Market Overview

The Qatar Aircraft Fuel Systems Market is USD ~ million big and has experienced substantial growth driven by the country’s rapidly expanding aviation industry and significant investments in modern infrastructure. Qatar’s aviation sector plays a pivotal role in the global market, with Hamad International Airport handling over ~million passengers in recent years, making it one of the busiest airports in the Middle East. Additionally, Qatar Airways, recognized as a major global airline, continues to expand its fleet, further driving the demand for advanced aircraft fuel systems. As Qatar continues its focus on modernization and sustainability, aircraft fuel systems are essential to achieving greater fuel efficiency and reducing emissions, solidifying their importance in the aviation ecosystem.

Qatar’s position as a leading hub for aviation in the Middle East contributes significantly to the dominance of the aircraft fuel systems market in the region. Doha, the capital, is home to Hamad International Airport, which is a crucial transit point for international air travel, reinforcing Qatar’s central role in the Middle Eastern aviation landscape. Qatar Airways continues to expand its fleet, which includes a variety of long-haul aircraft that require advanced fuel systems. The government’s robust investment in the aviation sector and the growing importance of Qatar as a global transit hub make it a dominant force in the region’s aircraft fuel systems market.

Market Segmentation

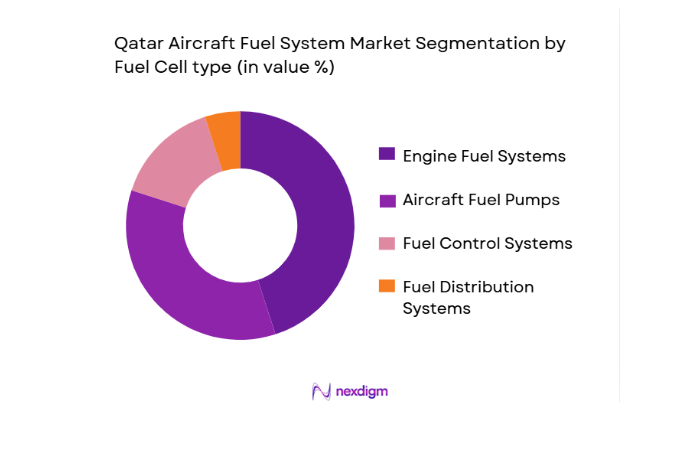

By Fuel System Type

The Qatar Aircraft Fuel Systems Market is segmented into various fuel system types, including Engine Fuel Systems, Aircraft Fuel Pumps, Fuel Control Systems, and Fuel Distribution Systems. Among these, Engine Fuel Systems hold the dominant market share due to the growing demand for advanced fuel-efficient engines in Qatar’s rapidly expanding aviation sector. These systems are integral to improving the fuel efficiency of aircraft, which is a key focus for Qatar Airways as it continues to modernize its fleet. Engine fuel systems also directly contribute to the reduction of carbon emissions, aligning with Qatar’s sustainability goals.

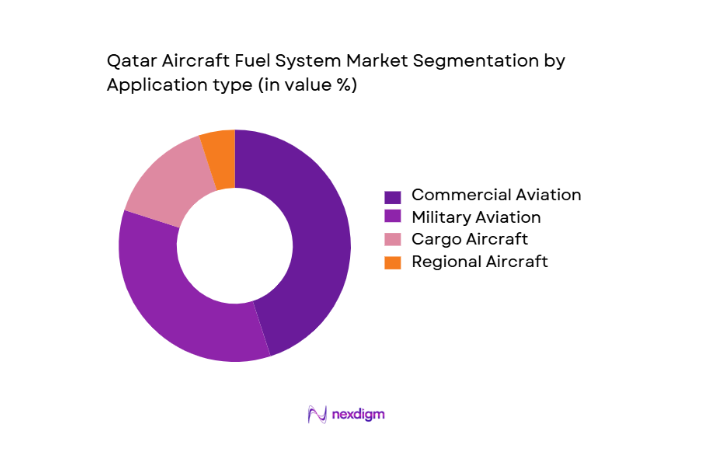

By Application

The Qatar Aircraft Fuel Systems Market is further segmented by application into Commercial Aviation, Military Aviation, Cargo Aircraft, and Regional Aircraft. The Commercial Aviation segment dominates the market, driven primarily by the expansion of Qatar Airways, which continues to increase its global reach with a growing fleet of long-haul aircraft. The need for advanced, efficient fuel systems is crucial as Qatar Airways continues to invest in environmentally friendly technologies to maintain its competitive edge in the aviation industry. This demand is further supported by Qatar’s strategic position as a hub for international flights.

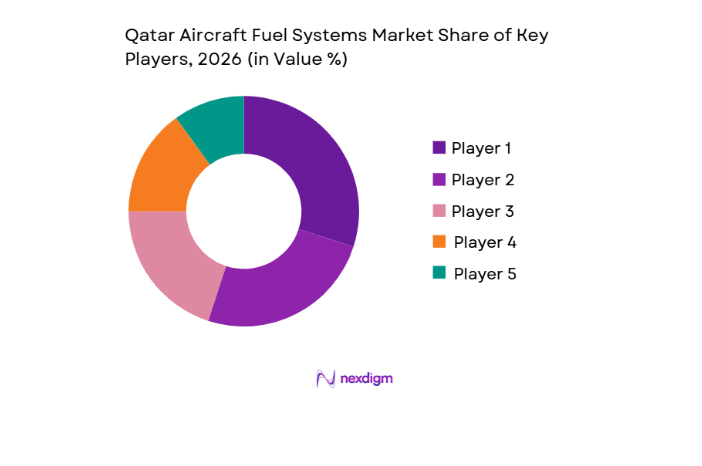

Competitive Landscape

The Qatar Aircraft Fuel Systems Market is dominated by a few major players, both global and regional, offering advanced technologies to meet the growing demand for efficient and sustainable fuel systems in aviation. Key players such as Honeywell Aerospace, GE Aviation, Rolls-Royce, Safran Aircraft Engines, and Embraer continue to innovate and expand their product portfolios to address the evolving needs of the aviation sector. These companies have strategic partnerships with Qatar Airways and other key stakeholders in the region, consolidating their dominance in the market. This consolidation highlights the significant influence of these companies, which are well-equipped to meet Qatar’s ambitious aviation growth and sustainability targets.

| Company | Establishment Year | Headquarters | Technology Focus | R&D Investment | Market Focus | Strategic Partnerships |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ |

Qatar Aircraft Fuel Systems Market Analysis

Growth Drivers

Increase in Air Traffic and Fleet Modernization

Qatar’s aviation sector has recorded substantial increases in passenger and aircraft activity, underscoring heightened demand for advanced aircraft fuel systems. Hamad International Airport served ~ million passengers in 2025, up from ~ million in 2024, evidencing robust traffic growth and expanding flight operations that drive fuel system utilization. Aircraft movements at the airport reached ~ operations, necessitating modern fuel system technologies that can handle higher throughput while ensuring efficiency and safety. Additionally, Qatar Airways operates a fleet of over ~ aircraft featuring modern Airbus and Boeing models, requiring contemporary fuel systems to support the diverse, longhaul and regional flight demands.

Focus on Fuel Efficiency and Environmental Regulations

The push toward greater fuel efficiency and reduced environmental impact is accelerating demand for innovative aircraft fuel systems in Qatar. Qatar Airways’ environmental initiatives include over ~ fuel optimisation projects designed to improve flight efficiency and reduce fuel burn, highlighting a direct industry focus on fuel management effectiveness. National and global aviation bodies, including ICAO, emphasize reductions in carbon emissions and implementation of sustainable aviation fuel frameworks, which increases the need for advanced fuel system technologies capable of integrating novel fuel types and enhancing combustion efficiency. These regulatory and industry actions underscore the importance of fuel systems that can support both operational efficiency and environmental mandates.

Market Challenges

High Initial Investment in Fuel System Technologies

Implementing advanced aircraft fuel system technologies presents a significant financial hurdle for aviation stakeholders in Qatar. Cuttingedge systems that support improved fuel flow regulation, realtime monitoring, and compatibility with alternative fuels require substantial R&D investment before operational rollout. Airlines such as Qatar Airways must balance these investments against other operational costs; for example, fuel remains one of the single largest expenses for carriers even amid optimisation efforts. The high cost of equipping fleets with sophisticated fuel systems, including sensors and automated management modules, can slow adoption. Moreover, infrastructure adjustments at key facilities like Hamad International Airport to support novel fuel handling further amplify upfront expenditure.

Regulatory Hurdles in Certification of Fuel Systems

Aircraft fuel systems must comply with stringent regulatory and safety requirements imposed by civil aviation authorities to ensure operational integrity. In Qatar, these systems must meet international airworthiness standards set by regulatory agencies and organisations such as ICAO, which requires extensive testing and validation before certification. Fuel system modifications, especially those intended for integration with alternative fuels or hybrid technologies, often undergo exhaustive evaluation processes to ensure reliability under diverse operating conditions. These regulatory hurdles extend certification timelines, increase compliance costs, and necessitate additional technical documentation and supplier coordination, posing significant barriers to rapid market entry and innovation.

Opportunities

Advancement in Hybrid and Electric Aircraft Fuel Systems

Emerging hybrid and electric aircraft concepts present meaningful opportunities for Qatar’s fuel systems market as airlines seek solutions that reduce traditional fuel reliance while maintaining performance. Research and technological developments in hybrid powertrains, such as those combining fuel cell systems with batteries for regional aircraft, highlight viable pathways to enhance energy efficiency without sacrificing range. These hybrid systems leverage advanced fuel management to optimise power distribution during flight, addressing utility limitations typical of energy storageonly solutions. Increased interest in integrating novel propulsion technologies can translate into demand for adaptable fuel systems capable of supporting hybrid configurations, positioning Qatar’s aviation infrastructure to benefit from global innovation trends in sustainable flight.

Increasing Focus on Sustainable Aviation Technologies

Sustainable aviation is a strategic priority for many carriers, including Qatar Airways, which is actively engaging in initiatives aimed at reducing carbon emissions and integrating cleaner fuels. Research projects in Qatar are focusing on sustainable aviation fuel alternatives, with initiatives estimating that such fuels could cut carbon emissions by up to ~percent compared with traditional jet fuel, underscoring the industry’s commitment to environmental solutions. As the aviation sector pivots toward broader adoption of sustainable aviation technologies, fuel systems must evolve to handle new fuel types, improved monitoring, and enhanced safety requirements. Qatar’s strategic investments in sustainability, coupled with global regulatory pressure on emissions, provide fertile ground for fuel system innovation and integration.

Future Outlook

Over the next few years, the Qatar Aircraft Fuel Systems Market is expected to experience significant growth driven by the ongoing expansion of Qatar’s aviation sector and the increasing demand for fuel-efficient and environmentally sustainable technologies. As Qatar Airways continues to expand its fleet, with a focus on long-haul aircraft, the need for advanced fuel systems will intensify. The shift toward reducing carbon emissions in line with global aviation sustainability goals will continue to drive innovation in fuel systems, particularly in hybrid and electric aircraft fuel systems. The market is also likely to benefit from the Qatar government’s long-term plans for aviation development, with investments focused on modernizing infrastructure and enhancing fuel management capabilities.

Major Players

- Honeywell Aerospace

- GE Aviation

- Rolls-Royce

- Safran Aircraft Engines

- Embraer

- Boeing

- Mitsubishi Heavy Industries

- UTC Aerospace Systems

- PowerCell Sweden AB

- Ballard Power Systems

- Plug Power

- Doosan Fuel Cell

- Toyota Industries Corporation

- Airbus

- ZeroAvia

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft Manufacturers

- Fuel System Technology Providers

- Aerospace Equipment Suppliers

- Airline Operators

- Environmental Agencies

- Aviation Sustainability Advocates

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping all stakeholders within the Qatar Aircraft Fuel Systems Market, including regulatory bodies, technology providers, and end-users. Secondary data collection is employed using a combination of proprietary and publicly available industry reports, databases, and governmental sources. The primary objective is to define key market variables and their impact on market dynamics.

Step 2: Market Analysis and Construction

This phase involves the collection and analysis of historical data related to market penetration, growth trends, and key technological advancements within the fuel systems sector. Detailed evaluations are conducted on the adoption rates of fuel system technologies and associated challenges faced by industry participants.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews with key industry stakeholders—including manufacturers, airline operators, and regulatory agencies—are conducted to validate market hypotheses. These consultations provide crucial insights into the operational challenges, market dynamics, and future trends driving the market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the research findings into actionable insights. Direct engagements with fuel system manufacturers, airlines, and regulatory bodies are conducted to validate the data and ensure accuracy. This process guarantees a comprehensive analysis and validated projections for the Qatar Aircraft Fuel Systems Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis of Qatar Aircraft Fuel Systems Market

- Timeline of Major Players

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in Air Traffic and Fleet Modernization

Focus on Fuel Efficiency and Environmental Regulations - Market Challenges

High Initial Investment in Fuel System Technologies

Regulatory Hurdles in Certification of Fuel Systems - Opportunities

Advancement in Hybrid and Electric Aircraft Fuel Systems

Increasing Focus on Sustainable Aviation Technologies - Trends

Shift Towards Smart and Autonomous Fuel Management Systems

Adoption of Green Aviation Fuel Systems - Government Regulation

- SWOT Analysis

- Pricing Analysis

- Porter’s Five Forces

- Market Value, 2020-2025

- Market Volume, 2020-2025

- Average Price Trends, 2020-2025

- By Fuel System Type (In Value %)

Engine Fuel Systems

Aircraft Fuel Pumps

Fuel Control Systems

Fuel Distribution Systems - By Application (In Value %)

Commercial Aviation

Military Aviation

Cargo Aircraft

Regional Aircraft - By Component (In Value %)

Fuel Pumps

Valves

Filters

Pipes

Fuel Tanks - By Distribution Channel (In Value %)

OEMs

Aftermarket - By Region (In Value %)

Central Region

Western Region

Eastern Region

Southern Region

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenues, Revenues by Type, Number of Touchpoints, Distribution Channels, Margins, Production Plants, Capacity, Unique Value Offering)

- SWOT Analysis

- Pricing Analysis Basis

- Detailed Profiles of Major Companies

Rolls-Royce

Honeywell Aerospace

Ballard Power Systems

Plug Power

Doosan Fuel Cell

UTC Aerospace Systems

PowerCell Sweden AB

Toyota Industries Corporation

Airbus

Boeing

GE Aviation

Safran Aircraft Engines

Mitsubishi Heavy Industries

Embraer

ZeroAvia

- Market Demand and Utilization in Civil Aviation

- Budget Allocations for Fuel System Development in Airlines

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Projected Market Value, 2026-2035

- Projected Market Volume, 2026-2035

- Projected Average Price Trends, 2026-2035