Market Overview

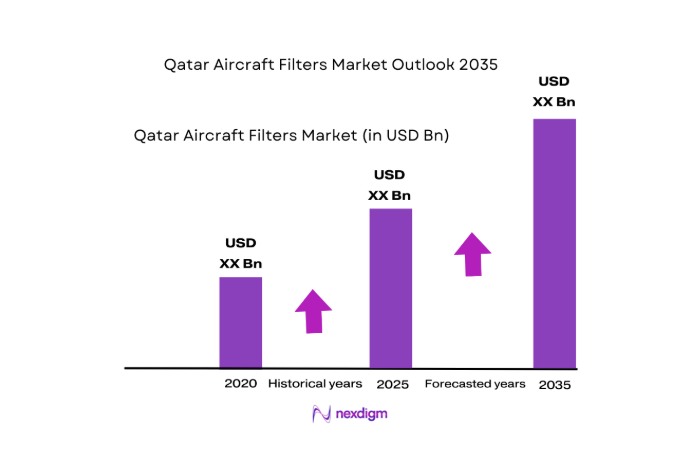

The Qatar aircraft filters market is valued at approximately USD ~ in 2024, with expectations for steady growth in 2025. The market is primarily driven by the rapid expansion of the airline fleet in Qatar, especially Qatar Airways, which continues to increase its global presence. The need for high-performance filters in aircraft systems, including air, fuel, oil, and hydraulic filters, is further accelerated by increasing flight hours and the demand for higher levels of operational efficiency. The continuous maintenance, repair, and overhaul (MRO) services required to ensure optimal aircraft performance also contribute to market growth. Furthermore, regional regulations focused on improving air quality and filtration standards in aviation support the demand for advanced filtration solutions.

Qatar dominates the aircraft filters market primarily due to the strong presence of Qatar Airways, one of the world’s leading airlines. The country’s aviation infrastructure, including the state-of-the-art Hamad International Airport, supports a significant demand for aircraft filters as a part of its global fleet expansion. Additionally, Qatar’s strategic positioning as a regional MRO hub for the Middle East enhances its market dominance. Other influential countries within the Middle East, such as the UAE and Saudi Arabia, contribute to the growing demand for aircraft filters, driven by their own airline fleets and growing aviation hubs.

Market Segmentation

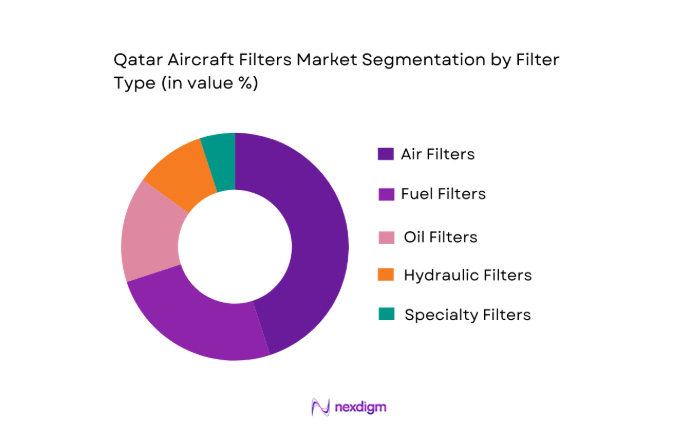

By Filter Type

The Qatar aircraft filters market is segmented by filter type into air filters, fuel filters, oil filters, hydraulic filters, and specialty filters. Among these, air filters have a dominant share in 2025. This is due to the rigorous standards imposed by aviation authorities such as the Qatar Civil Aviation Authority (QCAA) to ensure passenger comfort and safety. Air filtration systems, including HEPA and particulate filters, play a crucial role in maintaining cabin air quality, particularly on long-haul flights serviced by Qatar Airways. Furthermore, Qatar Airways’ emphasis on providing high-quality in-flight services reinforces the dominance of air filters in the market. The airline’s commitment to sustainability and eco-friendly initiatives also influences the growing demand for high-efficiency air filters.

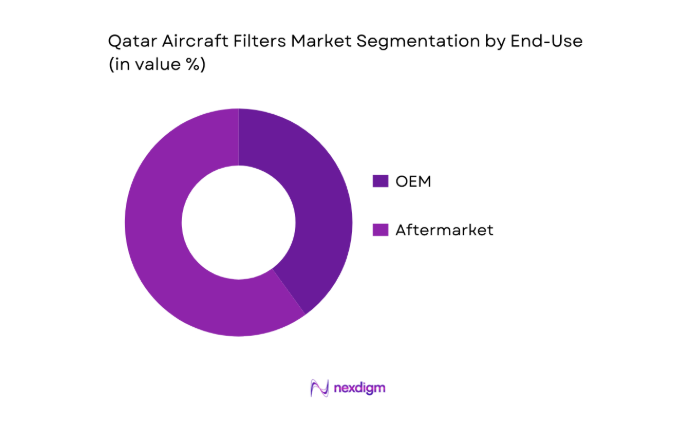

By End-Use

The market is divided into OEM and aftermarket segments. Aftermarket filters hold a dominant share in 2025 due to the substantial number of Qatar Airways’ aircraft reaching critical maintenance milestones. As the fleet ages, the demand for replacement filters grows significantly, with Qatar’s strong MRO industry playing a vital role. The regional MRO hubs, such as the Qatar Airways Technical Department, offer extensive support for aftermarket filter replacements, further driving this segment’s market share. Additionally, aftermarket filters are favored for their cost-effectiveness and availability, making them a popular choice among operators with established fleets.

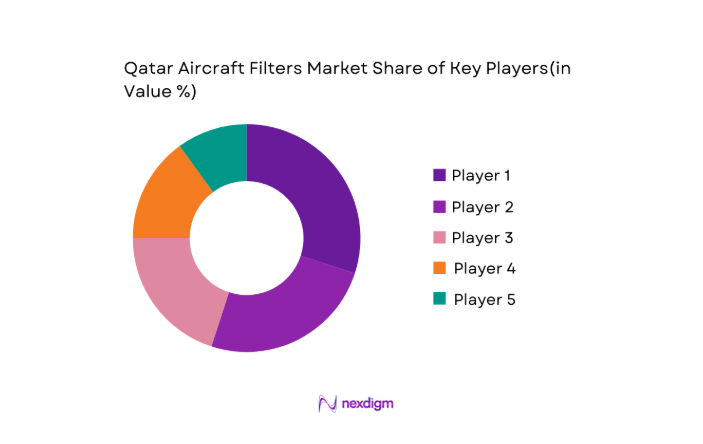

Competitive Landscape

The Qatar aircraft filters market is consolidated among a few key players, both local and international. Prominent global companies such as Parker Hannifin, Safran Filtration, and Honeywell dominate the market with strong product portfolios and established relationships with major airlines, including Qatar Airways. These companies hold significant influence in both OEM supply and aftermarket services. Additionally, regional players also contribute to the market, focusing on cost-effective solutions and tailored services for Qatar’s fleet.

| Company | Establishment Year | Headquarters | Product Portfolio | Market Reach | Innovation Focus | Strategic Partnerships |

| Parker Hannifin | 1917 | USA | ~ | ~ | ~ | ~ |

| Safran Filtration | 2005 | France | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ |

| Pall Corporation | 1946 | USA | ~ | ~ | ~ | ~ |

| Freudenberg Filtration | 1849 | Germany | ~ | ~ | ~ | ~ |

Qatar Aircraft Filters Market Analysis

Growth Drivers

Qatar Airways Fleet Expansion Driving Aftermarket Demand

Qatar Airways has been a key player in driving the demand for aircraft filters in Qatar. As of 2024, the airline’s fleet consists of more than 230 aircraft, with plans to continue expanding its fleet with new deliveries from Boeing and Airbus. The expansion of Qatar Airways’ fleet directly correlates with the increased need for aftermarket components, such as filters. In 2024 alone, Qatar Airways is set to receive 10 new aircraft, leading to an increased requirement for high-performance filters. Additionally, Qatar Airways’ expansion aligns with regional growth in passenger air traffic, which is forecast to increase by ~ annually over the next five years, according to the International Civil Aviation Organization (ICAO). The continued fleet growth and rising flight cycles significantly contribute to the demand for replacement aircraft filters.

Increased Air Traffic and Flight Cycles

The increase in air traffic and flight cycles in the Middle East region is a major growth driver for the aircraft filters market in Qatar. Qatar’s strategic geographic location, combined with growing air traffic at Hamad International Airport, contributes to the rise in flight cycles. In 2024, Qatar’s international flight departures are expected to exceed ~, reflecting a continuous upward trajectory in the number of flights. The increased flight frequency means a higher demand for regular maintenance, including replacement of air, fuel, and hydraulic filters. Macroeconomic growth in the Gulf Cooperation Council (GCC) region, projected at ~ in 2024 by the World Bank, further fuels the demand for air travel, directly impacting the aircraft filter market.

Market Challenges

Pricing Pressure from Global OEMs

The market for aircraft filters in Qatar faces significant pricing pressures from global OEMs who dominate the supply chain. Major filter manufacturers often hold long-term contracts with aircraft manufacturers, allowing them to dictate prices, particularly in the OEM segment. This increases the cost burden for smaller airlines and MRO service providers in Qatar, as they must procure replacement filters at higher prices from OEMs. The situation is compounded by increasing raw material costs. The global supply chain for aircraft components is facing challenges, with a projected 5% increase in the cost of key materials such as aluminum and steel in 2025, according to data from the World Trade Organization (WTO). These factors lead to reduced profit margins for suppliers of aftermarket aircraft filters, particularly in a region where competition is high and price sensitivity is a key factor.

Supply Chain Disruptions

The Qatar aircraft filters market is also challenged by supply chain disruptions, which have been exacerbated by the global logistics crisis. The COVID-19 pandemic and its long-lasting effects have severely impacted the timely delivery of components, including filters, to Qatar. Even as global supply chains are gradually recovering, delays in the manufacturing and shipping of critical components, especially from Asia and Europe, continue to affect the market. In 2024, the global lead time for aviation parts is expected to remain extended, with delivery delays impacting MRO services in Qatar. The global air cargo transportation index, which tracks the delivery of components, remains 12% below pre-pandemic levels, highlighting the persistent challenges in the logistics sector. These disruptions negatively impact the availability of aircraft filters for regular maintenance cycles, further slowing market growth.

Opportunities

MRO Technology Adoption

The growing adoption of advanced MRO technologies presents a major opportunity for the Qatar aircraft filters market. Technological advancements, including the use of predictive maintenance, IoT-enabled sensors, and automation in maintenance operations, are transforming the MRO landscape. Qatar’s major MRO players, such as Qatar Airways Technical, are increasingly adopting these technologies to enhance operational efficiency. By 2025, it is expected that nearly 40% of MRO operations in the GCC region will adopt predictive maintenance tools, according to the International Air Transport Association (IATA). These advancements are expected to enhance the monitoring and replacement of aircraft filters, creating greater demand for high-performance and technologically compatible filters. Additionally, as more airlines in the region look for ways to reduce costs, technology-driven maintenance strategies offer opportunities for filter suppliers to offer cost-effective solutions that meet both performance and environmental standards.

Regional MRO Hubs Serving GCC

The establishment of regional MRO hubs in Qatar and neighboring countries like the UAE is expected to drive significant opportunities for the aircraft filters market. Qatar’s position as a global aviation hub, with the continued growth of Hamad International Airport and the increasing demand for aircraft maintenance, offers a strong foundation for MRO operations. In 2025, Qatar’s MRO market is projected to exceed USD ~ in value, with strong growth anticipated in the coming years. The regional MRO services market is expanding due to the rising number of commercial and military aircraft operating in the Gulf region. Qatar’s strategic location provides a competitive advantage for MRO service providers, ensuring that the aircraft filters market will benefit from the expansion of these facilities. This will also lead to greater market penetration by local and international filter suppliers catering to both regional and global fleet operators.

Future Outlook

Over the next decade, the Qatar aircraft filters market is expected to witness steady growth, driven by Qatar’s expanding airline fleet, increased air traffic, and ongoing fleet modernization initiatives by Qatar Airways. The continuous development of MRO infrastructure in Qatar, along with stringent regulatory requirements for air quality and operational safety, will further elevate the demand for high-performance filters. As Qatar Airways continues to expand its global network, the need for regular filter replacements and maintenance will remain a key factor contributing to market growth.

Major Players

- Parker Hannifin Corporation

- Safran Filtration Systems

- Honeywell International Inc.

- Pall Corporation

- Freudenberg Filtration Technologies

- Donaldson Company, Inc.

- MANN+HUMMEL GmbH

- Eaton Corporation PLC

- Porvair Plc

- Champion Aerospace LLC

- Recco Products Inc.

- Cummins Filtration

- Aero Filters Ltd.

- Filtration Group Corporation

- Advanced Air Filter Systems

Key Target Audience

- Airlines

- MRO Providers

- OEMs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Operators

- Fleet Operators

- Aircraft Maintenance Facilities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the primary factors influencing the Qatar aircraft filters market, including fleet expansion, maintenance cycles, and regional regulations. We use secondary research methods, including databases, industry reports, and news articles, to create a comprehensive list of market variables that affect demand and supply.

Step 2: Market Analysis and Construction

This step entails analyzing historical data to estimate market value and volume. We examine aircraft fleet trends, flight hours, and maintenance schedules to develop accurate market projections. This also includes assessing the penetration of various filter types and their replacement intervals.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through discussions with experts in aviation maintenance and filtration systems. These include interviews with executives at Qatar Airways and other regional airlines, as well as MRO service providers to gain operational insights into market dynamics.

Step 4: Research Synthesis and Final Output

The final phase integrates the gathered data to develop a comprehensive market report. This step ensures the data’s reliability through cross-verification from industry professionals, providing a complete and accurate picture of the Qatar aircraft filters market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Qatar Airways fleet expansion driving aftermarket demand

Increased air traffic and flight cycles

Regulatory compliance for cabin air quality & environmental performance - Market Challenges

Pricing pressure from global OEMs

Supply chain disruptions - Opportunities

MRO technology adoption

Regional MRO hubs serving GCC - Emerging Trends

Lightweight & high‑efficiency filtration media

Sustainability & eco‑certified filters - Government & Regulatory Framework

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Filter Price, 2020-2025

- By Filter Type (In Value %)

Air Filters

Liquid Filters

Gas & Specialty Filters - By Platform (In Value %)

Commercial

Business Jets

Military & Government

UAV / Special Mission Aircraft - By End Use (In Value %)

OEM

Aftermarket - By Sales Channel (In Value %)

Direct OEM Contracts

Distributor / MRO Supply Chain - By MRO Service Type (In Value %)

Line Maintenance Filters

Heavy Maintenance Filters

Scheduled Filter Overhaul Programs

- Market Share of Major Players

- Cross‑Comparison Parameters (Filter Efficiency Ratings, Service Life / Replacement Interval, OEM Certification Penetration, MRO Readiness & Support Footprint, Warranty & Aftermarket Support Terms, Supply Lead Time)

- SWOT Analysis

- Pricing Analysis

- Detailed Profiles of Major Players

Parker Hannifin Corporation

Donaldson Company, Inc.

Safran Filtration Systems

Pall Corporation

Eaton Corporation PLC

Honeywell International Inc.

Freudenberg Filtration Technologies

MANN+HUMMEL GmbH

Porvair Plc

Purolator Facet Inc.

Hollingsworth & Vose

Champion Aerospace LLC

Recco Products Inc.

Cummins Filtration

Aero Filters Ltd.

- Filter performance / certification

- Total Cost of Ownership / Life‑Cycle Cost

- MRO service quality & turnaround time

- Supplier certification & reliability

- Forecast by Value, 2026-2035

- Forecast by Volume, 2026-2035

- Average Selling Price Forecast, 2026-2035