Market Overview

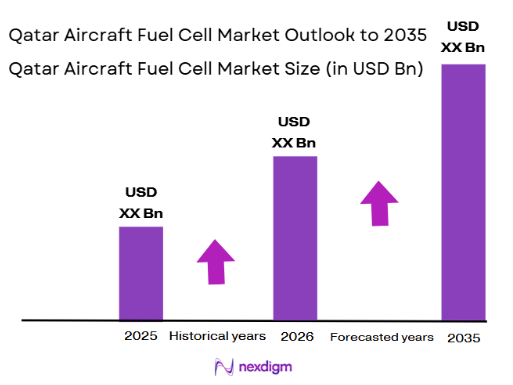

The Qatar Aircraft Fuel Cell Market is valued at approximately USD ~ million. The growth of this market is driven by Qatar’s strong commitment to sustainable aviation and reducing carbon emissions. The Qatar Civil Aviation Authority has emphasized the importance of environmental initiatives in aviation, pushing the adoption of hydrogen-based technologies, including fuel cells. Qatar Airways, one of the largest international airlines, is a key driver, actively pursuing the integration of fuel cell technology for hybrid and electric aircraft propulsion systems, aiming for a greener, zero-emission future. The growing demand for low-emission, high-efficiency propulsion systems is further bolstered by the national and international regulatory push for environmental sustainability within the aviation sector.

Qatar, particularly Doha, dominates the aircraft fuel cell market in the Middle East due to its strategic role in the aviation industry and government-backed sustainability initiatives. Qatar Airways is at the forefront of adopting fuel cell technologies, aligning with global trends toward reducing carbon emissions in aviation. The nation’s investment in green technologies and infrastructure, including a focus on hydrogen as an alternative fuel source, enhances its position as a leader in the market. Furthermore, Qatar’s ambitious plans to develop a sustainable aviation ecosystem and its hosting of the FIFA World Cup have accelerated investments in eco-friendly aviation technologies, propelling the country to a dominant position in the regional fuel cell market.

Market Segmentation

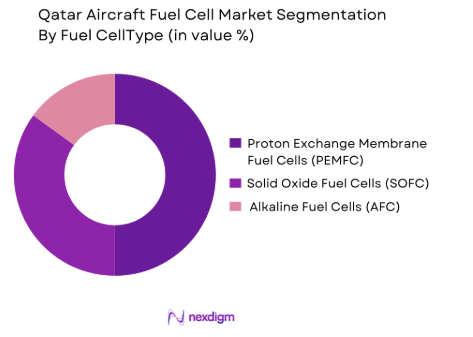

By Fuel Cell Type

The Qatar Aircraft Fuel Cell Market is segmented by fuel cell type into Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), and Alkaline Fuel Cells (AFC). The PEMFC segment is currently the dominant segment within the market due to its higher efficiency and applicability in aircrafts for both hybrid propulsion and auxiliary power units (APUs). PEMFCs are preferred for aviation applications because of their high energy density, lower operating temperatures, and ability to operate efficiently with hydrogen as a fuel source. As Qatar Airways and other regional carriers focus on transitioning to low-emission propulsion systems, the dominance of PEMFC technology is expected to grow due to its promising long-term advantages, such as fuel efficiency and environmental compatibility.

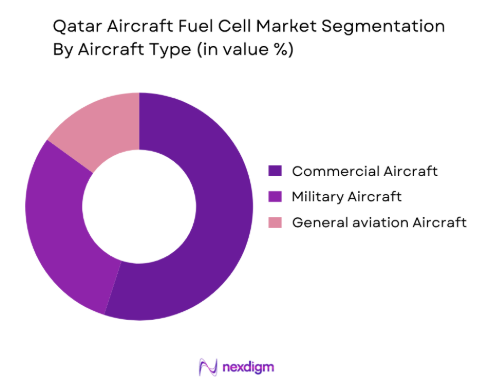

By Aircraft Type

The market is segmented by aircraft type, including commercial aircraft, military aircraft, and general aviation aircraft. Among these, commercial aircraft lead the segment in demand for fuel cell integration, driven by Qatar Airways’ fleet expansion and commitment to sustainable aviation technologies. As commercial aircraft become increasingly hybridized and powered by low-emission technologies, fuel cells are gaining traction for providing efficient auxiliary power and propulsion in newer models. This demand is especially high for long-haul aircraft, which require high energy efficiency to ensure sustainable operations. The commercial sector’s commitment to meeting international emissions reduction targets positions it as the key driver of fuel cell adoption in Qatar’s aircraft sector.

Competitive Landscape

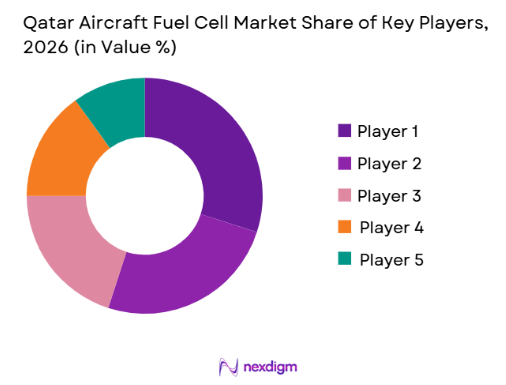

The Qatar Aircraft Fuel Cell market is competitive with several key players driving innovation in fuel cell technology for aviation applications. Major global and regional players, including Airbus, Boeing, Ballard Power Systems, and Honeywell, are actively involved in developing fuel cell systems tailored to the unique needs of the aviation industry. These companies play a significant role in advancing fuel cell technology, focusing on fuel efficiency, integration capabilities, and environmental sustainability. Qatar’s aviation industry, led by Qatar Airways, is a critical partner for these companies, with the country’s commitment to adopting greener technologies aligning with these global trends. As a result, these players are engaged in partnerships and joint ventures with local aerospace firms to bring fuel cell technology to the forefront of Qatar’s aviation landscape.

| Company | Establishment Year | Headquarters | Revenue (2023) | Technology Focus | Fuel Cell Type | Key Market |

| Ballard Power Systems | 1979 | Canada | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Netherlands | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

Qatar Aircraft Fuel Cell Market Analysis

Growth Drivers

Government Support for Sustainable Aviation Initiatives

Qatar’s government has been strongly supporting the adoption of sustainable aviation technologies as part of its broader environmental and economic strategies. The country has committed to achieving carbon-neutral aviation by 2050, aligning with global sustainability goals. Qatar Airways, in partnership with government entities, has pledged to invest in eco-friendly technologies, including fuel cell-powered aircraft, to reduce the aviation sector’s carbon footprint. As part of its climate strategy, Qatar’s National Vision 2030 aims to develop green infrastructure and establish Qatar as a regional leader in sustainable aviation. The Qatar government has earmarked significant investments in hydrogen technology to build necessary infrastructure and support the fuel cell adoption process across the aviation industry. The country’s strategy is backed by its role as a significant player in global aviation and its growing focus on sustainable technologies. According to the Qatar National Vision 2030, the government is aiming for a ~% reduction in greenhouse gas emissions by 2030, which is expected to fuel investments into clean aviation technologies, including hydrogen fuel cells.

Increasing Demand for Green and Sustainable Aircraft Propulsion Systems

The global trend toward sustainable aviation is accelerating, with growing demand for aircraft propulsion systems that reduce carbon emissions. Qatar’s aviation sector, represented by Qatar Airways, is increasingly focused on adopting green technologies, including fuel cells, to meet global environmental regulations. With global air traffic expected to increase by ~% annually between 2025 and 2026, the pressure on airlines to reduce carbon footprints becomes crucial. The transition to hydrogen-powered aircraft is seen as an essential step in this journey. The fuel cell technology provides a clean alternative to traditional aviation fuels, contributing to lower emissions, especially in Qatar, which is a significant hub for air travel in the Middle East. The aviation industry’s push for carbon neutrality aligns with Qatar’s investments in developing green aviation solutions. With global initiatives like the International Civil Aviation Organization (ICAO) setting net-zero emissions targets by 2050, demand for hydrogen fuel cell-based systems is set to increase, positioning Qatar as a key market.

Market Challenges

High Development and Integration Costs

One of the major challenges faced by the Qatar Aircraft Fuel Cell Market is the high costs associated with developing and integrating hydrogen fuel cell technology in aircraft. The initial investment for fuel cell development, coupled with high production costs of hydrogen fuel cells, presents a significant barrier. Development costs can run into the hundreds of millions for a fully integrated fuel cell-powered aircraft. Additionally, the integration of hydrogen fuel systems into existing aircraft requires substantial modifications, further driving up costs. According to the International Air Transport Association (IATA), the high development cost for hydrogen-powered aircraft, estimated at over USD ~ billion for a single aircraft model, remains a major hurdle for the broader industry. This challenge is compounded by the need for specialized infrastructure, such as hydrogen fueling stations, to support the deployment of fuel cell aircraft, which also demands significant investment.

Limited Infrastructure for Hydrogen Fuel Distribution in Qatar

The lack of robust infrastructure for hydrogen fuel distribution in Qatar poses a considerable challenge to the adoption of hydrogen-powered aircraft. The country is still in the early stages of establishing the necessary hydrogen fueling stations and storage facilities required to support widespread use of fuel cell technology. While Qatar has committed to developing green hydrogen infrastructure, the scale of such an initiative takes time. Currently, there are only a few pilot hydrogen stations in operation within the country, and many of them are located in urban areas with limited access to aviation hubs. Qatar’s National Hydrogen Strategy, unveiled in 2025, outlines a goal to increase hydrogen production to ~ million tons by 2030. However, widespread infrastructure capable of supporting hydrogen aircraft remains a significant bottleneck. This slow pace of infrastructure development is likely to hinder the market’s growth until 2026, when the country plans to scale up hydrogen production and distribution across aviation and other sectors.

Opportunities

Rising Interest in Hybrid Electric and Hydrogen Aircraft Solutions

Hybrid electric and hydrogen aircraft solutions are garnering significant interest from airlines and aerospace companies worldwide, with Qatar following suit. The hybrid-electric technology offers a potential solution for reducing fuel consumption and lowering emissions, while hydrogen fuel cells provide a clean energy alternative. In Qatar, Qatar Airways has expressed its commitment to exploring hybrid electric and hydrogen propulsion for its fleet as part of its sustainability roadmap. Global leaders in the aerospace industry, such as Airbus and Boeing, are already investing heavily in hybrid-electric aircraft technologies, signaling growing opportunities in this sector. The combination of hybrid and hydrogen-powered solutions is expected to revolutionize the aviation industry, and Qatar is positioning itself as a key player in this transition by investing in the research and development of such technologies. As of 2025, investments in hybrid and hydrogen aircraft technology saw a substantial increase, with projects worth over USD ~ billion initiated globally, suggesting that the market will likely see expanded adoption in the coming years.

Integration of Fuel Cells with Hybrid Propulsion Systems in Aircraft

The integration of hydrogen fuel cells with hybrid propulsion systems presents a significant opportunity for Qatar’s aircraft fuel cell market. Hybrid propulsion systems, which combine conventional engines with hydrogen fuel cells, are seen as a promising pathway to reduce the carbon emissions of existing aircraft fleets. This integration is already being explored by major manufacturers, with significant progress made in testing hybrid systems. The growth in hybrid fuel cell propulsion is driven by the global push toward reducing aviation’s carbon footprint and meeting stricter emissions standards. Qatar’s proximity to key aerospace hubs and its ongoing investments in clean energy technology make it an ideal location for the development and testing of hybrid fuel cell-powered aircraft. Current advancements in hybrid systems, particularly in Europe and North America, are expected to extend to Qatar in the coming years, helping the country to remain at the forefront of sustainable aviation technology. The hybrid market segment is predicted to grow at an accelerated rate, with hybrid-electric aircraft expected to make up ~% of new aircraft deliveries globally by 2030.

Future Outlook

Over the next several years, the Qatar Aircraft Fuel Cell Market is expected to see substantial growth. Qatar’s ambitious commitment to reducing aviation emissions, supported by the growing global trend towards sustainable aviation technologies, will continue to drive the market. Qatar Airways is focusing on reducing its carbon footprint by introducing new fuel-efficient aircraft with hybrid propulsion systems, including the integration of fuel cells. As regional regulatory bodies like the Civil Aviation Authority of Qatar (QCAA) implement stricter emissions regulations, there will be a continued push for innovative fuel solutions, positioning fuel cells as the cornerstone for sustainable aviation in Qatar. With advancements in hydrogen production, storage, and distribution technologies, the market for fuel cell-powered aircraft will become increasingly viable, contributing to Qatar’s leadership in green aviation.

Major Players

- Ballard Power Systems

- Honeywell Aerospace

- Airbus

- Boeing

- Rolls-Royce

- Plug Power

- Hydrogenics

- PowerCell Sweden AB

- General Electric Aviation

- Toshiba Energy Systems & Solutions Corporation

- Parker Hannifin

- Mitsubishi Power

- SFC Energy

- L3Harris Technologies

- ITM Power

Key Target Audience

- Airline Operators

- Aerospace OEMs

- MRO Providers

- Military and Defense Aviation Agencies

- Government Agencies and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Hydrogen and Clean Energy Solution Providers

- Aircraft Fuel Cell System Suppliers

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying critical market dynamics, including regulatory frameworks, technological advancements in fuel cell systems, and the competitive landscape within Qatar’s aerospace and clean energy sectors.

Step 2: Market Analysis and Construction

We will compile and analyze historical data and trends related to Qatar’s aviation sector, fuel cell technology adoption, and emissions regulations. We will also evaluate the infrastructure requirements for hydrogen fuel and its integration into Qatar’s aviation ecosystem.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts from aerospace companies, regulatory bodies like the QCAA, and manufacturers of fuel cell technologies to ensure a robust understanding of the dynamics at play.

Step 4: Research Synthesis and Final Output

This step involves synthesizing data from primary and secondary sources, such as interviews, regulatory reports, and market studies, to produce a comprehensive and reliable market analysis of the Qatar Aircraft Fuel Cell Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Support for Sustainable Aviation Initiatives

Increasing Demand for Green and Sustainable Aircraft Propulsion Systems

Technological Advancements in Fuel Cell Efficiency and Durability - Market Challenges

High Development and Integration Costs

Limited Infrastructure for Hydrogen Fuel Distribution in Qatar

Regulatory and Certification Challenges for Fuel Cell Technology - Opportunities

Rising Interest in Hybrid Electric and Hydrogen Aircraft Solutions

Integration of Fuel Cells with Hybrid Propulsion Systems in Aircraft - Trends

Shift Toward Zero-Emission Aircraft Development

Collaborations Between Aerospace and Clean Energy Companies

Global Initiatives Supporting Hydrogen as an Aviation Fuel - Government Regulation

Qatar Civil Aviation Authority’s Aviation Safety Standards

ICAO’s Environmental Standards for Aircraft Emissions

- Market Size, 2020-2025

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Fuel Cell Type, (In Value %)

Proton Exchange Membrane Fuel Cells

Solid Oxide Fuel Cells

Alkaline Fuel Cells - By Aircraft Type, (In Value %)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft - By Application, (In Value %)

Primary Power Systems

Auxiliary Power Units

Emergency Power Systems - By End User, (In Value %)

Aircraft OEMs

MRO & Retrofit Services

Government & Military Contractors - By Region, In Value %)

Qatar

Middle East

Global Market Comparison

- Market Share of Major Players by Fuel Cell Type

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues by Fuel Cell Type, Number of R&D Initiatives, Market Footprint and Strategic Partnerships.)

- SWOT Analysis

- Price Matrix

- Porter’s Five Forces

- Detailed Profiles

Ballard Power Systems

Plug Power Inc.

Hydrogenics

Power Cell Sweden AB

Honeywell Aerospace

Airbus S.A.S.

Rolls-Royce plc

Boeing

Toyota Motor Corporation

Honeywell International Inc.

General Electric Aviation

L3Harris Technologies

Toshiba Energy Systems & Solutions Corporation

Fuel Cell Energy, Inc.

Aviation H2 Technologies

- Commercial aviation sustainability and emissions reduction focus

- Defense interest in silent and efficient onboard power generation

- Government-backed research and demonstration programs

- UAV demand for lightweight and long-endurance power systems

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035