Market Overview

The Qatar Aircraft Communication Systems market is valued at USD ~ billion in 2024, driven by the growing adoption of advanced communication technologies within the aviation sector. The primary drivers include the rising demand for in-flight connectivity, enhanced communication systems for safety, and regulatory requirements for better communication infrastructure in both civil and military aviation. Technological advancements such as SATCOM, data link systems, and VHF communication radios have significantly enhanced operational efficiency, enabling Qatar’s aviation industry to maintain its competitive edge in both the Middle East and the global market.

Qatar’s dominance in the Aircraft Communication Systems market stems from its strategic position as a hub for both regional and international aviation. Doha, the capital, serves as a central node for Qatar Airways, one of the world’s fastest-growing airlines, which continually invests in upgrading its fleet with state-of-the-art communication systems. Qatar’s significant investments in infrastructure, the expansion of Hamad International Airport, and the government’s push for modernization in aviation and air traffic management further position the country as a key player in the market. Qatar’s market leadership is bolstered by a combination of high economic growth, government support, and the strong presence of key aviation operators.

Market Segmentation

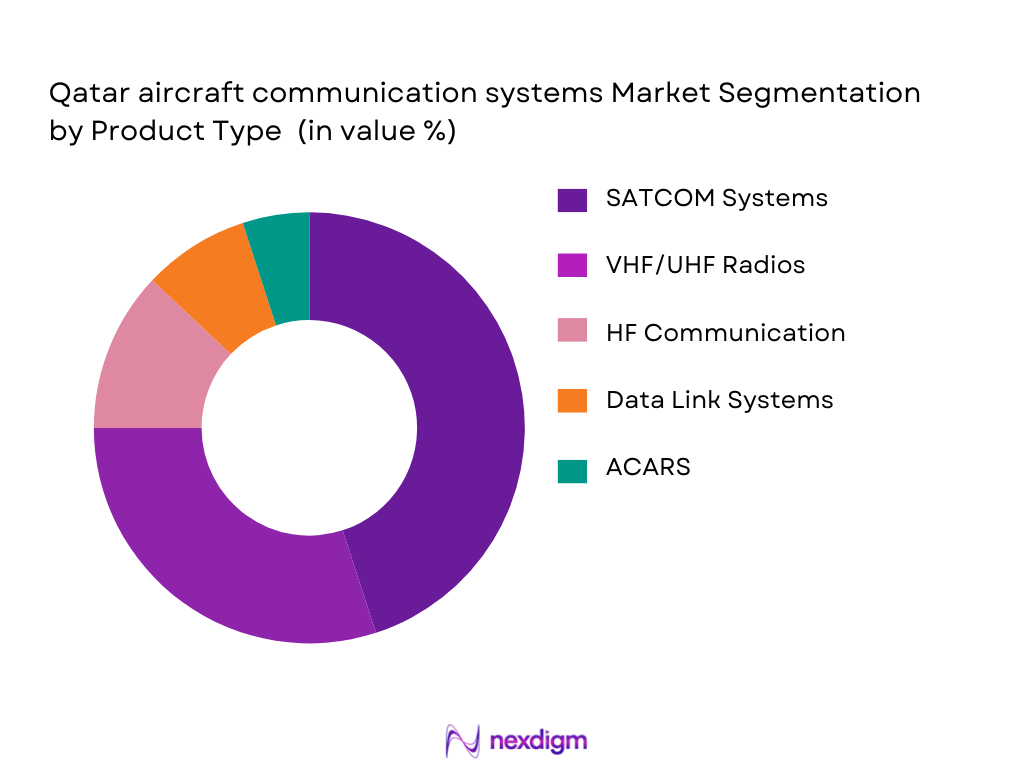

By Product Type

The Qatar Aircraft Communication Systems market is segmented into various communication systems, including SATCOM, VHF/UHF radios, HF communication, data link systems, and ACARS. The SATCOM system segment holds a dominant share, driven by the growing need for in-flight connectivity, especially for Qatar Airways, which is heavily investing in advanced satellite communication technologies to enhance passenger experience and operational safety. SATCOM systems enable seamless communication for long-range flights, making them essential for Qatar’s expansive international routes. This segment’s demand is further reinforced by the increasing importance of air traffic modernization efforts.

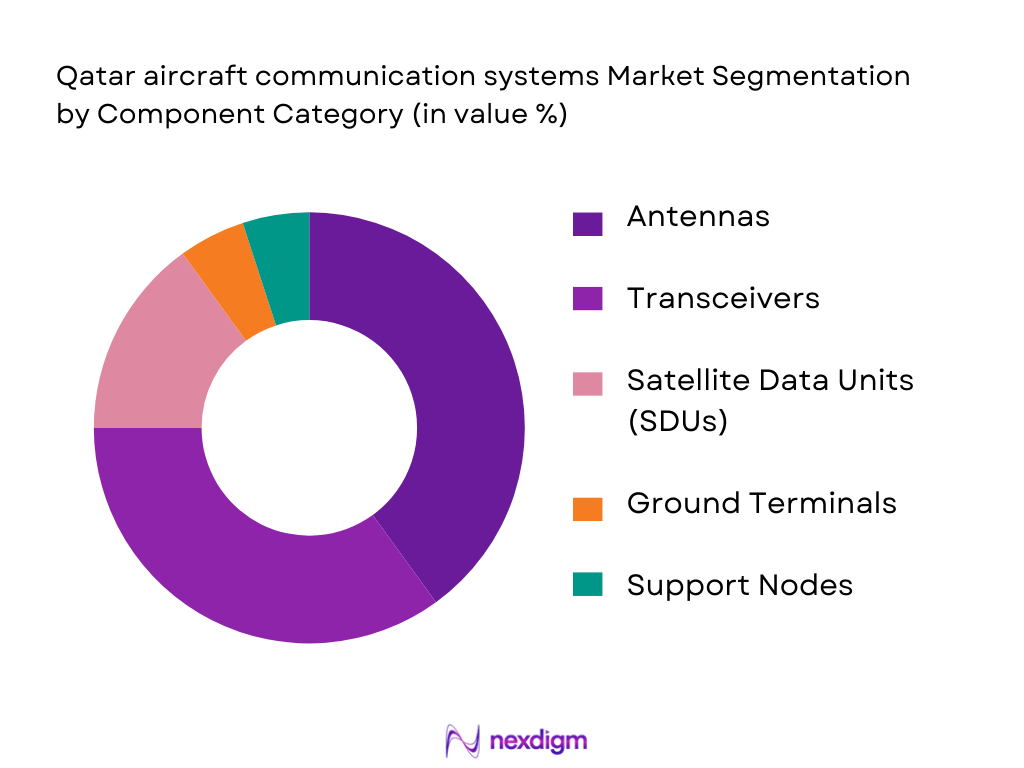

By Component Category

In the component category, the market is segmented into antennas, transceivers, satellite data units (SDUs), ground terminals, and support nodes. Among these, antennas and transceivers hold the highest market share. Antennas are essential for the functionality of communication systems, ensuring reliable connectivity for aircraft. Qatar’s demand for high-performance antennas is driven by the continuous upgrades to aircraft fleets, particularly Qatar Airways, which relies heavily on cutting-edge communication systems to maintain seamless operations. Transceivers are also a key part of the communication ecosystem, contributing significantly to the overall market share.

Competitive Landscape

The Qatar Aircraft Communication Systems market is dominated by a few major players, including both local and international firms. The competitive landscape is shaped by the strategic investments of these key players in providing cutting-edge communication technologies for Qatar’s aviation sector. Key players in this market include companies like Honeywell Aerospace, Collins Aerospace, Thales Group, and L3Harris Technologies, among others. These firms maintain a strong foothold through partnerships with major airlines like Qatar Airways and state-backed aviation authorities. The competitive edge is primarily driven by technological innovation, product quality, and the ability to meet regulatory requirements set by the Qatar Civil Aviation Authority (QCAA).

| Company | Establishment Year | Headquarters | Market Focus | Technology Offerings | Customer Base | Key Differentiator |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1939 | United States | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ |

| Cobham Aerospace | 1934 | United Kingdom | ~ | ~ | ~ | ~ |

Qatar Aircraft Communication Systems Market Analysis

Growth Drivers

Urbanization

The rapid urbanization in Qatar, exemplified by a steady population growth, is contributing significantly to the expansion of the Aircraft Communication Systems market. As of 2024, Qatar’s population has been steadily increasing, surpassing ~ million people, according to the World Bank. Urbanization is facilitating the growth of both civil and commercial aviation, with increased demand for high-quality communication infrastructure, especially in areas like Qatar Airways, the national carrier. Urban development in Doha is supported by extensive investments in infrastructure, including Hamad International Airport’s expansion, which strengthens the market for advanced communication systems. As a result, urbanization is leading to a greater need for cutting-edge communication systems to manage the growing number of flights and operations. The number of passengers traveling through Qatar’s aviation hub is expected to continue to rise in the coming years, further pushing the need for advanced aircraft communication technologies.

Industrialization

Qatar’s industrialization initiatives, particularly in the oil and gas sector, have played a crucial role in driving demand for advanced aircraft communication systems. With Qatar being one of the world’s leading producers of natural gas, industrial activities in sectors such as energy, manufacturing, and construction have been growing rapidly. By 2024, Qatar’s industrial output is forecasted to exceed USD ~ billion, contributing to significant air transport activity for resource extraction and global business connectivity. The demand for robust, secure communication systems, especially in remote and offshore operations, is expanding. Moreover, increased industrial projects necessitate airlift operations, which further boosts the need for efficient communication systems within the aviation sector. Industrialization has catalyzed a rise in both private and government aviation sectors, where communication technology is critical for operational efficiency.

Restraints

High Initial Costs

The high upfront investment required to deploy advanced aircraft communication systems remains a significant restraint for many operators in Qatar. The cost of modern communication systems, such as SATCOM and data link technologies, can be prohibitive. In 2024, the capital expenditure for aircraft communication systems is projected to be around USD ~ billion. This high initial cost limits adoption, particularly among smaller regional airlines and operators outside Qatar Airways. Furthermore, the operational complexity and installation costs associated with upgrading existing aircraft communication systems to meet modern standards of connectivity contribute to the financial burden. The substantial capital outlay needed for initial installations often requires considerable financing and leads to longer payback periods. As a result, while demand for communication systems is growing, significant upfront costs are a barrier to entry for many businesses, especially in cost-sensitive environments.

Technical Challenges

The Qatar Aircraft Communication Systems market faces technical challenges related to the integration of new systems with existing aviation infrastructures. The technical complexities involved in upgrading communication systems for aircraft to meet the required international standards can delay the adoption of new technologies. Challenges such as maintaining consistent satellite communication coverage, integrating data link systems, and ensuring compatibility between different communication technologies are ongoing concerns. With Qatar being home to one of the largest fleets in the region, particularly at Qatar Airways, the complexities of retrofitting existing fleets with the latest communication systems can lead to delays and additional costs. Additionally, ensuring secure and stable communication across long-haul international flights, especially over remote regions, adds another layer of technical complexity. As of 2024, issues related to network integration and system interoperability remain a significant hurdle in the seamless deployment of advanced communication technologies in Qatar’s aviation sector.

Opportunities

Technological Advancements

Technological advancements in communication systems present substantial opportunities for the Qatar Aircraft Communication Systems market. Innovations such as the development of satellite-based communication systems, particularly in the SATCOM domain, provide Qatar with the chance to strengthen its position as a leader in advanced aviation technologies. With Qatar Airways continuing to expand its fleet, the airline is integrating advanced communication systems to improve operational efficiency and enhance passenger experience. Furthermore, innovations in high-speed in-flight connectivity are expanding the demand for more robust communication systems. The growth of ultra-high-frequency communication and the implementation of systems like FANS (Future Air Navigation Systems) allow Qatar’s aviation sector to better manage air traffic, which will continue to drive demand for next-gen aircraft communication solutions. The continued push for automation and digitization in air traffic management, which directly ties into communication system integration, presents opportunities for market expansion and innovation.

International Collaborations

International collaborations present considerable growth opportunities for Qatar’s Aircraft Communication Systems market. As Qatar strengthens its aviation ties with global airlines, technology providers, and regulators, there is an increasing demand for international-standard communication systems to maintain seamless global operations. Qatar Airways’ alliances with global airlines and communication system suppliers, such as Boeing, Airbus, and Thales, offer the opportunity for expanding the adoption of the latest communication technologies. The collaboration with satellite communication providers like Inmarsat and Viasat for inflight connectivity also opens doors to future market growth. Additionally, Qatar’s ongoing participation in international aviation forums, such as ICAO (International Civil Aviation Organization) and IATA (International Air Transport Association), fosters collaborations aimed at improving global aviation communication standards. This global partnership dynamic supports the expansion of the aircraft communication system market as international cooperation drives the standardization of communication systems, enhancing global network efficiency.

Future Outlook

Over the next five years, the Qatar Aircraft Communication Systems market is expected to grow significantly, fueled by continuous investments in aircraft communication infrastructure and Qatar’s increasing demand for advanced connectivity solutions. With the government’s push for modernization in aviation infrastructure, the market is poised to expand as both civil and military aviation sectors invest in cutting-edge communication systems. Additionally, Qatar’s strategic alliances with global technology providers will drive growth, further solidifying its position as a key player in the Middle East aviation landscape.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- L3Harris Technologies

- Cobham Aerospace

- Rockwell Collins

- Safran Electronics & Defense

- BAE Systems

- Iridium Communications

- Inmarsat

- Viasat

- Panasonic Avionics

- Raytheon Technologies

- Garmin

- Satcom Direct

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Civil Aviation Authority – QCAA)

- Qatar Airways and Major Aviation Operators

- Air Traffic Control Providers

- MRO (Maintenance, Repair, and Overhaul) Service Providers

- OEMs (Original Equipment Manufacturers)

- Airline Fleet Management and Communication System Managers

- Satellite Communication Service Providers

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an extensive analysis will be conducted to identify the critical variables influencing the Qatar Aircraft Communication Systems market. This will involve comprehensive desk research, leveraging proprietary, and secondary databases from industry sources such as QCAA and key aviation stakeholders. The focus will be on defining the key drivers and barriers impacting the growth of the market.

Step 2: Market Analysis and Construction

This phase involves the collection of historical market data on installed systems, emerging technologies, and consumer preferences in Qatar’s aviation sector. The analysis will cover past market trends, identifying factors such as technological advancements in SATCOM, VHF/UHF systems, and demand for integrated communication platforms.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, we will conduct interviews with key stakeholders, including industry experts from aerospace firms, regulatory bodies, and aviation operators. These consultations will provide first-hand insights, ensuring that our analysis is accurate and grounded in real-world data.

Step 4: Research Synthesis and Final Output

The final stage will synthesize all gathered data, integrating expert insights with market analysis. Direct consultations with aircraft communication system providers will help validate findings and ensure that the report accurately reflects the competitive landscape, technological trends, and regulatory factors affecting the market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Data Sources, Qatar Aviation & Aerospace Databases, Forecast Methodology, Primary & Secondary Research Coverage, Triangulation Approach, Limitations & Bias Controls)

- Market Genesis and Strategic Importance for Qatar Aviation Sector

- Qatar Aviation Infrastructure & Fleet Growth

- Role of Aircraft Communication Systems in Modern Avionics Connectivity

- Qatar Air Traffic Management & CNS/ATM Adoption Context

- Key Technology Platforms (SATCOM, HF/VHF, Data Link, ADS‑B, ACARS, FANS) and Their Qatar Relevance

- Growth Drivers

Qatar Aviation Expansion & Fleet Growth

Rising Demand for Connected Flight Experience & Data Services

Regulatory Push for ADS‑B / CPDLC (Air Traffic Modernization)

- Market Challenges

High Capital Costs for Advanced Radios & SATCOM Platforms

Certification & Regulatory Barriers (EASA / ICAO / GCAA)

- Market Opportunities

SATCOM Coverage Expansion (LTE / Ka‑Band Inflight Services)

- Emerging Trends

Software Defined Radios & IP‑Native Architectures

AI / Predictive Communication Health Monitoring

Regulatory & Compliance Framework (GCAA, ICAO SARPs)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Communication System Type (In Value %)

SATCOM Systems (In‑Flight Broadband / Voice / Data)

HF Communications (Long‑Range Operational Connectivity)

VHF/UHF Communication Radios

Data Link Communication (Controller Pilot Data Link – CPDLC)

ACARS / Digital Aircraft Message Exchange - By Component Category (In Value %)

Antennas & RF Front‑Ends

Transceivers & SDR Platforms

Satellite Data Units (SDUs) & Modems

Ground‑Link Terminals & Connectivity Nodes

Navigation & Surveillance Nodes Supporting Communication Functions - By Aircraft Platform (In Value %)

Commercial Jets (Wide‑Body & Narrow‑Body)

Business & General Aviation

Military Aircraft & Defense Platforms

Helicopter & Rotorcraft Communications

Unmanned Aerial Systems - By Adoption Mode (In Value %)

Line‑Fit (OEM Integrated)

Retrofit / Aftermarket Upgrades

- Market Shares (Value & Installed Base)

- Cross‑Comparison Parameters (Company Overview, System Portfolio Breadth, Qatar & GCC Footprint, SATCOM Partnerships, Certification Status, After‑Sales Support Footprint, Local Partnerships, Revenue by Product Vertical, Technology Roadmap & R&D, Price Band Positioning, Delivery Lead Times, Warranty & SLA Offerings, Distribution / Channel Agreements, MRO Support Networks)

- Competitor Profiles

Honeywell Aerospace

Collins Aerospace (RTX)

Thales Group

L3Harris Technologies

Cobham Aerospace Communications

Rockwell Collins (now part of Collins)

Rohde & Schwarz

Safran Electronics & Defense

BAE Systems – Avionics Division

General Dynamics Mission Systems

Iridium Communications (SATCOM Backbone)

Inmarsat / GX Aviation Connectivity Providers

Viasat (Aircraft Connectivity Platforms)

Panasonic Avionics (In‑Flight Connectivity)

Elbit Systems

- Stakeholder & Value Chain Analysis

- Ecosystem Map (OEM → Integrators → Operators → End Users)

- Supply Chain Risk & Localization Potential in Qatar

- Certification Network (DO‑178C / DO‑254 / GCAA Type Certification)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035