Market Overview

The Qatar aircraft control surfaces market is experiencing robust growth due to the increasing demand for advanced aviation technologies and the country’s strategic focus on expanding its aerospace sector. In 2023, the market reached a valuation of USD ~ billion, driven by Qatar’s continued investments in both military and civilian aviation sectors. Government-backed initiatives, along with increasing fleet modernization in the commercial airline sector, fuel the demand for cutting-edge aircraft components, such as control surfaces. This demand is expected to rise further with Qatar’s emphasis on infrastructure development and military defense strategies, including procurement of high-tech aircraft systems.

Qatar is the dominant country in the Middle East for aircraft control surfaces, with its capital, Doha, emerging as a major aerospace hub in the region. The country’s dominance is primarily driven by its vast investments in military defense and commercial aviation. Qatar Airways, one of the largest and most advanced airlines globally, continues to expand its fleet, contributing to significant demand for aircraft control surfaces. Additionally, Qatar’s efforts to diversify its economy through aviation-related infrastructure, alongside its hosting of international events like the FIFA World Cup, further boosts the market’s growth potential.

Qatar Aircraft Control Surfaces Market Segmentation

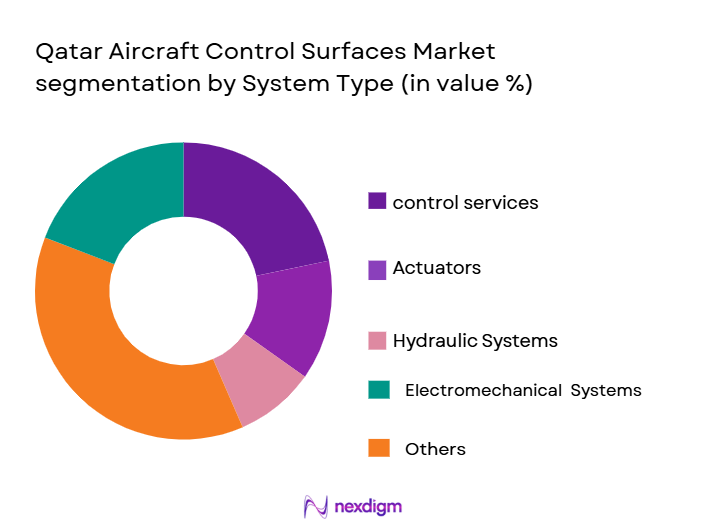

By System Type

The Qatar aircraft control surfaces market is segmented by system type into actuators, control surfaces, sensors, hydraulic systems, and electromechanical systems. Among these, the control surfaces segment has been dominating the market share. Control surfaces, including ailerons, rudders, and elevators, are critical components that ensure the stability and maneuverability of aircraft, making them indispensable in both military and commercial aviation. Their importance in modern aircraft design, combined with the rapid fleet expansion and modernization efforts by airlines and military organizations in Qatar, strengthens their market position. This segment benefits from both technological advancements and robust government investments in defense and commercial aviation sectors.

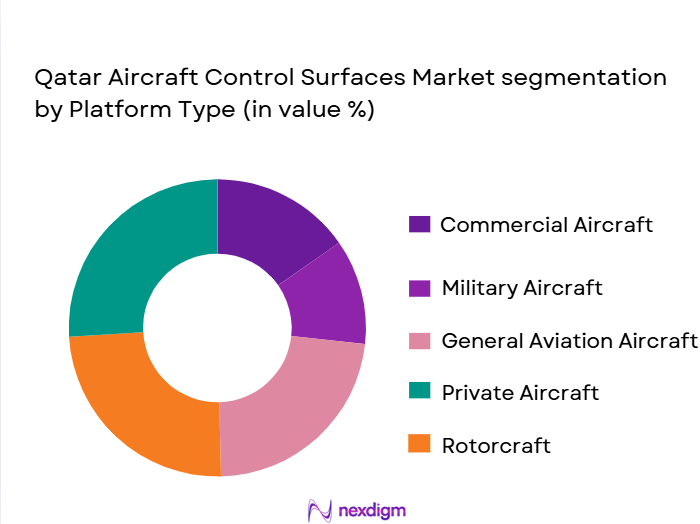

By Platform Type

The platform type segmentation includes commercial aircraft, military aircraft, private jets, unmanned aerial vehicles (UAVs), and helicopters. Military aircraft have emerged as the dominant segment in Qatar, driven by the country’s substantial defense spending and strategic military alliances. Qatar’s defense sector is modernizing rapidly, with advanced fighter jets and surveillance aircraft being prioritized. This growing demand for military-grade aircraft components, including control surfaces, has significantly influenced market share in this segment. The government’s focus on maintaining a state-of-the-art military, bolstered by foreign defense contracts and collaborations, ensures that military aircraft will continue to dominate the market for the foreseeable future.

Competitive Landscape

The Qatar aircraft control surfaces market is dominated by a few major global players, including well-established aerospace giants and specialized component manufacturers. The market features companies such as Boeing, Airbus, and Raytheon Technologies, which are known for their comprehensive aerospace portfolios and advanced aircraft systems. Their dominant market presence is attributed to their extensive experience, robust R&D capabilities, and strong relationships with both government and private sector customers in Qatar. The market’s competitive landscape reflects a trend towards increasing collaboration between international aerospace companies and local entities, ensuring a continuous supply of advanced components to meet the rising demand.

| Company Name | Establishment Year | Headquarters | R&D Investment | Technology Leadership | Production Capacity | Client Base | Global Reach |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Control Surfaces Market Dynamics

Growth Drivers

Increased Air Travel in the Middle East

The Middle East has seen significant growth in air travel, with the International Air Transport Association (IATA) reporting that the region’s aviation market is expected to grow by ~% annually over the next decade. Qatar Airways, the region’s flagship carrier, has expanded its fleet and network, continuously increasing demand for aircraft control surfaces. This demand is further fueled by the Qatar National Vision 2030, which places a strong emphasis on infrastructure development, including the aviation sector. With a projected increase in air traffic, Qatar’s airports are poised to handle more passengers, driving the need for enhanced aircraft components, including control surfaces. Qatar’s aviation sector is a key driver of economic diversification, contributing ~% to the GDP in 2023, as per the World Bank.

Expanding Defense Budgets in Qatar

Qatar’s defense budget has seen a consistent rise, with the government allocating USD ~ billion for defense expenditure in 2024. This increase reflects Qatar’s efforts to modernize its military capabilities, especially in terms of advanced fighter jets, UAVs, and surveillance aircraft, which require sophisticated control surfaces. The defense sector’s growth is largely driven by Qatar’s regional security concerns and partnerships with global powers. According to the International Institute for Strategic Studies (IISS), Qatar’s defense spending has been one of the highest in the Middle East relative to its GDP, ensuring a steady demand for high-tech aerospace components, including control surfaces.

Market Challenges

High Manufacturing Costs

Manufacturing advanced aircraft control surfaces, such as actuators and sensors, involves complex engineering and high-quality materials, driving up production costs. The cost of high-tech materials, such as titanium and composites, which are used in these components, remains high in 2024, affecting both the cost structure and profitability of manufacturers. According to the World Bank, raw material prices in the aerospace industry are expected to rise by ~% in 2024. Additionally, manufacturing facilities equipped with cutting-edge technology require significant capital investment, creating barriers to entry for new players in the market. This creates pressure on suppliers to keep prices competitive while managing their operational costs.

Complex Certification Processes

The certification process for aerospace components, including aircraft control surfaces, is rigorous and time-consuming, requiring compliance with both national and international aviation standards. The Qatar Civil Aviation Authority (QCAA) ensures that all components meet the stringent criteria set by the International Civil Aviation Organization (ICAO). As of 2024, the process for certifying new aircraft components can take up to 3 years, further prolonging the time-to-market for innovative systems. This regulatory environment significantly impacts manufacturers, slowing the adoption of new technologies, and increasing the time it takes to introduce new products into the market.

Market Opportunities

Growth in UAV and Drone Applications

Unmanned Aerial Vehicles (UAVs) are becoming increasingly important in both military and civilian applications, with significant investments being made in this area by the Qatari government. Qatar has been expanding its UAV fleet for surveillance, defense, and commercial uses, with a focus on integrating advanced technologies in control surfaces. As of 2024, the Qatar Armed Forces are set to acquire a variety of UAVs, each requiring sophisticated control systems to operate effectively. The UAV market is expected to see substantial growth, supported by both defense spending and increasing civilian demand for drones, creating a high demand for advanced aircraft control surfaces tailored to these platforms.

Strategic Defense Collaborations with Global Suppliers

Qatar’s defense sector is expanding through strategic collaborations with major global suppliers, including the US, France, and the UK. These collaborations, particularly in military aircraft procurement, drive the demand for high-quality control systems. Qatar’s military agreements with global powers ensure a constant influx of advanced military aircraft, including fighter jets and surveillance systems, which require cutting-edge control surfaces. As of 2024, Qatar has secured contracts for 36 Rafale fighter jets from France, marking a significant opportunity for control surface manufacturers in the region. These partnerships enhance Qatar’s position in the global aerospace industry, spurring continued growth in the aircraft control surfaces market.

Future Outlook

Over the next decade, Qatar’s aircraft control surfaces market is poised for substantial growth, driven by the country’s strategic investments in both civil and military aviation. With Qatar Airways expanding its fleet and Qatar’s military modernizing its aircraft systems, demand for advanced control surfaces will continue to rise. Additionally, technological advancements in automation, smart systems, and lightweight materials will shape the future of aircraft control components. The increasing need for more efficient, reliable, and cost-effective systems in the aerospace sector will fuel this market’s upward trajectory, with Qatar serving as a central hub for aerospace innovations in the Middle East.

Major Players

- Boeing

- Airbus

- Raytheon Technologies

- Lockheed Martin

- Safran

- Northrop Grumman

- General Electric

- Honeywell

- Collins Aerospace

- L3Harris Technologies

- Spirit AeroSystems

- Thales Group

- Leonardo

- Moog

- Curtiss-Wright

Key Target Audience

- Investments and Venture Capitalist Firms

- Qatar Ministry of Defense (MOD)

- Qatar Airways Management

- Qatar Aerospace Manufacturers

- Private Aviation Companies

- Civil Aviation Regulatory Authorities (Qatar Civil Aviation Authority)

- Aircraft Component Suppliers

- Military Procurement Agencies (Qatar Armed Forces)

Qatar Aircraft Control Surfaces Research Methodology

Step 1: Identification of Key Variables

In this phase, we construct an ecosystem map of all relevant stakeholders within Qatar’s aircraft control surfaces market. This step involves comprehensive desk research to identify critical market variables like demand for specific control surfaces and emerging technology trends.

Step 2: Market Analysis and Construction

This step involves compiling and analyzing historical data from 2020-2024, focusing on key market drivers like fleet expansion, military upgrades, and technological advancements in control surfaces. We will assess the market value for each year and derive insights regarding product demand and platform preferences.

Step 3: Hypothesis Validation and Expert Consultation

We validate the market hypotheses through consultations with aerospace industry experts and stakeholders. These consultations, including interviews and surveys, offer insights into operational challenges, technological innovations, and market trends.

Step 4: Research Synthesis and Final Output

The final output is based on a synthesis of both bottom-up and top-down data sources, verified through interactions with industry leaders in Qatar’s aerospace sector. The process ensures accurate forecasting and a validated report that reflects current and future market trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased air travel in the Middle East

Expanding defense budgets in Qatar

Technological advancements in aircraft control systems - Market Challenges

High manufacturing costs

Complex certification processes

Limited domestic manufacturing capabilities - Market Opportunities

Growth in UAV and drone applications

Strategic defense collaborations with global suppliers

Increasing demand for eco-friendly aircraft systems - Trends

Integration of AI and automation in control systems

Rise in demand for lightweight and durable materials

Shift toward electric and hybrid propulsion systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Actuators

Control Surfaces

Sensors

Hydraulic Systems

Electromechanical Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Retrofit

Maintenance, Repair & Overhaul (MRO)

Upgrades - By EndUser Segment (In Value%)

Commercial Airlines

Military Forces

Private Jet Owners

Aviation Maintenance Companies

Aerospace OEMs - By Procurement Channel (In Value%)

Direct Procurement

Distributors

OEM Partnerships

Third-Party Suppliers

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Technological Innovation, Pricing Strategy, Distribution Network, Product Diversification Product Certification & Regulatory Compliance Level, Technical Support & After-Sales Service Network, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Lockheed Martin

Northrop Grumman

General Electric

Honeywell

Safran

Raytheon Technologies

Collins Aerospace

L3Harris Technologies

Thales Group

Leonardo

Spirit AeroSystems

Curtiss-Wright

Moog

- Commercial airlines focusing on fleet modernization

- Military forces investing in advanced aircraft technology

- Private jet owners demanding high customization

- Aerospace OEMs exploring new control surface designs

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035