Market Overview

The Qatar Aircraft Cockpit Systems market is valued at USD ~ million, driven by the growing demand for advanced cockpit solutions in both commercial and military aviation. The market is shaped by the increasing adoption of modern technologies such as glass cockpits, flight management systems (FMS), and synthetic vision systems. Furthermore, the expansion of Qatar Airways and ongoing investments in defense aircraft upgrades have also contributed to this market growth. Qatar’s strategic location as an aviation hub and its emphasis on technological advancements in cockpit systems fuel the sector’s expansion.

Qatar, specifically its capital Doha, is a significant player in the aircraft cockpit systems market. The dominance of Qatar can be attributed to the country’s robust aviation sector, driven by its national airline, Qatar Airways, which is one of the world’s leading airlines. Additionally, Qatar’s ongoing military upgrades, as part of defense modernization programs, contribute to the demand for advanced avionics. The country’s heavy investments in aviation infrastructure and military platforms, paired with its growing aviation market, position Qatar as a dominant player in the Middle East.

Market Segmentation

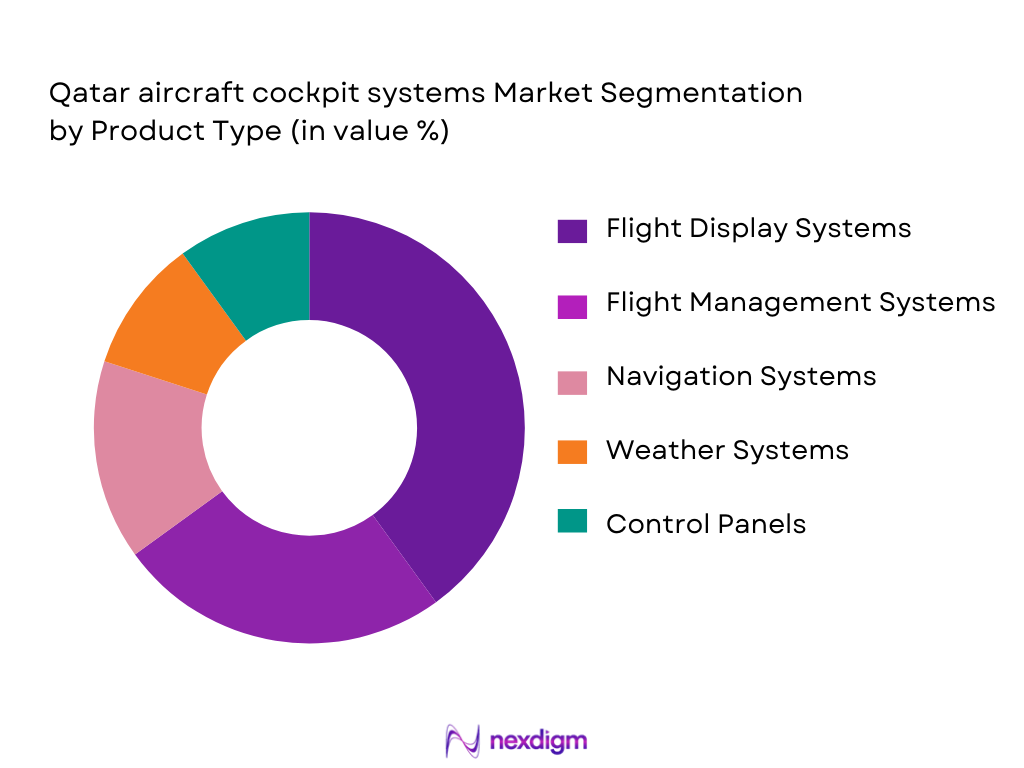

By Product Type

Qatar’s aircraft cockpit systems market is segmented by product type into flight display systems, flight management systems, navigation systems, weather systems, and control panels. Among these, flight display systems are dominating the market share, attributed to the increasing adoption of glass cockpit technology. Glass cockpit systems offer pilots a modern, intuitive interface, reducing pilot workload and improving safety. Additionally, advancements in flight display technology, such as Heads-Up Displays (HUD) and Multifunction Displays (MFD), have further driven demand for this segment.

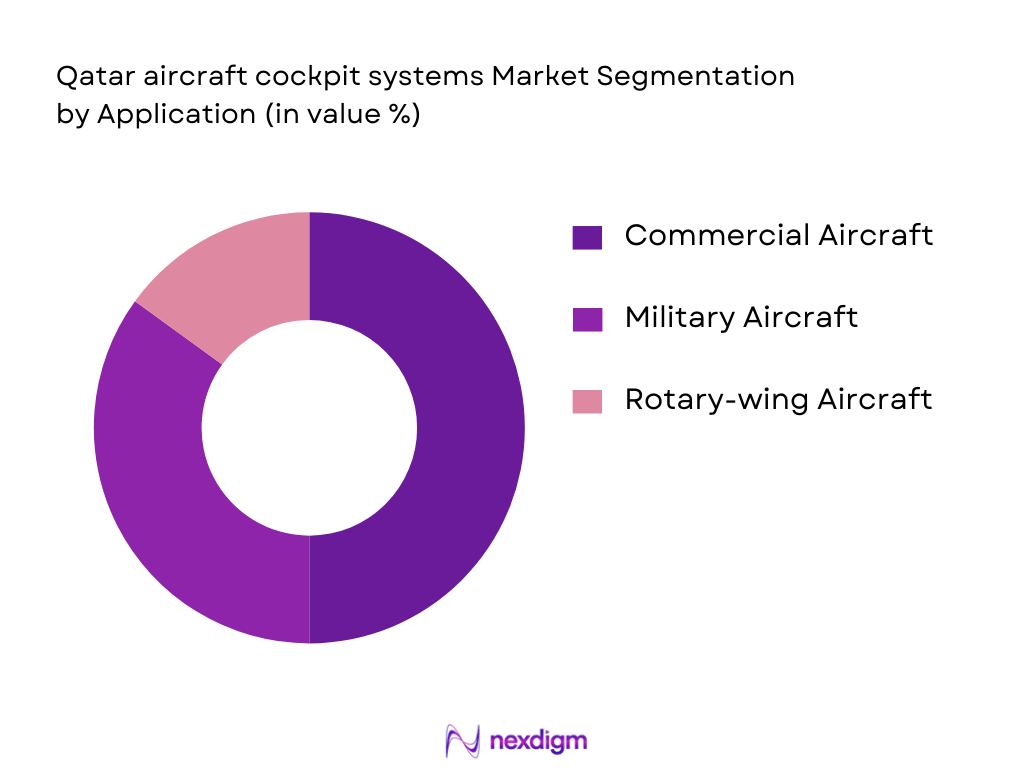

By Application

The market is segmented by application into commercial aircraft, military aircraft, and rotary-wing aircraft. Commercial aircraft lead the market due to the expanding fleet of Qatar Airways and other regional airlines. As the airline industry focuses on enhancing flight safety, operational efficiency, and customer experience, demand for advanced cockpit systems has surged. Commercial aircraft have widely adopted integrated avionics systems, which boost operational efficiency and reduce maintenance costs.

Competitive Landscape

The Qatar Aircraft Cockpit Systems market is dominated by a few major global players, including Honeywell, Collins Aerospace, and Thales Group. These companies are key contributors due to their advanced technology portfolios, long-standing relationships with aerospace manufacturers, and established presence in Qatar’s aviation and defense sectors. The market landscape is highly consolidated with these players having a significant influence over both commercial and military aviation systems, offering integrated cockpit solutions that enhance pilot efficiency and flight safety.

| Company | Establishment Year | Headquarters | Core Technology Portfolio | Product Portfolio | Defense Contracts | R&D Investment | Regional Presence |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | USA | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Cockpit Systems Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver of the Qatar Aircraft Cockpit Systems market as the country’s rapid urban expansion fuels the demand for advanced transportation infrastructure, including aviation. Qatar’s urban population growth, which has reached ~ million as of 2025, directly impacts the demand for both commercial and private aviation. As more people reside in urban centers, demand for efficient, safe, and high-tech aviation solutions increases. The urbanization process fosters the need for modern aircraft with cutting-edge cockpit systems, aligning with Qatar’s national development strategy focusing on enhancing connectivity and transportation.

Industrialization

Industrialization in Qatar, particularly in sectors such as energy, defense, and manufacturing, is propelling demand for advanced aircraft systems, including cockpit technologies. Qatar’s economy is heavily reliant on the oil and gas sector, and recent industrial growth within this sector has necessitated improved logistics, including air transport. The country’s industrial output has shown steady growth, with an industrial production increase of ~ % in 2025, which drives the need for modern aviation infrastructure. As Qatar invests heavily in defense and infrastructure, this leads to a rising demand for high-performance cockpit systems.

Restraints

High Initial Costs

The high initial costs associated with advanced cockpit systems are a key restraint in Qatar’s aviation sector. The implementation of glass cockpits, integrated avionics, and advanced flight management systems involves substantial capital expenditure. These technologies require heavy investments from airlines and defense contractors. In 2025, Qatar Airways and other aviation stakeholders were estimated to have spent over USD~ billion on fleet upgrades and maintenance. The procurement of these advanced cockpit systems requires significant capital, which can delay the adoption of new technologies, particularly in a cost-sensitive market environment.

Technical Challenges

The complexity and technical challenges involved in the integration of advanced cockpit systems, including flight display systems, flight management systems (FMS), and navigation technologies, act as a restraint. Issues such as system compatibility with existing aircraft, the complexity of software integration, and the need for ongoing pilot training present significant obstacles. In 2025, there were reports of delays in the rollout of next-gen cockpit systems in Qatar Airways’ fleet, as the airline worked to overcome technical barriers related to integrating new systems with legacy aircraft.

Opportunities

Technological Advancements

Technological advancements represent a prime opportunity for the Qatar Aircraft Cockpit Systems market. Innovations in artificial intelligence (AI), machine learning, augmented reality (AR), and synthetic vision systems offer tremendous potential for improving cockpit functionality and safety. Qatar is already at the forefront of adopting these technologies, particularly in the commercial aviation sector. In 2025, Qatar Airways began testing AR-based cockpit solutions for enhancing pilot visibility and situational awareness. As new technologies continue to evolve, the market for advanced cockpit systems in Qatar will expand, driven by these innovations.

International Collaborations

International collaborations present a significant opportunity for the Qatar Aircraft Cockpit Systems market. Qatar’s strategy of forging partnerships with global aerospace and defense companies facilitates the adoption of cutting-edge avionics systems. Notable collaborations, such as those with Thales and Collins Aerospace, are already enabling Qatar to enhance its aviation and defense sectors with state-of-the-art cockpit technologies. The government’s push for innovation and technology transfer, bolstered by the defense modernization plans, ensures that international collaborations will continue to shape the future of cockpit systems in Qatar.

Future Outlook

Over the next five years, the Qatar Aircraft Cockpit Systems market is expected to witness significant growth. The demand for advanced cockpit systems will continue to increase, driven by the expansion of Qatar Airways’ fleet, the country’s defense procurement programs, and the global trend toward digital cockpit technologies. With the government’s focus on modernizing its defense aviation infrastructure and the rapid pace of technological advancements in avionics, Qatar will maintain its position as a leader in the Middle East cockpit systems market. The integration of AI, machine learning, and augmented reality will further enhance the market’s trajectory.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- Garmin Ltd.

- Rockwell Collins

- L3Harris Technologies

- Universal Avionics Systems

- Avidyne Corporation

- Astronautics Corporation of America

- Elbit Systems Ltd.

- Boeing Avionics Division

- Airbus Integrated Systems

- Safran Electronics & Defense

- Raytheon Technologies

- BAE Systems

Key Target Audience

- Government Agencies (Qatar Civil Aviation Authority)

- Defense & Aerospace Contractors

- Airline Procurement Managers (Qatar Airways)

- Aviation Technology Providers

- Defense Technology Investment Firms

- Regulatory Bodies (Qatar Defense Ministry, GCAA)

- Aviation Maintenance, Repair, and Overhaul Providers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map, identifying all stakeholders within Qatar’s aviation industry, including OEMs, cockpit system providers, airlines, and defense entities. This step is supported by secondary data sources such as government publications and industry reports to understand key variables driving market dynamics.

Step 2: Market Analysis and Construction

This phase involves collecting historical data on market penetration and sales, analyzing current deployments of cockpit systems, and evaluating how different technologies are distributed across the commercial and defense sectors. Quantitative metrics such as unit sales and revenue generation from cockpit systems will be a focus.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with industry experts from airlines, defense contractors, and avionics suppliers. This step will include both qualitative and quantitative data to ensure that assumptions are accurate and reflective of market realities.

Step 4: Research Synthesis and Final Output

The final phase will combine the insights gained from primary and secondary research, consolidating data from manufacturers, airlines, and defense sectors to generate accurate, actionable conclusions. This includes further verification through engagement with key stakeholders to ensure the results align with industry trends.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations and Technical Glossary (e.g., EFIS, PFD, MFD, HUD, EICAS), Primary & Secondary Research Approach, Qatar Industry Interviews & Expert Panels, Data Triangulation & Forecast Model, Limitations & Confidence Levels)

- Cockpit Systems Market Landscape in Qatar (Commercial & Defense)

- Regional Significance in Middle East Aviation

- Value Chain (OEMs → Integrators → Airlines/MRO → End Users)

- Distribution & Service Chain in Qatar

- Cockpit System Architecture

- Core Subsystems

- Integration Interfaces & Standards (ARINC, DO‑178C, DO‑254)

- Business & Regulatory Timeline

- Industry Milestones (Fleet Acquisitions, Regulatory Changes)

- Major Contracts & Program Launches (Defense & Civil)

- Regulatory Bodies & Certification Paths (GCAA & International Standards)

- Suppliers, Integrators, Airlines (e.g., Qatar Airways), Defense Users

- Artificial Intelligence & Digital Integration Partners

- Local vs Foreign Sourcing Dynamics

- Growth Drivers

Qatar Aviation Expansion (air travel demand)

Technological Advancements (Glass Cockpit, AI, Synthetic Vision)

Defense Modernization Programs

Fleet Upgrade Cycles in Gulf Region

- Challenges

High Integration & Certification Costs

Skilled Workforce Shortage

Regulatory & Safety Compliance

- Opportunities

New Defense Contracts

Retrofit & Standardization

AI/ML‑enhanced Cockpit Solutions

- Market Trends

Shift to Integrated Digital Flight Decks

AR/Enhanced Vision Adoption

Cloud‑Connected Cockpit Data Analytics

- Government Policy & Regulation

Aviation Safety Regulation Framework

Local Content & Tech Transfer Incentives

Export Controls & Defense Procurement Policy

- SWOT Analysis

- Porter’s Five Forces

- Ecosystem Mapping

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Platform Type (In Value %)

Commercial Aircraft (Airliners, Business Jets)

Military Aircraft (Fighter & Trainer Jets, Transport)

Helicopters & Rotary Wing

Unmanned Aerial Platforms

Retrofit Programs

- By Cockpit Subsystem (In Value %)

Flight Display Systems (PFD/MFD/Head‑Up Display)

Flight Management Systems (FMS)

Navigation & Communication Systems (NAV/COM)

Weather & Surveillance Systems

Control & Interface Panels

- By Technology Level (In Value %)

Glass Cockpit Solutions

Avionics Integration Suites

AR/Enhanced/Synthetic Vision Systems

AI‑enabled Predictive Interfaces

- By End User (In Value %)

OEM Original Installations

Aftermarket & Retrofit

Maintenance, Repair & Overhaul (MRO)

Defense Procurement

- Competitive Share (Value %, Units)

- Cross Comparison Parameters (Company Overview, Core Cockpit Technologies Portfolio, Certified Airframe Integrations, Cockpit Display & Sensor Technologies, R&D & Innovation Investments, Global vs Local Support Footprint, Defense & Civil Contracts, Strategic Partnerships & Alliances)

- Detailed Company Profiles

Honeywell Aerospace

Collins Aerospace (RTX)

Thales Group

Garmin Ltd.

L3Harris Technologies

Universal Avionics Systems

Rockwell Collins

Avidyne Corporation

Aspеn Avionics

Astronautics Corporation of America

Elbit Systems Ltd.

Boeing Avionics Division

Airbus Integrated Systems

Safran Electronics & Defense

Raytheon Technologies

- Adoption Patterns by Airlines & Defense

- CapEx & Budget Trends

- Decision‑Making Criteria (Safety, Compatibility, Lifecycle Support)

- Pain Points & Integration Barriers

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035