Market Overview

The Qatar Aircraft Engine Blades market is valued at approximately USD ~ million, based on a five-year historical analysis. This market is primarily driven by the increasing demand for aircraft components as Qatar’s aviation industry expands. The growth of Qatar Airways, which operates a large fleet of aircraft, is contributing significantly to the need for advanced engine blades, including turbine blades. Additionally, the country’s investment in modernizing aviation infrastructure, including the development of Hamad International Airport, strengthens the demand for high-quality, durable engine blades. Regulatory demands for enhanced fuel efficiency and safety in aircraft engines are also fueling market growth.

Qatar dominates the aircraft engine blades market due to its significant role in the aviation sector, with Qatar Airways being a major player on the global stage. The country’s strategic location as a global aviation hub and its robust investments in the aviation industry make it a leader in engine blade demand. In addition, Qatar’s commitment to upgrading its fleet and increasing aircraft orders to maintain global competitiveness fuels the need for advanced engine technology. This position is bolstered by the expansion of the Hamad International Airport, further strengthening Qatar’s position in the global aviation market.

Market Segmentation

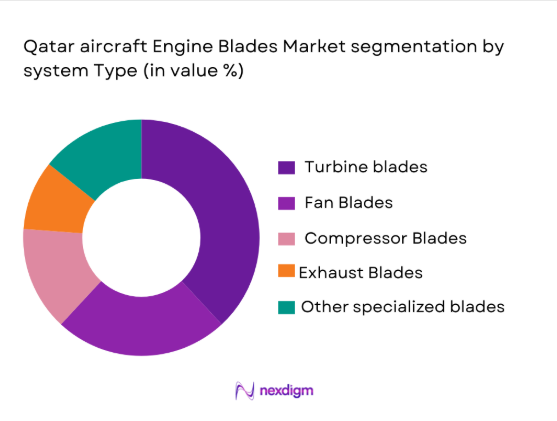

By System Type

The Qatar Aircraft Engine Blades market is segmented by system type into turbine blades, fan blades, compressor blades, exhaust blades, and other specialized blades. Among these, turbine blades dominate the market due to their critical role in engine performance. Turbine blades are designed to withstand extreme temperatures and pressure within aircraft engines, making them indispensable in commercial and military aviation. The demand for high-performance turbine blades is driven by advancements in materials like nickel alloys and ceramics, which allow for greater efficiency and longer operational lifespans, aligning with Qatar Airways’ fleet expansion and modernization.

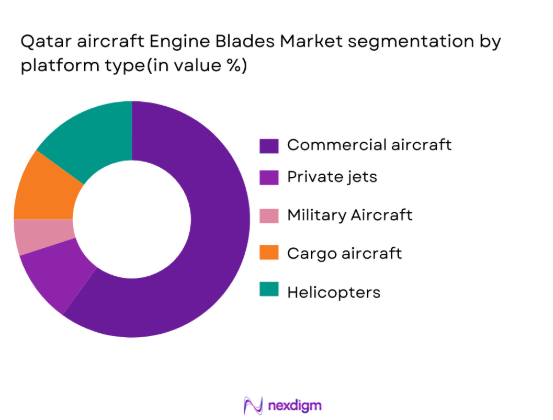

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, private jets, military aircraft, cargo aircraft, and helicopters. Commercial aircraft hold the dominant share in the market, driven by the massive fleet of commercial jets operated by Qatar Airways. The airline’s fleet expansion and continuous modernization have led to higher demand for advanced engine blades that meet stringent fuel efficiency and performance standards. As Qatar Airways adds new aircraft to its fleet, the need for high-quality engine blades to power these planes continues to increase, making commercial aircraft the dominant platform in the market.

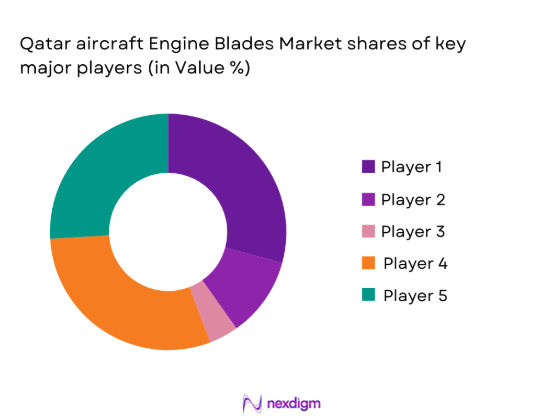

Competitive Landscape

The Qatar Aircraft Engine Blades market is highly competitive, dominated by a few key players in the aerospace sector, including General Electric, Rolls-Royce, Pratt & Whitney, Safran, and Honeywell. These companies provide the most advanced turbine blades and engine components, ensuring high performance, durability, and fuel efficiency. The market is characterized by strong collaborations between engine manufacturers and aircraft operators in Qatar, such as Qatar Airways, which demand cutting-edge materials and technology. Additionally, these companies continue to invest in R&D to enhance blade performance, longevity, and fuel efficiency, keeping them at the forefront of the market.

| Company | Establishment Year | Headquarters | Technologies | R&D Investment | Partnerships | Market Focus |

| General Electric | 1892 | USA | – | – | – | – |

| Rolls-Royce | 1906 | UK | – | – | – | – |

| Pratt & Whitney | 1925 | USA | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

| Honeywell | 1906 | USA | – | – | – | – |

Qatar Aircraft Engine Blades Market Dynamics

Growth Drivers

Increasing Demand for High-Performance Engine Components

The demand for high-performance engine components in Qatar’s aircraft sector is increasing due to the growing fleet of Qatar Airways and rising air traffic in the region. Qatar Airways, with its significant fleet expansion, is increasing its reliance on high-performance engine blades that provide improved fuel efficiency and higher durability. With Qatar’s aviation industry growing rapidly, the need for advanced turbine and fan blades that withstand extreme operational conditions is critical. This demand is reinforced by the growing emphasis on reducing aircraft maintenance downtime and increasing operational efficiency. The global aerospace sector, supported by substantial investments, shows a rise in demand for technologically advanced components like engine blades, contributing to this growth.

Strong Growth in Qatar’s Aviation Industry

Qatar’s aviation industry has been experiencing strong growth, driven by its strategic position as a global aviation hub and the expansion of its flagship airline, Qatar Airways. As of 2023, Qatar Airways has a fleet size of over 250 aircraft, and with plans to expand further, the demand for quality engine blades is set to rise. Hamad International Airport, handling millions of passengers annually, is undergoing continued expansion, which further fuels the need for aircraft with advanced engine components. The Qatar government’s long-term vision for the aviation sector includes continued investment in new fleets and infrastructure, directly supporting the growth of the engine blade market.

Market Challenges

High Cost of Advanced Materials and Manufacturing Processes

The high cost associated with advanced materials such as titanium alloys, ceramics, and nickel-based superalloys used in the manufacturing of aircraft engine blades is a significant challenge. These materials, which are essential for ensuring the durability and performance of engine blades, are expensive to produce and process. The cost is further compounded by the sophisticated manufacturing processes required, including precision casting and additive manufacturing technologies. In Qatar, this translates into higher production costs for companies that manufacture or source aircraft engine blades. As the aviation sector continues to modernize, these high costs remain a barrier for companies looking to maintain competitive pricing.

Complexity of Integrating New Technologies with Existing Engines

The complexity of integrating advanced engine blade technologies with existing aircraft engines is another challenge in the market. As Qatar Airways continues to modernize its fleet, new technologies such as ceramic matrix composites and next-generation fan blades must be integrated with existing engines. This process involves significant challenges in terms of system compatibility, modification of engine configurations, and retrofitting older engines to accommodate the latest advancements. These technological hurdles require careful planning and significant resources to overcome, which can delay the adoption of newer, more efficient engine components in Qatar’s aviation industry.

Market Opportunities

Rising Aircraft Fleet Expansions in Qatar and the Gulf Cooperation Council (GCC) Region

The expansion of Qatar Airways and the broader aviation sector in the GCC region presents significant opportunities for the aircraft engine blades market. Qatar Airways has been steadily increasing its fleet size, with new aircraft deliveries scheduled in the coming years. The overall aviation growth in the GCC region, supported by investments in airport infrastructure and airline expansion, is boosting the demand for high-performance engine blades. The Qatar government’s strategic investments in both domestic and international aviation infrastructure further promote the need for advanced engine components, positioning the country as a leader in the aircraft engine blades market.

Technological Advancements in Composite Materials for Engine Blades

Technological advancements in composite materials are creating significant opportunities in the aircraft engine blades market. New materials, such as ceramic matrix composites and carbon-fiber reinforced polymer blades, offer enhanced performance, lighter weight, and improved resistance to high temperatures. These advancements help aircraft manufacturers meet global demands for fuel efficiency and reduced emissions. In Qatar, as the aviation industry focuses on sustainable growth and reduced operational costs, the adoption of these new materials is expected to increase, providing an opportunity for market players to develop and deploy innovative engine blade solutions.

Future Outlook

Over the next decade, the Qatar Aircraft Engine Blades market is expected to experience significant growth, driven by the continuous expansion of Qatar Airways’ fleet and the demand for advanced, fuel-efficient aircraft components. With Qatar’s strategic focus on modernizing its aviation infrastructure and becoming a global aviation hub, the need for high-performance engine blades will continue to rise. Innovations in materials such as advanced composites and ceramic-based turbine blades will play a significant role in enhancing engine efficiency and longevity, further boosting the market. Additionally, government initiatives to support the aerospace sector will provide a favorable environment for the growth of this market.

Major Players in the Market

- General Electric

- Rolls-Royce

- Pratt & Whitney

- Safran

- Honeywell

- MTU Aero Engines

- IHI Corporation

- GKN Aerospace

- Magellan Aerospace

- Chromalloy

- Turbomeca

- Liebherr Aerospace

- Rockwell Collins

- AeroVironment

- Mitsubishi Heavy Industries

Key Target Audience

- Airlines (including Qatar Airways)

- Military and Defense Contractors

- Aircraft Engine Manufacturers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Aircraft Component Suppliers

- Government and Regulatory Bodies

- Aerospace Materials Suppliers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and defining the key variables that influence the Qatar Aircraft Engine Blades market. This includes understanding demand drivers such as fleet expansion, safety regulations, and technological advancements. The research relies on secondary sources and proprietary databases to gather critical information regarding these factors.

Step 2: Market Analysis and Construction

In this phase, comprehensive historical data is analyzed to understand market trends and the impact of various factors on market growth. This includes assessing the adoption rate of advanced engine blades, the evolution of Qatar Airways’ fleet, and other regional factors that affect demand.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including engine manufacturers, airline representatives, and regulatory bodies. These consultations help refine the assumptions and ensure that the findings are based on practical, real-world insights.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research data into a detailed report, validating findings with primary sources. The report will provide a comprehensive overview of the Qatar Aircraft Engine Blades market, offering insights into current trends, challenges, growth opportunities, and market projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for high-performance engine components

Strong growth in Qatar’s aviation industry

Government support for the aerospace sector - Market Challenges

High cost of advanced materials and manufacturing processes

Complexity of integrating new technologies with existing engines

Regulatory and certification hurdles for new engine blades - Market Opportunities

Rising aircraft fleet expansions in Qatar and the Gulf Cooperation Council (GCC) region

Technological advancements in composite materials for engine blades

Collaborations between Qatar-based airlines and global aerospace manufacturers - Trends

Advancements in lightweight and composite materials for engine blades

Increased emphasis on fuel-efficient and durable engine parts

Automation and AI-driven technologies in aircraft engine blade manufacturing

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan Engine Blades

Turbojet Engine Blades

Turboprop Engine Blades

Variable Fan Blades

Composite Engine Blades - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Military Aircraft

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM) Fitment

Aftermarket Fitment

Retrofit Installations

Modular Installations

System Upgrades - By End User Segment (In Value%)

Airlines

Private Aircraft Operators

Military and Defense Contractors

Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

Engine Manufacturers - By Procurement Channel (In Value%)

Direct OEM Sales

Third-party Vendors

Government Contracts

Integrated Solutions Providers

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters (Technological innovation, Supply chain efficiency, Manufacturing capabilities, Product quality, Customer satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

General Electric

Rolls-Royce

Pratt & Whitney

Safran

MTU Aero Engines

Honeywell Aerospace

Airbus

Boeing

GKN Aerospace

Magellan Aerospace

Chromalloy

IHI Corporation

Turbomeca

Liebherr Aerospace

AeroVironment

- Airlines investing in new and efficient engine blade technologies

- Military contractors adopting advanced materials for defense aviation

- MRO providers increasingly focusing on the repair and overhaul of advanced engine components

- Engine manufacturers enhancing the efficiency of production for turbine blades

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035