Market Overview

The Qatar Aircraft Computers market is valued at approximately USD ~ million in 2023, driven by the expanding aviation sector and increasing investments in advanced avionics systems. As Qatar’s aviation industry grows, both commercial and defense aircraft systems are evolving, with a strong demand for high-performance computers to enhance operational safety, communication, and navigation. The market’s growth is further supported by increasing air traffic, airline fleet expansions, and government funding towards military aircraft modernization.

Qatar dominates the aircraft computers market within the Middle East, driven by its robust aviation infrastructure and strategic positioning as a global aviation hub. The country’s flagship carrier, Qatar Airways, plays a crucial role in this growth, boosting demand for state-of-the-art avionics systems. Additionally, Qatar’s substantial defense expenditure supports the integration of advanced computer systems into its military aircraft. Other key regions contributing to the market include neighboring Gulf Cooperation Council (GCC) nations, where there is a rising trend in both commercial and military aviation developments.

Market Segmentation

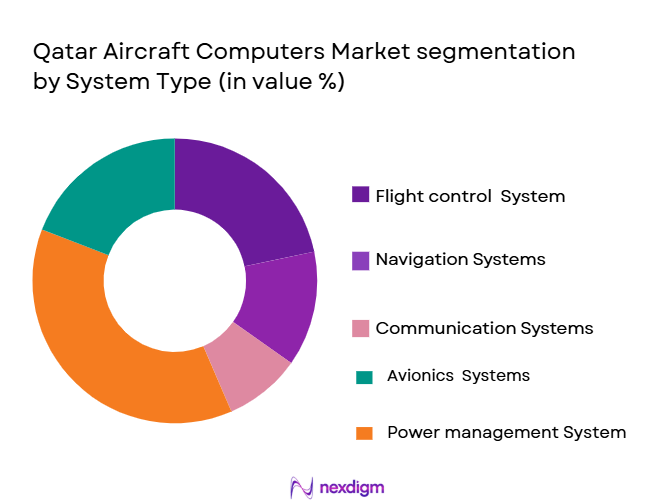

By System Type

The Qatar Aircraft Computers market is segmented by system type, primarily including Flight Control Systems, Navigation Systems, Communication Systems, Avionics Systems, and Power Management Systems. Flight Control Systems This segment dominates due to the increasing need for precision and reliability in controlling modern aircraft. Flight control systems are crucial for safe operations, particularly in commercial and military sectors. With the rise of automated flight systems, flight control systems have seen considerable adoption in both civil and defense applications.

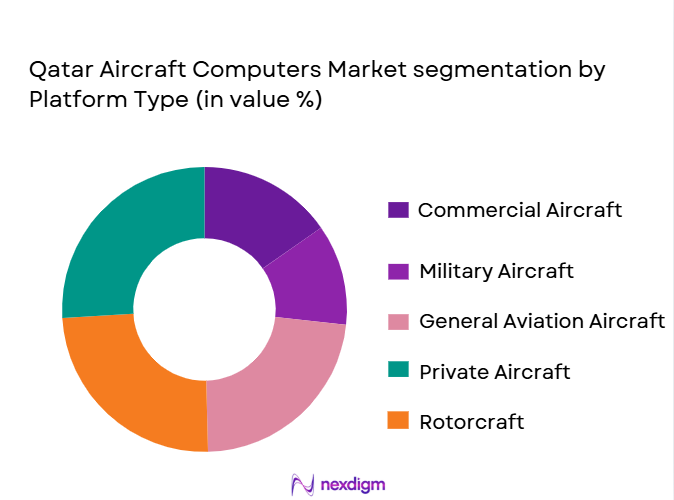

By Platform Type

The market is segmented by platform type into Commercial Aircraft, Military Aircraft, Business Jets, Helicopters, and Unmanned Aerial Vehicles (UAVs). The dominant platform in Qatar, commercial aircraft, is heavily reliant on advanced aircraft computers to ensure safety, passenger comfort, and operational efficiency. The growing demand for long-haul flights and modernization of fleets drives the continued investment in advanced avionics systems. Qatar’s defense spending is substantial, leading to an increased demand for advanced systems in military aircraft. The modernization of the Qatari military fleet requires cutting-edge aircraft computers to meet stringent performance and safety standards.

Competitive Landscape

The Qatar Aircraft Computers market is dominated by a few major players, including global giants like Thales, Honeywell, Collins Aerospace, and local companies that cater specifically to the growing demand from Qatar Airways and the Qatari military. These companies are heavily invested in the region, both through their existing contracts with airlines and governments and by participating in joint ventures that provide cutting-edge avionics technologies.

| Company Name | Establishment Year | Headquarters | R&D Investment | Technology Portfolio | Product Offerings | Global Reach | Customer Base |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Phoenix, USA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1935 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | Kansas, USA | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Computers Market Dynamics

Growth Drivers

Increasing Demand for Advanced Avionics Systems in Commercial Aircraft

The global aviation industry is seeing increasing demand for sophisticated avionics systems, with a focus on improving flight safety, fuel efficiency, and automation in commercial aircraft. The International Air Transport Association (IATA) forecasts that global air traffic will grow by 4.3% annually from 2024 onwards, which is expected to increase the demand for advanced avionics in commercial aircraft. The rising number of aircraft in Qatar’s fleet, including the high-profile Qatar Airways, directly contributes to this trend. With Qatar Airways aiming to expand its fleet to over 250 aircraft by 2026, this growing number of aircraft will likely require modern avionics systems that support real-time communication, navigation, and safety enhancements. The investments in upgrading fleet capabilities across the GCC region are expected to further drive this trend.

Rising Air Traffic and the Need for Enhanced Safety Features

Air traffic growth continues to be a major driver of demand for advanced aircraft computers, particularly in the Middle East, where Qatar plays a pivotal role. According to the World Bank, global air traffic is projected to reach pre-pandemic levels by 2024, with the region experiencing a faster recovery. Qatar, as a major hub, is forecasted to see a rise in air traffic with passenger numbers growing by over 5% annually, contributing to the need for enhanced avionics systems to handle increased traffic and improve safety. As air traffic density increases, aviation authorities, including the Qatar Civil Aviation Authority, are placing higher emphasis on advanced safety features and automation technologies to ensure smooth and safe air travel. The aviation market in Qatar is rapidly expanding, and ensuring operational safety through advanced avionics systems is a key driver.

Market Challenges

High Cost of Advanced Aircraft Computer Systems

One of the primary challenges facing the Qatar Aircraft Computers market is the high cost of advanced avionics systems. The development and deployment of these sophisticated systems require substantial investment in research, technology, and certification. Aircraft manufacturers and suppliers face high initial costs in designing and producing these systems, which, combined with integration expenses, contribute to the overall high price. In 2024, the cost of advanced flight control and navigation systems for a single aircraft is estimated to be in the range of USD 5-10 million, depending on the complexity of the systems. Additionally, the cost of continuous software updates and system maintenance compounds the financial burden. This challenge has been highlighted by reports from the Qatar Civil Aviation Authority, which underscores the importance of balancing safety, performance, and cost-effectiveness in the procurement process.

Stringent Regulatory Standards for Certification

The certification process for advanced aircraft computer systems is another major challenge. Qatar, like other nations, adheres to stringent certification standards set by international aviation bodies such as the European Union Aviation Safety Agency (EASA) and the U.S. Federal Aviation Administration (FAA). These agencies impose rigorous testing and documentation requirements before avionics systems can be approved for use in commercial and military aircraft. These certification requirements can take several years, delaying the deployment of new technology. In addition, the growing focus on cybersecurity in aviation systems has introduced even more stringent regulations, with new standards for data protection and network security expected to be enforced in the coming years. Meeting these regulatory requirements is both time-consuming and costly for manufacturers.

Market Opportunities

Expansion of Unmanned Aerial Vehicle (UAV) Applications

The UAV market is one of the most promising growth areas for the Qatar Aircraft Computers market. UAVs are increasingly used for military surveillance, border patrol, and search-and-rescue operations. In 2024, the Qatari government is investing in UAVs as part of its defense strategy, with applications expanding into commercial sectors like agriculture, infrastructure monitoring, and environmental surveys. UAVs are highly dependent on advanced computer systems for operations, such as flight control, navigation, and data transmission. The demand for such systems is expected to continue growing as the adoption of UAVs in both military and civilian applications increases. Qatar’s investment in UAV technology aligns with broader trends seen across the Middle East, where countries are looking to leverage UAVs for both defense and commercial purposes, fueling demand for advanced avionics.

Growth of Low-Cost Carriers Boosting Demand for Avionics

The rise of low-cost carriers (LCCs) in the Middle East, including Qatar, has been a significant driver for the aircraft computers market. LCCs focus on cost efficiency and operational effectiveness, and as such, they require modern avionics systems that can improve fuel efficiency, reduce maintenance costs, and enhance operational performance. In Qatar, with its growing population and the rising trend of affordable air travel, LCCs are becoming an important segment of the aviation market. This shift is encouraging investments in advanced avionics for more fuel-efficient flight operations, particularly in navigation, communication, and control systems. As Qatar continues to expand its aviation infrastructure, including new terminals and enhanced connectivity, the demand for avionics systems that support low-cost carriers is expected to increase.

Future Outlook

Over the next decade, the Qatar Aircraft Computers market is expected to witness considerable growth, primarily driven by Qatar’s continuous expansion of its aviation and defense sectors. With the demand for advanced flight control, navigation, and communication systems continuing to rise, aircraft manufacturers and the Qatari government are expected to invest heavily in next-generation avionics. This growth will also be fueled by technological advancements in AI and autonomous aircraft systems, enhancing the need for high-performance computers to handle complex data processing tasks.

Major Players

- Thales Group

- Honeywell Aerospace

- Collins Aerospace

- Rockwell Collins

- Garmin Ltd.

- Sagem Avionics

- Curtiss-Wright Corporation

- Moog Inc.

- Boeing

- Airbus

- Leonardo S.p.A.

- Safran Electronics & Defense

- Aerospace Systems & Technologies

- Northrop Grumman

- General Electric Aviation

Key Target Audience

- Airline Companies

- Aircraft Manufacturers

- Military and Defense Agencies (Qatar Armed Forces, Qatar Air Force)

- Government and Regulatory Bodies (Qatar Civil Aviation Authority)

- Aviation System Integrators

- Aircraft Maintenance and Repair Organizations (MROs)

- Aviation Technology Providers

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The research process begins with defining the key market variables, which include the segmentation, market drivers, and challenges impacting the Qatar Aircraft Computers market. This is based on secondary research, gathering historical data from government agencies, aviation authorities, and credible industry reports.

Step 2: Market Analysis and Construction

Data from a range of sources, including market reports and insights from aviation companies, is compiled to create an in-depth analysis. Key areas such as growth trends, demand drivers, and technological advancements are assessed in this phase.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from both the commercial aviation and defense sectors are consulted to validate hypotheses and provide insights into the future growth of the market. These consultations are vital for refining the initial research and forming a precise market outlook.

Step 4: Research Synthesis and Final Output

Following the collection of data and expert validation, the research is synthesized to produce the final output. This output integrates both qualitative and quantitative data, providing a comprehensive analysis of the Qatar Aircraft Computers market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for advanced avionics systems in commercial aircraft

Rising air traffic and the need for enhanced safety features

Government investments in modernizing military aircraft fleets - Market Challenges

High cost of advanced aircraft computer systems

Stringent regulatory standards for certification

Integration complexities with legacy systems in existing aircraft - Market Opportunities

Expansion of unmanned aerial vehicle (UAV) applications

Growth of low-cost carriers boosting demand for avionics

Technological advancements in AI and machine learning for aircraft systems - Trends

Shift towards digitalization and automation in aircraft systems

Increasing adoption of green and energy-efficient technologies in aviation

Rising focus on cybersecurity for aircraft computer systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Control Systems

Navigation Systems

Communication Systems

Avionics Systems

Power Management Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

Unmanned Aerial Vehicles - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Upgrades

Maintenance and Support - By End-user Segment (In Value%)

Commercial Airlines

Military and Defense Agencies

Private Aviation Operators

Cargo Operators

Aircraft Maintenance, Repair, and Overhaul (MRO) Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Distributors

Online Sales Channels

Government Contracts

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Technology Adoption, Customer Base, Geographical Presence, Product Portfolio Product Certification & Regulatory Compliance Level, Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Group

Honeywell Aerospace

Collins Aerospace

L3Harris Technologies

Rockwell Collins

Garmin Ltd.

Sagem Avionics

Curtiss-Wright Corporation

Moog Inc.

Boeing

Airbus

Leonardo S.p.A.

Safran Electronics & Defense

Aerospace Systems & Technologies

Northrop Grumman

General Electric Aviation

- Increased demand from commercial airlines for modern avionics

- Military agencies seeking next-gen flight control and navigation systems

- Rising interest in private aviation driving demand for customizable systems

- MRO providers looking for advanced diagnostic and maintenance systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System, Tier 2026-2035

- Future Demand by Platform, 2026-2035