Market Overview

The Qatar Aircraft Engine Compressor market has witnessed steady growth driven by the expansion of Qatar’s aviation sector, specifically with Qatar Airways significantly increasing its fleet and operational capacities. The market size for the aircraft engine compressor sector has been bolstered by global demand for high-performance and energy-efficient engines. Qatar’s strategic location as a hub for global air traffic, especially in the Middle East, coupled with rising air passenger numbers, has spurred this growth. The market is driven by technological advancements in engine components, including compressors, as airlines seek more fuel-efficient aircraft for their operations. As Qatar continues to invest in its aviation infrastructure and fleet, the market size for engine compressors is expected to remain robust, with substantial growth anticipated through 2024.

Qatar is positioned as a dominant player in the aircraft engine compressor market within the Middle East due to the rapid growth of Qatar Airways, one of the world’s leading airlines. The country’s continued investment in aviation infrastructure, including the construction of new airports like Hamad International Airport, and the government’s support for the aerospace sector, have made Qatar a key player in the regional and global aviation markets. Its strategic location as a transit hub for international flights further drives the demand for advanced engine components, including compressors. Additionally, the country’s strong economic growth and position as a major oil and gas exporter contribute to its financial strength in advancing aerospace technologies.

Market Segmentation

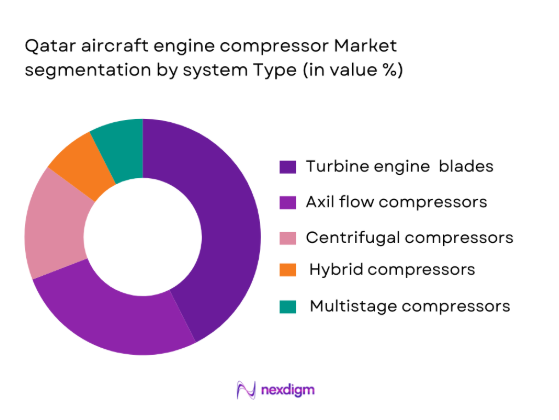

By System Type

The Qatar Aircraft Engine Compressor market is segmented into the following system types suxh as Turbine Engine Compressors, Axial Flow Compressors, Centrifugal Compressors, Hybrid Compressors, Multistage Compressors. By System Type, axial flow compressors have gained significant market share due to their ability to provide higher efficiency and reliability at high speeds. The demand for axial flow compressors is particularly high in modern aircraft, including wide-body jets used by Qatar Airways. This system type is preferred for its scalability and adaptability in larger engines, which is why it dominates the market for larger aircraft, contributing to the growth of Qatar’s aircraft engine compressor market.

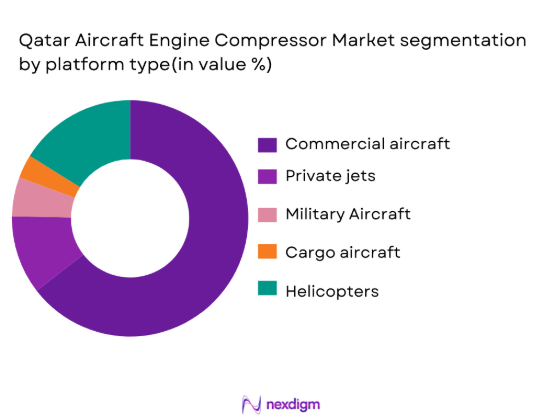

By Platform Type

The Qatar Aircraft Engine Compressor market is also segmented based on platform types such as Commercial Aircraft, Private Jets, Military Aircraft, Cargo Aircraft, Helicopters. In terms of Platform Type, the commercial aircraft segment is the leading subsegment. Qatar Airways, one of the world’s largest international airlines, operates a fleet of over 200 aircraft, with continuous expansion plans. The high demand for commercial aircraft in Qatar and the broader Middle Eastern region, coupled with the fleet’s constant renewal and upgrade, makes commercial aircraft the dominant platform driving demand for advanced engine compressors. As the airline industry continues to focus on reducing fuel consumption and improving engine efficiency, the demand for modern compressors in commercial aircraft remains high.

Competitive Landscape

The Qatar Aircraft Engine Compressor Market is dominated by a few key global players, including engine manufacturers, component suppliers, and specialized technology providers.

The competitive landscape reflects the global nature of the aerospace industry, with companies like Rolls-Royce, General Electric, and Pratt & Whitney holding dominant positions. These companies have a robust presence in Qatar due to the demand for advanced engine technology in commercial and military aircraft. Their continued focus on producing efficient, durable, and high-performance compressors has solidified their position in Qatar’s growing aerospace market.

The market also benefits from significant collaboration between Qatar’s aviation sector and these global players, especially as Qatar Airways expands its fleet with state-of-the-art aircraft. The involvement of these key players in research, development, and the certification of new compressor technologies will drive competition and innovation within the market.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Key Partnerships | Technology Focus |

| Rolls-Royce | 1904 | United Kingdom | – | – | – |

| General Electric | 1892 | United States | – | – | – |

| Pratt & Whitney | 1925 | United States | – | – | – |

| Safran | 2005 | France | – | – | – |

| Honeywell | 1906 | United States | – | – | – |

Qatar Aircraft Engine Compressor Market Dynamics

Growth Drivers

Expansion of Qatar’s Aviation Sector

Qatar’s aviation industry continues robust expansion, led by fleet growth and increased air passenger traffic through Hamad International Airport. As national carriers procure new aircraft—including next-generation widebodies for long-range and high-capacity routes—engine component demand rises accordingly. Aircraft engine compressors are essential for performance and fuel efficiency, making them critical in both new engine deliveries and after-sales servicing. This expansion aligns with broader aviation trends that show fleet modernization and rising airline activity as central drivers for compressor demand globally.

Global Push for Fuel Efficiency and Emissions Reduction

Airlines in Qatar, like their global counterparts, are under strong pressure to cut fuel consumption and emissions. Engine compressors directly influence combustion efficiency and overall engine performance. Advances such as lightweight materials and multi-stage designs support reduced fuel burn and optimized thrust, attracting investment from OEMs and airlines alike. This broader aerospace trend toward high-efficiency propulsion systems further reinforces market growth.

Market Opportunities

Fleet Modernization and Aftermarket Services

The modernization of commercial and military fleets in Qatar presents significant opportunities. Older engines are progressively replaced or retrofitted with advanced units that require high-performance compressors. This generates demand not just for new compressors but also for repair, overhaul, and replacement services, expanding the aftermarket segment. Additionally, strategic initiatives to develop local maintenance capabilities could enhance service revenues and reduce reliance on external providers.

Technology Innovation and Smart Systems:

Technological innovation is reshaping the aircraft engine compressor market globally. Adoption of additive manufacturing, advanced materials like titanium alloys, and embedded sensors for predictive maintenance are opening new avenues for product differentiation. Qatar’s position as an emerging MRO hub can leverage these innovations for competitive advantage. These trends align with global moves toward data-driven maintenance and high-efficiency compressor designs.

Market Challenges

High Development, Production, and Certification Costs

Aircraft engine compressors are among the most technical aerospace components, requiring costly R&D, precision manufacturing, and extensive certification to meet stringent safety and emissions standards. These factors increase barriers to entry, extend development timelines, and raise unit costs. For local players in Qatar, reliance on imported technology further compounds these financial and technical pressures.

Supply Chain Vulnerabilities and Skilled Labor Constraints

The global aerospace supply chain faces ongoing disruptions, including material shortages and logistical bottlenecks. Advanced compressor manufacturing depends on critical materials such as high-grade alloys, which can be subject to geopolitical or trade risks. Additionally, the highly specialized nature of compressor design and maintenance requires skilled labor—a scarce resource locally—which can limit growth and operational scalability.

Future Outlook

The Qatar Aircraft Engine Compressor market is poised for continued growth driven by the expansion of Qatar Airways’ fleet and the increasing demand for efficient, high-performance aircraft. As Qatar continues to develop as a key hub for international aviation, the demand for advanced compressors that meet environmental and efficiency standards will remain strong. The market will see further growth as airlines and military operators in the region prioritize fuel efficiency and operational savings, with a particular focus on hybrid and multistage compressors that provide enhanced performance for modern engines. Innovation in materials science and manufacturing technologies will continue to play a crucial role in shaping the market.

Major Players in the Market

- Rolls-Royce

- General Electric

- Pratt & Whitney

- Safran

- Honeywell

- MTU Aero Engines

- IHI Corporation

- GKN Aerospace

- Magellan Aerospace

- Chromalloy

- Turbomeca

- Liebherr Aerospace

- Rockwell Collins

- AeroVironment

- Mitsubishi Heavy Industries

Key Target Audience

- Airlines

- Military and Defense Contractors

- Aircraft Engine Manufacturers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Aircraft Component Suppliers

- Government and Regulatory Bodies

- Aerospace Materials Suppliers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the key drivers and challenges within the Qatar Aircraft Engine Compressor market. This involves analyzing industry trends, Qatar’s aviation expansion, and technological innovations in engine compressor systems. Secondary research is conducted to gather comprehensive data on these variables.

Step 2: Market Analysis and Construction

The market analysis phase focuses on evaluating past and present trends in the aviation and aerospace industry in Qatar. This includes assessing the demand for new aircraft, the technological developments in engine compressors, and the role of key players in the market.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and aviation professionals are consulted to validate the research hypotheses and refine the data. This provides practical insights into the operational and financial dynamics of the Qatar Aircraft Engine Compressor market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the collected data into a comprehensive report that includes detailed insights into the market dynamics, opportunities, and competitive landscape, ensuring that the analysis is both accurate and actionable.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for high-performance engine compressors

Growth in Qatar’s aviation sector and expansion of air traffic

Government investments in aerospace infrastructure - Market Challenges

High cost of advanced materials for engine compressors

Technological complexity in compressor integration

Regulatory and certification hurdles for new systems - Market Opportunities

Rising aircraft fleet expansion in Qatar and GCC region

Technological advancements in hybrid and multistage compressors - Trends

Focus on fuel-efficient and lightweight compressor designs

Increased use of advanced composite materials for compressors

Automation in compressor manufacturing processes.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbine Engine Compressors

Axial Flow Compressors

Centrifugal Compressors

Hybrid Compressors

Multistage Compressors - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Military Aircraft

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) Fitment

Aftermarket Fitment

Retrofit Installations

Modular Installations

System Upgrades - By End User Segment (In Value%)

Airlines

Private Aircraft Operators

Military and Defense Contractors

MRO (Maintenance, Repair, and Overhaul) Providers

Engine Manufacturers - By Procurement Channel (In Value%) Direct OEM Sales

Third-party Vendors

Government Contracts

Integrated Solutions Providers

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters (Technological capabilities, Supply chain efficiency, Product quality, Customer service, Innovation capacity)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

General Electric

Rolls-RoycePratt & Whitney

Safran

Honeywell

MTU Aero Engines

IHI Corporation

GKN Aerospace

Magellan Aerospace

Chromalloy

Turbomeca

Liebherr Aerospace

Rockwell Collins

AeroVironment

Mitsubishi Heavy Industries

- Airlines investing in new engine compressor technologies

- Military contractors adopting high-efficiency engine components

- MRO providers focused on advanced compressor system repairs

- Engine manufacturers enhancing compressor system integration

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035