Market Overview

The Qatar Aircraft Electrification market is valued at USD ~ billion, based on a comprehensive historical analysis. The growing demand for sustainable aviation technologies, driven by environmental concerns and government incentives, plays a significant role in the market’s expansion. Qatar’s commitment to reducing carbon emissions by 2030, along with its investment in green technologies, is further propelling market growth. The electrification of aircraft is gaining traction as airlines seek alternative solutions to conventional jet fuel to

Qatar is a dominant player in the aircraft electrification market due to its strategic location and investments in aviation infrastructure. Qatar Airways, one of the world’s leading airlines, plays a key role in driving the adoption of new technologies, including electric aircraft. The country’s government supports this initiative through substantial funding for research and development, particularly in eco-friendly technologies. Additionally, global leaders in aviation electrification, such as the United States and European nations, have a significant presence in the market, given their technological advancements and infrastructure readiness.

Market Segmentation

By System Type

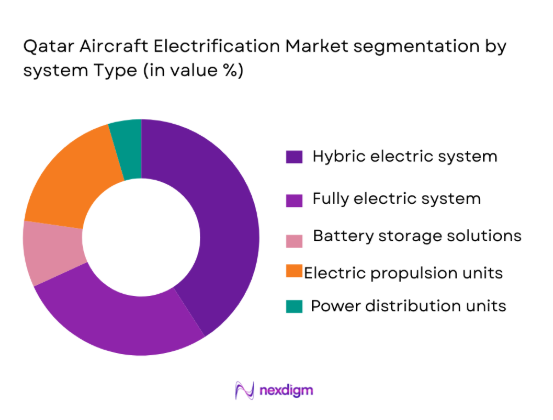

The Qatar Aircraft Electrification market is segmented by system type into hybrid electric systems, fully electric systems, battery storage solutions, electric propulsion units, and power distribution units. Among these, hybrid electric systems dominate the market due to their ability to reduce fuel consumption while still leveraging traditional engines for longer flights. Airlines and aircraft manufacturers prefer hybrid systems as they offer a transitional solution before fully electric systems can take over. Additionally, hybrid systems provide a balance between operational cost savings and environmental goals, making them the preferred choice for initial electrification projects.

By Platform Type

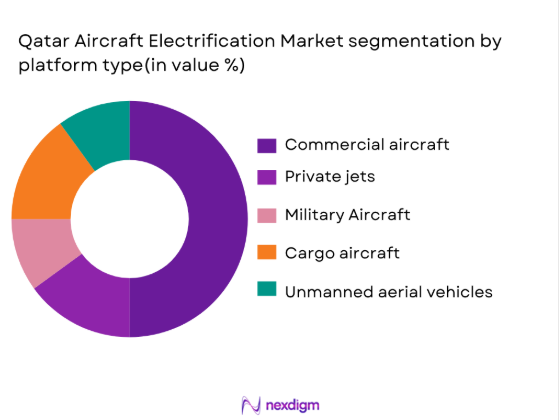

In the Qatar Aircraft Electrification market, the platform type segmentation includes commercial aircraft, private jets, military aircraft, cargo aircraft, and unmanned aerial vehicles (UAVs). Among these, commercial aircraft hold the dominant market share. The large-scale adoption of electric propulsion technologies by commercial airlines is supported by extensive fleets and the drive towards reducing carbon emissions. Airlines like Qatar Airways have been actively involved in pilot projects for electrification, seeking to integrate electric solutions into their operations. The potential cost savings from fuel consumption and maintenance further enhance the attractiveness of electric aircraft for commercial operations.

Competitive Landscape

The Qatar Aircraft Electrification market is dominated by key players with significant technological expertise and global reach. These include major aerospace manufacturers such as Boeing, Airbus, and Rolls-Royce, alongside emerging companies in the electric aviation space like MagniX and Eviation Aircraft. These companies are focusing on electric propulsion systems and are heavily investing in R&D to pioneer the next generation of electric aircraft. Their leadership in the market is reinforced by strong partnerships with airlines and government-backed funding initiatives.

| Company | Establishment Year | Headquarters | Technologies | R&D Investment | Partnerships | Market Focus |

| Boeing | 1916 | USA | – | – | – | – |

| Airbus | 1970 | France | – | – | – | – |

| Rolls-Royce | 1906 | UK | – | – | – | – |

| MagniX | 2009 | USA | – | – | – | – |

| Eviation Aircraft | 2015 | USA | – | – | – | – |

Qatar Aircraft Electrification Market Dynamics

Growth Drivers

Increasing Demand for Sustainable Aviation Technologies

The global push for sustainability in the aviation sector is significantly driving the demand for electrification in aircraft, including in Qatar. Qatar’s commitment to reducing carbon emissions by 25% by 2030, aligned with the country’s National Vision 2030, supports the adoption of electric aircraft. The aviation sector alone contributes to over 2.5% of global carbon emissions (2023 data from the International Air Transport Association). Additionally, the Qatar Civil Aviation Authority (QCAA) is promoting initiatives to encourage the transition to sustainable aviation technologies, including electric propulsion systems. This drive is reflected in growing investments in sustainable aviation, driven by the urgency of cutting greenhouse gas emissions.

Government Incentives and Funding for Green Technologies

Qatar’s government continues to invest heavily in green technologies, including those for aviation. The Qatar National Vision 2030 emphasizes environmental sustainability, prompting government bodies to support projects that focus on green technologies. In 2023, Qatar invested over USD 10 billion in clean energy and sustainable infrastructure projects. These investments include substantial funding allocated to the electrification of aircraft. The Qatar Investment Authority (QIA) is expected to fund multiple initiatives to advance clean energy technologies in aviation, in line with the broader GCC region’s ambitions to achieve net-zero emissions by 2050. The government’s proactive role is essential for market growth, making sustainable aviation technologies a priority.

Market Challenges

High Initial Cost of Electrification Technologies

The adoption of electric aircraft systems in Qatar is hindered by the high initial cost of electrification technologies. Current estimates indicate that the cost of electric aircraft propulsion systems, including battery storage solutions, can exceed USD 20 million for commercial-scale aircraft. This high upfront cost remains a significant barrier for airlines and operators looking to make the switch to electric solutions. However, the QCAA has acknowledged the importance of long-term cost savings in fuel and maintenance, encouraging a gradual adoption strategy. Until the technology matures and economies of scale are realized, this cost will continue to pose challenges to widespread implementation.

Regulatory and Certification Barriers

Electric aircraft face significant regulatory hurdles in Qatar, particularly regarding certification by the Qatar Civil Aviation Authority (QCAA) and international aviation bodies like the International Civil Aviation Organization (ICAO). As of 2023, there is no global standard for certifying electric propulsion systems for large aircraft. The lack of clear, standardized certification processes presents a challenge for manufacturers and airlines looking to integrate electric aircraft into their fleets. However, international collaboration is expected to address these challenges over time, with regulatory bodies working towards defining specific standards for electric aircraft certification.

Market Opportunities

Emerging Markets for Electric Aircraft in Qatar and the GCC Region

The Qatar aircraft electrification market stands to benefit from emerging markets in the GCC region, where governments are heavily investing in sustainable technologies. Qatar, in particular, is positioning itself as a hub for green technology in aviation. The adoption of electric aircraft is poised to expand as GCC countries, including the UAE and Saudi Arabia, are setting ambitious targets for reducing aviation emissions. The integration of electric propulsion systems in the region’s aviation sector is anticipated to gain momentum, driven by a combination of government incentives, global partnerships, and a shared commitment to meeting the climate goals set by the GCC. Qatar’s role as a leader in this sector will create substantial market opportunities for electric aircraft solutions.

Technological Collaboration Between Airlines and Electric System Providers

As part of Qatar’s strategic goals, airlines in the country, particularly Qatar Airways, have shown interest in collaborating with global electric aircraft system providers. This collaboration includes the integration of electric propulsion systems into their existing fleets, ensuring smooth transitions to hybrid and fully electric aircraft. The partnerships are set to advance electric propulsion technologies, including more efficient battery systems and charging infrastructure. This collaboration offers a massive opportunity for further market growth, as Qatar Airways continues to push the envelope on sustainability in aviation. Through these partnerships, there will be ongoing advancements in the feasibility of electric aircraft and increased demand for such solutions.

Future Outlook

Over the next decade, the Qatar Aircraft Electrification market is expected to experience significant growth driven by continued advancements in battery technology, regulatory support, and increasing environmental pressures to reduce aviation emissions. The aviation industry in Qatar, led by major players like Qatar Airways, is actively investing in electric propulsion technologies as part of its commitment to achieving sustainability goals. Moreover, the adoption of electric aircraft is projected to expand beyond commercial use into private jets and military applications, contributing to the growing diversification of electric aviation platforms.

Major Players in the Market

- Boeing

- Airbus

- Rolls-Royce

- MagniX

- Eviation Aircraft

- GE Aviation

- Safran

- Honeywell

- Siemens

- Piper Aircraft

- Lilium

- Vertical Aerospace

- Embraer

- Thales

- Quantum Systems

Key Target Audience

- Airlines

- Private Aircraft Operators

- Military and Defense Contractors

- Aircraft Maintenance, Repair, and Overhaul Providers

- Aviation Technology Manufacturers

- Aircraft Component Suppliers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all major stakeholders in the Qatar Aircraft Electrification Market. This is done through extensive desk research utilizing secondary databases to gather comprehensive industry-level information. Key variables influencing the market dynamics are identified, including technological advancements, regulatory frameworks, and adoption rates among airlines.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data specific to the Qatar Aircraft Electrification Market, assessing key data points such as market penetration and the ratio of electric aircraft to traditional aircraft. Service quality and operational statistics are also evaluated to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert consultations with industry leaders, including representatives from aircraft manufacturers and airlines. These consultations will provide valuable insights into product development, adoption trends, and future market needs.

Step 4: Research Synthesis and Final Output

The final phase includes gathering primary data from key industry stakeholders to validate market data and provide additional insights into product segments and consumer preferences. This will complement the insights derived from secondary research, ensuring a comprehensive and accurate analysis of the Qatar Aircraft Electrification Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for sustainable aviation technologies

Government incentives and funding for green technologies

Technological advancements in battery and power systems - Market Challenges

High initial cost of electrification technologies

Regulatory and certification barriers

Limited infrastructure for electric aircraft charging and maintenance - Market Opportunities

Emerging markets for electric aircraft in Qatar and the GCC region

Technological collaboration between airlines and electric system providers

Growth in the UAV sector for electric propulsion - Trends

Shift towards hybrid-electric and fully electric aircraft solutions

Growing investment in electric aircraft research and development

Increase in public and private partnerships for electric aircraft infrastructure

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Hybrid Electric Systems

Fully Electric Systems

Battery Storage Solutions

Electric Propulsion Units

Power Distribution Units - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Military Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

New Aircraft Production

Aircraft Retrofit

Modular Fitment

OEM Integration

Aftermarket Fitment - By End User Segment (In Value%)

Airlines

Private Aircraft Operators

Military and Defense Contractors

Cargo and Freight Operators

Aircraft Maintenance, Repair, and Overhaul (MRO) Providers - By Procurement Channel (In Value%)

Direct OEM Sales

Third-party Vendors

Integrated Solutions Providers

Government Contracts

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters (Market share, Pricing models, Technological advancements, Customer satisfaction, Distribution channels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Airbus

Boeing

Rolls-Royce

GE Aviation

Safran

Honeywell

MagniX

Eviation Aircraft

Embraer

Thales

Siemens

Pipistrel

Vertical Aerospace

Lilium

Quantum Systems

- Airlines are increasingly adopting electrification for cost savings and regulatory compliance

- Private aircraft operators are exploring electric solutions for lower operational costs

- Military and defense sectors are exploring electric propulsion for efficiency and reduced emissions

- MRO providers are focusing on electric aircraft maintenance expertise

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035