Market Overview

The Qatar Aircraft Engines market is valued at approximately USD ~ billion, driven by the country’s robust aviation infrastructure and its strategic position as a hub for both commercial and military aviation. Qatar’s aviation sector benefits from the continued expansion of its airline industry, particularly Qatar Airways, which remains a key driver of engine demand. Additionally, the government’s substantial investments in infrastructure development, including the expansion of Hamad International Airport, have further stimulated demand for advanced aircraft engines. This market is also being bolstered by Qatar’s ambitious vision of becoming a global aviation leader, fostering steady growth in both the commercial and military aircraft sectors.

The market is dominated by cities and countries that are central to the Middle Eastern aviation industry. Qatar’s capital, Doha, serves as a key regional aviation hub, with its airlines and military operations pushing demand for aircraft engines. Neighboring countries such as the UAE and Saudi Arabia also play significant roles in shaping the market landscape due to their strategic investments in airline fleets and military aviation. These regions have a strong focus on modernization, technological advancements, and international partnerships, which collectively influence engine demand within Qatar and the surrounding areas. Moreover, Qatar’s positioning within the GCC (Gulf Cooperation Council) strengthens its dominance in the region.

Market Segmentation

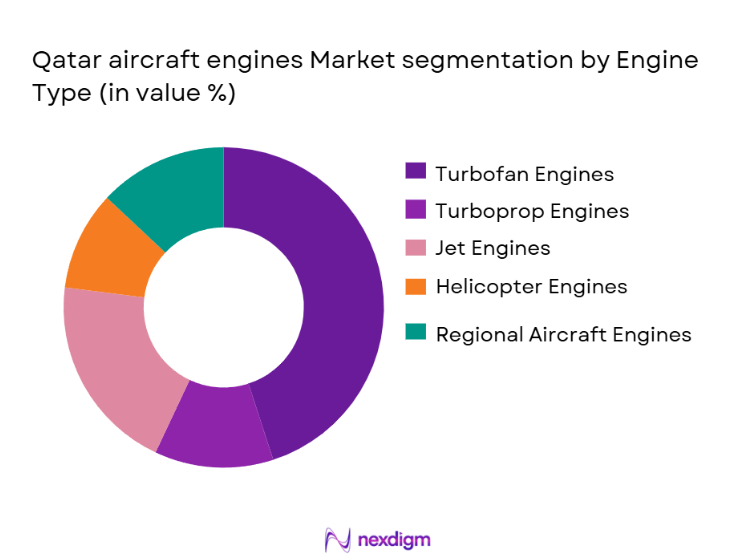

By Engine Type

The Qatar Aircraft Engines market is segmented by engine type into turbofan engines, turboprop engines, jet engines, helicopter engines, and regional aircraft engines. Among these, turbofan engines dominate the market due to their widespread use in both commercial and military aircraft. These engines offer superior fuel efficiency, longer operational life, and reduced maintenance costs, making them the preferred choice for modern aviation fleets. Qatar Airways, for instance, relies heavily on turbofan engines for its extensive fleet of long-haul aircraft. The demand for turbofan engines is also supported by the growing demand for fuel-efficient aircraft in both commercial and defense sectors.

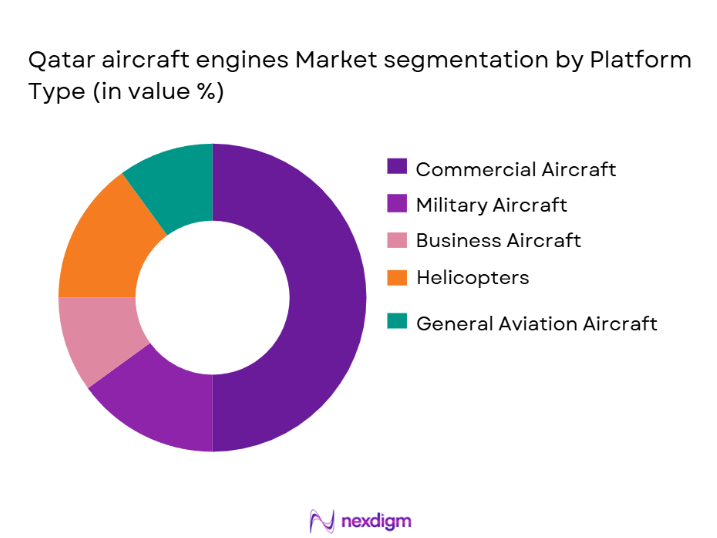

By Platform Type

The Qatar Aircraft Engines market is also segmented by platform type, including commercial aircraft, military aircraft, business aircraft, helicopters, and general aviation aircraft. Among these, commercial aircraft dominate the market due to the expansion of airlines in Qatar, primarily Qatar Airways. With its extensive fleet, Qatar Airways serves as the largest driver of demand for aircraft engines in the commercial aviation sector. The rapid growth of global air travel and the need for fleet expansion in the Middle East are key factors contributing to this dominance. Furthermore, the continuous upgrade and maintenance of Qatar Airways’ fleet drive a significant portion of the demand for commercial aircraft engines.

Competitive Landscape

The Qatar Aircraft Engines market is dominated by a mix of global and regional players, with a few large companies leading the market. The competition is particularly fierce in the commercial aircraft engine segment, where international manufacturers such as Rolls-Royce, General Electric (GE), and Pratt & Whitney are the key competitors. These companies benefit from their extensive track record of engine development, strong brand recognition, and global supply networks. Qatar’s strategic investments in both civilian and military aviation contribute to a growing demand for advanced engine technology, creating opportunities for these established players to expand their market share in the region.

| Company | Establishment Year | Headquarters | Engine Type Focus | Regional Market Presence | R&D Investment Focus | Strategic Partnerships |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ |

| General Electric | 1892 | United States | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Germany | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Expanding Aviation Infrastructure

Qatar’s significant investments in aviation infrastructure, such as the expansion of Hamad International Airport and the establishment of new regional hubs, are driving the demand for advanced aircraft engines. The rapid growth of Qatar Airways, with its increasing fleet size and global routes, further strengthens the need for state-of-the-art engines.

Government Support and Strategic Vision

Qatar’s government has consistently backed the growth of its aviation sector through strategic initiatives and funding. The national vision to position Qatar as a leading global aviation hub, coupled with efforts to enhance defense capabilities, has increased the demand for both commercial and military aircraft engines.

Market Challenges

High Development and Maintenance Costs

The production of advanced aircraft engines requires significant investment in research, development, and maintenance. These high costs are a barrier to entry for smaller manufacturers and pose a financial challenge for operators who need to manage ongoing maintenance costs for their fleets.

Regulatory and Certification Hurdles

Stringent aviation regulations and lengthy certification processes required by authorities such as the Qatar Civil Aviation Authority can delay product launches and complicate market entry. These regulatory barriers can slow down the growth of new engine technologies in the market.

Opportunities

Fuel-Efficient and Eco-Friendly Engine Demand

There is a growing shift toward eco-friendly and fuel-efficient aircraft engines due to rising fuel prices and environmental concerns. The demand for engines that offer reduced emissions and lower fuel consumption presents an opportunity for innovation in the engine market, especially as Qatar focuses on sustainability in aviation.

Military Modernization and Defense Expansion

Qatar is enhancing its defense capabilities, increasing demand for military aircraft engines. The nation’s investment in modernizing its defense fleet, including acquiring advanced aircraft and helicopters, creates significant opportunities for engine manufacturers in both the military and aerospace sectors.

Future Outlook

Over the next five years, the Qatar Aircraft Engines market is expected to show consistent growth, driven by the government’s continued investments in infrastructure and aviation technology. The demand for advanced aircraft engines is projected to rise due to an expanding fleet, particularly with the anticipated growth in international air travel. Additionally, with the push towards more fuel-efficient engines, Qatar is likely to experience an influx of new technologies in the aircraft engine market. As the aviation sector continues to modernize, the market is set to witness steady growth across both commercial and military aircraft segments, positioning Qatar as a central hub for global aviation.

Major Players

- Rolls-Royce

- General Electric

- Pratt & Whitney

- Safran

- MTU Aero Engines

- Honeywell Aerospace

- CFM International

- Collins Aerospace

- Embraer

- Mitsubishi Aircraft Corporation

- GE Aviation

- Airbus

- Boeing

- Leonardo

- UTC Aerospace Systems

Key Target Audience

- Aircraft manufacturers

- Military and defense agencies

- Airlines and aviation operators in the Middle East

- Aviation equipment suppliers and distributors

- Investment and venture capitalist firms

- Aviation maintenance, repair, and overhaul service providers

- Government and regulatory bodies

- Financial institutions and funding organizations

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a comprehensive ecosystem map for the Qatar Aircraft Engines market, focusing on major stakeholders such as engine manufacturers, airline operators, and regulatory bodies. Secondary and proprietary databases will be employed to gather industry-level data, which will help identify the key variables that impact the market’s growth trajectory.

Step 2: Market Analysis and Construction

In this phase, historical data will be compiled and analyzed, focusing on market size, engine types, and platform segmentation. The evaluation will also include an assessment of key industry players, their market shares, and sales performance across the region. This will allow for a granular understanding of market dynamics and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through interviews with industry experts from leading aircraft engine manufacturers, airline operators, and government bodies. These consultations will provide crucial operational insights, helping to refine and validate the data used in the report.

Step 4: Research Synthesis and Final Output

The final research phase involves direct engagement with key stakeholders, including aircraft manufacturers and MRO service providers. This step aims to validate the research findings and ensure that the analysis accurately reflects the current and future state of the market, particularly regarding product segments, technological advancements, and regional demand dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air traffic in the Middle East

Advancements in engine technology

Government investments in aviation infrastructure - Market Challenges

High cost of engine development

Regulatory compliance and certification hurdles

Dependence on international suppliers - Market Opportunities

Expansion of the aviation sector in Qatar

Growing demand for fuel-efficient engines

Emerging trends in hybrid and electric aircraft engines - Trends

Increased demand for sustainable aviation solutions

Technological advancements in engine materials

Shift towards autonomous aircraft systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbofan Engines

Turboprop Engines

Jet Engines

Helicopter Engines

Regional Aircraft Engines - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Aircraft

Helicopters

General Aviation Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Replacement Engines

MRO (Maintenance, Repair, and Overhaul)

Retrofit - By EndUser Segment (In Value%)

Commercial Airlines

Military Forces

Government & Defense

Private Jet Operators

Helicopter Operators - By Procurement Channel (In Value%)

Direct Sales

Distributors

OEM Partnerships

Online Sales

Third-Party Suppliers

- Market Share Analysis

- CrossComparison Parameters (Market Share, Technological Innovation, Product Portfolio, Customer Base, Geographical Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce

General Electric

Pratt & Whitney

CFM International

Safran

MTU Aero Engines

Honeywell Aerospace

Embraer

Turkish Engine Industry

Airbus

Boeing

GE Aviation

Collins Aerospace

Leonardo

Airbus Helicopters

- Increased fleet size of commercial airlines in the Middle East

- Military modernization programs driving engine demand

- Shift towards private and business aviation

- Rising demand for rotary wing aircraft engines

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035