Market Overview

The Qatar Aircraft Heat Exchanger market is valued at approximately USD ~ million, based on data from the Qatar Civil Aviation Authority (QCAA). The demand for heat exchangers in aircraft is mainly driven by Qatar’s growing aviation industry, with an increasing fleet size that demands efficient cooling systems. As Qatar’s national carrier, Qatar Airways, continues to expand its operations globally, the need for advanced aircraft components like heat exchangers grows. Moreover, the shift towards more fuel-efficient aircraft with advanced materials and systems contributes to market growth, with Qatar’s aviation sector prioritizing energy efficiency.

Qatar dominates the aircraft heat exchanger market in the Middle East due to its strong aviation sector, led by Qatar Airways, which operates one of the youngest fleets globally. The country’s strategic location and robust investment in aviation infrastructure make it a hub for air travel in the region. Additionally, Qatar’s focus on sustainability and technological advancements in aircraft components positions it as a leader in adopting cutting-edge systems like heat exchangers, driving growth in this sector. Other influential players in the region include the UAE and Saudi Arabia, whose large airline fleets also contribute to the regional demand for high-performance aircraft systems.

Market Segmentation

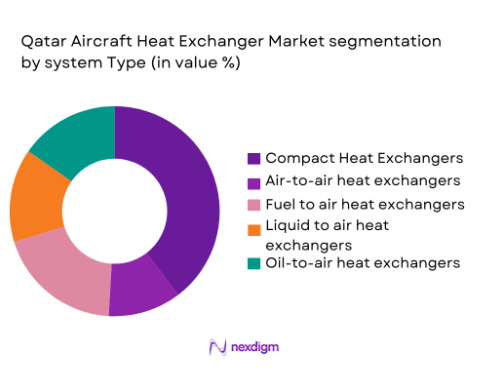

By System Type

The Qatar Aircraft Heat Exchanger market is segmented by system type into compact heat exchangers, air-to-air heat exchangers, fuel-to-air heat exchangers, liquid-to-air heat exchangers, and oil-to-air heat exchangers. Among these, compact heat exchangers dominate the market due to their lightweight and high-efficiency performance, which is crucial for modern aircraft. Compact designs enable reduced weight and space usage, allowing for better fuel efficiency and overall aircraft performance. Airlines like Qatar Airways prioritize compact heat exchangers as part of their fuel efficiency initiatives, driving the demand for this sub-segment.

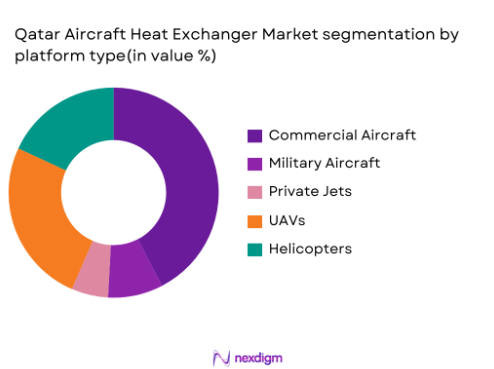

By Platform Type

The market is also segmented by platform type into commercial aircraft, military aircraft, private jets, unmanned aerial vehicles (UAVs), and helicopters. The commercial aircraft segment holds the largest market share due to the ongoing fleet expansion by airlines such as Qatar Airways, which continues to grow its fleet of long-haul aircraft. These aircraft require advanced heat exchangers for optimal performance, especially as airlines push for more sustainable and fuel-efficient operations. Qatar’s position as a key international aviation hub contributes to the dominance of this segment.

Competitive Landscape

The Qatar Aircraft Heat Exchanger market is characterized by the presence of both global and regional players, with a few major companies holding significant market share. The competition is marked by advanced technological offerings, with companies constantly innovating to meet the increasing demand for efficient heat exchangers. The market is dominated by key global players such as Honeywell, Collins Aerospace, and Safran, all of whom have strong ties with Qatar Airways and other Middle Eastern carriers. These players focus on providing advanced, lightweight, and fuel-efficient systems tailored to the specific needs of modern aircraft fleets.

| Company | Establishment Year | Headquarters | Technology Expertise | Product Range | Key Partnerships | Market Focus |

| Honeywell | 1906 | USA | – | – | – | – |

| Collins Aerospace | 2018 | USA | – | – | – | – |

| Safran | 2005 | France | – | – | – | – |

| Airbus | 1970 | France | – | – | – | – |

| Boeing | 1916 | USA | – | – | – | – |

Qatar Aircraft Heat Exchanger Market Dynamics

Growth Drivers

Rising Air Traffic in the Middle East Driving Demand for Aircraft Components

The Middle East aviation sector has seen significant growth, with passenger traffic in the region reaching 210 million in 2023. Qatar’s aviation market, driven by Qatar Airways, is a key contributor to this growth. The expansion of Qatar Airways’ fleet, which now includes over 200 aircraft, has increased the demand for essential components, such as heat exchangers, to ensure fuel efficiency and operational safety. As air traffic continues to rise, the need for advanced components that help manage aircraft temperatures efficiently grows. The International Air Transport Association (IATA) forecasts continued growth in the Middle East aviation sector, supporting the demand for heat exchangers in aircraft.

Technological Advancements in Heat Exchanger Systems Improving Performance

The adoption of advanced materials and technologies in heat exchanger systems is playing a significant role in improving performance and efficiency in aircraft. The aerospace sector is increasingly investing in heat exchangers made from lightweight materials such as titanium and composite alloys, which reduce weight and enhance thermal efficiency. Furthermore, the integration of digital technologies that monitor heat exchanger performance in real-time is gaining traction, improving overall system reliability. These advancements directly contribute to the growing demand for aircraft heat exchangers in Qatar’s expanding aviation industry.

Market Challenges

High Cost of Advanced Heat Exchanger Systems

One of the major challenges faced by the Qatar Aircraft Heat Exchanger market is the high cost of advanced systems. The manufacturing of high-performance heat exchangers involves sophisticated technologies and high-quality materials, making them expensive. As per the World Bank, the aerospace manufacturing industry continues to experience significant input cost pressures due to the rising prices of raw materials like aluminum, titanium, and advanced alloys. These rising material costs directly impact the final price of heat exchangers, making them a significant investment for airlines and aircraft manufacturers in Qatar.

Challenges in Maintaining High-Performance Standards in Extreme Operating Conditions

Heat exchangers in aircraft must operate under extreme conditions, including high temperatures, pressure variations, and altitude changes, which makes maintaining their performance a significant challenge. Qatar Airways operates long-haul flights to diverse destinations, requiring heat exchangers that can withstand these challenging conditions without failure. According to the International Civil Aviation Organization (ICAO), extreme weather events and fluctuating operational environments further exacerbate the challenge. Regular maintenance and testing are required to ensure that heat exchangers continue to perform efficiently, adding complexity and cost to operations.

Market Opportunities

Growing Demand for Sustainable Aircraft Technologies

There is a growing emphasis on sustainability in the aviation sector, with global trends shifting toward environmentally friendly technologies. In Qatar, the government has committed to reducing carbon emissions by 25% by 2030, which directly impacts the demand for energy-efficient aircraft systems, including heat exchangers. Qatar Airways has also made sustainability a priority by incorporating sustainable technologies into its fleet. The emphasis on reducing the environmental impact of air travel is pushing airlines to adopt heat exchangers that enhance fuel efficiency and reduce energy consumption.

Increased Military Spending in the Middle East Driving Demand for Defense Aircraft Components

Military spending in the Middle East has been steadily increasing, with Qatar expected to allocate USD 16 billion towards defense in 2024. This uptick in defense spending is driving demand for high-performance components for defense aircraft, including heat exchangers. Qatar’s military, as part of its modernization efforts, has been investing in advanced aircraft systems, contributing to the demand for heat exchangers that can operate efficiently under extreme military conditions. The growing focus on enhancing defense capabilities in Qatar and the broader region presents a promising opportunity for suppliers of aircraft components.

Future Outlook

Over the next decade, the Qatar Aircraft Heat Exchanger market is expected to show substantial growth driven by the continued expansion of Qatar Airways and the increasing need for fuel-efficient, advanced cooling systems. With Qatar investing heavily in aviation infrastructure and aiming to position itself as a key global aviation hub, the demand for high-performance aircraft components, such as heat exchangers, is poised to rise. Technological advancements, especially in lightweight materials and improved system efficiencies, will continue to fuel the market’s growth.

Major Players

- Honeywell

- Collins Aerospace

- Safran

- Airbus

- Boeing

- Raytheon Technologies

- United Technologies Corporation (UTC)

- Parker Hannifin

- Meggitt PLC

- Eaton Corporation

- Thales Group

- Ametek Inc.

- Rolls-Royce

- GE Aviation

- Liebherr Aerospace

Key Target Audience

- Airlines and Aviation Operators

- Aerospace Manufacturers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Providers

- Private Aircraft Owners

- Government and Regulatory Bodies

- Aircraft Component Suppliers

- Military and Defense Contractors

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map is created by identifying the key stakeholders in the Qatar Aircraft Heat Exchanger market. Extensive desk research, supported by secondary databases, is used to define critical variables affecting the market dynamics, including technological trends, regulatory factors, and customer demands.

Step 2: Market Analysis and Construction

The next phase involves compiling historical data on the Qatar Aircraft Heat Exchanger market, focusing on market penetration, trends, and emerging technologies. This includes analyzing aircraft fleet size, procurement channels, and regional demand drivers.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed and validated through interviews with experts from aerospace manufacturers, airlines, and component suppliers. These consultations provide valuable insights into current trends, technological advancements, and the practical challenges faced by industry players.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the research findings from both secondary data and expert consultations to produce a comprehensive and validated market outlook. This phase includes data validation through direct engagement with market players to refine market projections and provide actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising air traffic in the Middle East driving demand for aircraft components

Increased focus on fuel efficiency in aircraft operations

Technological advancements in heat exchanger systems improving performance - Market Challenges

High cost of advanced heat exchanger systems

Challenges in maintaining high-performance standards in extreme operating conditions

Regulatory hurdles in the certification of new heat exchanger technologies - Market Opportunities

Growing demand for sustainable aircraft technologies

Increased military spending in the Middle East driving demand for defense aircraft components

Opportunities in retrofitting older aircraft fleets with advanced heat exchangers - Trends

Shift towards lightweight and compact heat exchangers

Integration of digital monitoring systems in heat exchangers for real-time performance tracking

Growth of the Middle Eastern aerospace sector attracting global suppliers

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Compact Heat Exchanger

Air-to-Air Heat Exchanger

Fuel-to-Air Heat Exchanger

Liquid-to-Air Heat Exchanger

Oil-to-Air Heat Exchanger - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

Linefit

Retrofit

OEM Fitment

Aftermarket Fitment

Maintenance Fitment - By End User Segment (In Value%)

Airlines

Aircraft Manufacturers

Military and Defense Contractors

MRO Providers

Private Aircraft Owners - By Procurement Channel (In Value%)

Direct Procurement

Distributors & Resellers

OEM Procurement

Online Sales

Government Procurement

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Technological Integration, Regulatory Compliance, Pricing Strategy, After-Sales Service)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

GE Aviation

Honeywell International

Collins Aerospace

Safran

Airbus

Boeing

Raytheon Technologies

Diehl Aerospace

United Technologies Corporation (UTC)

Parker Hannifin

Airbus Defence and Space

Eaton Corporation

Lufthansa Technik

Meggitt PLC

Ametek Inc.

- Growing commercial airline fleet in Qatar increasing demand for heat exchangers

- Military demand for high-performance heat exchangers in defense aircraft

- Rapid growth in private aviation in Qatar creating a new market for heat exchangers

- Maintenance, repair, and overhaul (MRO) sector expanding due to aging fleets

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035