Market Overview

The Qatar Aircraft Engine MRO market is valued at approximately USD ~ billion, driven by a rapidly expanding aviation sector. Qatar Airways, one of the world’s fastest-growing airlines, continues to boost its fleet size, leading to increased demand for engine maintenance, repair, and overhaul services. The growing number of commercial aircraft and a shift toward more fuel-efficient and technologically advanced engines contribute significantly to this market. Qatar’s position as a key Middle Eastern aviation hub further drives demand, with state-of-the-art facilities and expertise in aviation maintenance.

Qatar, particularly Doha, serves as the central hub for aircraft engine MRO services in the Middle East. Qatar Airways, with its rapid fleet expansion, plays a major role in establishing Doha as a global center for aviation maintenance. In addition, Qatar’s strategic geographic location between Europe, Africa, and Asia enhances its appeal as a preferred location for MRO services. The growth of key airports such as Hamad International Airport and the government’s investment in infrastructure further strengthen the country’s dominance in the market.

Market Segmentation

By System Type

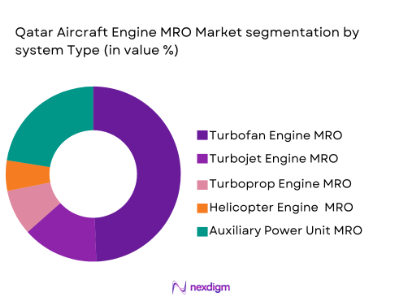

The Qatar Aircraft Engine MRO market is segmented by system type into turbofan engine MRO, turbojet engine MRO, turboprop engine MRO, helicopter engine MRO, and auxiliary power unit (APU) MRO. Turbofan engine MRO dominates the market due to the widespread use of turbofan engines in commercial aviation. These engines require frequent maintenance, especially as Qatar Airways and other regional airlines continue to expand their fleets of wide-body, long-haul aircraft. The advanced technology in these engines also increases the complexity of MRO services, driving the demand for specialized parts and skilled technicians.

By Platform Type

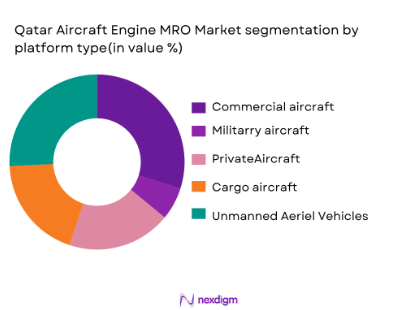

The market is also segmented by platform type into commercial aircraft, military aircraft, private aircraft, cargo aircraft, and unmanned aerial vehicles (UAVs). The commercial aircraft segment holds the dominant share due to the large fleet operated by Qatar Airways and other regional airlines. As the airline expands, particularly with its fleet of Airbus A350s and Boeing 787s, the demand for engine MRO services for commercial aircraft remains high. Additionally, the regional cargo aircraft segment continues to grow, further contributing to the demand for engine MRO services in Qatar.

Competitive Landscape

The Qatar Aircraft Engine MRO market is highly competitive, with several global players dominating the market. Companies such as Rolls-Royce, General Electric, and Pratt & Whitney lead the market, providing specialized services and advanced technology for engine repairs and overhauls. Additionally, regional players, such as Qatar Airways and its associated MRO services at Hamad International Airport, contribute to the competitive landscape. These companies benefit from established reputations and long-term contracts with airlines, ensuring a steady stream of service demand.

| Company | Establishment Year | Headquarters | Technology Focus | Global Presence | Market Share Focus | Service Offerings |

| Rolls-Royce | 1904 | United Kingdom | – | – | – | – |

| General Electric | 1892 | United States | – | – | – | – |

| Pratt & Whitney | 1925 | United States | – | – | – | – |

| Qatar Airways MRO | 1993 | Qatar | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

Qatar aircraft engine mro Market Analysis

Growth Drivers

Expansion of the aviation industry in the Middle East

The Middle Eastern aviation industry continues to see robust expansion, driven by rising air travel demand. According to the International Air Transport Association (IATA), the region’s aviation sector is expected to grow significantly, with passenger traffic forecasted to increase at an annual rate of 4.7% until 2025. Qatar Airways, one of the region’s leading carriers, has expanded its fleet, including new aircraft such as the Boeing 787 Dreamliner and Airbus A350. This growth leads to a higher need for aircraft engine MRO services to support fleet maintenance and optimization. Qatar’s geographic location also strengthens its role as a regional aviation hub, attracting airlines from Europe, Asia, and Africa for MRO services.

Rising demand for fuel-efficient and environmentally friendly engine technologies

As the aviation sector faces increasing pressure to reduce emissions and improve fuel efficiency, there is a significant demand for advanced, eco-friendly engine technologies. In 2023, Qatar Airways committed to operating a more sustainable fleet, with investments in fuel-efficient aircraft such as the Airbus A350, which has a 25% reduction in fuel consumption compared to older models. This commitment is bolstered by global regulations, such as the International Civil Aviation Organization (ICAO) targeting carbon-neutral growth by 2020 and reducing net emissions by 50% by 2050. These initiatives encourage airlines to prioritize engine technologies that meet stringent environmental standards, increasing the demand for modern engine MRO services capable of supporting these advancements.

Market Challenges

High cost of MRO services and components

The cost of MRO services and components is a significant challenge in the Qatar Aircraft Engine MRO market. In Qatar, the overall cost of aircraft maintenance has risen due to factors like inflation, scarcity of specific components, and high labor costs. The cost of jet fuel has remained volatile, significantly impacting the operational budgets of airlines, which, in turn, affects spending on MRO services. Additionally, Qatar Airways, which operates one of the largest fleets in the region, faces ongoing pressure to balance cost-effective maintenance with maintaining high standards of service. The rising cost of high-tech components, such as turbine blades, made from advanced materials like titanium, further increases the overall maintenance costs.

Limited availability of skilled technicians in Qatar

The availability of skilled technicians in Qatar remains a challenge, with the country facing a shortage of qualified personnel for aircraft engine maintenance. According to the International Labour Organization (ILO), the aviation sector in Qatar is heavily dependent on foreign talent due to a lack of local expertise in specialized fields like aircraft engine repair. In 2023, Qatar Airways reported the need for more engineers and skilled technicians to meet the growing demand for MRO services. With Qatar aiming to become a regional aviation hub, the scarcity of trained workforce members could limit the capacity to service the expanding fleet. This skill gap is exacerbated by the rapid technological advancements in engine designs that require highly specialized knowledge and training.

Market Opportunities

Growth of Qatar Airways fleet and its expanding international reach

The expansion of Qatar Airways’ fleet presents a significant opportunity for the Qatar Aircraft Engine MRO market. As of 2024, Qatar Airways operates over 240 aircraft, including the latest models of Boeing and Airbus, and plans to continue expanding its fleet to support increased global demand. The airline’s growing international reach, with more than 170 destinations across the globe, creates an increasing need for aircraft engine MRO services. Additionally, Qatar Airways’ fleet modernization, including the introduction of more fuel-efficient and environmentally friendly aircraft, drives the demand for cutting-edge engine repair and maintenance technologies. The airline’s expanding routes, particularly in Europe, Asia, and Africa, also position Qatar as a key player in regional MRO services.

Development of Qatar as a regional MRO hub

Qatar’s ambition to become a regional MRO hub is a significant opportunity for the market. The Qatar National Vision 2030, which includes initiatives to improve infrastructure and support the aviation industry, has positioned Qatar as a leading provider of MRO services in the Middle East. In 2023, Qatar Airways’ MRO division at Hamad International Airport (HIA) expanded its capabilities, including the development of a state-of-the-art engine overhaul facility. As airlines increasingly seek cost-effective and efficient MRO services, Qatar’s well-established aviation infrastructure, skilled workforce, and strategic location make it an attractive destination for global airlines looking to reduce downtime and maintenance costs. The development of Qatar as a regional MRO hub is poised to drive long-term growth in this sector.

Future Outlook

Over the next decade, the Qatar Aircraft Engine MRO market is expected to grow significantly, driven by continuous expansion in both commercial and military aviation sectors. Qatar Airways, as one of the largest fleet operators in the region, is a primary driver of demand for engine MRO services. The airline’s commitment to fleet modernization and the adoption of cutting-edge, fuel-efficient engines ensures a consistent need for maintenance services. Furthermore, Qatar’s growing role as an aviation hub in the Middle East strengthens the country’s position as a prime location for aircraft MRO services.

15 Major Players in the Market

- Rolls-Royce

- General Electric

- Pratt & Whitney

- Qatar Airways MRO

- Safran

- MTU Aero Engines

- Liebherr Aerospace

- Raytheon Technologies

- Boeing Commercial Airplanes

- Embraer

- Airbus

- Comac

- IHI Corporation

- Mitsubishi Heavy Industries

- Honeywell Aerospace

Key Target Audience

- Aircraft Manufacturers

- Military and Defense Organizations (Qatar Ministry of Defense)

- Airlines and Fleet Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Civil Aviation Authority of Qatar)

- Maintenance, Repair, and Overhaul (MRO) Service Providers

- Aviation Technology Suppliers

- Aircraft Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the major factors influencing the Qatar Aircraft Engine MRO market, including technological advancements, government regulations, and industry-specific trends. This is achieved through extensive desk research, leveraging secondary and proprietary databases to gather detailed market information.

Step 2: Market Analysis and Construction

Historical data pertaining to the Qatar Aircraft Engine MRO market is analyzed, focusing on key metrics such as market growth, service demands, and the types of engines in operation. The analysis also includes an evaluation of major players and their market strategies to estimate future growth trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including engineers, executives, and senior professionals from the MRO industry. These consultations provide valuable insights into emerging trends, technological innovations, and operational challenges within the market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all the collected data into a comprehensive report. This includes verifying the data, assessing the accuracy of the market forecasts, and finalizing the report to ensure it provides an in-depth and actionable analysis of the Qatar Aircraft Engine MRO market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of the aviation industry in the Middle East

Rising demand for fuel-efficient and environmentally friendly engine technologies

Increase in the number of aircraft fleets in Qatar - Market Challenges

High cost of MRO services and components

Limited availability of skilled technicians in Qatar

Stringent regulatory and certification requirements - Market Opportunities

Growth of Qatar Airways fleet and its expanding international reach

Development of Qatar as a regional MRO hub

Technological advancements in engine diagnostics and predictive maintenance - Trends

Increase in digitalization and automation within MRO operations

Focus on reducing engine downtime through predictive maintenance technologies

Adoption of more eco-friendly engine systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan Engine MRO

Turbojet Engine MRO

Turboprop Engine MRO

Helicopter Engine MRO

Auxiliary Power Unit (APU) MRO - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Cargo Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) MRO

Replacement MRO

Aftermarket MRO

Upgrade MRO

Refurbished MRO

- Market Share Analysis

- Cross Comparison Parameters (Market Share by Region, Technology Adoption, Innovation Rate, Pricing Strategy, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Rolls-Royce

General Electric

Pratt & Whitney

Honeywell Aerospace

Safran Aircraft Engines

MTU Aero Engines

Liebherr Aerospace

Raytheon Technologies

Boeing Commercial Airplanes

Embraer

Airbus

Comac

Korean Air Aerospace Division

IHI Corporation

Mitsubishi Heavy Industries

- High demand from Qatar Airways and other airlines in the region

- Growing military aircraft fleet requiring MRO services

- Increasing demand from private jet operators for specialized MRO services

- Expanding MRO contracts and partnerships with international airlines

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035