Market Overview

The Qatar Aircraft Emergency Systems market is valued at approximately USD ~ million, based on a five-year historical analysis. This market is primarily driven by Qatar’s robust aviation industry and its commitment to ensuring the highest standards of safety in air travel. The country’s significant investments in its aviation infrastructure, including its rapidly growing fleet and airports like Hamad International Airport, directly contribute to the increasing demand for advanced emergency systems. Additionally, the rising number of air passengers and the push for higher safety standards globally are fueling this market’s growth.

Qatar is a dominant player in the aircraft emergency systems market due to its position as a global aviation hub and its continued focus on safety standards. With Qatar Airways being one of the leading airlines in the world, the demand for cutting-edge emergency systems has risen significantly. Moreover, Qatar’s strong regulatory environment, led by the Civil Aviation Authority of Qatar, and its proactive safety measures for aviation make it a key market for aircraft safety technologies. Other Gulf countries such as the UAE also support this growth, but Qatar’s concentrated investments in air travel infrastructure make it the regional leader.

Market Segmentation

By System Type

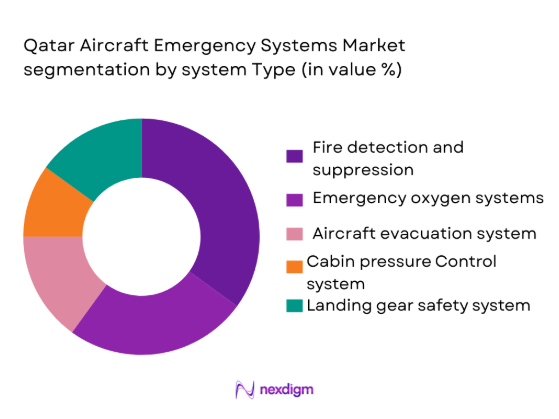

The Qatar Aircraft Emergency Systems market is segmented by system type, which includes fire detection and suppression systems, emergency oxygen systems, aircraft evacuation systems, cabin pressure control systems, and landing gear safety systems. Among these, fire detection and suppression systems dominate the market. The high priority given to preventing and managing fire hazards in aircraft, as well as the regulatory requirements for compliance with international safety standards, make these systems critical. The need for immediate and efficient response to fire-related emergencies has led to their widespread implementation across commercial aircraft fleets operating in Qatar.

By Platform Type

The market is also segmented by platform type, including commercial aircraft, private jets, military aircraft, cargo aircraft, and helicopters. The commercial aircraft segment holds the largest share in Qatar, driven by the significant presence of Qatar Airways and its fleet expansion. Qatar Airways operates one of the youngest and largest fleets globally, necessitating the constant upgrade and integration of advanced emergency systems. Additionally, with increasing passenger traffic at Hamad International Airport, the demand for reliable emergency systems for commercial aircraft is higher compared to other platform types.

Competitive Landscape

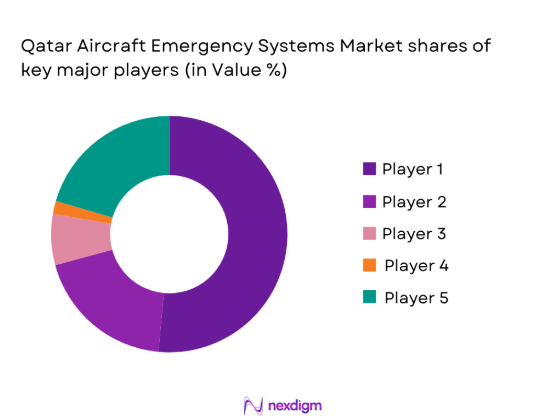

The Qatar Aircraft Emergency Systems market is dominated by a few key global players specializing in aviation safety technologies. Companies such as Honeywell, Collins Aerospace, and Safran are leading providers of advanced emergency systems, contributing to the market’s technological progress and regulatory compliance. The dominance of these players in the market is attributed to their long-established presence, technological innovations, and ability to meet the stringent regulatory requirements of the aviation industry in Qatar. These companies also have strong partnerships with Qatar Airways and other aviation players, further solidifying their position in the market.

| Company | Establishment Year | Headquarters | Technologies | R&D Investment | Partnerships | Market Focus |

| Honeywell | 1906 | USA | – | – | – | – |

| Collins Aerospace | 2018 | USA | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

| UTC Aerospace Systems | 1934 | USA | – | – | – | – |

| L3 Technologies | 1997 | USA | – | – | – | – |

Qatar Aircraft Emergency Systems Market Dynamics

Growth Drivers

Increasing Demand for Enhanced Safety Protocols in Aviation

The demand for enhanced safety protocols in the aviation industry is steadily rising as safety becomes the top priority for airlines and regulatory authorities. In Qatar, the Civil Aviation Authority has implemented stricter regulations to ensure aircraft safety, directly influencing the demand for advanced emergency systems. As Qatar Airways expands its fleet to accommodate increasing passenger numbers, the focus on emergency preparedness has intensified. Qatar is heavily investing in aviation safety technologies, aligning with the global trend where over USD 2.3 billion was allocated for safety-related technology improvements in the aviation sector in 2023.

Growing Focus on Aircraft Safety and Emergency Preparedness

Qatar has made substantial strides in improving aircraft safety and emergency preparedness. The aviation industry’s growth, coupled with the need for heightened security, fuels demand for advanced emergency systems such as fire detection and suppression, emergency oxygen, and evacuation systems. Qatar Airways has recently upgraded its fleet to incorporate cutting-edge emergency safety technologies, responding to regional and international pressures for robust safety standards. The country’s participation in global safety initiatives, including the International Civil Aviation Organization’s (ICAO) safety framework, ensures that emergency systems receive continuous development and regulation, fostering market growth.

Market Challenges

High Cost of Advanced Emergency Systems

The high cost of advanced emergency systems is one of the most significant challenges facing the aircraft safety industry in Qatar. Implementing state-of-the-art systems, such as fire suppression, evacuation technology, and oxygen systems, requires a considerable investment, making it financially challenging for smaller carriers. In 2023, the price of a full suite of aircraft emergency systems could exceed USD 5 million per aircraft. Given the rapid expansion of Qatar Airways and the associated need for system upgrades across its fleet, these costs pose a challenge for future fleet development. Moreover, these investments often require long-term financial planning.

Stringent Regulatory and Certification Processes

The regulatory environment in Qatar and international standards set by ICAO impose significant certification hurdles for aircraft emergency systems. Meeting these standards can delay the adoption of new safety technologies. Qatar’s participation in the Global Aviation Safety Roadmap requires ongoing compliance with evolving safety regulations. Aircraft manufacturers must navigate a complex regulatory process to ensure their systems meet the required certifications, adding to the time and cost required to bring new technologies to market. These stringent regulations are essential for safety but present a challenge for system integration and innovation in the short term.

Market Opportunities

Growing Demand for Advanced Safety Systems in Qatar’s Aviation Industry

The rapid expansion of Qatar’s aviation industry presents a significant opportunity for advanced emergency systems. As Qatar Airways continues to add new aircraft to its fleet, the demand for enhanced emergency systems increases. In line with global aviation trends, the Qatar aviation sector is investing heavily in safety technologies to meet the needs of its growing passenger base. Furthermore, the expansion of Hamad International Airport and the development of a new mega-airport offer substantial opportunities for advanced safety system providers. Qatar’s commitment to becoming a global leader in aviation safety positions the country for long-term growth in this sector.

Technological Advancements in Emergency System Automation

Technological advancements in emergency system automation are creating new opportunities for market growth in Qatar. Automated emergency evacuation systems, fire detection systems, and oxygen delivery mechanisms are being developed to enhance the safety and efficiency of emergency responses. These innovations are being implemented across commercial fleets in Qatar, driven by the increasing need for rapid and efficient emergency management. Qatar Airways is at the forefront of integrating these advanced systems, which not only improve safety but also reduce response time during critical emergencies. This technological evolution is expected to drive growth in the demand for cutting-edge emergency systems.

Future Outlook

Over the next decade, the Qatar Aircraft Emergency Systems market is expected to witness substantial growth driven by continued safety improvements, technological advancements, and the ongoing expansion of Qatar’s aviation sector. Qatar Airways’ fleet expansion plans, coupled with a consistent rise in air traffic, will create demand for advanced and highly reliable emergency systems. Additionally, stringent safety regulations imposed by local and international aviation bodies will push for the adoption of cutting-edge emergency technologies. As the market evolves, the integration of automation and real-time monitoring systems will play a significant role in shaping the future of aircraft safety.

Major Players in the Market

- Honeywell

- Collins Aerospace

- Safran

- UTC Aerospace Systems

- L3 Technologies

- BAE Systems

- Airbus

- Boeing

- Rockwell Collins

- GE Aviation

- Thales

- Meggitt

- Esterline Technologies

- Moog

- Trelleborg

Key Target Audience

- Airlines

- Private Aircraft Operators

- Military and Defense Contractors

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Aviation Technology Manufacturers

- Aircraft Component Suppliers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the primary variables impacting the Qatar Aircraft Emergency Systems market, such as regulatory factors, technological innovations, and safety trends. Desk research and proprietary databases are utilized to create an ecosystem map of all market stakeholders, identifying the crucial factors that drive market growth and adoption.

Step 2: Market Analysis and Construction

This phase involves collecting historical data regarding market penetration, safety standards, and the adoption of emergency systems in Qatar’s aviation sector. It also includes an evaluation of the technology adoption rate by airlines and government bodies, offering insight into the current market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with industry experts, including manufacturers, airline representatives, and government officials. These interviews help validate assumptions about growth drivers, challenges, and trends in the emergency systems segment, providing direct insights into the evolving landscape.

Step 4: Research Synthesis and Final Output

In this final phase, the research is synthesized, with additional data from multiple industry sources and market participants, including manufacturers and airlines. This ensures the accuracy of the findings and allows for a comprehensive understanding of the Qatar Aircraft Emergency Systems market’s future outlook.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for enhanced safety protocols in aviation

Growing focus on aircraft safety and emergency preparedness

Rising number of air passengers and flights - Market Challenges

High cost of advanced emergency systems

Stringent regulatory and certification processes

Technological complexity and integration challenges - Market Opportunities

Growing demand for advanced safety systems in Qatar’s aviation industry

Technological advancements in emergency system automation

Expansion of Qatar’s aviation industry with new airports and airlines - Trends

Technological innovations in emergency evacuation systems

Increased investments in safety features by Gulf-based airlines

Emphasis on real-time monitoring of emergency system performance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

- Fire Detection and Suppression Systems

Emergency Oxygen Systems

Aircraft Evacuation Systems

Cabin Pressure Control Systems

Landing Gear Safety Systems - By Platform Type (In Value%)

- Commercial Aircraft

Private Jets

Military Aircraft

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

- Original Equipment Manufacturer (OEM) Fitment

Aftermarket Fitment

Retrofit Installations

Modular Installations

System Upgrades - By End User Segment (In Value%)

- Airlines

Private Aircraft Operators

Military and Defense Contractors

Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

Government and Regulatory Bodies - By Procurement Channel (In Value%)

- Direct OEM Sales

Third-party Vendors

Government Contracts

Integrated Solutions Providers

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters (Technological innovations, Pricing strategies, Market penetration, Customer satisfaction, Distribution channels)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed company profiles

Honeywell

UTC Aerospace Systems

L3 Technologies

Safran

B/E Aerospace

Collins Aerospace

Esterline

Moog Inc.

Airbus

Boeing

General Electric

SABCA

GKN Aerospace

Liebherr Aerospace

Rockwell Collins

- Airlines are investing heavily in next-gen emergency systems for enhanced safety standards

- Private aircraft operators are adopting advanced emergency systems for compliance and safety

- MRO providers are seeing increased demand for emergency system upgrades and maintenance

- Government and regulatory bodies are focusing on tightening safety regulations and compliance

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035