforts to integrate these cutting-edge technologies, there are concerns about compatibility, system downtime, and disruption to existing operations. For example, legacy systems lack the capacity to interface seamlessly with modern cargo tracking and security solutions, making integration a complex and costly process. The high level of expertise required to handle this integration also poses an operational challenge.

Market Opportunities

Expansion of Qatar’s Cargo Hub and Increased Airfreight Demand

Qatar’s continued investment in its aviation and logistics infrastructure presents significant opportunities for the aircraft cargo systems market. The expansion of Hamad International Airport and its status as a critical global cargo transshipment hub contribute to the increasing demand for advanced cargo handling systems. The airfreight demand is supported by the 5.8% growth in Qatar’s total cargo handled in 2023, driven by increasing trade flows between Asia, Europe, and Africa. The government’s strategic investments in cargo infrastructure, as part of its Vision 2030 goals, will further bolster growth prospects for cargo systems providers.

Growing Adoption of Automated and AI-Based Cargo Handling Systems

There is a growing adoption of automated and AI-based cargo handling systems in Qatar, driven by the need for efficiency and cost savings. The government and private sector are both focused on improving operational efficiency at Hamad International Airport and other air cargo facilities. In 2023, Qatar Airways Cargo adopted AI-powered cargo management tools that helped streamline cargo operations, reduce human error, and improve security. This trend towards automation is expected to continue, as Qatar looks to maintain its competitive edge in global air cargo. The adoption of AI-based systems will drive further demand for advanced cargo systems in the coming years.

Future Outlook

Over the next 5 years, the Qatar Aircraft Cargo Systems market is expected to show steady growth driven by increasing demand for faster, more efficient, and secure cargo handling systems. As Qatar continues to invest in its aviation infrastructure and Hamad International Airport expands its cargo capacity, the need for automated, high-tech cargo systems will intensify. Additionally, Qatar Airways’ continued expansion into new markets will fuel demand for more advanced cargo management systems to ensure smooth and efficient operations. Innovations in AI and IoT-based systems are expected to drive the future growth of cargo security, monitoring, and automation systems.

Major Players

- Swisslog

- Honeywell

- ST Engineering

- Panasonic

- Siemens

- L3 Technologies

- Boeing

- Kuehne + Nagel

- Geodis

- DSV

- DHL

- United Parcel Service (UPS)

- Qatar Airways Cargo

- Menzies Aviation

- DB Schenker

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Qatar Civil Aviation Authority, Ministry of Transport and Communications Qatar)

- Airlines operating in the Middle East

- Aircraft manufacturers

- Cargo operators and freight companies

- MRO service providers

- Logistics and supply chain management companies

- Airport authorities and infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying the critical variables that drive the Qatar Aircraft Cargo Systems market. This includes evaluating the technological advancements in cargo handling and automation systems, as well as the market demand driven by growing air cargo traffic through Hamad International Airport. Data sources include government reports, aviation industry data, and market analysis reports.

Step 2: Market Analysis and Construction

In this phase, the historical data related to air cargo growth, infrastructure development, and the adoption of advanced cargo systems in Qatar are compiled. The analysis focuses on understanding how technological improvements are transforming cargo handling processes. The market construction process involves analyzing demand from airlines, airports, and freight operators for different cargo systems.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses, such as the increasing need for automation in air cargo systems, will be validated through consultations with industry experts. Interviews with aviation professionals, MRO service providers, and technology suppliers will provide insights into market dynamics, technological trends, and regulatory challenges. These consultations will help refine market data and validate projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing findings from the market analysis and expert consultations. A comprehensive report is developed to ensure that all data is accurate, reliable, and actionable for stakeholders in the Qatar Aircraft Cargo Systems market. This step also includes validating the forecast for future market trends and key developments.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for cargo capacity in Qatar’s expanding aviation sector

Technological advancements in cargo handling and monitoring systems

Government investment in airport infrastructure and logistics optimization - Market Challenges

High costs of advanced cargo systems

Technological integration complexities with legacy systems

Regulatory challenges in system certifications and compliance - Market Opportunities

Expansion of Qatar’s cargo hub and increased airfreight demand

Growing adoption of automated and AI-based cargo handling systems

Collaborations with global logistics players to enhance supply chain efficiency - Trends

Integration of IoT and AI for real-time cargo monitoring

Shift towards eco-friendly and energy-efficient cargo systems

Adoption of fully automated cargo terminals

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Cargo Loading Systems

Cargo Handling Systems

Cargo Monitoring Systems

Cargo Security Systems

Automated Cargo Systems - By Platform Type (In Value%)

Commercial Aviation

Military Aviation

Cargo Aviation

Business Aviation

Private Aviation - By Fitment Type (In Value%)

OEM Equipment

Aftermarket Equipment

Retrofit Solutions

Integrated Systems

Standalone Systems - By End User Segment (In Value%)

Airlines

MRO Service Providers

Cargo Operators

Freight Forwarders

OEM Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

OEM Partnerships

Third-Party Distributors

Online Channels

Service Contracts

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Technological Innovation, Regional Presence, Customer Service, Pricing Strategy)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Qatar Airways

DHL

Kuehne + Nagel

Swisslog

TUI Group

Honeywell International

Lufthansa Cargo

Geodis

ST Engineering

Mammoet

AeroExpo

Kuehne+Nagel

Fiege Logistics

DB Schenker

Air France KLM Cargo

- Increasing demand for cargo handling services from airlines

- Focus on improving airfreight operations for cargo operators

- Rising adoption of advanced cargo systems by MRO service providers

- Growth in freight forwarding services with enhanced cargo handling solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035