Market Overview

The Qatar Aircraft Flame Retardant Films market is valued at USD ~ in 2024 and has witnessed steady growth driven by the increasing demand for safer and more efficient materials in the aviation sector. The market is primarily influenced by stringent fire safety regulations set by the Qatar Civil Aviation Authority (QCAA) and international standards such as ICAO and EASA. The growing need for fire-resistant materials for aircraft interiors, including cabin walls, ceiling panels, and insulation wraps, is propelling the demand for flame retardant films. Additionally, the expansion of Qatar’s aviation sector, especially the Qatar Airways fleet and infrastructure, further strengthens market growth.

Qatar and the surrounding GCC (Gulf Cooperation Council) countries, including the UAE and Saudi Arabia, dominate the aircraft flame retardant films market due to their advanced aviation infrastructure and regulatory focus on fire safety. Qatar’s strategic position as a major aviation hub, led by Qatar Airways, makes it a significant player in the Middle Eastern aerospace sector. Furthermore, the region’s strict adherence to global fire safety standards and investment in new aircraft and retrofitting existing fleets drives the demand for high-quality flame-retardant films in both OEM and MRO applications.

Market Segmentation

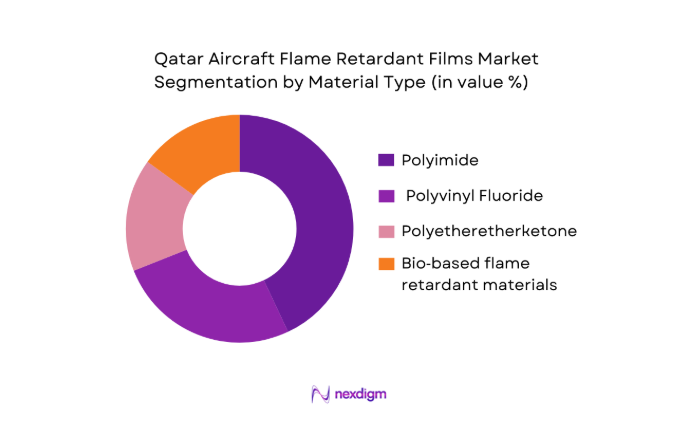

By Material Type

The Qatar Aircraft Flame Retardant Films market is segmented into various material types, including Polyimide (PI), Polyvinyl Fluoride (PVF), Polyetheretherketone (PEEK), and Bio‑based flame retardant materials.

Polyimide (PI) films dominate the market share in this segment due to their high thermal stability and excellent resistance to flame and smoke. As the aviation sector demands increasingly stringent fire safety standards, PI films have become the material of choice for insulation wraps and electrical harnesses in aircraft interiors. This material is favored for its ability to maintain its structural integrity at high temperatures, making it suitable for both commercial and military aircraft. PI films are also compliant with global aviation fire safety certifications, ensuring their continued dominance in the market.

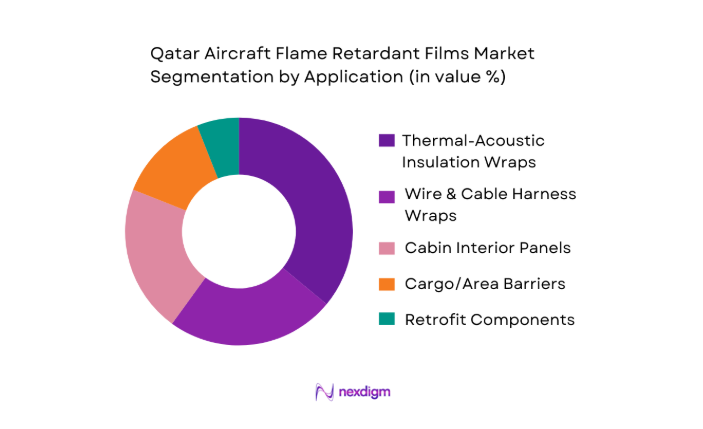

By Application

The market is segmented by application into Thermal-Acoustic Insulation Wraps, Wire & Cable Harness Wraps, Cabin Interior Panels, Cargo/Area Barriers, and Retrofit Components.

Thermal-Acoustic Insulation Wraps lead the market within this segment due to their essential role in fire containment and noise reduction within aircraft. The increasing focus on improving passenger comfort and safety has led to a surge in demand for high-performance insulation materials. Insulation wraps made from flame retardant films help meet the industry’s safety standards and contribute to overall weight reduction, which is a key consideration for airlines looking to optimize fuel efficiency. This has resulted in thermal-acoustic wraps securing the largest share in the market.

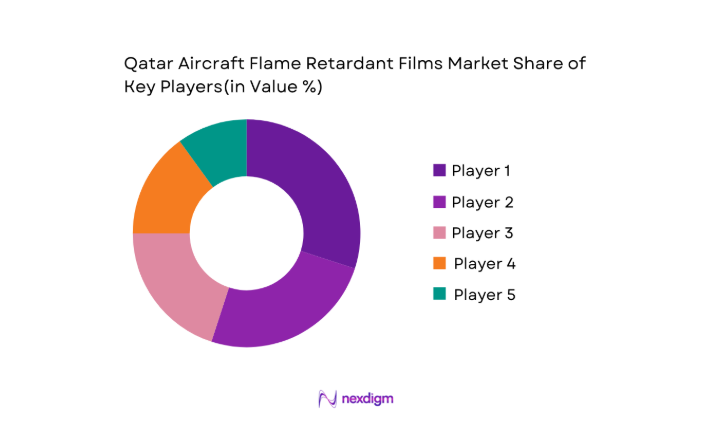

Competitive Landscape

The Qatar Aircraft Flame Retardant Films market is highly competitive with several major players competing for dominance. The market features both global players and regional manufacturers who provide high-quality flame retardant films suitable for the aviation industry.

The market landscape is dominated by a few major players, including global companies like DuPont, Solvay, and Toray Industries, as well as regional players with a strong presence in the GCC market. These companies have a significant influence due to their advanced technological capabilities, strong supply chains, and longstanding relationships with OEMs and MROs in the region.

| Company Name | Establishment Year | Headquarters | Material Type Focus | Market Strategy | Regulatory Compliance | R&D Investment |

| DuPont | 1802 | USA | ~ | ~ | ~ | ~ |

| Solvay | 1863 | Belgium | ~ | ~ | ~ | ~ |

| Toray Industries | 1926 | Japan | ~ | ~ | ~ | ~ |

| Avery Dennison | 1905 | USA | ~ | ~ | ~ | ~ |

| Berry Global Inc. | 1967 | USA | ~ | ~ | ~ | ~ |

Qatar Aircraft Flame Retardant Films Market Analysis

Growth Drivers

Safety Regulation Tightening

In recent years, fire safety regulations for the aviation industry have become more stringent, driven by both global and regional standards, such as those enforced by the International Civil Aviation Organization and the European Union Aviation Safety Agency (EASA). For example, the ICAO recently updated its fire safety standards, requiring materials used in aircraft cabins to have a higher flame resistance to reduce the risks of in-flight fires. As of 2024, ICAO’s regulations emphasize using materials with enhanced fire resistance, pushing manufacturers to adopt flame-retardant solutions like aircraft films. These evolving regulations are crucial in ensuring passenger and crew safety. The tightening of fire safety norms correlates with rising demand for certified materials, which is expected to boost demand for flame-retardant films, making compliance a significant driver of growth in the market.

Fleet Expansion

Qatar’s aviation sector, led by Qatar Airways, is witnessing substantial fleet expansion, which is directly influencing the demand for flame-retardant films. As Qatar Airways continues to modernize its fleet, it has invested in acquiring new aircraft, including the Boeing 787 and Airbus A350, with Qatar Airways’ fleet growing by over ~ between 2020 and 2024. This fleet expansion is further supported by Qatar’s growing aviation infrastructure, with new terminals and expansion of Hamad International Airport. This expansion correlates with the increasing demand for fire-resistant materials, including flame-retardant films, as they are integral in meeting the stringent safety regulations of modern aircraft. The Qatar government has also allocated over USD ~ for infrastructure development in the aviation sector, which further fuels the market for advanced safety materials.

Market Challenges

High Material ASP

One of the primary challenges facing the Qatar Aircraft Flame Retardant Films market is the high average selling price (ASP) of advanced flame-resistant films. The costs of raw materials for flame-retardant films, such as polyimide and polyvinyl fluoride, have risen significantly in recent years. For example, in 2024, the cost of high-performance polymers used in flame-retardant films has increased due to supply chain disruptions, particularly in the wake of global shortages of raw materials and geopolitical tensions affecting global supply chains. Furthermore, the demand for higher quality and more durable materials to meet strict aviation standards has caused an upward shift in material prices. According to the World Bank, global inflation rates, which are projected to reach ~ in 2024, continue to impact the cost of production for flame-retardant films, making them more expensive and limiting their adoption in some markets.

Certification Lead Times

Certification lead times for flame-retardant films in the aviation sector can pose a challenge for manufacturers and suppliers. The process of meeting the stringent requirements set by aviation safety regulators such as the Qatar Civil Aviation Authority (QCAA) and the European Union Aviation Safety Agency (EASA) can be prolonged. For instance, the approval process for a new fire-resistant material may take several months, and in some cases, years, before it is officially recognized and adopted by the industry. As a result, delays in obtaining the necessary certifications to meet safety standards can delay product deployment, contributing to a slow pace of market adoption for new flame-retardant films. Additionally, the complexity of meeting regulatory standards across different countries adds further delays in getting products to market.

Market Opportunities

Low-Toxicity Materials

There is an increasing demand for low-toxicity materials in the aviation industry, and this presents a significant opportunity for the flame-retardant films market. As regulations around environmental sustainability tighten globally, particularly in the EU and North America, there is growing emphasis on reducing the use of harmful chemicals in aircraft interiors. Flame-retardant films made from low-toxicity, bio-based materials are gaining traction. Current market trends show a shift toward using bio-based alternatives such as bio-polymers that emit lower levels of toxic smoke in the event of a fire. For instance, a recent study by the European Commission highlights a growing move towards using non-halogenated flame-retardants, which are more environmentally friendly. This presents an opportunity for manufacturers in Qatar to develop and supply more sustainable and safer flame-retardant films to meet emerging global standards.

Lightweight Composites

Another opportunity for growth in the Qatar Aircraft Flame Retardant Films market is the increasing demand for lightweight composite materials in aircraft manufacturing. As airlines seek to improve fuel efficiency and reduce carbon emissions, there is a strong push for lightweight materials that do not compromise on safety. Flame-retardant films made from lightweight composites offer both safety and efficiency, providing the perfect balance for the aviation sector. With Qatar’s aviation sector heavily investing in expanding its fleet of modern aircraft, manufacturers of flame-retardant films can seize the opportunity to supply lightweight, durable solutions that meet both fire safety regulations and the growing demand for fuel-efficient, low-emission aircraft. According to the International Air Transport Association (IATA), the global push towards reducing CO2 emissions in aviation has led to increased adoption of lightweight materials in aircraft production, which further opens the door for composite-based flame-retardant films in the market.

Future Outlook

Over the next decade, the Qatar Aircraft Flame Retardant Films market is expected to exhibit significant growth. This growth is primarily driven by continued advancements in flame retardant material technology, as well as stricter regulatory requirements for fire safety in aircraft. Additionally, the expansion of Qatar Airways and other regional airlines is expected to increase demand for fire-resistant films, both for new aircraft and retrofitting older models. The growing emphasis on sustainable, bio-based flame retardant materials will also play a key role in shaping the future of the market.

Major Players

- DuPont

- Solvay

- Toray Industries

- Avery Dennison

- Berry Global Inc.

- 3M Company

- Victrex plc

- SABIC

- Covestro AG

- Teijin Limited

- Madico, Inc.

- DAF Products, Inc.

- Saint-Gobain Performance Plastics

- DowDuPont Advanced Materials

- BASF

Key Target Audience

- Aerospace Manufacturers

- Aviation Safety Regulatory Bodies

- Airline Operators and Fleet Managers

- Aircraft Maintenance, Repair, and Overhaul Providers

- Material Suppliers and Distributors

- OEM Aircraft Component Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial step involves constructing an ecosystem map of the major stakeholders within the Qatar Aircraft Flame Retardant Films market. Secondary research and proprietary databases will be used to collect industry-level information, focusing on key variables like material types, regulations, and consumer preferences.

Step 2: Market Analysis and Construction

Data on the market’s historical performance, including material penetration, revenue generation, and the ratio of OEM vs aftermarket sales, will be compiled and analyzed. This phase also involves evaluating service quality statistics and operational practices in both commercial and military aircraft.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts. This phase involves interviews with key personnel in major aerospace firms, regulatory bodies, and material suppliers to gain insights into current trends, material innovations, and growth drivers.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the research and validating the findings by directly engaging with key players in the aerospace sector. This will include discussions with manufacturers, MRO service providers, and regulators to ensure accuracy and reliability in the market data.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

safety regulation tightening

fleet expansion

retrofit cycles - Market Challenges

high material ASP

certification lead times

supply chain constraints - Opportunity

low‑toxicity materials

lightweight composites

MRO demand - Trends

OEM integration strategies

bio‑based flame retardants - Government Regulations & Aviation Standards

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price Trends, 2020-2025

- By Material Type (In Value %)

Polyimide

Polyvinyl Fluoride

Polyetheretherketone

Bio‑derived flame retardant materials

Others - By Application (In Value %)

Thermal‑Acoustic Insulation Wraps

Wire & Cable Harness Wraps

Cabin Interior Panels

Cargo/Area Barriers - By Aircraft Type (In Value %)

Commercial Aircraft

Military & Defense Platforms

Business & VIP Jets

Helicopters & Rotocraft - By Fitment Channel (In Value %)

OEM

Aftermarket

Third‑Party Certified Distributors - By End‑User Sector (In Value %)

National Airlines

Defense

Aviation MRO Players

- Market Share of Major Players

- Cross‑Comparison Parameters (Material Performance Ratings, Certification Breadth, Supply Chain Lead Time & Local Inventory Strategy, OEM Approvals & Tier‑1 Contracts, Aftermarket Service Capabilities, Cost per Installed Area, Sustainability Credentials)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

DuPont de Nemours, Inc.

Saint‑Gobain Performance Plastics

Solvay SA

Victrex plc

Toray Industries, Inc.

Avery Dennison Corporation

Covestro AG

TEIJIN LIMITED

3M Company

SABIC

Berry Global Inc.

DowDuPont Advanced Materials

Madico, Inc.

DAF Products, Inc.

BOSK

- Key Drivers of End‑User Selection

- Service Life Expectations

- Cost of Ownership & ASP Impact

- Regional Safety Perception & Insurance Influence

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035