Market Overview

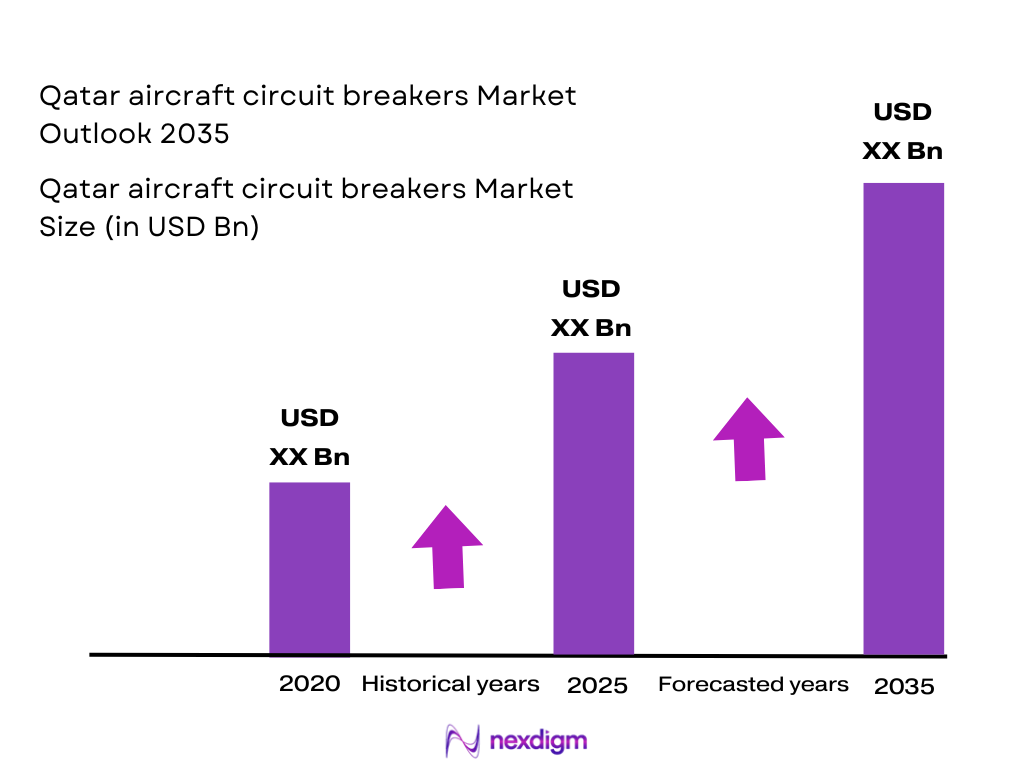

The Qatar Aircraft Circuit Breakers market is valued at approximately QAR ~ million in 2024. This market is primarily driven by the growing demand for advanced aircraft protection systems, stemming from the continuous expansion of both commercial and military aviation sectors. The increasing fleet size of commercial airlines, coupled with a rise in regional defense procurement, is fostering a need for reliable and high-performance circuit breakers. Furthermore, technological advancements in circuit breaker systems, such as the shift towards solid-state breakers, are further propelling market growth. Market demand is also supported by the ongoing adoption of more-electric aircraft, which requires highly efficient and sophisticated electrical protection systems.

Qatar stands out as a key player in the Middle Eastern aviation market due to its well-developed infrastructure, growing number of aircraft, and strategic position as a hub for international air travel. The country’s major cities, especially Doha, host numerous aerospace and defense contractors, and the national airline, Qatar Airways, has one of the fastest-growing fleets globally. Qatar’s government investments in modernizing military and commercial fleets, combined with its ambitious defense and aerospace goals, make it a leader in the region. Neighboring countries such as the UAE also play significant roles, with Dubai emerging as a strong aviation hub, further stimulating demand for aircraft components, including circuit breakers.

Market Segmentation

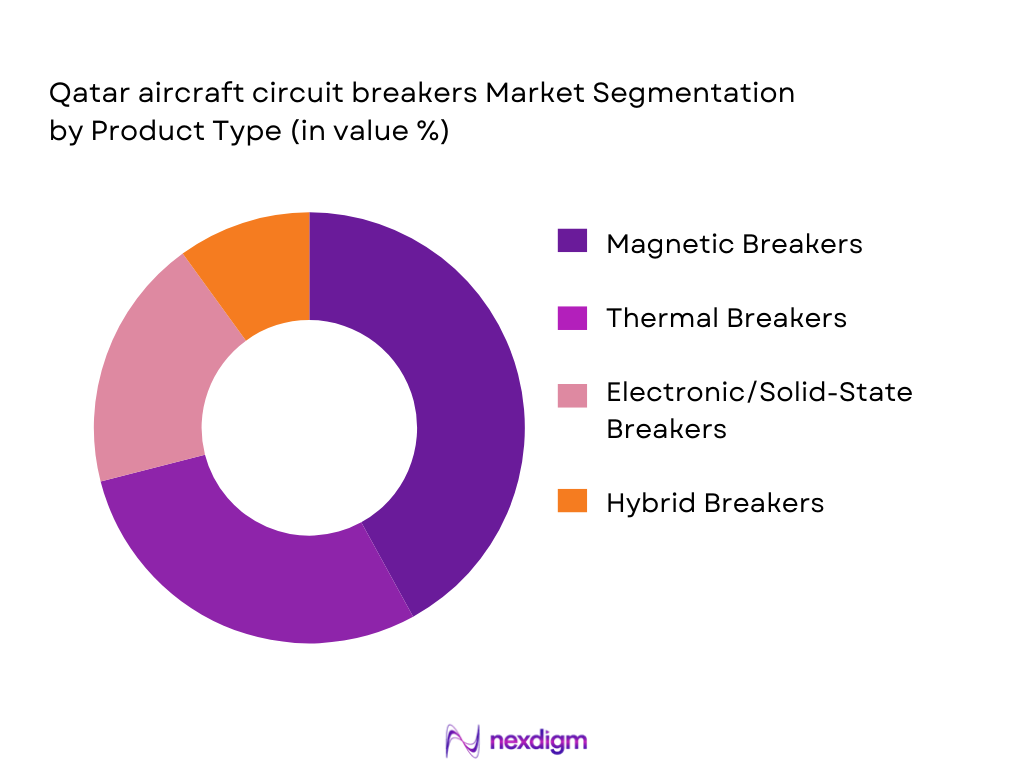

By Product Type

The Qatar Aircraft Circuit Breakers market is segmented by product type into thermal breakers, magnetic breakers, electronic/solid-state breakers, and hybrid breakers. Among these, magnetic circuit breakers dominate the segment due to their robust and reliable nature, widely used in both commercial and military aviation. These breakers provide enhanced protection by interrupting current flow in case of overload or short-circuit conditions. Magnetic breakers’ ability to handle high voltages and their long-term reliability in harsh aerospace environments have made them the preferred choice for aviation manufacturers and MRO service providers in Qatar.

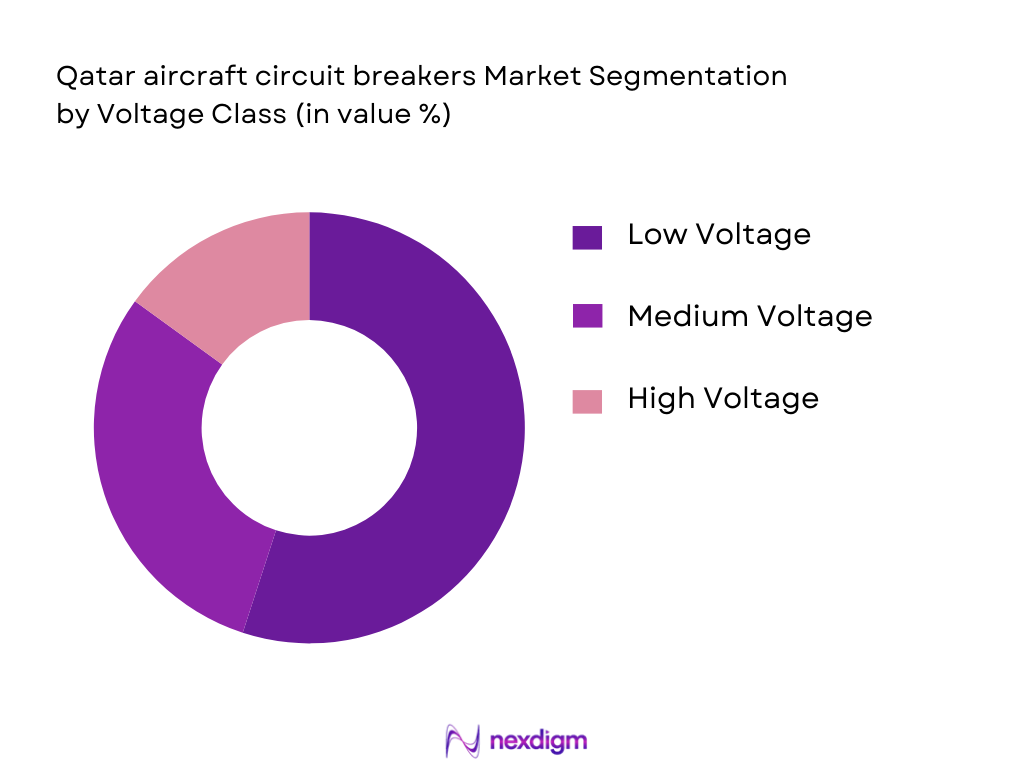

By Voltage Class

The voltage class segmentation includes low voltage, medium voltage, and high voltage circuit breakers. Low voltage circuit breakers dominate the market, particularly for commercial aircraft. This is because the majority of electrical systems in commercial aircraft operate at low voltage levels, requiring reliable protection systems to prevent electrical faults. As the aviation industry in Qatar continues to evolve with an increasing number of commercial and defense aircraft, the demand for low voltage protection systems is expected to maintain its dominance, ensuring electrical safety and operational reliability.

Competitive Landscape

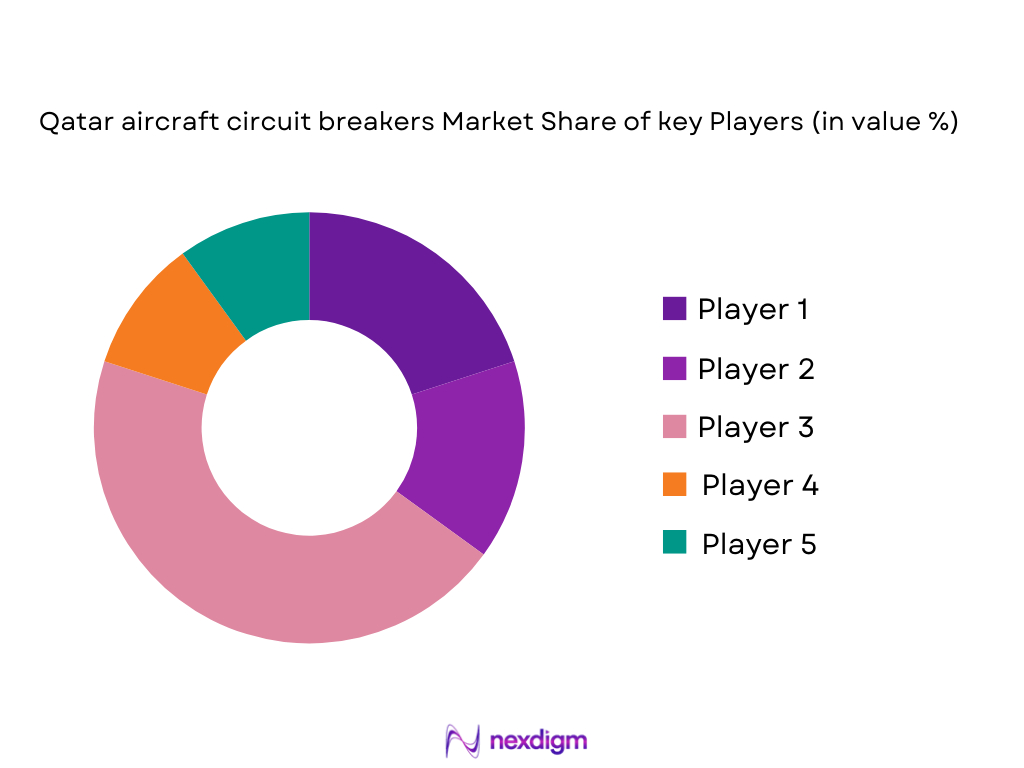

The Qatar Aircraft Circuit Breakers market is highly competitive, with a mix of global and regional players. Key global companies such as Honeywell Aerospace, Safran Electrical & Power, and Eaton dominate the landscape, given their extensive product portfolios and technological innovations. Local players also hold significant market share by leveraging close ties with Qatar Airways and the Qatari government, enabling them to fulfill strict regulatory standards and provide reliable aftersales service. The market is also marked by a continuous shift toward smart and solid-state breakers, with the growing trend of more-electric aircraft driving the need for advanced protection systems.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Certifications | R&D Investment | Market Strategy |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| Safran Electrical & Power | 2005 | France | ~ | ~ | ~ | ~ |

| Eaton | 1911 | Ireland | ~ | ~ | ~ | ~ |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ |

| Amphenol Aerospace | 1932 | USA | ~ | ~ | ~ | ~ |

Qatar Aircraft Circuit Breaker Market Analysis

Growth Drivers

Urbanization

Urbanization has significantly contributed to the growth of the Qatar Aircraft Circuit Breakers market. The urban population in Qatar has been steadily increasing, with over ~ % of the country’s population living in urban areas as of 2025, a trend that is supported by the World Bank. This urbanization directly correlates with the expansion of the aviation sector as more people rely on air travel for both business and leisure. With Qatar’s rapidly developing infrastructure and ongoing projects like Doha’s new airport terminal and the expansion of Qatar Airways’ fleet, demand for advanced aircraft systems such as circuit breakers is rising, ensuring the safety and reliability of electrical systems in aircraft.

Industrialization

Industrialization in Qatar, driven by the ongoing economic diversification efforts under Qatar National Vision 2030, has led to the establishment of advanced manufacturing and defense industries, which are key drivers for the aircraft industry and related sectors. Qatar’s government has invested heavily in its aerospace sector, with Qatar’s total aerospace industry exports surpassing QAR ~ billion in 2025. This push towards industrialization is increasing the demand for high-quality electrical protection systems like aircraft circuit breakers to meet the needs of both the commercial and military aviation sectors. Such growth in industrial output and related infrastructure necessitates enhanced electrical safety solutions for aircraft.

Restraints

High Initial Costs

One of the significant barriers to the widespread adoption of advanced aircraft circuit breakers in Qatar is the high initial cost associated with their procurement and installation. The cost of high-performance circuit breakers is notably higher than traditional options due to their advanced technology and strict regulatory certifications. The Qatari government’s defense budget, which saw an increase of QAR ~ billion in 2025, reflects the high investment required for modernizing both commercial and military aircraft fleets, but high initial costs of advanced systems like aircraft circuit breakers pose a challenge for many stakeholders in the industry. The expensive nature of these systems limits accessibility and adoption across the industry, especially for smaller operators or maintenance providers.

Technical Challenges

Despite the growing need for advanced circuit breakers in Qatar’s aerospace sector, technical challenges remain a significant barrier. These challenges include the complexity of integrating newer, smart circuit breakers into older aircraft systems and the stringent certification requirements from regulatory bodies like the Qatar Civil Aviation Authority (QCAA). In 2025, the QCAA imposed new standards requiring that all new electrical components, including circuit breakers, undergo extensive testing before use in commercial aircraft. This regulatory pressure increases the time and costs for manufacturers, limiting the speed at which technological advancements can be adopted across the market.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the growth of the Qatar Aircraft Circuit Breakers market. Qatar is experiencing rapid advancements in aircraft electrification and digitalization, which have spurred demand for next-generation circuit breakers. The Qatar Airways fleet alone, which comprises over ~ aircraft, is increasingly transitioning to more-electric aircraft systems, creating a demand for advanced circuit protection solutions. Additionally, the growing trend towards smart and solid-state circuit breakers, which provide real-time monitoring and enhanced reliability, is opening opportunities for manufacturers to introduce innovative products that meet the evolving needs of the aerospace industry.

International Collaborations

Qatar’s strategic efforts to forge international collaborations in the aerospace industry open avenues for growth in the aircraft circuit breakers market. Qatar’s partnership with leading aerospace manufacturers and technology providers, such as Boeing and Airbus, is expected to drive further innovation in aircraft electrical systems. The Qatar Investment Authority’s involvement in global aerospace ventures is also likely to increase international collaboration opportunities. These collaborations can lead to shared technological advancements, bringing cutting-edge circuit protection solutions to the Qatar market. The expanding network of global partnerships ensures that Qatar will continue to benefit from the latest innovations in the field of electrical systems for aircraft.

Future Outlook

Over the next 5 years, the Qatar Aircraft Circuit Breakers market is expected to exhibit steady growth. The demand for aircraft protection systems will be driven by Qatar’s continuing aviation expansion, coupled with significant investments in defense and commercial fleets. The adoption of smart circuit breakers, fueled by the shift toward more-electric aircraft architectures, will further boost market opportunities. Additionally, with the evolving regulatory landscape and the focus on safety and efficiency, Qatar is poised to become a regional leader in advanced circuit protection systems, which will drive long-term growth.

Major Players in the Market

- Honeywell Aerospace

- Safran Electrical & Power

- Eaton

- TE Connectivity

- Amphenol Aerospace

- Littelfuse

- Mersen

- Schneider Electric

- Rockwell Collins

- Curtiss-Wright Defense Solutions

- Raytheon Technologies

- Airbus Group

- Bourns

- GE Aviation

- Magnetrol International

Key Target Audience

- Aerospace and Defense Manufacturers

- Commercial Aircraft Operators

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Civil Aviation Authority, GCC Aviation Authorities)

- Aircraft Maintenance, Repair, and Overhaul (MRO) Service Providers

- Aerospace OEMs

- Aircraft Equipment Suppliers

- Aviation Regulatory Authorities (QCAA, EASA, FAA)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the critical stakeholders in Qatar’s aircraft circuit breaker market. The key variables driving market growth will be identified, such as aircraft fleet size, circuit breaker technology, regulatory landscape, and military procurement initiatives.

Step 2: Market Analysis and Construction

In this phase, historical data will be compiled to assess market penetration, fleet expansion, and aviation sector growth. The analysis will include a detailed evaluation of market performance across various product segments, with a focus on regional trends and emerging technologies.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses generated will be validated through interviews with industry experts from leading aerospace companies, MRO providers, and aviation authorities. These insights will provide operational and financial perspectives on the market, enhancing the validity of the data.

Step 4: Research Synthesis and Final Output

In the final phase, a comprehensive synthesis of data from interviews, secondary research, and market statistics will be conducted. The result will be a fully validated, accurate, and actionable market report for stakeholders seeking to understand the dynamics of the Qatar Aircraft Circuit Breakers market.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Data Sources & Validation Approach, Market Sizing & Forecast Methodology, Primary Research Framework, Forecast Scenarios (Base / Optimistic / Conservative), Research Limitations & Quality Checks)

- Definition and Scope

- Product Role in Aircraft Safety & Electrical Architecture

- Evolution of Aircraft Circuit Breakers in Gulf Aviation

- Qatar Aviation Infrastructure & Fleet Landscape

- Supply Chain Mapping (Local & Global OEM/Distributor Flows)

- Growth Drivers

Commercial fleet growth & Middle East air travel expansion

Defense procurement modernization initiatives

Shift to Electric/More‑Electric Aircraft architectures

- Market Challenges

Certification timelines & regulatory requirements

High entry cost for advanced electronic circuit breakers

Supply chain dependencies

- Market Opportunities

Smart breaker adoption (IoT / CBM)

Local maintenance ecosystem development

Regional air mobility & UAV growth

- Market Trends

Electrification & redundancy architectures

Modular and scalable breaker systems

Digital condition monitoring integration

- Regulatory & Compliance Environment

GCAA / Qatar Aviation Regulations

Regional safety standards alignment

Export control & defense procurement rules

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Breaker Technology (In Value %)

Thermal (Thermal & Thermal‑Magnetic) (circuit interruption mechanism)

Magnetic (magnetic actuated protection)

Electronic/Solid-State (intelligent & rapid trip functions)

Hybrid / Smart Integrated Units (condition monitoring) - By System Type (In Value %)

AC Circuit Breakers (Alternating current systems)

DC Circuit Breakers (Direct current / avionics distribution) - By Voltage Class (In Value %)

Low Voltage Solutions

Medium Voltage Protection

High Voltage Protection Systems - By Platform (In Value %)

Commercial Airliners (narrow‑body / wide‑body)

Military & Defense Aircraft

Helicopters & VTOL Platforms

UAVs / RPAS Systems - By End‑User (In Value %)

OEM (Original Equipment Manufacturing)

Aftermarket / MRO (Maintenance Repair & Overhaul)

- Market Share by Value / Units Installed

- Cross Comparison Parameters (Product Portfolio Breadth (series & voltage classes), Technology Adoption Level (solid‑state vs legacy), Certifications & Aviation Approvals, Aftermarket Support & Service Footprint, Lead Time & Supply Reliability, Local Presence / Qatar & GCC Distribution, Warranty Policies & TPM (Total Product Margin), Price Competitiveness & TCO Metrics)

- Detailed Company Profiles

Eaton Corporation Plc

ABB Ltd

Schneider Electric SE

Honeywell Aerospace

Collins Aerospace (RTX)

Safran Electrical & Power

TE Connectivity / Raychem Aerospace

Bourns Inc.

Littelfuse Inc.

Mersen Group

Siemens AG

Curtiss‑Wright Defense Solutions

Amphenol Aerospace

Rockwell Collins Power Systems

Magnetrol International

- Demand Analysis (Operators, MROs, Defense)

- Purchasing & Procurement Cycle

- Cost Sensitivity & Total Cost of Ownership (TCO)

- Integration Preferences (OEM Tie‑Ups vs Open Market)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035