Market Overview

The Qatar Aircraft Gears market is valued at USD ~ billion in 2023, driven by a growing demand for advanced, efficient, and lightweight aircraft gear systems. The need for high-performance systems has been spurred by continuous innovations in aerospace technology, alongside the growth of aviation in the Gulf region. The market is also influenced by the expansion of Qatar Airways and increasing investments in the defense sector, boosting the demand for aircraft gears in both commercial and military aviation. The market’s size is expected to increase as new technological advancements drive demand for replacement, upgrades, and new systems.

Qatar, along with the UAE, leads the aircraft gears market in the Middle East due to its strong aviation infrastructure, including major hubs like Hamad International Airport. Qatar Airways, one of the world’s largest airlines, plays a key role in driving the demand for advanced aircraft gears, both in terms of fleet expansion and maintenance. The country’s strategic investments in defense and its position as an aviation hub in the region make it a dominant player in the market, further enhanced by government-backed aerospace initiatives and increased air traffic.

Market Segmentation

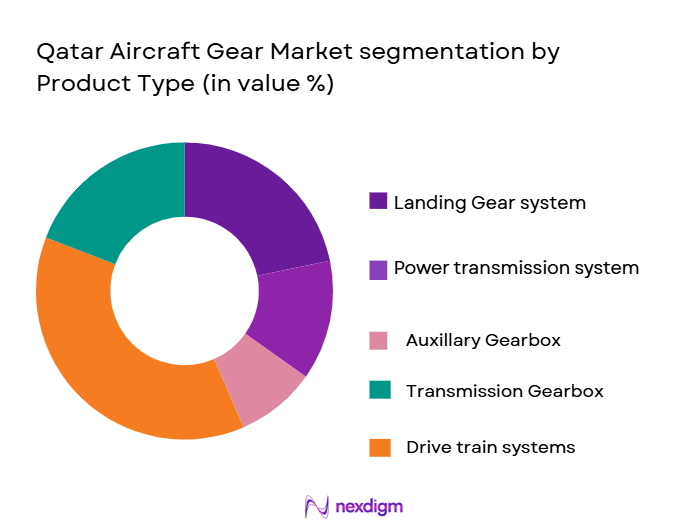

By Product Type

The Qatar Aircraft Gears market is segmented by product type into landing gear systems, power transmission systems, auxiliary gearboxes, main gearboxes, and drive train systems. Among these, landing gear systems hold the largest market share in 2024 due to their critical role in aircraft functionality. This segment benefits from the high demand for commercial and military aircraft, where advanced landing gear systems are essential for safety and efficiency. Moreover, the increasing frequency of aircraft takeoffs and landings in the region, alongside stringent regulations for aircraft safety and performance, makes this subsegment dominant. Leading players in the market, including Rolls-Royce and GE Aviation, focus on innovations that enhance the durability and performance of landing gear systems, which contributes to the market’s growth.

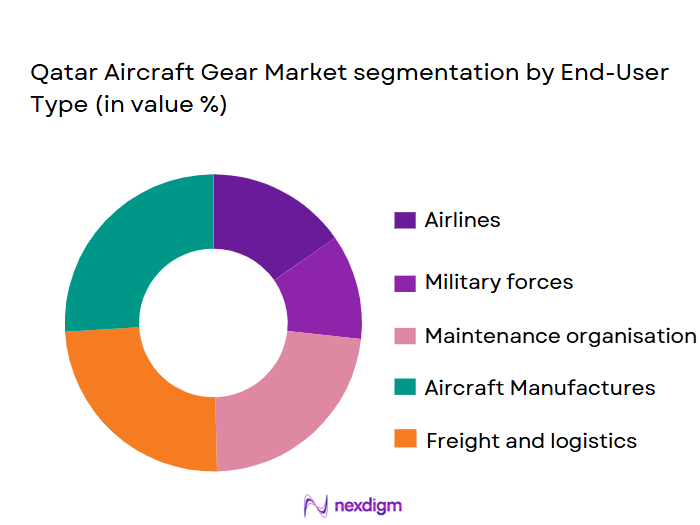

By End-User

The market is segmented by end-user into airlines, military forces, maintenance organizations, aircraft manufacturers, and freight & logistics companies. Airlines dominate this segment in 2024, driven by the significant fleet expansions and upgrades by regional airlines, especially Qatar Airways. The continuous demand for advanced aircraft systems, including gears, for fleet maintenance and new aircraft deliveries supports this dominance. Furthermore, the increase in air travel across the Middle East has prompted airlines to invest in more efficient, high-performance gear systems, making them the key contributors in this segment. Military forces, while important, hold a smaller share compared to the airline sector but still show steady growth due to increasing defense budgets and modernization efforts.

Competitive Landscape

The Qatar Aircraft Gears market is dominated by a few major players, including global giants such as Rolls-Royce, GE Aviation, Safran, Collins Aerospace, and Honeywell Aerospace. These companies have established strong footholds in the market through technological innovation, extensive distribution networks, and strategic partnerships with airlines and defense organizations. The consolidation of these key players reflects the high barriers to entry and the technological expertise required in the aircraft gears industry. Additionally, local players like Qatar Airways and Qatar Aeronautical College contribute significantly to the market’s dynamics, particularly in the MRO (Maintenance, Repair, and Overhaul) segment.

| Company | Establishment Year | Headquarters | Market Share (%) 2024 | Technological Innovation | Production Capacity | Distribution Network | MRO Services | Customer Base |

| Rolls-Royce | 1904 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | United States | ~

|

~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~

|

~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1934 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar aircraft gears Market Dynamics

Growth Drivers

Increased Aviation Traffic in the Middle East

The rapid growth of air traffic in the Middle East, particularly in Qatar, is a significant driver for the aircraft gears market. Qatar Airways, one of the world’s largest airlines, continues to expand its fleet, which directly increases the demand for aircraft gear systems. As the region becomes a hub for international air travel, the need for efficient and high-performance gears in commercial and military aircraft has surged. The Middle East’s air traffic volume, expected to continue increasing over the next decade, further supports this growth driver.

Technological Advancements in Aircraft Manufacturing

Ongoing innovations in aircraft technology, such as fuel-efficient engines, lightweight materials, and electric propulsion systems, contribute to the growing demand for advanced aircraft gear systems. The integration of these technologies requires high-performance gears capable of handling new design specifications and enhancing efficiency. As the industry focuses on sustainability and reducing operating costs, demand for technologically advanced and lightweight gear systems has increased, further driving market growth.

Market Challenges

High Production Costs of Aircraft Gear Systems

Aircraft gear systems are costly to produce due to the high-quality materials and precision engineering required. The rising cost of essential materials like titanium and high-strength alloys, coupled with advanced manufacturing processes, increases the overall production cost. This poses a challenge for manufacturers, as they must balance affordability with performance, especially in a market where cost optimization is crucial for airlines and aerospace companies.

Supply Chain Disruptions and Component Shortages

Global supply chain disruptions continue to affect the aircraft components industry, including gears. The shortage of critical components like titanium and delays in the delivery of essential raw materials have led to longer lead times and increased production delays. These disruptions have impacted the timely delivery of aircraft gear systems, causing bottlenecks in both commercial and military aircraft manufacturing, which hinders overall market growth.

Market Opportunities

Expanding Military Aircraft Demand in the Middle East

The growing defense budgets in the Middle East, particularly in Qatar, provide significant opportunities for the aircraft gears market. With increasing investments in military aviation and modernization programs, there is a rising demand for specialized gear systems for military aircraft. As Qatar continues to strengthen its defense capabilities, manufacturers of aircraft gears are poised to benefit from the increasing demand for high-performance, durable gear systems tailored for military applications.

Development of Electric and Hybrid Aircraft

The global shift towards environmentally friendly aviation presents an opportunity for the aircraft gears market. Electric and hybrid aircraft, which are being developed to reduce emissions and improve fuel efficiency, require specialized gear systems. As airlines and governments, including Qatar’s national carriers, invest in sustainable aviation technologies, the demand for lightweight, high-performance gears designed for these next-generation aircraft is expected to grow, positioning manufacturers for significant future growth.

Future Outlook

Over the next ~ to ~ years, the Qatar Aircraft Gears market is expected to witness steady growth, primarily driven by the continuous expansion of Qatar’s aviation sector and the region’s increasing defense expenditure. The growth in commercial air travel, coupled with advancements in aerospace technology and military modernization programs, will contribute to a substantial rise in the demand for aircraft gears. Additionally, government initiatives promoting the growth of the aerospace industry and significant investments by Qatar Airways will further enhance the demand for high-performance aircraft gear systems, ensuring the market remains dynamic and competitive.

Major Players

- Rolls-Royce

- GE Aviation

- Safran

- Collins Aerospace

- Honeywell Aerospace

- Liebherr Aerospace

- Héroux-Devtek

- MTU Aero Engines

- AeroVironment

- GKN Aerospace

- Pratt & Whitney

- Boeing

- Airbus

- Qatar Airways

- Qatar Aeronautical College

Key Target Audience

- Airlines and Aviation Companies

- Military and Defense Organizations (e.g., Qatar Armed Forces)

- Aircraft Manufacturers (e.g., Airbus, Boeing)

- MRO Service Providers

- Aerospace Equipment Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Qatar Civil Aviation Authority, Qatar Ministry of Defense)

- Aerospace Research and Development Entities

Research Methodology

Step 1: Identification of Key Variables

The first step in our research methodology is to create an ecosystem map of the Qatar Aircraft Gears market. This process involves conducting extensive desk research using both secondary and proprietary sources to gather insights into industry dynamics. Key variables influencing market growth, such as technological advancements, government regulations, and the competitive landscape, will be identified and defined.

Step 2: Market Analysis and Construction

In this phase, historical data from multiple sources will be analyzed to construct a comprehensive market model. This will include assessing the market penetration rate, examining the size of each product type and end-user segment, and evaluating the trends influencing the Qatar Aircraft Gears market. A detailed breakdown of product performance and revenue generation will also be undertaken.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through consultations with industry experts and professionals in the aerospace and aviation sectors. These will include structured interviews and computer-assisted telephone interviews (CATIs) with representatives from airlines, defense organizations, and aircraft manufacturers. Insights gathered will help refine the market data and ensure that it aligns with current industry trends and challenges.

Step 4: Research Synthesis and Final Output

The final research phase will involve direct engagement with key stakeholders in the Qatar Aircraft Gears market. This step will include validating the data and ensuring it accurately represents market conditions. Direct consultations will focus on obtaining product performance insights, sales trends, and future projections, providing a solid foundation for market forecasts and strategic recommendations.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air travel in the Middle East region

Advancements in aircraft technology

Government investments in defense and aerospace - Market Challenges

High cost of aircraft gear systems

Supply chain constraints for critical components

Fluctuations in fuel prices impacting the aerospace industry - Market Opportunities

Rising demand for military aircraft in the Gulf region

Emerging markets for UAV and drone technology

Shift toward electric and hybrid aircraft - Trends

Increasing use of lightweight materials in gear systems

Automation and AI in aircraft maintenance

Sustainability trends influencing manufacturing processes

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Gearboxes

Auxiliary Gearboxes

Power Gearboxes

Landing Gear Systems

Drive Train Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Helicopters

Business Jets

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Replacement Parts

Retrofitting

MRO (Maintenance, Repair, and Overhaul) - By End-user Segment (In Value%)

Airlines

Military Forces

Maintenance Organizations

Aircraft Manufacturers

Freight & Logistics Companies - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Suppliers

Online Procurement

Auction Marketplaces

Distributor/Wholesalers

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Technological Innovation, Production Capacity, Supply Chain Resilience, Customer Base) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

GE Aviation

Safran

Rolls-Royce

Honeywell Aerospace

Collins Aerospace

United Technologies Corporation

Liebherr Aerospace

Héroux-Devtek

MTU Aero Engines

AeroVironment

GKN Aerospace

Pratt & Whitney

Boeing

Airbus

Qatar Airways

- Growing demand for new commercial aircraft in Qatar

- Military expenditure driving demand for specialized gear systems

- Increased focus on MRO services and aftermarket

- Technological advancements driving innovation in end-user applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035