Market Overview

The Qatar Aircraft Fairings market is valued at USD ~ million, supported by the region’s increasing aircraft fleet and expansion of aviation infrastructure. The market growth is primarily driven by Qatar’s expanding airline sector, including the growth of Qatar Airways, and the national emphasis on becoming a global aviation hub. Technological advancements in materials such as composites and regulations focusing on environmental sustainability are further boosting market demand. The aerospace sector’s growing investment in aircraft components, including fairings, is crucial in shaping the market’s performance.

Qatar is one of the dominant countries in the aircraft fairings market due to its strategic location, extensive investments in aviation infrastructure, and the presence of Qatar Airways, which continues to expand its global fleet. Additionally, the country’s commitment to becoming a central aviation hub in the Middle East strengthens the demand for aircraft fairings. Other contributing factors include significant investments in maintenance, repair, and overhaul (MRO) facilities, further enhancing the demand for specialized aircraft components like fairings.

Market Segmentation

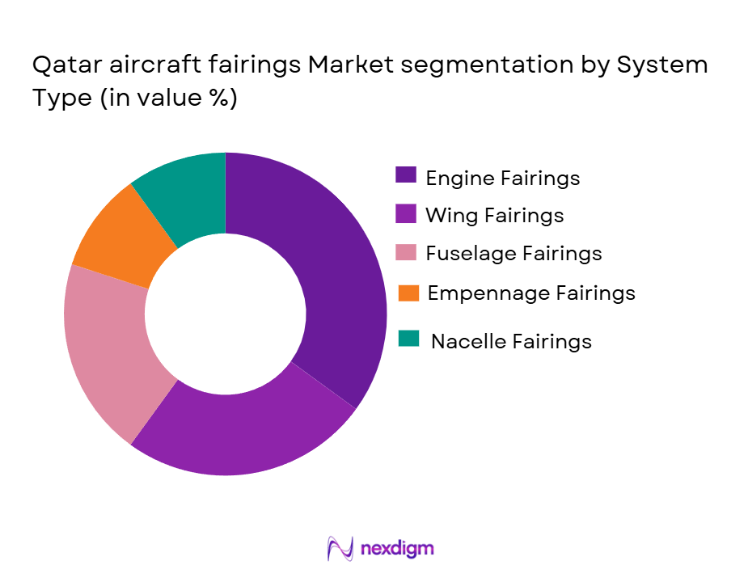

By System Type

The Qatar Aircraft Fairings market is segmented by system type into engine fairings, wing fairings, fuselage fairings, empennage fairings, and nacelle fairings. Currently, engine fairings dominate the market share due to their critical role in aerodynamics and engine efficiency. Engine fairings are vital components for reducing drag and improving fuel efficiency, which is crucial for Qatar Airways’ expansive fleet of long-haul aircraft. As Qatar Airways increasingly integrates advanced technologies for fuel-efficient aircraft, the demand for high-performance engine fairings remains robust.

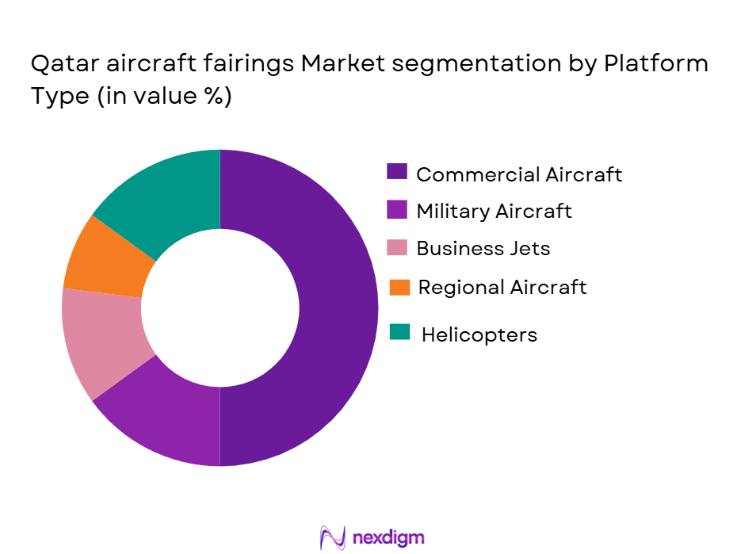

By Platform Type

The Qatar Aircraft Fairings market is segmented by platform type into commercial aircraft, military aircraft, business jets, regional aircraft, and helicopters. Commercial aircraft hold the dominant market share due to the continued growth of Qatar Airways’ fleet, which operates a significant number of wide-body and narrow-body aircraft. Qatar’s strategic location as an aviation hub further accelerates the demand for commercial aircraft and, consequently, the need for high-quality fairings that enhance performance and reduce maintenance costs.

Competitive Landscape

The Qatar Aircraft Fairings market is dominated by major global players and specialized local companies. The market is led by companies such as Collins Aerospace, Safran Aircraft Engines, GKN Aerospace, Liebherr Aerospace, and Stelia Aerospace, all of which have established themselves as leaders in aerospace components. These players are well-positioned due to their extensive experience, strong global presence, and robust portfolios of aircraft fairings solutions tailored to the growing needs of Qatar’s aviation sector.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Geographic Presence | Market Focus | Technological Advancements | Customer Base |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| GKN Aerospace | 2007 | UK | ~ | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 2000 | Germany | ~ | ~ | ~ | ~ | ~ |

| Stelia Aerospace | 2005 | France | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Fairings Market Analysis

Growth Drivers

Expansion of Qatar Airways Fleet

Qatar Airways’ rapid fleet expansion, including the acquisition of new fuel-efficient aircraft, drives the demand for high-performance aircraft fairings. As the airline continues to grow, it requires advanced fairings to improve aerodynamics and reduce fuel consumption.

Government Investments in Aviation Infrastructure

Qatar’s government has made significant investments in expanding its aviation infrastructure, including new airports and maintenance facilities. This infrastructure growth supports the demand for aircraft components like fairings, particularly in the MRO (Maintenance, Repair, and Overhaul) segment.

Market Challenges

High Cost of Advanced Materials

The use of lightweight composite materials in aircraft fairings results in higher production costs. The challenge of balancing cost-effectiveness with performance requirements affects market profitability, especially as manufacturers seek to reduce production expenses.

Supply Chain Disruptions

The global supply chain for aircraft components, including fairings, is often vulnerable to disruptions. Factors such as geopolitical tensions, trade restrictions, or global pandemics can delay the delivery of materials or finished products, impacting production schedules.

Opportunities

Technological Advancements in Fairing Materials

The development of newer, more advanced composite materials for aircraft fairings presents an opportunity to enhance performance while reducing weight and maintenance costs. Manufacturers investing in R&D to improve these materials can gain a competitive edge.

Growing Demand for Sustainable Aircraft

The increasing global focus on sustainability and reducing carbon emissions creates an opportunity for the aircraft fairings market. Aircraft manufacturers and airlines are focusing on greener, more fuel-efficient technologies, driving the need for fairings that contribute to these sustainability goals.

Future Outlook

Over the next five years, the Qatar Aircraft Fairings market is expected to experience strong growth driven by the region’s continued expansion in aviation infrastructure, fleet modernization, and technological advancements in aircraft manufacturing. The demand for high-performance fairings is anticipated to rise as Qatar Airways and other local airlines expand their fleets with new, fuel-efficient aircraft. Additionally, advancements in lightweight composite materials and government initiatives supporting the aviation industry will further propel market growth.

Major Players

- Collins Aerospace

- Safran Aircraft Engines

- GKN Aerospace

- Liebherr Aerospace

- Stelia Aerospace

- AeroFabricators

- Magellan Aerospace

- ACME Aerospace

- Avcorp Industries

- FACC AG

- MRO Holdings

- UTC Aerospace Systems

- Sikorsky Aircraft

- RUAG Aerospace

- AAR Corporation

Key Target Audience

- Aircraft Manufacturers

- MRO Service Providers

- Airlines

- Government Agencies

- Aviation Regulatory Bodies

- Investment and Venture Capitalist Firms

- Aircraft Leasing Companies

- Defense and Military Contractors

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map encompassing all major stakeholders within the Qatar Aircraft Fairings Market. Secondary research will be used to gather comprehensive industry-level data, followed by identification of the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data will be analyzed to assess the penetration of aircraft fairings in Qatar, including revenue generation, product performance, and service quality. This will provide an understanding of the market’s growth and demand trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts. These consultations will be carried out with professionals in the aerospace sector, particularly those dealing with fairing production and distribution, to validate the findings.

Step 4: Research Synthesis and Final Output

The final phase includes engaging with aircraft manufacturers and MRO service providers in Qatar. Detailed insights into product segments, sales performance, and consumer preferences will be gathered to complement the data derived from both primary and secondary research.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for fuel-efficient aircraft

Expansion of Qatar’s aviation infrastructure

Growing passenger traffic and fleet expansion - Market Challenges

High cost of advanced composite materials

Regulatory and certification delays

Supply chain disruptions - Market Opportunities

Technological advancements in aircraft fairing design

Increasing demand for military aircraft fairings

Expansion of MRO services in the Middle East - Trends

Adoption of 3D printing for fairing manufacturing

Shift towards lightweight composite materials

Growing focus on sustainability in aircraft production

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Engine Fairings

Wing Fairings

Fuselage Fairings

Empennage Fairings

Nacelle Fairings - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Regional Aircraft

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Maintenance, Repair, and Overhaul (MRO)

Upgrades and Retrofit

Spare Parts - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

MRO Service Providers

Government & Defense Contractors

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Platforms

Government Procurement

Retailers

- Market Share Analysis

- CrossComparison Parameters (Product Type, Market Share, Geographic Presence, Innovation, Pricing Strategy)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Collins Aerospace

GKN Aerospace

Safran Aircraft Engines

Liebherr Aerospace

UTC Aerospace Systems

AeroFabricators

Avcorp Industries

Stelia Aerospace

FACC AG

Magellan Aerospace

ACM Aerospace

Turbomeca

Sikorsky Aircraft

AAR Corporation

RUAG Aerospace

- Increased fleet size in the Middle East

- Growing emphasis on aircraft maintenance

- Shift towards sustainable aviation technologies

- Collaborations between airlines and MRO providers

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035