Market Overview

The Qatar Aircraft Door Market is valued at USD~ million, driven by robust growth in the aerospace and aviation sector. A notable factor contributing to the market’s size is the consistent expansion of Qatar Airways and the increasing demand for aircraft fleet maintenance, upgrades, and modernization. The aviation sector’s push towards more efficient, lightweight, and durable aircraft doors, coupled with increased demand for maintenance, repair, and overhaul (MRO) services, further fuels market expansion. The market’s growth is reinforced by the rising number of aircraft deliveries and door replacement cycles, which constitute a significant part of the market.

Qatar is a dominant player in the Middle East’s aerospace industry, with Doha emerging as a major hub for aviation. Qatar Airways, one of the fastest-growing airlines globally, along with its substantial aircraft fleet, plays a pivotal role in driving the market. Additionally, the country’s investment in state-of-the-art infrastructure, such as Hamad International Airport and the expansion of its fleet, propels the demand for aircraft components, including aircraft doors. Moreover, Qatar’s strategic location, enabling easy access to the wider Middle East and beyond, also supports its dominance in the aircraft door market.

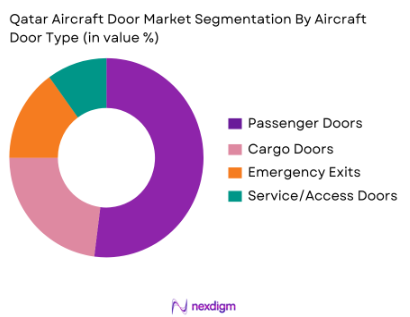

Market Segmentation

By Aircraft Door Type

The Qatar Aircraft Door Market is segmented by door type into passenger doors, cargo doors, emergency exits, and service/access doors. The passenger doors segment holds a dominant market share due to the rapid expansion of Qatar Airways’ fleet, which includes a large number of narrow-body and wide-body aircraft. These doors are integral for ensuring both safety and passenger convenience. Qatar Airways’ continuous fleet expansion, including newer models such as the Boeing 787 and Airbus A350, which are equipped with technologically advanced, lightweight aircraft doors, is a significant factor driving this segment’s dominance.

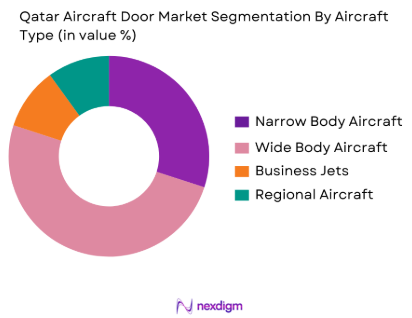

By Aircraft Type

The market is also segmented by aircraft type, which includes narrow-body, wide-body, business jets, and regional aircraft. The wide-body segment holds a significant market share, as Qatar Airways operates a large number of wide-body aircraft such as the Airbus A350 and Boeing 777. These aircraft require specialized aircraft doors that are both larger and more technologically advanced. With the expansion of international long-haul flights, the demand for wide-body aircraft doors has surged. Additionally, narrow-body aircraft doors are also seeing increasing demand due to the expansion of the regional fleet.

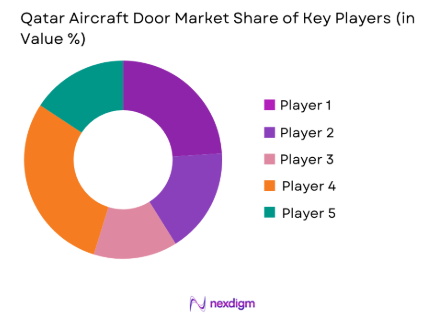

Competitive Landscape

The Qatar Aircraft Door Market is highly competitive, with major global aerospace manufacturers leading the charge. This competitive environment is dominated by companies that produce both original equipment (OEM) and aftermarket aircraft doors, supporting the large fleet expansions of airlines such as Qatar Airways.

| Company | Establishment Year | Headquarters | Production Capacity | Technological Innovation | Certifications | Market Focus |

| Safran SA | 2005 | France | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1935 | USA | ~ | ~ | ~ | ~ |

| Latécoère S.A. | 1917 | France | ~ | ~ | ~ | ~ |

| Spirit AeroSystems | 2005 | USA | ~ | ~ | ~ | ~ |

| MHI Aerospace | 1884 | Japan | ~ | ~ | ~ | ~ |

Qatar Aircraft Door Market Dynamics & Competitive Forces

Growth Drivers

Qatar Aviation Fleet Expansion & New Airline Capacity

The rapid expansion of Qatar Airways, which currently operates over 230 aircraft in its fleet and plans to add 50 new aircraft by 2025, is a significant driver of the aircraft door market. Qatar Airways’ expansion includes orders for advanced models such as the Boeing 787 and Airbus A350, which are equipped with state-of-the-art aircraft doors. Additionally, the expansion of Hamad International Airport is further bolstering aviation capacity, accommodating the increase in passenger traffic and new aircraft, leading to heightened demand for aircraft components, including doors. This growth is in line with Qatar’s national economic push to bolster non-oil sectors, with aviation being a key focus area as outlined in the Qatar National Vision 2030.

Aircraft Modernization & Safety Upgrade Mandates

Aircraft safety standards, such as the mandatory installation of new doors for fleet modernization and regulatory safety upgrades, are major market drivers. The global shift towards more stringent safety requirements by aviation authorities like the EASA (European Union Aviation Safety Agency) and ICAO (International Civil Aviation Organization) has pushed airlines to retrofit their fleets with enhanced safety features, including advanced aircraft doors. For instance, Qatar Airways has undertaken a massive retrofit project for its fleet, incorporating newer, safer, and lighter doors as per the regulatory standards set for 2024. This move reflects the broader trend in the Gulf region, where aviation authorities are enforcing higher safety standards, directly boosting the demand for specialized aircraft doors.

Challenges

Certification & Compliance Costs

One of the challenges in the aircraft door market is the increasing cost of certification and compliance with international standards. For example, aircraft doors need to meet rigorous safety, structural, and environmental standards set by aviation authorities like the FAA and EASA. With new materials such as composites being used in modern doors, certification processes have become more complex, increasing the overall cost. In Qatar, the regulatory landscape, governed by the Qatar Civil Aviation Authority (QCAA), enforces compliance with these stringent safety and environmental norms. As of 2024, the certification process for new aircraft components like doors can take several years, requiring significant financial and technological investment.

Supply Chain Constraints & Lead Times

The aircraft door market faces ongoing challenges related to supply chain disruptions and lead time increases. The global supply chain for aerospace components, including aircraft doors, has been significantly impacted by factors such as the COVID-19 pandemic and ongoing geopolitical tensions. This has resulted in extended delivery times for critical components. For example, the global lead time for aerospace parts, including aircraft doors, has increased by nearly 30% from previous years, creating a bottleneck in production. In Qatar, the importation of components for aircraft doors, especially advanced lightweight materials, has been delayed, slowing down the replacement and delivery cycles for aircraft doors.

Opportunities

Lightweight Composites & Advanced Door Automation

As aircraft manufacturers increasingly adopt lightweight composite materials and automated mechanisms for aircraft doors, there is a growing opportunity in the market for manufacturers who can produce high-performance, lightweight, and automated doors. Qatar Airways has shown interest in integrating new technologies such as carbon Fiber composites in its fleet, which reduces the overall weight of aircraft and improves fuel efficiency. By 2024, there is a rising trend among airlines to invest in automated aircraft doors, driven by the operational efficiency and improved passenger experience they offer. Manufacturers that focus on these innovations will benefit from the shift towards these advanced technologies.

Local Supplier Partnerships

Qatar’s push for industrial diversification and the growth of its aviation sector presents significant opportunities for local suppliers to enter the aircraft door market. The Qatari government’s initiatives under the Qatar National Vision 2030 encourage partnerships between international aerospace companies and local businesses. Qatar’s national airline, Qatar Airways, is increasingly relying on local suppliers for the provision of various aircraft components. This trend is likely to grow, presenting opportunities for local manufacturers to secure long-term contracts for the supply of aircraft doors, maintenance services, and after-sales support.

Future Outlook

The Qatar Aircraft Door Market is expected to see robust growth over the coming years. The market will be driven by continued expansion in Qatar Airways’ fleet, technological advancements in aircraft door materials, and the increasing focus on improving aircraft performance and passenger safety. As new aircraft models with advanced door designs are introduced, the demand for more efficient and lightweight aircraft doors will continue to rise. Additionally, the increasing volume of international air traffic through Qatar’s well-positioned airports will bolster the demand for aircraft doors in both OEM and aftermarket sectors.

Major Players

- Safran SA

- Collins Aerospace

- Latécoère S.A.

- Spirit AeroSystems

- MHI Aerospace

- GKN Aerospace

- Aernnova Aerospace

- Leonardo S.p.A.

- Boeing

- Airbus

- Honeywell Aerospace

- Triumph Group

- Daimler AG

- Terma Group

- Potez Aéronautique

Key Target Audience

- Aerospace Manufacturers

- Airlines

- MRO Providers

- Aviation OEMs

- Investments and Venture Capitalist Firms

- Government Agencies

- Aircraft Fleet Operators

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This step involves gathering comprehensive data on all key stakeholders in the Qatar Aircraft Door Market, including airlines, aircraft manufacturers, MRO providers, and component suppliers. A combination of secondary research from credible databases and primary research will be used to gather relevant data.

Step 2: Market Analysis and Construction

We will analyse market data related to aircraft fleet sizes, MRO trends, and OEM supply channels. We will also assess product adoption rates and the relationship between aircraft door suppliers and aircraft manufacturers to understand market penetration.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations will be conducted with industry professionals, such as MRO service providers and OEM manufacturers, to validate initial hypotheses. These insights will be critical to refining the data and ensuring accuracy.

Step 4: Research Synthesis and Final Output

The final analysis will be based on a combination of in-depth stakeholder consultations, market forecasts, and insights derived from primary and secondary research. This comprehensive analysis will provide a clear picture of the Qatar Aircraft Door Market’s dynamics.

- Executive Summary

- Research Methodology (Definitions, Market Sizing & Forecasting Approach, Primary Research Framework, Data Sources & Validation, Assumptions & Limitations)

- Market Landscape

- Market Structure

- Regulatory & Aviation Certification Framework

- Qatar Civil Aviation Trends & Strategic Investments

- Aircraft Fleet Profile & Door Replacement Cycles

- Growth Drivers

Qatar aviation fleet expansion & new airline capacity

Aircraft modernization & safety upgrade mandates

Aftermarket demand from MRO operations - Challenges

Certification & compliance costs

Supply chain constraints & lead times

Replacement cycle volatility - Opportunities

Lightweight composites & advanced door automation

Local supplier partnerships

Defense aircraft door demand - Industry Trends

Digital supply chain & predictive maintenance

OEM‑tier supplier consolidation

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Adoption Price, 2020-2025

- By Segment Profitability & Margins, 2020-2025

- Market Share – Top Suppliers (Value & Volume)

- Cross Comparison Parameters (Company Overview, Business Strategy, Product Portfolio

Quality & Certification, Production Capacity & Technological Depth, Distribution Footprint, Strategic Alliances & Contracts, Aftermarket Support & Repair Capabilities, Pricing Strategy & Pricing Tiers, Warranty & Service Agreements, R&D Investment & Innovation Roadmap)

- Strategic SWOT Profiles of Key Players

- Pricing & SKU Analysis

- Porter’s Five Forces

- Detailed Profiles

Safran SA

Collins Aerospace

Groupe Latécoère

Latecoere S.A.

Elbit Systems Ltd.

Mitsubishi Heavy Industries Ltd.

Saab AB

Spirit AeroSystems

Dynamatic Technologies Limited

Aernnova Group

Terma Group

SICAMB S.p.A.

Hellenic Aerospace Industry

Potez Aéronautique

Primus Aerospace

- Demand Patterns

- Purchasing Criteria

- Buyer Decision Journey

- MRO Economics & Door Overhaul Cycles

- Forecasted Utilization & Inventory Strategies

- Market Size Forecast, 2026-2035

- Door Type Demand Projections, 2026-2035

- Aircraft Fleet Growth & Door Replacement Forecast, 2026-2035 t

- Price Trend Projections, 2026-2035