Market Overview

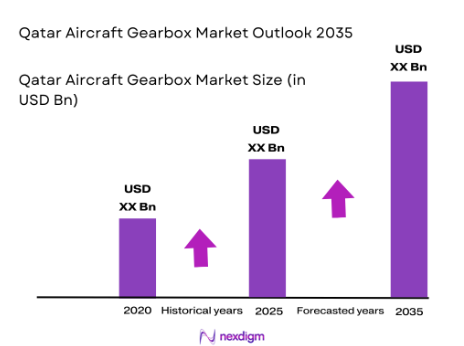

The Qatar Aircraft Gearbox market is valued at approximately USD ~ million, driven by the increasing demand for efficient, high-performance gearboxes used in commercial, military, and private aircraft. The market is experiencing growth, with Qatar’s aviation sector, particularly Qatar Airways, expanding its fleet significantly in recent years. Additionally, the rapid advancement of gearbox technology, such as the development of lightweight materials and higher fuel efficiency, further drives the demand. The rise in the adoption of fuel-efficient and next-gen aircraft also plays a major role in driving the market forward.

Qatar dominates the aircraft gearbox market within the Middle East, largely due to its significant investments in aviation infrastructure, spearheaded by Qatar Airways, a global leader in air transport. Doha’s strategic location as a global hub for air travel, coupled with Qatar’s expanding fleet, strengthens the market’s position. Furthermore, the country’s substantial investments in defense, bolstered by military aircraft procurements, create a growing demand for specialized aircraft gearboxes. Qatar’s focus on becoming a world-leading aviation center fuels the expansion of its aircraft gearbox market.

Market Segmentation

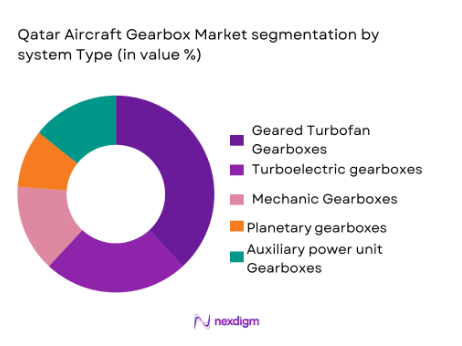

By System Type

The Qatar Aircraft Gearbox market is segmented into various system types, including turboelectric gearboxes, mechanical gearboxes, planetary gearboxes, geared turbofan gearboxes, and auxiliary power unit (APU) gearboxes. Geared turbofan gearboxes dominate this segment due to their critical role in modern aircraft engines, particularly in commercial aviation. These gearboxes are central to improving fuel efficiency and performance in next-generation aircraft like the Airbus A350 and Boeing 787. The increasing emphasis on fuel economy and the rising use of turbofan engines in long-haul flights are pushing the demand for these gearboxes in Qatar’s expanding fleet.

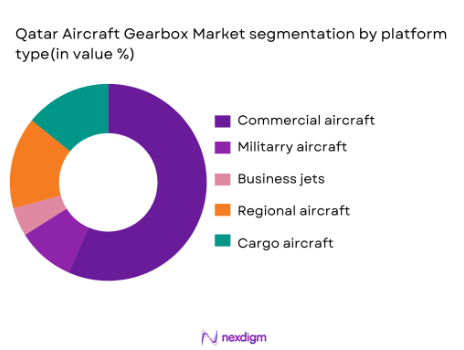

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, business jets, regional aircraft, and cargo aircraft. Commercial aircraft dominate this segment due to the significant fleet size of airlines such as Qatar Airways. The growing number of long-haul and wide-body aircraft, which rely on high-performance gearboxes for efficient operations, contributes to the dominance of this segment. Qatar’s strong focus on long-haul international travel and its continuous investment in expanding its fleet further drive the demand for aircraft gearboxes in commercial aviation.

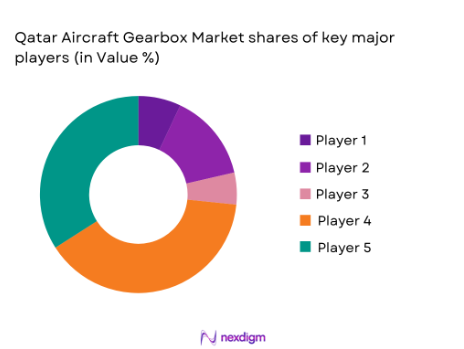

Competitive Landscape

The Qatar Aircraft Gearbox market is dominated by key players, including global leaders like Rolls-Royce, Pratt & Whitney, and Safran. These companies maintain strong market positions due to their advanced technology in aircraft engine systems and gearboxes. Rolls-Royce, for example, has a long-standing relationship with Qatar Airways, providing cutting-edge engines and gearbox systems for its fleet. The competitive landscape is characterized by continuous innovation in gearbox technology, with players focusing on improving fuel efficiency, reducing weight, and enhancing system reliability. These market leaders are well-positioned due to their global presence, strong R&D capabilities, and established customer bases.

| Company | Establishment Year | Headquarters | Product Range | Technological Focus | Major Clients | Partnerships & Collaborations |

| Rolls-Royce | 1904 | London, UK | – | – | – | – |

| Pratt & Whitney | 1925 | Connecticut, USA | – | – | – | – |

| Safran | 2005 | Paris, France | – | – | – | – |

| General Electric | 1892 | Boston, USA | – | – | – | – |

| Honeywell International | 1906 | Morris Plains, USA | – | – | – | – |

Qatar Aircraft Gearbox Market Dynamics

Growth Drivers

Expansion of Qatar Airways fleet

Qatar Airways, one of the world’s fastest-growing airlines, continues to expand its fleet, which directly impacts the demand for aircraft gearboxes. In 2023, Qatar Airways took delivery of 16 new aircraft, including wide-body models such as the Boeing 777 and Airbus A350, all of which require advanced gearboxes for optimal performance. As the airline operates one of the largest fleets of long-haul aircraft globally, this fleet expansion drives the demand for high-performance and durable gearboxes that can handle longer flight durations and heavier operational loads. This growth is set to continue as Qatar Airways plans to add up to 50 more aircraft by 2025.

Increased demand for fuel-efficient aircraft

With rising fuel costs and increasing environmental concerns, the demand for fuel-efficient aircraft is on the rise, directly influencing the demand for high-performance gearboxes. In 2023, the aviation industry saw significant interest in next-generation, fuel-efficient aircraft models like the Airbus A350 and Boeing 787, both of which rely on advanced gearbox systems. As these aircraft incorporate more efficient technologies, the need for specialized gearboxes that support these technologies becomes crucial. Qatar Airways’ ongoing fleet modernization, which emphasizes fuel efficiency, contributes to this growing demand for aircraft gearboxes designed for performance and fuel savings.

Market Challenges

High maintenance costs of aircraft gearboxes

Aircraft gearboxes, due to their complexity and critical role in engine performance, incur high maintenance costs. This poses a challenge, especially for operators like Qatar Airways, which maintain a large fleet of high-performance aircraft that require frequent servicing and replacement of gearbox components. The cost of maintaining and replacing gearboxes can be substantial, which directly affects airline operating costs. As Qatar Airways continues to expand its fleet, managing these high maintenance costs becomes a key challenge, as older aircraft with worn-out gearboxes require significant investment for continued operation.

Complexity of gearbox certification and safety regulations

Gearboxes used in aircraft must comply with rigorous certification and safety regulations, which add to the complexity and cost of production. The Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) impose stringent requirements for gearbox performance, safety, and durability. The certification process involves extensive testing, which can extend the lead time for producing and deploying new gearbox systems. As Qatar Airways introduces new aircraft models and upgrades its fleet, ensuring that the newly developed gearboxes meet the required safety standards presents a significant challenge, especially in a market with evolving regulations

Market Opportunities

Growth in military aircraft procurement in the Middle East

The growing defense budgets in the Middle East, particularly in countries like Qatar, present a significant opportunity for the aircraft gearbox market. In 2023, Qatar made substantial investments in upgrading its air force fleet, including new fighter jets and military transport aircraft, which require high-performance gearboxes. The regional shift towards enhancing military capabilities will drive the demand for specialized aircraft gearboxes designed to handle the demanding requirements of military aviation. As Qatar continues to bolster its defense sector, the procurement of military aircraft will contribute to an increasing need for advanced gearboxes. Source: Global Defense Review, 2023

Increase in regional air travel driving demand for new gearboxes

As air travel continues to grow in the Middle East, particularly within the Gulf Cooperation Council (GCC) region, the demand for new aircraft and subsequently for advanced gearboxes is increasing. The Middle East is expected to see a significant rise in regional air travel, with a projected 5% annual growth in passenger traffic. This surge in air travel, particularly short- and medium-haul flights, will lead to greater demand for new aircraft and more efficient gearbox systems. Qatar Airways, with its growing fleet, is expected to contribute to this demand, offering opportunities for the aircraft gearbox market in the region.

Future Outlook

The Qatar Aircraft Gearbox market is set for significant growth over the next decade. Driven by continued fleet expansion at Qatar Airways, the rise in fuel-efficient aircraft, and advancements in gearbox technologies, the market will experience strong demand. As Qatar Airways enhances its fleet with newer aircraft like the Airbus A350 and Boeing 787, the need for advanced gearboxes to optimize performance and efficiency will increase. Technological innovations, including the integration of hybrid-electric propulsion systems, will further shape the demand for specialized gearboxes in the coming years.

15 Major Players in the Market

- Rolls-Royce

- Pratt & Whitney

- Safran

- General Electric

- Honeywell International

- Boeing

- Airbus

- Liebherr Aerospace

- Avio Aero

- Magellan Aerospace

- Raytheon Technologies

- GKN Aerospace

- MTU Aero Engines

- ITP Aero

- L3 Technologies

Key Target Audience

- Airlines & Aircraft Operators

- Aircraft Manufacturers

- Aviation Equipment Suppliers

- Government & Regulatory Bodies

- OEMs

- Investors and Venture Capitalist Firms

- Military Forces

- Aerospace Industry Associations

Research Methodology

Step 1: Identification of Key Variables

This phase involves gathering information to identify key variables that influence the Qatar Aircraft Gearbox market. We conduct extensive desk research, drawing on secondary databases, government reports, and industry insights to understand market dynamics. Our goal is to identify major market drivers, growth factors, and technological advancements impacting the aircraft gearbox market.

Step 2: Market Analysis and Construction

During this phase, we will analyze historical data on the Qatar Aircraft Gearbox market, including market penetration, revenue trends, and market share by system type. We will also evaluate supply chain and procurement channels to assess future growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations with industry leaders, manufacturers, and airline operators. These interviews provide valuable insights into market trends, product innovation, and operational requirements, ensuring our findings are grounded in real-world expertise.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from research and expert consultations. We will deliver an actionable, comprehensive market report with verified insights into market trends, competitive analysis, and strategic recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of Qatar Airways fleet

Increased demand for fuel-efficient aircraft

Technological advancements in gearbox designs and materials - Market Challenges

High maintenance costs of aircraft gearboxes

Complexity of gearbox certification and safety regulations

Challenges in integrating new gearbox systems into legacy aircraft - Market Opportunities

Growth in military aircraft procurement in the Middle East

Increase in regional air travel driving demand for new gearboxes

Development of lightweight, fuel-efficient gearboxes for future aircraft - Trends

Rise of hybrid-electric propulsion systems requiring specialized gearboxes

Shift towards modular and more customizable gearbox solutions

Advancements in gearbox materials reducing weight and improving fuel efficiency

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turboelectric Gearboxes

Mechanical Gearboxes

Planetary Gearboxes

Geared Turbofan Gearboxes

Auxiliary Power Unit (APU) Gearboxes - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Regional Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Upgrades & Modifications

System Replacements - By End User Segment (In Value%)

Airlines

Government & Military

Aircraft Manufacturers

Private Jet Operators

Freight Carriers - By Procurement Channel (In Value%)

Direct Sales

OEM Contracts

Distributors

Third-party Procurement

Online Channels

- Market Share Analysis

- Cross Comparison Parameters (Price, Product Quality, Technological Innovation, Regulatory Compliance, Customer Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Boeing

Airbus

GE Aviation

Rolls-Royce

Pratt & Whitney

Honeywell International

Safran

Collins Aerospace

BendixKing

Magellan Aerospace

L3 Technologies

GKN Aerospace

SNECMA

Avio Aero

AeroVironment

- Airlines expanding fleets and upgrading gearboxes

- Military forces investing in new aircraft with advanced gearboxes

- Private jet owners seeking customized, high-performance gearboxes

- Aircraft manufacturers innovating in gearbox technology for better efficiency

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035