Market Overview

The Qatar aircraft fire protection systems market is valued at approximately USD ~, with steady growth driven by the country’s expanding aviation sector, robust regulatory frameworks, and increasing fleet modernization initiatives. The market is primarily driven by the adoption of advanced fire suppression systems, including Halon-free agents, for new aircraft and retrofit programs. Qatar’s strategic investments in aviation infrastructure and high safety standards, coupled with demand from local airlines and military aviation, are key contributors to the market’s growth. In 2024, the aviation industry’s rapid expansion and the implementation of stringent fire safety regulations are expected to sustain the market’s momentum.

Qatar, particularly the capital city of Doha, dominates the aircraft fire protection systems market due to its status as a regional aviation hub with major players like Qatar Airways and its continuous infrastructure development at Hamad International Airport. The country’s aviation industry is known for its high safety standards and investments in fleet expansion. Additionally, Qatar’s proactive approach toward safety regulations and modernization of its fleet further propels the market for aircraft fire protection systems. The government’s strong support for the aviation sector and its strategic geographic location also enhance its dominance in the market.

Market Segmentation

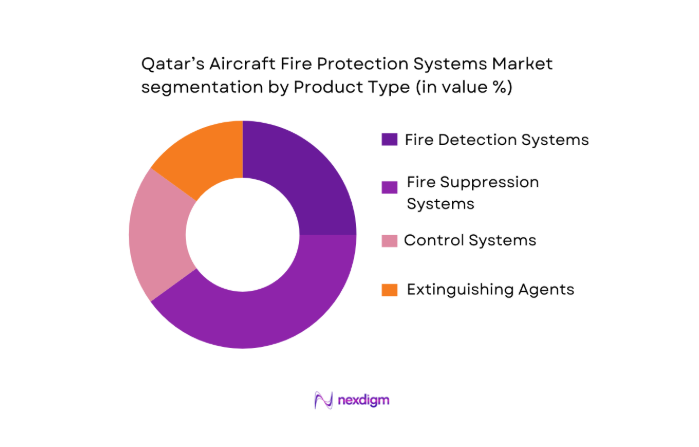

By Product Type

The Qatar aircraft fire protection systems market is segmented by product type into fire detection systems, fire suppression systems, control systems, and extinguishing agents. Among these, fire suppression systems dominate the market due to their direct impact on ensuring safety during flight operations. Fire suppression systems, especially those incorporating advanced, Halon-free suppression agents, have seen increased adoption due to international regulations mandating the phase-out of Halon-based products. This demand is largely driven by airlines’ need to comply with evolving safety standards while maintaining operational efficiency. The increasing fleet modernization efforts and the integration of these systems in both new and retrofitted aircraft contribute to the continued dominance of this segment.

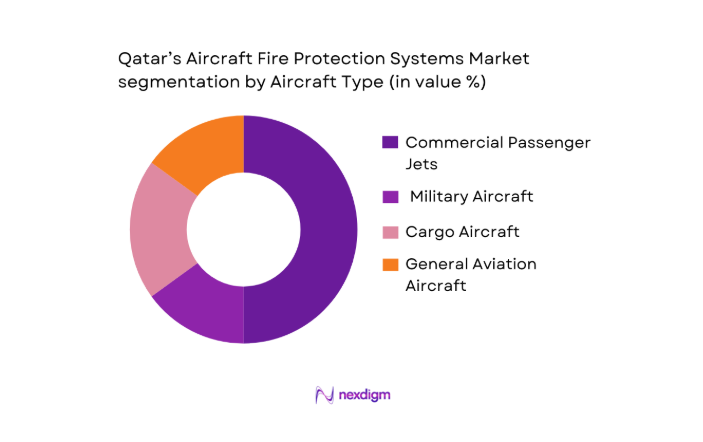

By Aircraft Type

The market is also segmented by aircraft type into commercial passenger jets, military aircraft, cargo aircraft, and general aviation aircraft. Commercial passenger jets account for the largest market share in Qatar’s aircraft fire protection systems market. This segment is dominated by leading airlines like Qatar Airways, which operates a large fleet of long-haul aircraft. With the need for advanced fire protection systems to ensure passenger and crew safety during flight, passenger jets necessitate higher levels of compliance with international fire protection regulations. As Qatar Airways continues to expand its fleet, the demand for fire protection systems in commercial aircraft remains strong.

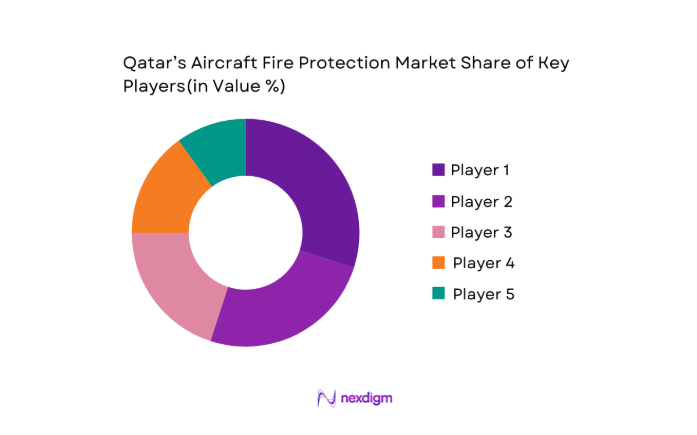

Competitive Landscape

The Qatar aircraft fire protection systems market is dominated by a few key global and regional players. The competitive landscape is shaped by established multinational corporations and regional suppliers that offer a wide range of fire safety systems, including fire suppression, detection, and control systems. Major players like Honeywell International, Collins Aerospace, and Meggitt PLC are key competitors, benefiting from their strong technological expertise, comprehensive service offerings, and established relationships with major aircraft manufacturers. Local players also contribute to the market by providing retrofit and MRO services tailored to the needs of Qatar’s aviation sector.

| Company | Establishment Year | Headquarters | Fire Detection Systems | Fire Suppression Systems | MRO Services | Halon-Free Solutions | OEM Integration | Market Penetration |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Meggitt PLC | 1947 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| H3R Aviation Inc. | 1995 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| AMETEK FFE Ltd. | 1945 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Fire Protection Systems Market Analysis

Growth Drivers

Fleet Expansion

The fleet expansion in Qatar’s aviation sector continues to drive the demand for aircraft fire protection systems. Qatar Airways, which is one of the world’s fastest-growing airlines, has an expanding fleet of over 250 aircraft. The airline is expected to receive more aircraft in the coming years, as it continues to bolster its global connectivity. In addition, Qatar is investing in major aviation infrastructure, such as the Hamad International Airport, which is projected to handle 53 million passengers annually by 2025. This rapid fleet and infrastructure expansion will directly increase the need for enhanced fire safety systems. According to the International Air Transport Association (IATA), global air travel is set to recover to pre-pandemic levels in 2025, which will likely lead to greater demand for aviation safety solutions.

Linefit Mandates

Linefit mandates by global regulatory bodies such as the International Civil Aviation Organization (ICAO) and the European Union Aviation Safety Agency (EASA) have significantly influenced the growth of fire protection systems in new aircraft deliveries. In 2024, ICAO and other aviation regulators require all new aircraft to meet stringent safety standards that include the integration of advanced fire suppression and detection systems. As a result, original equipment manufacturers (OEMs) are integrating these systems in their linefit offerings. In the Middle East, where aviation is one of the fastest-growing sectors, regulations play a key role in driving fire safety adoption. This regulatory pressure ensures that new aircraft models from manufacturers like Boeing and Airbus are equipped with state-of-the-art fire protection technologies, increasing market demand.

Market Challenges

Compliance Costs

Compliance costs remain a major challenge in the Qatar aircraft fire protection systems market. The high cost of meeting stringent international safety regulations, including those set by ICAO and QCAA, results in increased prices for fire suppression and detection systems. For example, compliance with the new Halon replacement policies alone can raise costs for both OEMs and retrofit providers. The global phase-out of Halon, a commonly used fire suppression agent, is expected to increase the cost of aircraft fire suppression systems as airlines are required to replace old equipment with environmentally-friendly alternatives. In addition, the cost of certifying these systems to meet regional and international safety standards significantly adds to the financial burden. According to the International Monetary Fund (IMF), high inflationary pressures and rising costs of materials will affect the aviation industry, thereby escalating compliance-related expenses for suppliers.

Supplier Constraints

Supplier constraints pose a significant challenge to the Qatar aircraft fire protection systems market, especially in terms of the availability of critical components such as fire suppression agents and sensors. There has been a notable disruption in the global supply chain, particularly for components like Halon-free agents and fire detection sensors. In 2024, manufacturers face delays due to limited production capacities and global transportation bottlenecks, which hinder the timely supply of fire safety systems to aircraft operators. Moreover, only a few manufacturers globally are able to meet the specific standards required for the aviation industry. According to the World Bank, global supply chain disruptions continue to affect industries reliant on high-tech components, such as aerospace, making it difficult for suppliers to fulfill large orders in a timely manner.

Market Opportunities

Eco-friendly Agents

The growing trend towards eco-friendly fire suppression agents presents a promising opportunity in Qatar’s aircraft fire protection systems market. With the global phase-out of Halon, the demand for sustainable fire suppression agents such as water mist, foam, and clean agents has risen sharply. Qatar’s airlines and MROs are increasingly seeking alternatives that comply with environmental regulations while maintaining safety standards. Qatar Airways has actively been involved in retrofitting its fleet to use Halon-free agents as part of its commitment to sustainability and environmental responsibility. In line with this, Qatar is exploring more environmentally friendly fire suppression systems, opening up a substantial opportunity for manufacturers providing eco-conscious fire protection technologies. The World Bank forecasts a growing shift toward sustainable practices across industries, including aviation, as countries continue to pursue climate goals.

AI Predictive Detection

Artificial Intelligence (AI)-powered predictive detection systems offer significant opportunities for the Qatar aircraft fire protection systems market. With the growing reliance on data-driven technologies, AI is being leveraged to enhance fire detection capabilities by predicting and identifying potential fire hazards before they escalate. These systems use machine learning algorithms to process data from multiple sensors and detect anomalies that might indicate the onset of a fire. The adoption of AI in aircraft fire protection systems allows for faster response times, reduced false alarms, and enhanced safety. Qatar Airways, for example, has been investing in AI-based technologies for predictive maintenance of its aircraft, which includes fire safety systems. As AI technology continues to mature, its integration into fire detection and suppression systems presents a substantial opportunity for market players.

Future Outlook

The Qatar aircraft fire protection systems market is poised to witness substantial growth over the next decade, fueled by continuous advancements in fire safety technologies, Qatar’s rapid fleet expansion, and increasingly stringent fire safety regulations. As the aviation industry in Qatar continues to thrive, the demand for high-quality, compliant fire protection systems will remain a critical factor for both new aircraft and retrofitted fleets. Additionally, innovations in eco-friendly fire suppression agents and smart detection systems will play a key role in driving the market forward.

Major Players

- Honeywell International

- Collins Aerospace

- Meggitt PLC

- H3R Aviation Inc.

- AMETEK FFE Ltd.

- Eaton Corporation

- Thales Group

- Diehl Stiftung & Co. KG

- AeroTurbine Inc.

- CMC Electronics

- Advanced Aircraft Extinguishers Ltd.

- Raytheon Technologies

- Airbus Fire Safety Division

- Boeing Fire Safety Systems

- Qatar-based Fire Protection Solutions Providers

Key Target Audience

- Airlines and Aviation Operators

- Aircraft Manufacturers

- Aircraft Component Manufacturers

- MRO Providers

- Aviation Safety Regulatory Bodies

- Military and Defense Aviation Units

- Investment and Venture Capitalist Firms

- Aviation Industry Consultants

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we develop an ecosystem map that identifies the key stakeholders, including airlines, aircraft manufacturers, and MRO providers. We leverage both secondary and proprietary data sources to ensure a comprehensive understanding of the variables that influence the market, such as regulatory changes and technology adoption.

Step 2: Market Analysis and Construction

Historical data is gathered and analyzed to assess the current state of the Qatar aircraft fire protection systems market. This includes the analysis of aircraft fleet sizes, fire protection system adoption rates, and revenue generation from major product types. Service quality statistics are also evaluated to validate the financial data and ensure an accurate reflection of the market.

Step 3: Hypothesis Validation and Expert Consultation

Key industry experts, including engineers from aircraft manufacturers and executives from MRO providers, are interviewed to validate the initial hypotheses. These consultations provide valuable insights into current market challenges and growth opportunities, which help refine the analysis and forecast.

Step 4: Research Synthesis and Final Output

The final output is synthesized from in-depth engagement with major fire protection system manufacturers, OEMs, and service providers. This helps in refining the market data and forecasting future growth trends, ensuring that the final report offers accurate and actionable insights.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Fleet Expansion

Linefit Mandates

QCAA Safety Upgrades - Market Challenges

Compliance Costs

Supplier Constraints

Sensor False‑Alarm Rates - Market Opportunities

Eco‑friendly Agents

AI Predictive Detection - Market Trends

Smart Sensor Integration

Halon‑free Adoption

Retrofit Demand - Government Regulations & Compliance

- SWOT Analysis

- Porter’s Five Forces

- By Revenue, 2020-2025

- By Volume, 2020-2025

- By Average Price per Aircraft System, 2020-2025

- By Component (In Value %)

Fire Detection Systems (Optical Smoke, Thermal, Gas Sensors)

Fire Suppression Systems (Halon‑free Agents, Aerosol Systems)

Control & Monitoring Units (Integrated Airbus/Boeing Interfaces)

Extinguishing Agents & Accessories - By Aircraft Type (In Value %)

Commercial Passenger Jets

Cargo Aircraft

Military & Defense Aircraft

Business / General Aviation - By Fitment (In Value %)

OEM / Linefit (Factory Installed)

Aftermarket & Retrofit

MRO Service Contracts - By Installation Zone (In Value %)

Engines & APUs (Engine Bay Protection)

Cargo & Hold Compartments

Cabin & Lavatory Protection

Cockpit / Avionics Bays - By End‑User (In Value %)

Airlines

Aircraft OEMs

MRO Providers

- Market Share of Major Players

- Cross‑Comparison Parameters (Market Penetration, Technology Breadth, Compliance Certifications, MRO Support Network, Cost per Unit, Aftermarket Service Footprint, Regional Supply Chain Presence, Integration with Airline Fleet Systems)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Honeywell International Inc.

UTC / Collins Aerospace Fire Protection Division

RTX Corporation Fire Safety Solutions

Meggitt PLC Aircraft Fire Protection Group

Siemens AG Fire Safety Aviation Technologies

H3R Aviation Inc.

AMETEK / FFE Ltd. Aviation Fire Detection Systems

Diehl Stiftung & Co. KG Aviation Fire Systems

Eaton Corporation plc

Thales Group Fire Safety Solutions

Advanced Aircraft Extinguishers Ltd.

AeroTurbine Inc. Fire Suppression Units

CMC Electronics Fire System Div.

Collins Aerospace / Rockwell Collins Fire Safety Units

Local GCC Providers & Regional Integrators

- Safety & Certification Compliance Requirements

- Total Cost of Ownership & Lifecycle Costs

- Integration with Aircraft Systems / OEM Compatibility

- Aftermarket Service & Maintenance Contracts

- By Revenue, 2026-2035

- By Volume, 2026-2035

- By Average Price per Aircraft System, 2026-2035