Market Overview

The Qatar Aircraft De-Icing market is primarily driven by the increased need for aircraft safety and efficiency during seasonal weather events, despite Qatar’s generally mild climate. In 2025, Qatar Airways, which operates one of the world’s largest fleets, recorded over ~ flights, resulting in substantial demand for aircraft ground services, including de-icing procedures during occasional weather disruptions. Although Qatar has a warm climate, sporadic rain and dust storms in winter months create a need for these services, which is further heightened by the high number of international flight operations. The airline industry’s growth, especially with Qatar Airways expanding its global routes, significantly contributes to the increasing need for de-icing services at Hamad International Airport.

Qatar, particularly Doha, dominates the regional Aircraft De-Icing market due to its strategic position as a global aviation hub. Hamad International Airport (DOH), one of the busiest airports in the Middle East, handles a significant portion of international flight traffic. This airport’s centrality in connecting the East to the West, combined with Qatar Airways’ large fleet and high turnover rate, drives the demand for de-icing services. Despite Qatar’s relatively mild climate, occasional cold weather and heavy rainfall necessitate the services, particularly for long-haul international flights that arrive in Doha from colder regions. The significant concentration of aircraft movements at Hamad International further supports Qatar’s leadership in the de-icing services market.

Market Segmentation

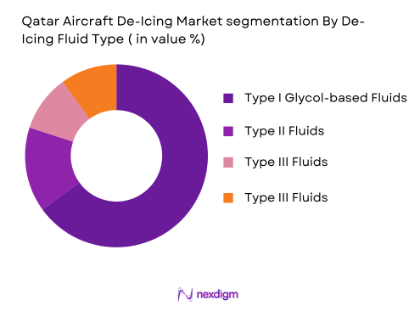

By De-Icing Fluid Type

The market is segmented by the types of de-icing fluids used in the aviation industry. The primary categories include Type I, Type II, Type III, and Type IV de-icing fluids, with Type I being the most commonly used fluid due to its effectiveness in removing snow and ice. Type I fluids, which are glycol-based, are the most common choice for de-icing in Qatar because they are ideal for initial removal of contaminants from aircraft surfaces. They are widely used in the initial stages of de-icing at Hamad International Airport, where quick turnaround times are essential.

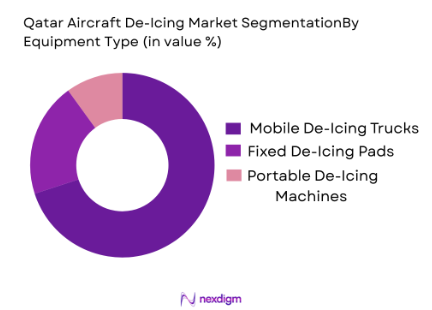

By Equipment Type

Aircraft de-icing equipment is categorized into mobile de-icing trucks, fixed de-icing pads, and portable de-icing machines. Mobile de-icing trucks hold the largest market share due to their flexibility and ease of operation. These trucks, equipped with heated applicators and large fluid storage tanks, allow for de-icing operations to be quickly performed across multiple aircraft. Fixed de-icing pads, while useful for centralized service hubs, are less commonly used in Qatar due to the airport’s relatively warm climate and the low frequency of de-icing needs.

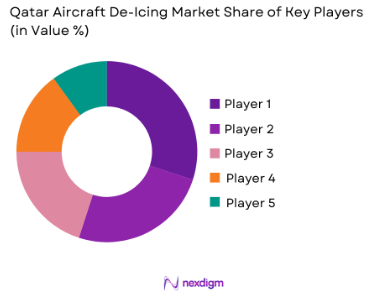

Competitive Landscape

The Qatar Aircraft De-Icing market is dominated by a few key players, with both global and regional companies offering de-icing services and equipment. Major companies like Vestergaard Company, Global Ground Support, and Oshkosh Aerotech lead the market with extensive service networks and specialized de-icing technologies. These companies offer comprehensive de-icing fluid solutions and equipment that are critical for operations at major hubs like Hamad International Airport, where high traffic volumes require efficient de-icing processes.

| Company | Establishment Year | Headquarters | Key Market Parameters | Product Portfolio | Distribution Channels | Technological Innovations | Revenue Streams | Capacity (GSE & Fluids) | Compliance Standards |

| Vestergaard Company | 1957 | Denmark | De-icing fluids, equipment manufacturing, service providers | Type I, Type II, Type IV Fluids | Airport Ground Services | ~ | ~ | ~ | ~ |

| Global Ground Support | 1985 | USA | De-icing equipment manufacturing, service providers | Mobile de-icing trucks | Airports worldwide | ~ | ~ | ~ | ~ |

| Oshkosh Aerotech | 1917 | USA | Ground support equipment, de-icing trucks | Mobile de-icing trucks | Airports, Airlines | ~ | ~ | ~ | ~ |

| Cryotech / General Atomics | 1986 | USA | De-icing fluids, GSE equipment | Type I, Type IV Fluids | Airport Ground Services | ~ | ~ | ~ | ~ |

| Tronair Inc. | 1978 | USA | Ground support equipment, de-icing units | Type I Fluids, Portable Units | Airlines, Airports | ~ | ~ | ~ | ~ |

Qatar Aircraft De‑Icing Market Landscape & Dynamics

Market Drivers

Regulatory Safety Mandates and Holdover Time Standards

Global aviation safety reporting frameworks emphasize meticulous aircraft preparation before departure, including surface contamination control when weather warrants it. According to global scheduled flight activity data, widespread aviation operations require compliance with safety protocols that incorporate de‑icing where necessary to maintain aircraft certification and operational legality. While Qatar’s local climate seldom reaches freezing thresholds, occasional rain and humidity can impact surface contamination. International aviation safety policy and monitoring data reinforce the need for adherence to de‑icing and anti‑icing practices as part of standard safety procedures for commercial carriers operating into and out of Doha’s hub.

Demand for Operational Efficiency

Hamad International Airport’s handling of ~aircraft movements alongside growing passenger volume exemplifies tight operational scheduling. Efficient turnaround — the interval between an aircraft’s arrival and its scheduled departure — is critical for maximizing runway and taxiway utilization. Quick de‑icing operations, when needed, prevent delays that cascade across itineraries on tightly scheduled flights. Airport operational metrics show that high movement throughput requires streamlined ground processes, including rapid de‑icing fluid application and equipment deployment, to align with aircraft turnaround windows and minimize ramp occupancy time, particularly in busy flight banks and point‑to‑point sectors.

Market Restraints

Environmental Regulations on Glycol Disposal and Run‑Off

Even with sporadic weather conditions necessitating de‑icing, environmental safeguarding of airport surroundings is mandatory. De‑icing fluids often contain glycols that require careful capture and disposal to prevent contamination of soil and drainage systems. Qatar’s environmental monitoring frameworks and airport compliance standards mandate containment systems and treatment processes for fluid run‑off. These requirements add complexity and cost to operations, as ground handling must account for environmental impact mitigation protocols while delivering timely aircraft services. Adherence to such environmental standards can constrain rapid deployment without supporting infrastructure.

Skill & Training Gaps in Ground Handling Teams

Aircraft de‑icing requires precise execution and safety compliance. Despite efficient ground handling in Doha, the specialized nature of de‑icing operations — particularly fluid application under variable conditions — demands dedicated training. Statistics from aviation hubs globally indicate investments in workforce competencies are critical to reducing procedural errors and maintaining safety standards. In Qatar, where climatic de‑icing events are less frequent, ground staff may have fewer practical application opportunities, potentially leading to operational gaps that must be counterbalanced through rigorous training programs to ensure readiness when weather conditions mandate de‑icing procedures.

Market Opportunities

Predictive Analytics & AI for De‑icing Scheduling

Air traffic and ground handling datasets, such as aircraft movement volumes, enable the application of predictive analytics to anticipate service needs, including de‑icing operations triggered by weather anomalies. Using real‑time and historical data, AI could forecast when de‑icing services are necessary — optimizing staffing, equipment allocation, and fluid inventory levels. This analytical approach enhances preparedness without over‑committing operational resources, especially in regions with infrequent de‑icing demand. Research from aviation operational analytics underscores the value of predictive systems in maintaining efficiency across complex airport agendas.

Partnerships Between Airports, Ground Handlers, and OEMs

Collaboration between Hamad International Airport authorities, ground handling service providers, and original equipment manufacturers (OEMs) of de‑icing systems can unlock efficiencies. With reported record passenger and movement figures, partnerships allow shared investment in training, equipment modernization, and adaptive systems tailored to local operational realities. Such ecosystems also support joint R&D initiatives for sustainable de‑icing solutions and optimized workflows. Shared commitments reduce individual financial burdens while ensuring capabilities are aligned with service demand patterns, creating a resilient and responsive network supporting Qatar’s aviation infrastructure.

Future Outlook

Over the next decade, Qatar’s Aircraft De-Icing market is poised for continued growth, fueled by the ongoing expansion of international flights, particularly with Qatar Airways’ rapidly growing fleet. This will drive the need for robust ground handling capabilities, including efficient de-icing services. Additionally, technological advancements, particularly in predictive analytics for weather conditions and de-icing scheduling, will further streamline operations, improving cost-effectiveness and environmental sustainability.

Major Players

- Vestergaard Company

- Global Ground Support

- Oshkosh Aerotech

- Cryotech / General Atomics

- Tronair Inc.

- JBT Corporation

- TLD Group

- AeroTech Services

- Aviation Ground Support

- Airside Mobile Deicing

- Dufour Aerospace

- John Bean Technologies

- Kährs

- Harlan Global Manufacturing

- Aero Specialties

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airline Operators

- Airport Authorities

- Ground Handling Companies

- De-Icing Equipment Manufacturers

- Aviation Safety Authorities

- Aviation Logistics Providers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical factors such as the number of aircraft movements, weather patterns, and the availability of ground handling equipment. Data sources include historical data from Qatar Airways, Hamad International Airport, and weather stations.

Step 2: Market Analysis and Construction

The analysis focuses on compiling historical data, reviewing annual reports from key stakeholders, and assessing the infrastructure and fleet capacity. Data on operational efficiency and service frequency will be used to assess market trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations with industry professionals from aircraft ground services and de-icing equipment manufacturers will help validate assumptions about the market dynamics and service requirements.

Step 4: Research Synthesis and Final Output

This phase consolidates all collected data into a cohesive market analysis. Interviews with ground handling companies and manufacturers will confirm product demand and operational readiness, ensuring an accurate and reliable analysis of the Qatar Aircraft De-Icing market.

- Executive Summary

- Research Framework & Methodology (Market Definitions and Scope, Region‑Specific Market Modelling, Data Sources & Reliability Matrix, Sampling & Primary Research Framework, Estimation Approach, Data Triangulation Logic, Limitations and Assumptions)

- Industry Structure & Value Chain

- Role of De‑Icing in Flight Safety Compliance

- Airport Ground Handling Integration

- De‑Icing Service Delivery Models

- Interdependency with Weather Patterns & Seasonal Operations

- Growth Drivers

Increasing Commercial Flight Frequency and Fleet Expansion

Airport Capacity Growth

Regulatory Safety Mandates and Holdover Time Standards

Demand for Operational Efficiency - Market Restraints

High Operational & Capital Costs

Limited Cold Weather Occurrence vs Cost‑Justified Investment

Environmental Regulations on Glycol Disposal and Run‑off

Skill & Training Gaps in Ground Handling Teams - Market Opportunities

Eco‑friendly De‑icing Fluids / Digital Application Systems

Remote & Centralized De‑icing Infrastructure

Predictive Analytics & AI for De‑icing Scheduling

Partnerships Between Airports, Ground Handlers, and OEMs - Market Trends

De‑icing Fluid Run‑off Capture & Environmental Compliance

Integration with Digital Flight Operations Systems

Airport Infrastructure Constraint

- By Value, 2020-2025

- By Volume, 2020-2025

- Pricing Trends, 2020-2025

- Average Service Km/Flight De‑ice Metrics, 2020-2025

- By De‑Icing Fluid Type (In Value%)

Type I

Type II

Type III / IV

Eco‑Friendly Glycol Alternatives - By De‑Icing Equipment/System (In Value%)

De‑icing Trucks

Fixed & Remote De‑icing Pads

Infrared & Heated Fluid Systems

Hybrid & Digital Automated Systems - By Application (In Value%)

Commercial Fleet Operations

Business/Private Aviation

Military & Special Missions - By Service Provider Type (In Value%)

Airport Ground Handling Units

Third‑Party Specialists

OEM / Integrated Aviation Services - By End‑User (In Value%)

Full‑Service Carriers

Low‑Cost Carriers

General Aviation Operators

- Market Share & Positioning (Value/Volume)

- Cross‑Comparison Parameters (Product/Service Portfolio Breadth, Global & Regional Footprint, Technology Adoption Index, Annual Fluid Consumption Volume, Fleet Serviced / Airport Throughput, Environmental Compliance & Run‑off Mitigation Capabilities, Pricing Structures, Strategic Partnerships & Airport Alliances)

- Strategic SWOT Profiles of Key Players

- Pricing & SKU Analysis

- Porter’s Five Forces

- Detailed Competitive Profiles

Clariant AG

BASF SE

Dow Inc.

Kilfrost Ltd.

Collins Aerospace

Cryotech / General Atomics

Vestergaard Company A/S

JBT Corporation

Oshkosh Aerotech

Tronair Inc.

Honeywell International Inc.

Global Ground Support LLC

Airside Mobile Deicing

AeroTech Services

Airborne Maintenance & Engineering Services

- Doha Airport De‑Icing Treatment Capacity

- Runway & Ramp De‑icing Infrastructure Index

- Fluid Storage & Handling Facilities

- De‑icing Service Delivery Footprint

- Connectivity to Ground Service OEMs

- Forecasted Market Value & Volume Trajectories, 2026-2035

- Demand Drivers, 2026-2035

- Technology Adoption Curve, 2026-2035

- Strategic Initiatives & Infrastructure Investments, 2026-2035