Market Overview

The Qatar aircraft cockpit display systems market is valued at USD ~ million. The market’s growth is driven by increasing demand for enhanced flight safety systems, the modernization of existing aircraft fleets, and growing adoption of glass cockpits and multi-functional display systems in both commercial and military aviation sectors. Additionally, the significant increase in air travel, especially from the Middle East region, and technological advancements in avionics systems, such as augmented reality displays and synthetic vision systems, play pivotal roles in market expansion. Qatar’s strategic location as a key aviation hub further contributes to the market’s growth.

Qatar dominates the aircraft cockpit display systems market due to its robust aviation infrastructure, including Doha’s Hamad International Airport, which serves as a major global transit hub. Additionally, Qatar Airways, one of the world’s leading airlines, has significantly increased its fleet size, creating a high demand for cockpit display systems. Qatar’s strategic aviation policies, combined with government support for the aerospace sector, enhance its market presence. The Middle East region, particularly countries like the UAE and Saudi Arabia, also play a significant role due to high investments in aviation and defense technologies.

Market Segmentation

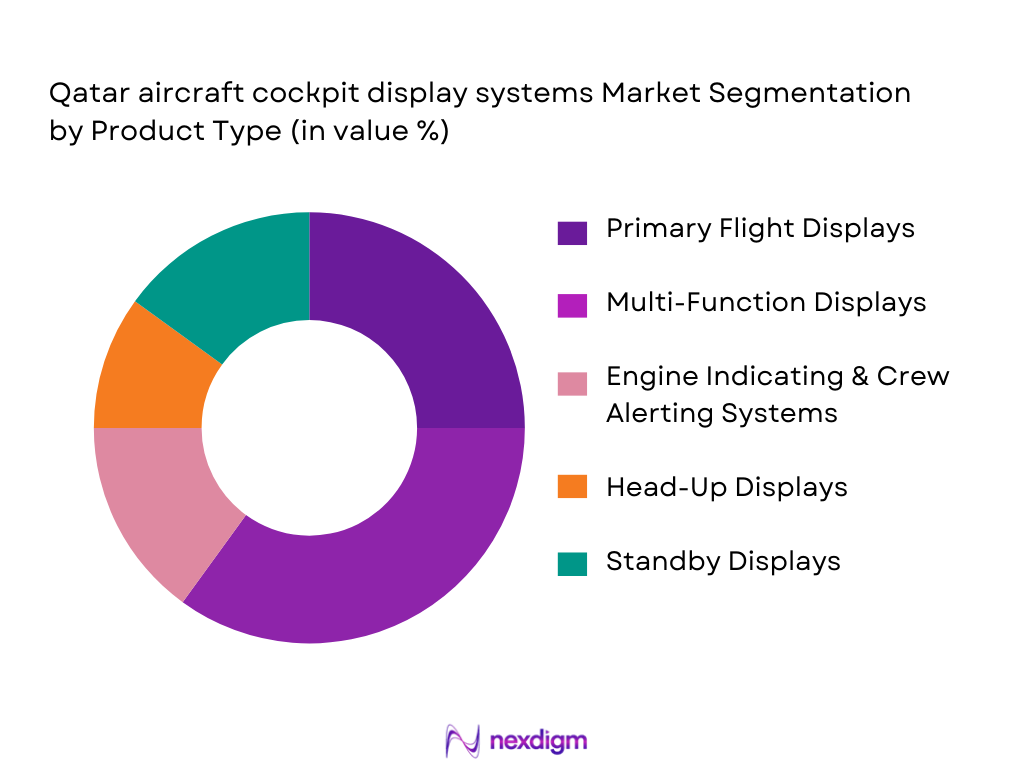

By Product Type

The aircraft cockpit display systems market is segmented by product type into Primary Flight Displays (PFD), Multi-Function Displays (MFD), Engine Indicating and Crew Alerting Systems (EICAS), Head-Up Displays (HUD), and Standby Displays. Among these, the Multi-Function Displays (MFD) dominate the market, driven by their increasing integration in glass cockpit systems, which combine multiple functions like navigation, engine monitoring, and flight management into a single, user-friendly interface. The adoption of MFDs is growing as airlines look to streamline cockpit operations, improve situational awareness, and enhance pilot safety. This technology is commonly integrated into modern aircraft across commercial, defense, and business aviation sectors.

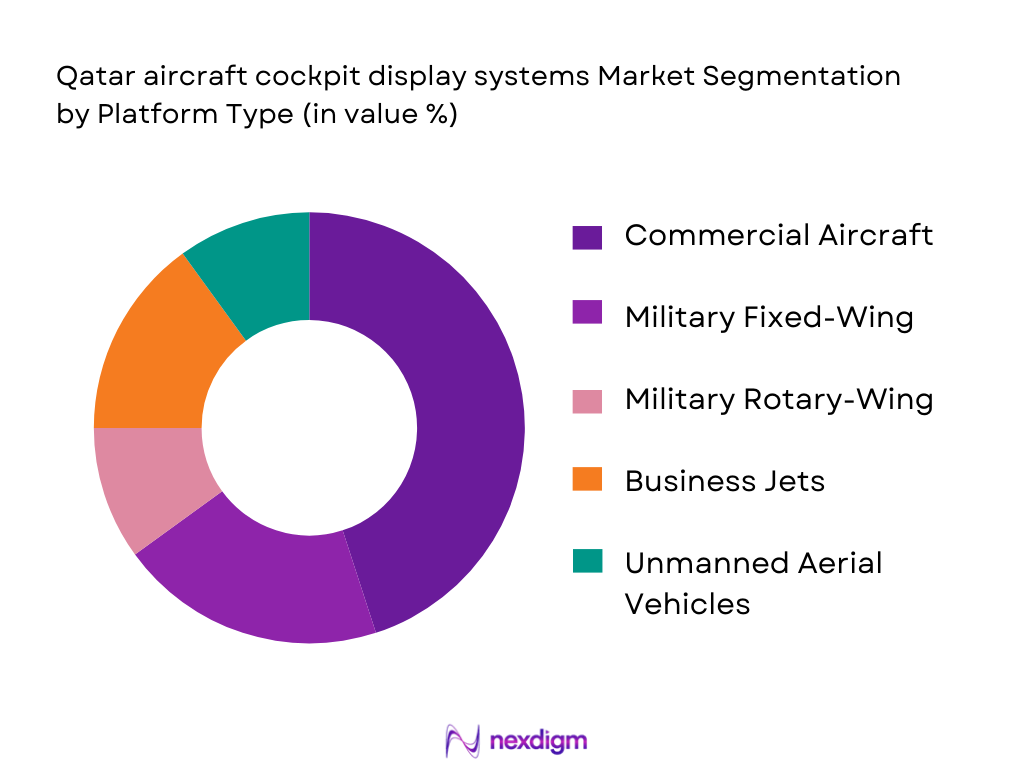

By Platform Type

The market is segmented by platform type into commercial aircraft, military fixed-wing, military rotary-wing, business jets, and unmanned aerial vehicles (UAV). The commercial aircraft segment has the largest market share, driven by the continuous expansion of airline fleets, including newer aircraft with advanced cockpit systems. Qatar Airways’ fleet expansion and modernization of commercial jets play a crucial role in boosting the demand for cockpit display systems. As commercial airlines prioritize safety and fuel efficiency, the demand for integrated display solutions such as glass cockpits and synthetic vision systems is projected to remain robust.

Competitive Landscape

The aircraft cockpit display systems market in Qatar is competitive, with several key global players operating alongside regional companies. Major players such as Honeywell Aerospace, Collins Aerospace, and Thales Group dominate the market due to their extensive product portfolios, strong presence in the Middle East, and relationships with commercial and military airlines. These companies lead to the development of advanced cockpit systems such as Synthetic Vision Systems (SVS) and enhanced cockpit displays, which contribute to improving flight safety and operational efficiency.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Portfolio | R&D Investment | Key Region |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1931 | United States | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | United States | ~ | ~ | ~ | ~ |

| Garmin Ltd | 1989 | United States | ~ | ~ | ~ | ~ |

Qatar Aircraft Cockpit Display Systems Market Analysis

Growth Drivers

Urbanization

Urbanization in Qatar continues to expand rapidly, creating a larger base of commercial and residential aviation demand. As Qatar’s urban population grows, so does the need for air travel, which directly boosts the aviation sector’s demand for advanced cockpit display systems. According to the World Bank, Qatar’s urban population has risen from ~ % in to ~ %, a trend that is expected to continue. This urbanization drives increased passenger and cargo traffic, directly contributing to the demand for sophisticated cockpit technology. The urban growth also supports infrastructural investments in airports and aviation systems, which demand modern cockpit display systems for both commercial and defense aircraft.

Industrialization

Qatar’s industrial expansion, particularly in the aerospace and defense sectors, supports the growing demand for cockpit display systems. In recent years, Qatar has heavily invested in diversifying its economy, focusing on high-tech industries like aviation and defense. The Qatari government has committed to boosting its defense and aviation technologies through projects such as the Qatari National Vision 2030. According to the Qatar National Bank, industrial output in Qatar grew by ~ % in 2025, with a significant portion of the investments allocated to aerospace technology. This industrial growth will lead to higher demand for cockpit display systems for military and commercial aviation.

Restraints

High Initial Costs

The high initial cost of advanced cockpit display systems remains a significant restraint. Modern cockpit display systems, which include multi-functional displays (MFDs), synthetic vision systems (SVS), and head-up displays (HUD), are expensive, making it challenging for smaller airlines or defense organizations to afford them. The cost of upgrading from traditional systems to advanced technologies is substantial, with some estimates indicating an upgrade could cost airlines millions of dollars. In 2025, the cost for installing a full suite of cockpit displays in a commercial airliner was reported at approximately USD ~ million, a barrier for entry for many small or mid-sized operators.

Technical Challenges

The integration of advanced cockpit display systems presents several technical challenges, particularly in terms of system compatibility, interoperability, and complexity. The Qatar Civil Aviation Authority has highlighted the need for compliance with strict certification processes for avionics systems. In 2025, there were multiple incidents of delayed certifications for cockpit systems due to technical issues, which slowed the pace of new technology adoption. Moreover, many legacy aircraft in Qatar’s fleet are not compatible with the newest cockpit technologies, necessitating complex retrofits and upgrades. These challenges are compounded by the limited availability of qualified technicians to install and maintain these advanced systems.

Opportunities

Technological Advancements

Technological advancements in avionics systems, including the development of augmented reality displays and artificial intelligence (AI)-based cockpit solutions, offer significant growth opportunities in Qatar’s aircraft cockpit display systems market. The global trend towards digitizing cockpit displays is mirrored in Qatar’s growing interest in enhancing pilot assistance through next-generation technologies. For instance, the Qatar Civil Aviation Authority has been actively exploring the use of AI in cockpit systems for predictive maintenance and flight path optimization. The rise of next-gen display solutions, which integrate real-time data processing and augmented reality, offers enhanced safety and operational efficiency, increasing demand for such systems. The Ministry of Defense has also expressed interest in upgrading its military fleets with cutting-edge cockpit technologies that align with global defense advancements.

International Collaborations

International collaborations in the aerospace and avionics sectors present substantial opportunities for the Qatar cockpit display systems market. Qatar’s strategic position as a key player in Middle Eastern aviation, coupled with its partnerships with international aerospace giants like Boeing and Airbus, fosters an environment conducive to technological transfer and innovation. In 2025, Qatar Airways entered into several joint ventures with European and North American aerospace companies to upgrade its fleet with state-of-the-art cockpit technologies. These collaborations not only enhance Qatar’s aviation infrastructure but also drive demand for cockpit display systems from global suppliers, enabling Qatar to access the latest avionics technologies. These partnerships enable Qatar to stay at the forefront of innovations in flight deck technologies and create opportunities for local aerospace companies to partner with international players in system integration and manufacturing.

Future Outlook

The aircraft cockpit display systems market in Qatar is expected to see substantial growth over the next six years. Driven by continuous advancements in avionics technology, increasing fleet modernization programs, and a robust defense procurement pipeline, the demand for advanced cockpit display solutions is expected to grow significantly. Government support for aviation infrastructure, especially in Qatar and surrounding regions, will continue to be a key growth driver. Additionally, the rising trend of integrating augmented reality (AR) and synthetic vision systems (SVS) into flight decks will further fuel the market’s expansion.

Major Players in the market

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- Garmin Ltd

- Rockwell Collins

- Elbit Systems

- BAE Systems Avionics

- Universal Avionics Systems

- Northrop Grumman

- Raytheon Technologies

- Barco NV

- Genesys Aerosystems

- Astronautics Corp of America

- Becker Avionics GmbH

- Avidyne Corporation

Key Target Audience

- Aviation Operators (Airlines, chartered flight companies)

- Defense Contractors (Military aircraft manufacturers and suppliers)

- Avionics System Integrators

- Aircraft Manufacturers (OEMs such as Airbus, Boeing)

- Aerospace Component Suppliers (Display system manufacturers)

- Investments and Venture Capitalist Firms

- Government Regulatory Bodies (Qatar Civil Aviation Authority, Directorate General of Civil Aviation – Qatar)

- Military Procurement Agencies (Qatar Ministry of Defense)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining key variables by mapping major stakeholders in the Qatar aircraft cockpit display systems market, including OEMs, government bodies, and system integrators. This research also includes market trends, technological advancements, and regulatory frameworks impacting product development.

Step 2: Market Analysis and Construction

This phase compiles data from industry reports, proprietary databases, and historical trends to construct the Qatar aircraft cockpit display systems market’s historical performance and project future growth. We also focus on analyzing market penetration and sector-wise adoption rates across commercial and defense aircraft.

Step 3: Hypothesis Validation and Expert Consultation

We engage in expert interviews with professionals from the aerospace and avionics industries, using insights to validate assumptions and refine our market model. These consultations provide direct feedback on emerging trends and market dynamics.

Step 4: Research Synthesis and Final Output

The final stage synthesizes the data gathered from primary and secondary sources to present a holistic view of the Qatar aircraft cockpit display systems market. We refine the model further through consultations with key industry stakeholders to ensure the data is accurate and comprehensive.

- Executive Summary

- Research Methodology ( Market Definitions (Cockpit Display Systems, Avionics Suite Components, Glass Cockpit Interfaces), Abbreviations (PFD, MFD, HUD, EICAS, SVS, AR/VR Integration), Data Collection Framework (Primary + Secondary), Qatar Aviation Sector Mapping, Assumptions & Standardization Protocols, Market Sizing Techniques (Bottom‑Up vs Top‑Down), Validation (Expert Interviews, Operator Surveys), Research Limitations)

- Qatar Aviation & Aerospace Infrastructure Context

- Cockpit Display Technology Evolution

- Regulatory & Airworthiness Standards in Qatar

- Qatar Defense Aviation Policy & Military Avionics Mandates

- Supply Chain & Component Ecosystem

- Value Chain Mapping

- Investment & Government Incentive Landscape

- Growth Drivers

Fleet Modernization Demands

High‑Definition, Multi‑Sensor Integration

Demand for Enhanced Situational Awareness & Safety

Expansion of Private and Defense Flight Operations

Component Miniaturization & Weight Reduction

- Market Challenges

High Certification & Safety Compliance Costs

Supply Chain Constraints (Semiconductors & Specialized Displays)

Integration Complexities Across Avionics Suites

- Market Opportunities

Retrofit Upgrade Programs for Aging Fleets

Digital & Connected Cockpit Initiatives

Qatar Defense Avionics Procurement Expansion

- Market Trends

AI/ML‑Assisted Pilot Interfaces

Cybersecurity for Display Networks

Touchscreen & Gesture Control Adoption

- Regulatory Framework

Qatar Civil Aviation Authority Display Mandates

Defense Airworthiness Requirements

ICAO / FAA / EASA Interoperability Standards - SWOT Analysis

- Porter’s Five Forces

- Stakeholder Ecosystem Mapping

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Display Type (In Value %)

Primary Flight Display (PFD)

Multi‑Function Display (MFD)

Engine Indicating & Crew Alerting System (EICAS)

Head‑Up Display (HUD)

Standby & Backup Displays (Resilience) - By Platform Type (In Value %)

Commercial Aircraft (A‑Series, B‑Series Deployments)

Military Fixed Wing

Military Rotary Wing (Helicopter Cockpits)

Business & Corporate Jets

Unmanned Platforms (UAV/UAS HUD/PFD) - By Technology Tier (In Value %)

Digital Flat Panel Display

Touchscreen Integrated Displays

Synthetic Vision & Enhanced Vision Systems (SVS/EVS)

AR/VR Integrated Cockpit Displays

Ruggedized / MIL‑STD Compliant Displays - By Integration Level (In Value %)

OEM Linefit Systems

Retrofit & Upgrade Packages

Aftermarket Support Systems

- Market Share: System Value & Installed Units

- Cross‑Comparison Parameters (Product Portfolio Breadth (Display Types Supported), Certification Capabilities (DO‑178C / DO‑254 Certification Levels), Integration Capabilities with Avionics Suite, Aftermarket Support & Service Footprint, Local Presence & Qatar Defense Contracts, R&D Spend & Innovation Index, Supply Chain Resilience, Warranty & Lifecycle Support)

- SWOT Profiles of Tier‑1 Players

- Pricing Benchmarking (By SKU / Display Tier)

- Detailed Company Profiles

Honeywell Aerospace

Collins Aerospace (RTX)

Thales Group

Garmin Ltd

Rockwell Collins

Elbit Systems

BAE Systems Avionics

Universal Avionics Systems Corp

Northrop Grumman

Raytheon Technologies (Pratt & Whitney / Collins)

Barco NV

Genesys Aerosystems

Astronautics Corp of America

Becker Avionics GmbH

Avidyne Corporation

- Demand & Utilization Metrics

- Procurement Cycle & Budget Allocations

- Decision‑Making Criteria

- Pain Points & Functional Requirements

- Certification & Support Requirements

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035