Market Overview

The Qatar aircraft flight recorder market is valued at approximately USD ~million. This market is largely driven by the growing demand for advanced aviation safety systems, supported by strict regulatory compliance requirements, such as those set by the Qatar Civil Aviation Authority and the International Civil Aviation Organization. The surge in air traffic, particularly with Qatar Airways being one of the leading international carriers, further supports the market growth. With the aviation industry in Qatar expanding, coupled with mandatory flight data recording systems, the market is expected to witness a steady growth trajectory through the forecast period.

Qatar, along with other Gulf Cooperation Council countries, holds a dominant position in the aircraft flight recorder market, primarily due to its rapidly expanding aviation industry. The demand for aircraft flight recorders is especially high in major aviation hubs like Doha, which is home to Qatar Airways, one of the largest international airlines. The country’s stringent regulatory requirements for flight safety and the growing fleet of modern aircraft are contributing factors to its market leadership. Qatar’s significant role in the aviation industry ensures its central position in the regional market dynamics.

Market Segmentation

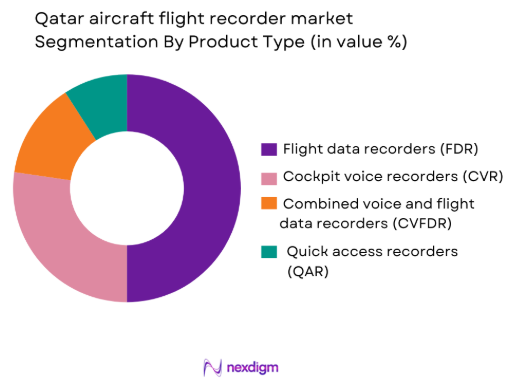

By Product Type

The Qatar aircraft flight recorder market is segmented by product type into flight data recorders (FDR), cockpit voice recorders (CVR), combined voice and flight data recorders (CVFDR), and quick access recorders (QAR). The dominant sub-segment in this category is the Flight Data Recorder (FDR), which captures essential flight parameters to assist in crash investigation and safety analysis. FDRs have been the industry standard for years, primarily due to their critical role in accident investigations and their long-standing regulatory requirements for commercial aircraft. The market for FDRs is further reinforced by the rising number of commercial aircraft in operation, where the need for data-driven safety systems is ever-growing.

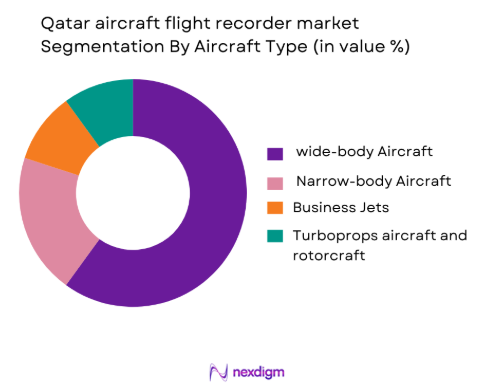

By Aircraft Type

The Qatar aircraft flight recorder market is segmented by aircraft type, including narrow-body, wide-body, business jets, turboprops, and rotorcraft. The wide-body segment leads the market in terms of demand for flight recorders, driven by the fleet composition of Qatar Airways, which operates numerous wide-body aircraft for long-haul international flights. Wide-body aircraft require sophisticated flight recorder systems due to the increased complexity of their operations, including extended flight durations and higher passenger volumes, which necessitate detailed data recording for safety and regulatory compliance. This sub-segment is expected to continue dominating the market, particularly as the global fleet of wide-body aircraft continues to grow.

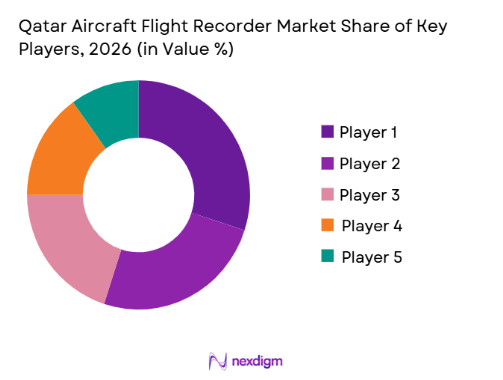

Competitive Landscape

The Qatar aircraft flight recorder market is highly competitive with several key players leading the industry. The market is dominated by both international giants and regional players who have established strong relationships with aircraft manufacturers and airlines. These include companies like Honeywell Aerospace, L3Harris Technologies, and Collins Aerospace, which are known for their high-quality flight recorder systems. In Qatar, the competition is further fueled by the growing aviation sector, which demands cutting-edge safety technology and regulatory compliance. Additionally, the market also sees innovation from newer players offering more advanced digital flight data recorders and analytics solutions.

| Company | Establishment Year | Headquarters | Revenue (2023) | Product Portfolio | Key Market | Technology Focus |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ |

| Collins Aerospace (Raytheon) | 2018 | USA | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 2005 | France | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

Qatar Aircraft Flight Recorder Market Analysis

Growth Drivers

Mandatory Flight Safety Recording Compliance

The Qatar aircraft flight recorder market benefits significantly from the mandatory flight safety recording compliance requirements enforced by both the International Civil Aviation Organization (ICAO) and the Qatar Civil Aviation Authority (GCAA). ICAO mandates that all commercial aircraft must have flight data and cockpit voice recorders installed, which has led to the widespread adoption of these systems. In 2022, Qatar’s civil aviation sector grew at a rate of ~%, driven by Qatar Airways’ fleet expansion and ongoing investments in aviation safety systems. Additionally, GCAA’s implementation of stricter aviation safety measures has prompted rapid system upgrades across the nation’s fleet. According to ICAO’s data, over ~% of commercial aircraft globally are equipped with flight data recorders, and the same compliance pressures are applied in Qatar to ensure safety across the Middle East.

Expansion of Qatar Airline Fleet & International Routes

The expansion of Qatar Airways’ fleet has been a primary driver for the growth of the flight recorder market. Qatar Airways, one of the largest airlines globally, has continuously expanded its fleet, with a projected addition of ~ new aircraft by 2025. This expansion includes large investments in wide-body aircraft, which require sophisticated flight recorder systems. According to the International Air Transport Association (IATA), the Middle East’s air passenger traffic is expected to increase by ~% annually, further boosting demand for advanced flight safety systems in the region. Qatar Airways’ continuous international route expansion necessitates enhanced flight data and cockpit voice recording systems, especially for long-haul flights. As of 2025, Qatar Airways serves over ~ destinations worldwide, significantly increasing the need for safety compliance.

Challenges

Cost of Installation & Certification

The high costs associated with the installation and certification of flight data recorders pose a restraint to the market’s growth. In particular, retrofitting older aircraft with new systems is a costly process due to the need for extensive modification and certification procedures. For instance, the installation of flight data recorders in commercial aircraft can cost airlines up to USD ~ per aircraft, with additional ongoing maintenance costs. According to the World Bank’s 2025 aviation safety report, certification and maintenance expenses for new systems and retrofit technologies have been rising by an average of ~% annually over the past five years. This significant investment is a barrier for smaller carriers and operators looking to comply with evolving safety regulations.

Supply Chain Limitations for Advanced Recorder Systems

The Qatar aircraft flight recorder market faces supply chain challenges due to the increasing demand for advanced digital and solid-state recorders. These challenges are exacerbated by the global semiconductor shortage and delays in the manufacturing of high-tech electronic components, which are essential for flight recorder systems. The global semiconductor shortage, which began in 2026, continues to affect multiple industries, including aviation. According to a report from the World Economic Forum, global supply chains were disrupted by a ~% decline in semiconductor production capacity in 2025, impacting the timely delivery of flight recorder systems. This has caused delays in the installation of new systems and has resulted in a backlog for retrofitting older aircraft in Qatar’s fleet.

Opportunities

Predictive Safety Analytics Integration

The integration of predictive safety analytics presents a significant opportunity for the aircraft flight recorder market. Airlines and operators in Qatar are increasingly adopting advanced data analytics to enhance flight safety and operational efficiency. Real-time data collected by flight data recorders is now being processed and analyzed to predict potential failures and maintenance needs before they occur. This predictive capability is particularly valuable in the growing fleet of Qatar Airways and other regional operators. According to the Gulf Cooperation Council’s (GCC) aviation safety report, the region’s demand for data-driven insights into flight operations has increased by ~% annually since 2025, with Qatar at the forefront of these initiatives. By incorporating artificial intelligence (AI) and machine learning into flight recorder systems, operators can minimize unplanned maintenance and reduce operational downtimes, presenting a clear growth opportunity in this market.

Adoption of Wireless QAR & Real Time Health Monitoring

The adoption of wireless Quick Access Recorders (QAR) and real-time health monitoring systems is opening up new opportunities in the aircraft flight recorder market. Wireless QAR systems allow for more efficient data transmission, reducing the need for manual data retrieval and enabling real-time monitoring of an aircraft’s performance. As Qatar Airways continues to modernize its fleet, the airline is investing in technologies that allow for quicker access to flight data, enhancing both safety and operational efficiency. The growing demand for wireless data transmission in the Middle East has driven airlines in Qatar to adopt these technologies more rapidly, with the latest systems being incorporated into their fleets. This technological shift is expected to further enhance the competitiveness of Qatar’s aviation industry and improve safety monitoring capabilities, which is an ongoing opportunity for flight recorder manufacturers in the region.

Future Outlook

Over the next few years, the Qatar aircraft flight recorder market is expected to experience substantial growth, driven by technological advancements in digital flight data recording and the ongoing expansion of the country’s aviation infrastructure. The continuous development of Qatar Airways’ fleet and the stringent regulatory requirements for flight data recording will further fuel the demand for these critical systems. Innovations such as cloud-based data storage, real-time analytics, and improved crash survivability features are expected to be pivotal in the future development of the market.

Major Players

- Honeywell Aerospace

- L3Harris Technologies

- Collins Aerospace

- Safran Electronics & Defense

- Thales Group

- Acron Aviation

- CurtissWright Controls

- Esterline/TE Connectivity

- Universal Avionics Systems

- Universal Flight Services

- AVIONICA Corp

- Panasonic Avionics

- Boeing Avionics Division

- Northrop Grumman

- Esterline Technologies

Key Target Audience

- Airlines and Air Operators

- Aerospace OEMs

- MRO and Retrofit Service Providers

- Air Traffic Control and Aviation Safety Authorities

- Regulatory Agencies

- Government and Defense Agencies

- Investments and Venture Capitalist Firms

- Aircraft Data Analytics and Software Companies

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying and defining critical variables that influence the Qatar aircraft flight recorder market. It includes gathering secondary data from industry reports, government regulations, and company financials. The objective is to pinpoint key factors driving market trends and consumer demand.

Step 2: Market Analysis and Construction

We will analyze historical data regarding the demand for flight recorders in Qatar, including aircraft fleet composition, compliance trends, and technological shifts. This data will form the base for constructing market estimates and projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth trends, regulatory impacts, and technology adoption will be validated by conducting interviews with industry experts, regulatory bodies, and key players in Qatar’s aviation sector. This will help refine and validate our market data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes insights from expert consultations and company reports to provide a comprehensive and accurate picture of the Qatar aircraft flight recorder market. This phase ensures that all findings are verified and aligned with the real-world aviation landscape.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Forecast Modeling Framework, Primary & Secondary Data Sources, Market Sizing Approach, Research Limitations, Data Triangulation Strategy, Interview Protocol with Qatar Airline and Regulator Experts, Conclusion)

- Definition and Scope of Flight Recorder Systems

- Historical Evolution of Flight Recorder Adoption Globally and in Qatar

- Regulatory Landscape

- Mandatory Compliance Requirement

- Qatar’s Fleet Safety Infrastructure & Investigative Protocols

- Growth Drivers

Mandatory Flight Safety Recording Compliance

Expansion of Qatar Airline Fleet & International Routes

Retrofit Demand for Legacy Aircraft

Growth in Business & Private Aviation - Market Restraints

Cost of Installation & Certification

Supply Chain Limitations for Advanced Recorder Systems - Opportunities

Predictive Safety Analytics Integration

Adoption of Wireless QAR & Real Time Health Monitoring - Market Trends

Digital Shift from Analog to Solid State Recorders

Integration with Big Data & AI Based Insights

OEM/CDM Partnerships for Region specific Solutions

- Market Value by Segment, 2020-2025

- Unit Volume Installed Base, 2020-2025

- Average Price Trends by Recorder Class, 2020-2025

- Installed Base by Aircraft Type, 2020-2025

- Middle East & Qatar Regional Installed Base Comparison, 2020-2025

- By Product Type (In Value %)

Flight Data Recorder

Cockpit Voice Recorder

Combined Voice & Data Recorder

Quick Access Recorder - By Aircraft Type (In Value %)

Narrow Body

Wide Body

Business Jets & Corporate Aircraft

Turboprop

Rotorcraft - By Component (In Value %)

Memory Module & Recorder Media

Electronic Controller Board

Input & Sensor Devices

Power Supply & Beacon System

Software & Analytics Modules - By Functionality (In Value %)

Parametric Flight Data Recording

Cockpit Audio Recording

Data Link / Real Time Telemetry

Maintenance & Performance Analytics - By End User (In Value %)

Commercial Airlines

Cargo & Logistics Aviation

Military & Defense Aviation

OEM Aircraft Integrators

MRO & Retrofit Service Providers

- Market Share Value & Volume by Key Players

- Cross Comparison Parameters (Company Overview, Product Portfolio Breadth, Recording Technology, Compliance Certifications, Service & Retrofit Capabilities, Regional Support Footprint, Pricing Strategy, Warranty & AfterSales, Integration with OEMs, Supply Chain Strength)

- SWOT analysis of key players

- Pricing analysis of major players

- Porter’s Five Forces

- Detailed Profiles

Honeywell Aerospace

L3Harris Technologies

Collins Aerospace

Universal Avionics Systems

Acron Aviation

Curtiss Wright Controls

Thales Group

Northrop Grumman

Esterline/TE Connectivity

Universal Flight Services

AVIONICA Corp

Safran Electronics & Defense

Panasonic Avionics

Boeing Avionics Div.

Collins Aerospace – QAR Solutions

- Commercial airline fleet safety compliance requirements

- Defense aviation mission data and training analysis needs

- Business aviation demand for advanced safety monitoring

- Rotorcraft operational safety and offshore mission support

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035