Market Overview

The Qatar aircraft exhaust systems market is valued at approximately USD ~ million, with growth primarily driven by the expanding aviation industry in the Middle East. Factors such as increasing air traffic, technological advancements in aircraft systems, and a rising demand for fuel-efficient solutions propel the market’s expansion. The aviation sector’s increasing focus on reducing carbon emissions and improving system performance further accelerates demand for advanced aircraft exhaust systems. The market also benefits from the growing defense spending, which boosts the demand for military aircraft exhaust systems.

Qatar is a dominant player in the Middle Eastern aircraft exhaust systems market due to its robust aviation sector, with Doha serving as a major hub for international air travel. The country’s strong investments in infrastructure, strategic location for transit flights, and government-backed initiatives in aviation expansion make Qatar a leading market for exhaust systems. Additionally, the strong presence of major aircraft manufacturers and repair facilities in the region positions Qatar as a crucial player in the market.

Market Segmentation

By System Type

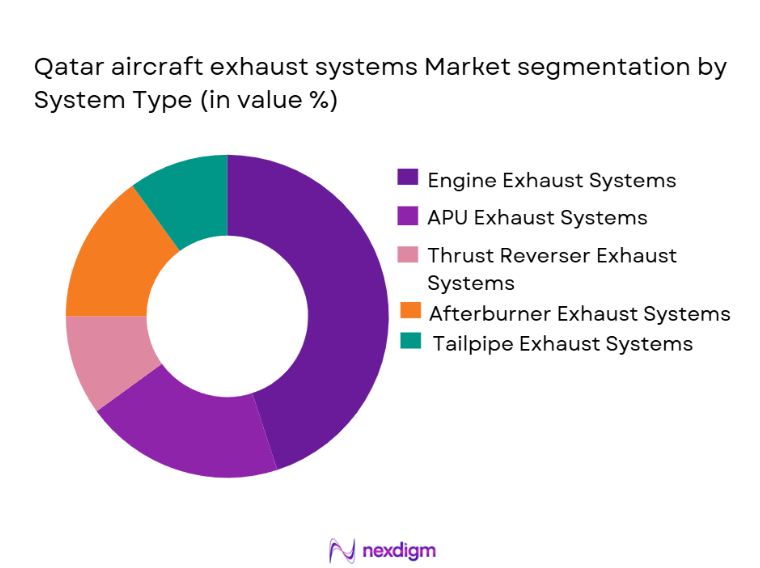

The Qatar aircraft exhaust systems market is segmented by system type, including engine exhaust systems, auxiliary power unit (APU) exhaust systems, thrust reverser exhaust systems, afterburner exhaust systems, and tailpipe exhaust systems. Among these, engine exhaust systems dominate the market due to their critical role in aircraft performance and safety. Engine exhaust systems are integral to aircraft engines, responsible for directing exhaust gases away from the engine and ensuring operational efficiency. As Qatar’s aviation sector grows, with airlines investing in newer, more fuel-efficient aircraft, the demand for engine exhaust systems continues to rise.

By Platform Type

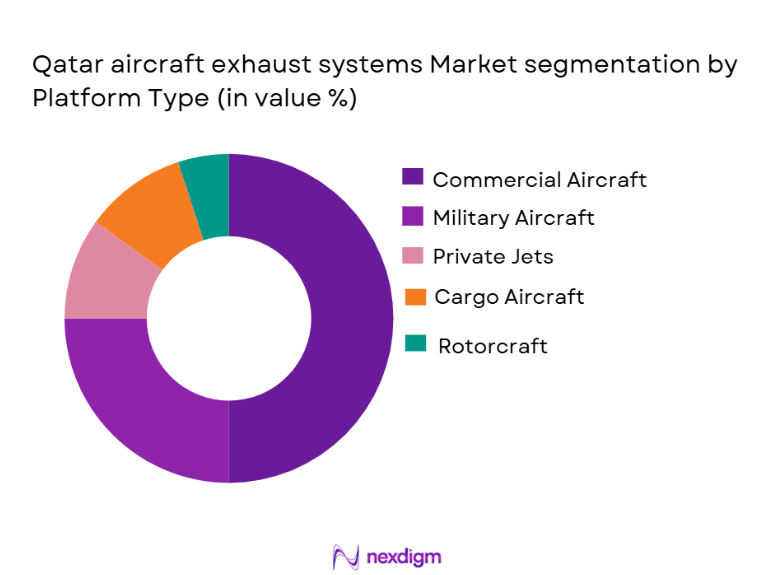

The platform type segmentation includes commercial aircraft, military aircraft, private jets, cargo aircraft, and rotorcraft. Commercial aircraft platforms hold the largest share of the market in Qatar, driven by the country’s prominent airline, Qatar Airways, and the increasing volume of international air travel. The growing fleet size of commercial aircraft, along with investments in new, advanced aircraft models, further fuels the demand for aircraft exhaust systems. Military aircraft, while important, follow commercial aircraft in market share, due to Qatar’s defense procurement policies and regional security requirements.

Competitive Landscape

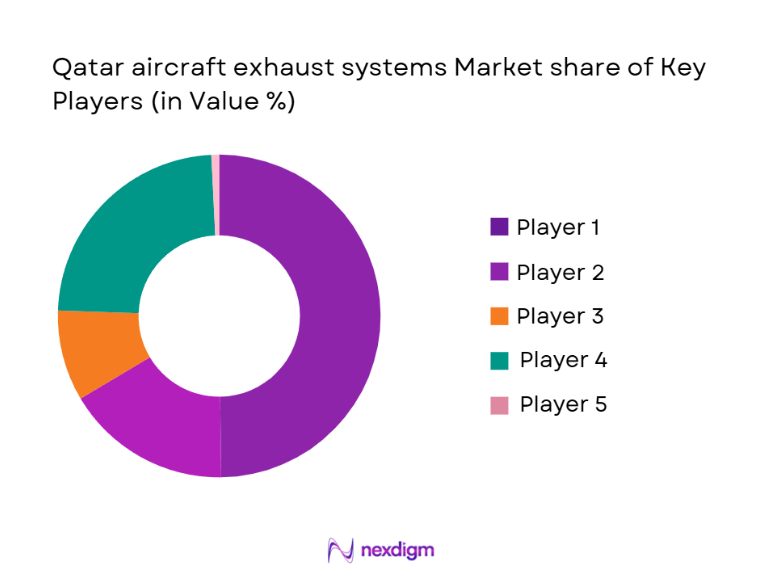

The Qatar aircraft exhaust systems market is dominated by several major players, including global aviation suppliers and specialized exhaust system manufacturers. Key competitors in the market include GE Aviation, Rolls-Royce, and Safran Aircraft Engines. These players have strong brand recognition, significant technological expertise, and established relationships with key airlines and military contractors. The market is characterized by a few large companies that lead the sector, but there is room for smaller, specialized firms to enter and capture niche segments with innovative solutions.

| Company Name | Establishment Year | Headquarters | Product Range | Technological Innovation | Market Penetration | Key Partnerships | Financial Strength |

| GE Aviation | 1992 | United States | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1999 | United States | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Exhaust Systems Market Analysis

Growth Drivers

Increasing Aviation Traffic

Qatar’s position as a major international travel hub, with its flagship carrier Qatar Airways, has significantly boosted demand for aircraft exhaust systems. The consistent rise in air traffic in the region fuels the need for advanced, fuel-efficient aircraft, driving demand for high-performance exhaust systems.

Technological Advancements in Aircraft Systems

Continuous advancements in aircraft engine technologies, such as the development of more fuel-efficient engines and the integration of new materials, are driving the demand for specialized exhaust systems. These innovations require modern exhaust solutions to ensure optimal engine performance and environmental sustainability.

Market Challenges

High Cost of Exhaust System Integration and Maintenance

Aircraft exhaust systems are complex and costly to integrate into new aircraft designs, with high maintenance requirements for existing fleets. These cost factors can inhibit the adoption of advanced systems, particularly in the price-sensitive aftermarket segment.

Regulatory and Environmental Compliance

Stringent regulations governing emissions and noise reduction from aircraft exhaust systems present significant challenges. Manufacturers must continuously innovate to meet evolving environmental standards, which requires considerable investment in research and development.

Opportunities

Demand for Eco-Friendly Aviation Solutions

As sustainability becomes increasingly important in the aviation industry, the demand for aircraft exhaust systems that reduce environmental impact is on the rise. This provides an opportunity for manufacturers to develop cutting-edge systems that meet both performance and eco-friendly criteria.

Growing Defense Sector Investments

Qatar’s growing investments in its defense sector, including military aircraft procurement, create opportunities for aircraft exhaust system manufacturers to provide specialized solutions tailored to military requirements, such as higher durability and reduced radar visibility.

Future Outlook

Over the next five years, the Qatar aircraft exhaust systems market is expected to show consistent growth, driven by continuous advancements in aircraft technology, increasing passenger air travel, and government policies promoting sustainable aviation. Qatar’s strategic position as a hub for air traffic between Europe, Asia, and Africa further bolsters the demand for aircraft exhaust systems. Additionally, the expansion of Qatar Airways and increasing fleet modernization efforts will continue to drive demand for advanced, efficient exhaust systems.

Major Players

- GE Aviation

- Rolls-Royce

- Safran Aircraft Engines

- Pratt & Whitney

- Honeywell Aerospace

- MTU Aero Engines

- Boeing

- Airbus

- Turbomeca

- United Technologies

- Liebherr-Aerospace

- GKN Aerospace

- Exhaust Systems Inc.

- Aero Engine Controls

- C&D Zodiac

Key Target Audience

- Aircraft Manufacturers

- Airlines and Aviation Operators

- Military and Defense Agencies (Qatar Ministry of Defense)

- Aviation Maintenance, Repair & Overhaul (MRO) Service Providers

- Aviation System Suppliers

- Aircraft Component Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping all key stakeholders within the Qatar aircraft exhaust systems market. This involves a thorough analysis of both primary and secondary data sources, focusing on market demand, system types, platform types, and regional trends to construct a comprehensive view of the market landscape.

Step 2: Market Analysis and Construction

In this step, historical data related to the aircraft exhaust systems market is compiled, focusing on penetration rates, industry revenue, and market dynamics. A deep dive into service quality and performance metrics ensures that revenue forecasts and market sizing are accurate and reliable.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct interactions with industry experts, including suppliers, manufacturers, and airline operators. These consultations help refine assumptions, corroborate market data, and ensure the research is reflective of actual market trends.

Step 4: Research Synthesis and Final Output

Finally, insights gathered from industry players and comprehensive data analysis are synthesized to produce a validated, robust market report. This includes detailed forecasts, growth drivers, challenges, and opportunities, providing stakeholders with actionable intelligence.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for fuel-efficient aircraft systems

Rising air traffic in the Middle East

Growing focus on reducing emissions from aviation - Market Challenges

High cost of exhaust system installation and maintenance

Stringent regulatory standards for emissions

Complexity in adapting systems to diverse aircraft models - Market Opportunities

Development of lightweight, high-performance exhaust systems

Opportunities in defense and military aircraft

Emerging markets for aircraft exhaust systems in the Middle East - Trends

Shift towards sustainable aviation technologies

Increasing integration of digital technologies in exhaust system management

Rising collaboration between OEMs and exhaust system suppliers

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Engine Exhaust Systems

Auxiliary Power Unit Exhaust Systems

Thrust Reverser Exhaust Systems

Afterburner Exhaust Systems

Tailpipe Exhaust Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Cargo Aircraft

Rotorcraft - By Fitment Type (In Value%)

OEM Exhaust Systems

Aftermarket Exhaust Systems

Retrofit Exhaust Systems

MRO Services

Engineering Services - By EndUser Segment (In Value%)

Aircraft OEMs

Aircraft Operators

MRO Providers

Government & Defense Agencies

Component Suppliers - By Procurement Channel (In Value%)

Direct Sales

Distributors & Dealers

Online Sales Platforms

OEM Partnerships

Aftermarket & MRO Networks

- Market Share Analysis

- CrossComparison Parameters (Market Share, Revenue Growth, Technology Innovation, Product Range, Geographic Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

GE Aviation

Rolls-Royce

Safran Aircraft Engines

Pratt & Whitney

Honeywell Aerospace

MTU Aero Engines

Boeing

Airbus

Turbomeca

United Technologies

Liebherr-Aerospace

GKN Aerospace

Exhaust Systems Inc.

Aero Engine Controls

C&D Zodiac

- Increased investment in aviation infrastructure in Qatar

- Focus on energy-efficient and environmentally friendly aircraft

- Demand for customized exhaust solutions from commercial airlines

- Growing defense sector investments in advanced aircraft technologies

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035