Market Overview

The Qatar Aircraft DC Converter market is expected to reach USD ~ billion based on a recent historical assessment. The market’s growth is driven by the increasing need for efficient power conversion systems in modern aviation, particularly for commercial and military aircraft. The rising demand for energy-efficient solutions, along with advancements in aircraft electrical systems, is fueling the market for DC converters, which are essential in optimizing energy usage and improving system performance across the aerospace industry.

The Middle East, with Qatar at its center, is becoming a dominant force in the global aircraft DC converter market. The country’s strategic location, booming aviation industry, and extensive government investment in infrastructure development contribute to its dominance. Qatar is enhancing its aviation capabilities, both in the civil and defense sectors, and is increasingly focusing on sustainability and energy-efficient technologies, which further propels the demand for advanced power conversion solutions, including DC converters.

Market Segmentation

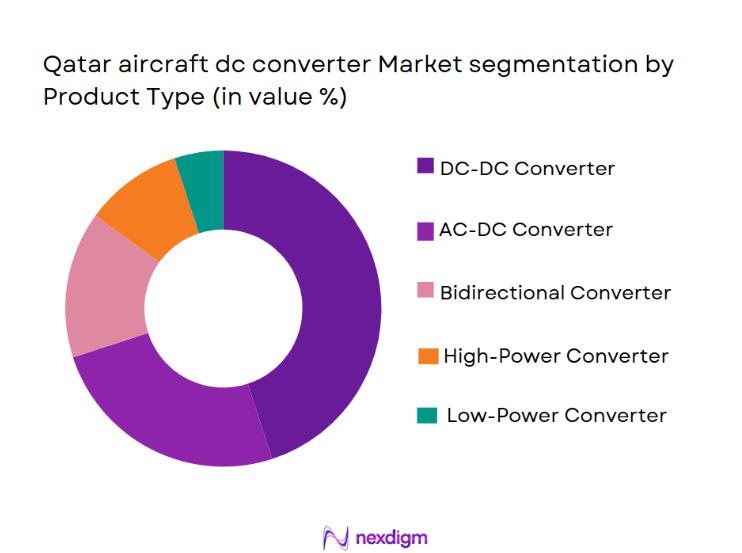

By Product Type

The Qatar Aircraft DC Converter market is segmented by product type into DC-DC converters, AC-DC converters, bidirectional converters, high-power converters, and low-power converters. The DC-DC converter sub-segment is currently dominating the market share, owing to its versatility and ability to efficiently convert electrical power across various voltage levels. DC-DC converters are preferred for their compact size, efficiency, and reliability, making them ideal for integration in both commercial and military aircraft systems. Their widespread use in power management and system integration further solidifies their dominant position.

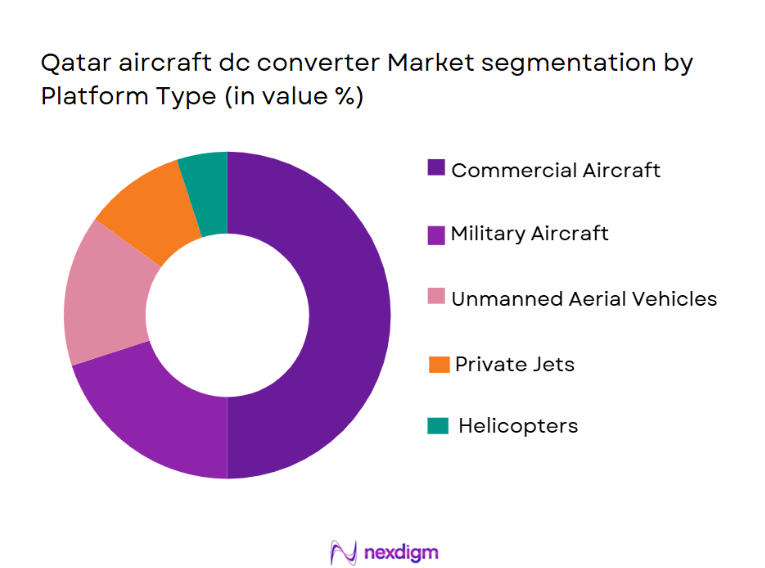

By Platform Type

The Qatar Aircraft DC Converter market is segmented by platform type into commercial aircraft, military aircraft, unmanned aerial vehicles (UAVs), private jets, and helicopters. Commercial aircraft dominate the market share due to the substantial growth in the airline industry and the increasing demand for energy-efficient aircraft systems. The need for higher power capacity, reliability, and integration of advanced avionics in commercial aircraft systems has driven the adoption of DC converters, as they provide an optimal solution for these critical power conversion needs.

Competitive Landscape

The competitive landscape of the Qatar Aircraft DC Converter market is characterized by a high degree of consolidation, with several key players holding substantial influence in the market. These players focus on delivering high-performance DC converters that meet the stringent requirements of the aviation sector. Major companies are investing in R&D to develop more efficient and compact solutions that can handle the evolving demands of aircraft electrical systems. As the market expands, strategic partnerships, mergers, and acquisitions are increasingly common, allowing companies to enhance their product portfolios and strengthen their market positions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | United States | ~ | ~ | ~ | ~ |

| General Electric | 1892 | United States | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | United States | ~ | ~ | ~ | ~ |

Qatar Aircraft DC Converter Market Analysis

Growth Drivers

Rising Demand for Energy-Efficient Aircraft

The need for fuel-efficient and energy-saving solutions in the aviation sector is one of the key growth drivers for the aircraft DC converter market. With rising fuel costs and environmental concerns, the industry is moving toward reducing energy consumption across all systems. DC converters play a significant role in optimizing electrical power usage, making them an essential component of new-generation aircraft designs.

Technological Advancements in Aircraft Systems

The rapid advancements in avionics, electric propulsion, and hybrid aircraft technologies are propelling the demand for high-performance DC converters. Modern aircraft require more complex electrical systems, with higher efficiency and greater power handling capacities, all of which increase the need for advanced DC converters to support these systems.

Market Challenges

High Initial Cost of Advanced Power Systems

One of the major challenges faced by the aircraft DC converter market is the high initial investment required for advanced power systems. While the long-term benefits of energy savings and efficiency are clear, the high upfront cost of equipment, installation, and integration into existing aircraft systems can pose a barrier for smaller airlines and military fleets with limited budgets.

Regulatory Compliance and Safety Standards

Compliance with stringent safety and regulatory standards, particularly in the aviation industry, presents another challenge. DC converters must meet high standards for reliability, performance, and safety, which requires significant investment in research and development to ensure the products meet evolving regulatory requirements.

Opportunities

Expansion of Aircraft Fleet in Emerging Markets

With the growing middle-class population and increasing air travel demand in emerging economies, particularly in the Asia-Pacific region, there is an opportunity for the aircraft DC converter market to expand. As new airlines emerge and current fleets are modernized, the demand for advanced electrical systems, including DC converters, will rise significantly.

Growth in Electric and Hybrid Aircraft Development

The increasing interest in electric and hybrid aircraft technology presents a major opportunity for the aircraft DC converter market. These next-generation aircraft rely heavily on DC converters for managing electrical systems and power distribution. As the industry shifts toward more sustainable aviation solutions, the market for DC converters is expected to see substantial growth.

Future Outlook

The future outlook for the Qatar Aircraft DC Converter market over the next five years appears promising, with the market poised for continued growth. Advancements in aircraft electrification, including the integration of more efficient power systems, will drive demand for DC converters. Technological developments, such as miniaturization and improved power density, will enhance the capabilities of DC converters. Additionally, regulatory support for green aviation technologies and the increasing adoption of UAVs will further fuel market expansion. As the aerospace industry focuses on reducing its carbon footprint, DC converters will continue to play a vital role in improving the energy efficiency of aircraft systems.

Major Players

- Honeywell Aerospace

- Thales Group

- L3Harris Technologies

- General Electric

- Rockwell Collins

- Eaton Corporation

- Meggitt PLC

- Raytheon Technologies

- Collins Aerospace

- Moog Inc.

- Turbomeca

- Safran Electrical & Power

- Embraer

- Liebherr Aerospace

- Rolls-Royce Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Military contractors

- UAV manufacturers

- Airlines

- MRO (Maintenance, Repair, and Overhaul) service providers

- Aircraft component suppliers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that influence the Qatar Aircraft DC Converter market, such as product types, technological trends, and regulatory frameworks. This step establishes a foundation for market analysis.

Step 2: Market Analysis and Construction

This step focuses on the collection and analysis of market data to create a comprehensive market model. It involves understanding market dynamics, including demand-supply scenarios, consumer behavior, and competitive pressures.

Step 3: Hypothesis Validation and Expert Consultation

In this step, hypotheses about market trends are tested through consultations with industry experts and stakeholders. Their insights help validate assumptions and refine market predictions.

Step 4: Research Synthesis and Final Output

The final step synthesizes all the data and analysis into a cohesive report that presents clear market insights, future forecasts, and strategic recommendations for industry stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for more efficient aircraft systems

Rising aircraft fleet sizes in the Middle East

Technological advancements in power conversion systems - Market Challenges

High initial installation and maintenance costs

Regulatory hurdles and certification complexities

Limited availability of skilled workforce - Market Opportunities

Growth of UAVs and their integration with aircraft power systems

Increased investment in aircraft electrification

Rising demand for environmentally friendly power solutions - Trends

Advancements in power density and efficiency of converters

Trend towards miniaturization of power systems

Shift towards more sustainable and eco-friendly aircraft components - Government Regulations

Evolving certification standards for power converters in aviation

Government incentives for sustainable aviation technologies

Aviation safety and compliance regulations impacting component design

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

DC-DC Converter

AC-DC Converter

Bidirectional Converter

High-Power Converter

Low-Power Converter - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Unmanned Aerial Vehicles (UAVs)

Private Jets

Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Modular Fitment

Custom Fitment - By EndUser Segment (In Value%)

Airlines

Military Contractors

Private Operators

UAV Manufacturers

Maintenance, Repair, and Overhaul (MRO) Services - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Distributors

OEM Procurement

Government Contracts

Online Procurement

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Fitment Type, EndUser Segment, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell Aerospace

Thales Group

L3Harris Technologies

General Electric

Rockwell Collins

Schaeffler Group

Eaton Corporation

Meggitt PLC

Raytheon Technologies

Collins Aerospace

Moog Inc.

Turbomeca

Safran Electrical & Power

Embraer

Liebherr Aerospace

- Growth of regional airline fleets

- Increasing defense spending and military contracts

- Rising adoption of UAVs for commercial purposes

- Expansion of MRO services in the region

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035