Market Overview

The Qatar Aircraft Electric Motors market is witnessing a robust growth trajectory, driven by the increasing adoption of electric propulsion technologies in aviation. With a growing focus on energy efficiency and reducing carbon emissions, the market has gained significant traction in recent years. The market size, based on recent historical assessments, is expected to reach USD ~ billion by 2025. This growth is primarily driven by technological advancements in electric motor systems, increased investments in electrification, and rising government support for sustainable aviation practices.

Qatar and other Gulf countries are leading the charge in the Middle East’s electric aviation sector, primarily due to substantial investments in green technologies and infrastructure development. Doha, the capital of Qatar, has become a central hub for electric propulsion innovation, backed by strong government initiatives, favorable policies, and collaborations with international players. Qatar’s strategic geographical position and its forward-thinking approach to sustainability place it at the forefront of this emerging market in the region.

Market Segmentation

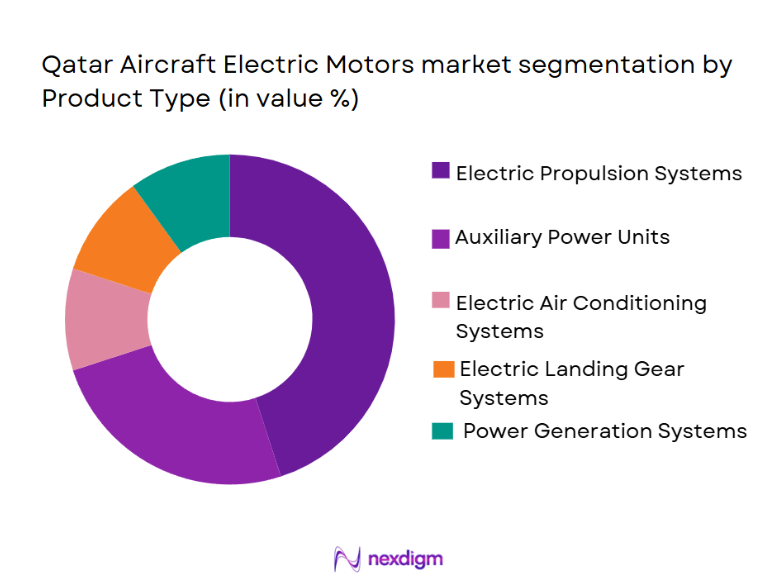

By Product Type

The Qatar Aircraft Electric Motors market is segmented by product type into various categories, such as propulsion systems, auxiliary power units, and air conditioning systems. Among these, electric propulsion systems dominate the market due to their potential to significantly reduce fuel consumption and emissions. The growing focus on hybrid-electric aircraft and fully electric aircraft is pushing the demand for more efficient, reliable, and cost-effective propulsion solutions, contributing to the dominance of this sub-segment.

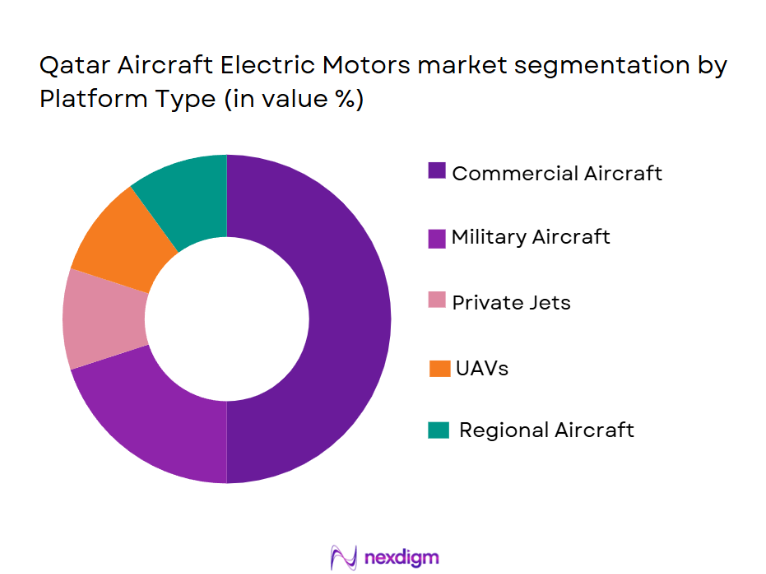

By Platform Type

The Qatar Aircraft Electric Motors market is also segmented by platform type into commercial aircraft, military aircraft, private jets, unmanned aerial vehicles (UAVs), and regional aircraft. Commercial aircraft are the dominant sub-segment, owing to the increasing focus on reducing operational costs and carbon footprints within the aviation industry. The adoption of electric motors in commercial airliners is being driven by the demand for cleaner technologies and government regulations on emissions, which make the market for electric propulsion systems in commercial platforms the most substantial.

Competitive Landscape

The competitive landscape in the Qatar Aircraft Electric Motors market is marked by consolidation, with major international players dominating the space. These companies are focusing on strategic partnerships, technological innovation, and regional expansions to maintain their competitive edge. The influence of key players is particularly strong in the development of new propulsion systems and the adoption of electric aviation technologies, enabling them to shape market trends and drive long-term growth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter (Electric Motor Efficiency) |

| GE Aviation | 1917 | United States | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1930 | United States | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Electric Motors Market Analysis

Growth Drivers

Government Initiatives

The government’s focus on achieving sustainability goals and reducing carbon emissions is a major growth driver for the electric motors market in Qatar. Qatar’s Vision 2030 includes significant investments in renewable energy and electrification across industries such as aviation and transportation, which directly supports the growth of the electric motors sector. Public-private partnerships, along with government incentives for electric mobility, have further bolstered the demand for electric motors.

Technological Advancements

The continuous improvement in electric motor technology hasgreatly influenced market growth. Innovations in lightweight, high-efficiency motors, as well as the development of new materials for better heat management, have made electric motors more reliable and efficient, especially in high-performance applications such as aircraft propulsion. These advancements have expanded the scope of electric motor use, driving their adoption in multiple sectors in Qatar.

Market Challenges

High Initial Cost

The adoption of electric motors, especially in industries like aerospace and automotive, faces challenges due to the high initial costs associated with advanced technologies. Although electric motors offer long-term operational savings, the upfront investment required for electric propulsion systems can be a barrier to widespread adoption. Overcoming this challenge involves securing government funding and subsidies, as well as technological advancements that bring costs down.

Infrastructure Limitations

Despite Qatar’s advancements in technology, the lack of a fully developed infrastructure for electric vehicles and aviation presents a challenge to the market. The deployment of electriccharging stations and maintenance facilities for electric-powered aircraft and vehicles remains insufficient in some areas. Expanding this infrastructure is critical for encouraging adoption across sectors that rely on electric motors.

Opportunities

Smart City Development

Qatar’s commitment to developing smart cities presents an opportunity for the electric motors market. As part of the infrastructure development, electric vehicles and autonomous transportation systems are expected to increase, creating further demand for electric motors. These projects provide new business opportunities for manufacturers of electric motors, especially in sectors like urban mobility and public transport.

Electrification of Aircraft

The growing trend of electrifyingaircraft presents a significant opportunity for electric motor manufacturers in Qatar. Qatar is investing heavily in aviation technologies, including electric and hybrid aircraft. As the country aims to position itself as a leader in air mobility, the demand for efficient, lightweight electric motors will increase, further driving the market growth.

Future Outlook

Over the next five years, the Qatar Aircraft Electric Motors market is expected to experience steady growth, driven by technological developments and a strong push for greener aviation solutions. The demand for electric propulsion systems will rise as new regulations come into effect, pushing for more sustainable practices within the aviation industry. Technological advancements in battery systems and electric motor efficiency are expected to further drive adoption, while government support for eco-friendly initiatives will continue to be a significant demand-side factor.

Major Players

- GE Aviation

- Rolls-Royce

- Honeywell Aerospace

- Safran

- Collins Aerospace

- MagniX

- ZeroAvia

- Heart Aerospace

- Vertical Aerospace

- Raytheon Technologies

- Thales Group

- BAE Systems

- Liebherr Aerospace

- Rolls-Royce Electrical

- Siemens

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Aircraft OEMs

- Private jet owners

- MRO service providers

- UAV developers

- Electric propulsion component suppliers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables that could impact the market, including technological developments, government policies, and market drivers and challenges.

Step 2: Market Analysis and Construction

Next, an in-depth analysis of historical data and current trends is conducted to build a comprehensive view of the market landscape. This involves evaluating current market dynamics, growth projections, and competitive trends.

Step 3: Hypothesis Validation and Expert Consultation

The third step involves validating the market hypotheses through consultations with industry experts, engineers, and market analysts to ensure accuracy and robustness of the research framework.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all findings and analysis into a final comprehensive report. This includes refining the market forecast, validating data points, and finalizing insights for decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for energy-efficient aircraft

Advancements in electric propulsion technology

Government support for sustainable aviation - Market Challenges

High initial investment costs

Regulatory barriers for electric aircraft

Limited infrastructure for electric propulsion systems - Market Opportunities

Increased focus on urban air mobility

Potential for electric aircraft in regional travel

Expanding electric aircraft fleet for military applications - Trends

Growth of hybrid-electric aircraft systems

Shift towards lightweight, efficient electric motors

Advancements in battery and charging technology - Government Regulations

Carbon emission reduction targets

Electrification standards for aircraft

Certification requirements for electric aircraft systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Aircraft Propulsion Systems

Electric Landing Gear Systems

Air Conditioning Systems

Power Generation Systems

Auxiliary Power Units - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Unmanned Aerial Vehicles

Regional Aircraft - By Fitment Type (In Value%)

Line-fit

Retrofit

Aftermarket

OEM

MRO (Maintenance, Repair & Overhaul) - By EndUser Segment (In Value%)

Airlines

Military Forces

Private Jet Owners

MRO Service Providers

OEM Manufacturers - By Procurement Channel (In Value%)

Direct Sales

Third-Party Distributors

OEM Procurement

E-commerce Platforms

Authorized Resellers

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Fitment Type, End User Segment, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

GE Aviation

Honeywell Aerospace

Rolls-Royce

Safran

Boeing

Airbus

BAE Systems

Thales Group

Liebherr Aerospace

Raytheon Technologies

Collins Aerospace

MagniX

ZeroAvia

Heart Aerospace

Vertical Aerospace

- Demand from commercial airlines

- Military adoption of electric propulsion

- Growth in private jet market

- MRO sector’s role in supporting electric motors

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035