Market Overview

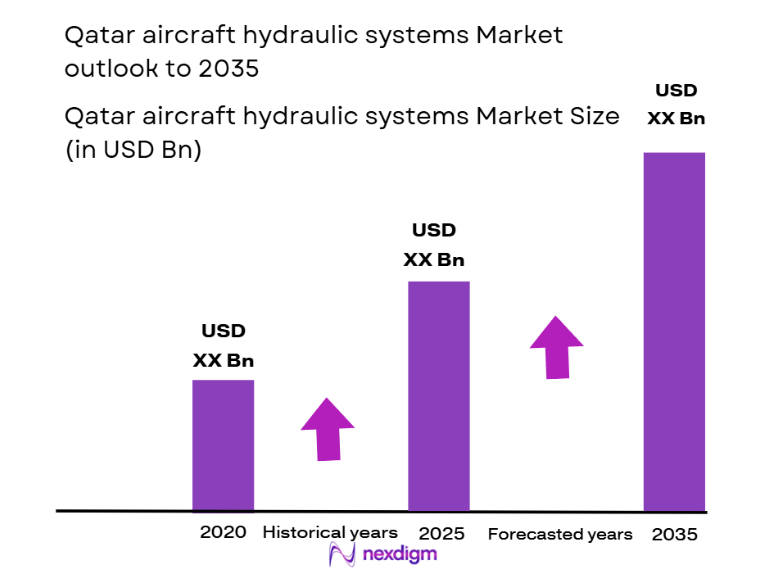

The Qatar aircraft hydraulic systems market is valued at approximately USD ~ billion in 2025, with substantial demand driven by the expansion of Qatar Airways’ fleet and increasing MRO (Maintenance, Repair, and Overhaul) activities within the region. The market is propelled by a growing need for sophisticated hydraulic systems for commercial aircraft, military, and private jets, underpinned by Qatar’s strategic role in aviation. Technological advancements in hydraulic components, such as lightweight actuators, are also contributing to the market’s positive trajectory.

The Qatar aircraft hydraulic systems market is dominated by Qatar, the UAE, and Saudi Arabia, with Qatar Airways leading the demand for hydraulic systems due to its rapidly expanding fleet. These countries have established themselves as aviation hubs, driven by their massive investments in infrastructure, modern airports, and aircraft fleets. Qatar Airways is one of the fastest-growing airlines globally, increasing the demand for high-performance hydraulic systems, both for new aircraft deliveries and MRO services. This dominance is supported by regional aviation regulations and robust government support for the aviation sector.

Market Segmentation

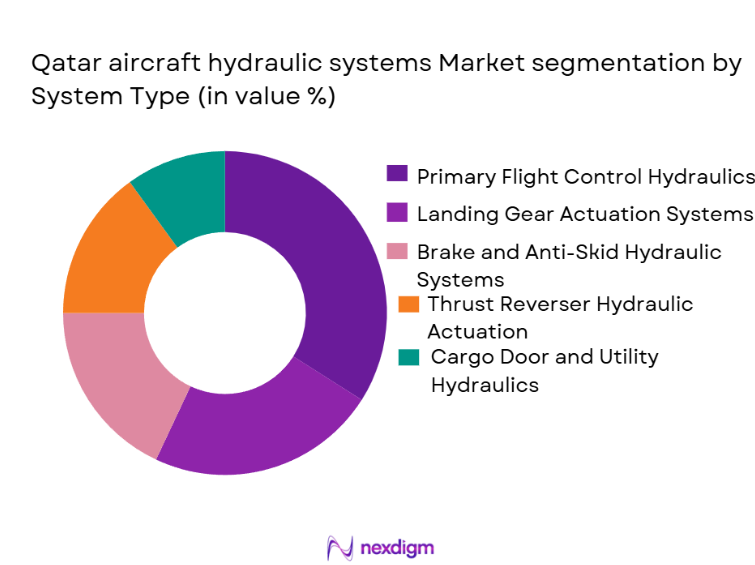

By System Type

The Qatar aircraft hydraulic systems market is segmented into primary flight control hydraulics, landing gear actuation systems, brake and anti-skid hydraulic systems, thrust reverser hydraulic actuation, and cargo door and utility hydraulics. Among these, primary flight control hydraulics holds the dominant market share. This segment is crucial due to the ever-increasing demand for aircraft that ensure high safety and efficiency standards. Aircraft manufacturers and fleet operators in Qatar, particularly Qatar Airways, prioritize reliable and advanced primary flight control systems, which are critical for smooth and safe operations of various flight control surfaces.

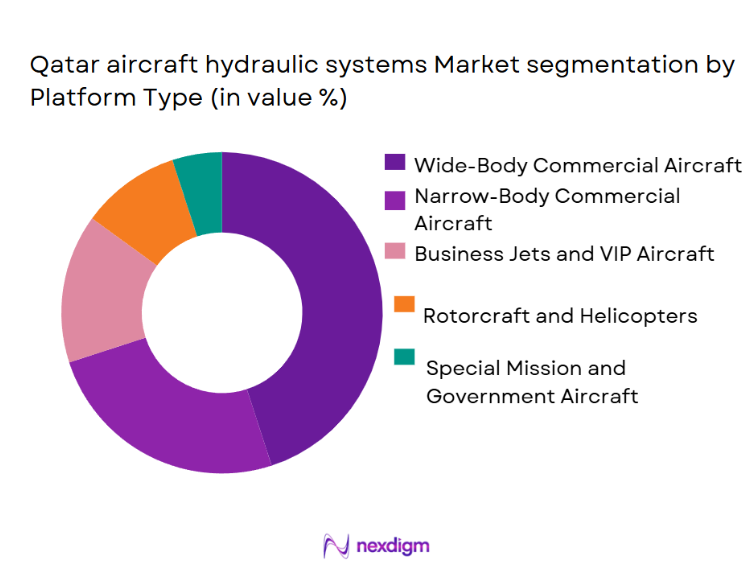

By Platform Type

In the Qatar aircraft hydraulic systems market, aircraft platforms are divided into narrow-body commercial aircraft, wide-body commercial aircraft, business jets and VIP aircraft, rotorcraft and helicopters, and special mission and government aircraft. The wide-body commercial aircraft segment dominates the market. This is primarily due to the significant investments by Qatar Airways in large-capacity, long-haul aircraft like the Boeing 777 and Airbus A350, both of which require advanced hydraulic systems for efficient performance. Additionally, wide-body aircraft are essential for Qatar Airways’ global operations, further boosting demand for specialized hydraulic components designed for larger aircraft.

Competitive Landscape

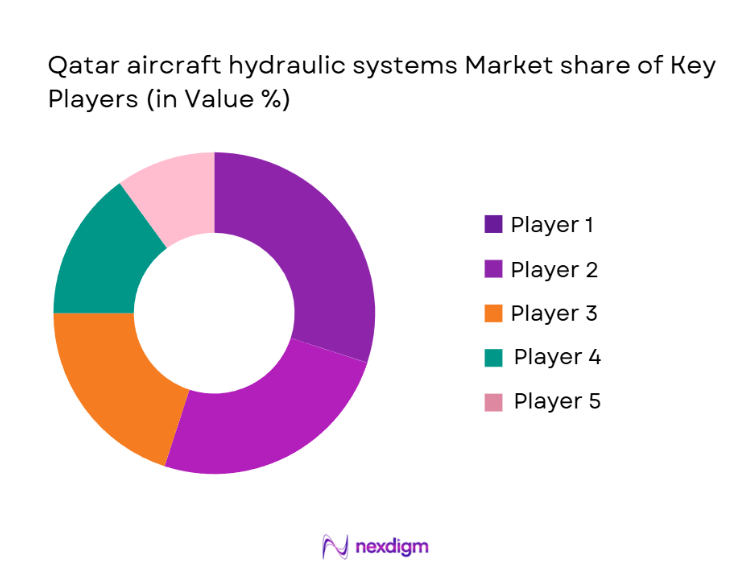

The Qatar aircraft hydraulic systems market is dominated by a few major global players, including firms such as Parker Aerospace, Eaton Aerospace, and Collins Aerospace. These companies have established strong footholds due to their innovation, extensive service networks, and long-standing relationships with original equipment manufacturers (OEMs). They provide highly reliable, state-of-the-art hydraulic systems critical for the operation of large commercial aircraft and military platforms. The market is also influenced by regional players that cater to the unique demands of the Middle Eastern aviation market.

| Company | Establishment Year | Headquarters | Hydraulic System Product Portfolio | Market Specialization | Key Clients | Partnerships & Collaborations |

| Parker Aerospace | 1917 | Cleveland, USA | ~ | ~ | ~ | ~ |

| Eaton Aerospace | 1911 | Dublin, Ireland | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1999 | Charlotte, USA | ~ | ~ | ~ | ~ |

| Moog Aircraft Systems | 1951 | East Aurora, USA | ~ | ~ | ~ | ~ |

| Liebherr Aerospace | 1949 | Lindenberg, Germany | ~ | ~ | ~ | ~ |

Qatar Aircraft Hydraulic Systems Market Analysis

Growth Drivers

Fleet Expansion and Aircraft Modernization

The continued growth and modernization of regional airline fleets, particularly with Qatar Airways expanding its operations, significantly drive the demand for advanced hydraulic systems. As airlines increasingly adopt new aircraft models with complex hydraulic requirements, manufacturers see a rise in demand for cutting-edge hydraulic components and systems.

MRO Industry Growth

The expanding Maintenance, Repair, and Overhaul (MRO) sector in the Middle East plays a critical role in the market’s growth. With the increasing number of aircraft requiring hydraulic system maintenance and upgrades, the growing number of MRO facilities in the region ensures a steady demand for hydraulic system components and services.

Market Challenges

High Maintenance Costs

One of the key challenges is the high cost associated with maintaining hydraulic systems, including parts replacement and routine checks. The need for specialized knowledge and the complex nature of hydraulic components can create operational inefficiencies and high costs for operators, especially when dealing with life-limited components.

Supply Chain Disruptions

The global supply chain disruptions, particularly related to aerospace components, pose a challenge to the market. Issues such as delays in component shipments and component shortages, especially during peak demand periods, can cause delays in production, increasing costs, and potentially affecting delivery timelines for customers.

Opportunities

Technological Advancements

Ongoing advancements in hydraulic technologies, such as more efficient, lighter systems and digital monitoring tools for predictive maintenance, present significant opportunities for growth. These innovations enable airlines and MRO providers to reduce maintenance costs, improve system reliability, and extend component life, making them attractive to fleet operators.

Growing Demand for Regional Air Travel

As regional air travel continues to expand in the Middle East, the demand for reliable, high-performance hydraulic systems is expected to increase. Regional carriers and private jet operators require advanced hydraulic systems to meet safety and performance standards, providing growth opportunities for manufacturers in this sector.

Future Outlook

Over the next 5 years, the Qatar aircraft hydraulic systems market is expected to show significant growth driven by continuous fleet expansion, particularly by Qatar Airways, and the increasing demand for high-tech hydraulic systems for both commercial and military aircraft. The market will benefit from ongoing advancements in hydraulic system design, with a focus on reducing weight, improving reliability, and enhancing system performance to meet the growing aviation demands in the region. Additionally, advancements in digital hydraulic systems and predictive maintenance technologies will further drive the growth of the market.

Major Players

- Parker Aerospace

- Eaton Aerospace

- Collins Aerospace

- Moog Aircraft Systems

- Liebherr Aerospace

- Honeywell Aerospace

- Safran Landing Systems

- Ametek MRO Solutions

- Triumph Actuation Systems

- Meggitt Aircraft Braking Systems

- Kawasaki Precision Machinery

- Woodward Aerospace

- Marotta Controls

- Senior Aerospace

- HAECO Component Overhaul

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airline Operators

- Aircraft Manufacturers

- Aerospace Component Suppliers

- MRO Service Providers

- Aviation Consulting Firms

- Aircraft Leasing and Asset Management Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of key stakeholders in the Qatar aircraft hydraulic systems market. Through extensive desk research, secondary sources such as industry reports and proprietary databases are utilized to gather data about market drivers, challenges, and segmentation. The objective is to define critical variables influencing the market’s growth trajectory.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to identify trends, revenue patterns, and market penetration for Qatar’s aircraft hydraulic systems. This involves evaluating segment performance and forecasting market dynamics across various categories such as system types and platform types. This step ensures accurate data compilation and reliable analysis.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, consultations are conducted with industry experts via interviews and surveys. This process involves engaging with professionals from top aerospace manufacturers and MRO service providers in Qatar. These interactions help refine the accuracy of the market data and offer insight into operational practices and business strategies.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and comparing it with market observations. Through direct engagements with OEMs, suppliers, and key industry players, the data is verified and refined to ensure the final report is comprehensive, accurate, and reflective of the actual market conditions. This final output includes a detailed analysis of both historical and forecasted trends in the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Fleet expansion and renewal programs by Qatar-based operators increasing demand for modern hydraulic actuation and braking systems

Rising heavy maintenance activity and component overhaul cycles driving recurring aftermarket purchases of pumps, valves, actuators, and seals

Operational reliability requirements encouraging higher spend on predictive maintenance, spares provisioning, and certified replacement components - Market Challenges

Long lead times and supply-chain constraints for certified hydraulic components creating AOG risk and inventory cost pressure

Strict airworthiness compliance and certification documentation requirements limiting alternative sourcing and increasing qualification timelines

Skill and tooling requirements for hydraulic testing, contamination control, and overhaul capacity constraining local throughput - Market Opportunities

Expansion of in-country MRO capabilities enabling localized hydraulic component repair, test benches, and spares pooling partnerships

Adoption of health-monitoring and contamination-sensing solutions to reduce unscheduled removals and optimize component life

Growing demand for lightweight, high-pressure, and low-leakage architectures supporting more-electric aircraft initiatives and efficiency targets - Trends

Shift toward performance-based logistics and power-by-the-hour contracts for hydraulic LRUs and rotable pools

Increased focus on hydraulic fluid cleanliness management, filtration upgrades, and contamination diagnostics across fleets

Greater use of digital MRO systems integrating part traceability, service bulletins, and component life tracking for hydraulics

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Primary Flight Control Hydraulics

Landing Gear Actuation Systems

Brake and Anti-Skid Hydraulic Systems

Thrust Reverser Hydraulic Actuation

Cargo Door and Utility Hydraulics - By Platform Type (In Value%)

Narrow-Body Commercial Aircraft

Wide-Body Commercial Aircraft

Business Jets and VIP Aircraft

Rotorcraft and Helicopters

Special Mission and Government Aircraft - By Fitment Type (In Value%)

Linefit on New Aircraft Deliveries

Retrofit and Modification Programs

Overhaul Replacement During Heavy Checks

On-Condition Component Swap

Life-Limited Component Replacement - By EndUser Segment (In Value%)

Commercial Airlines and Fleet Operators

MRO Service Providers

Government and Defense Aviation Units

Business Aviation Operators

Aircraft Leasing and Asset Management Firms - By Procurement Channel (In Value%)

OEM Direct Contracts

Authorized Aftermarket Distributors

MRO Bundled Procurement Agreements

Long-Term Service Agreements and PBH

Tenders via Government and Flag-Carrier Procurement

- Market Share Analysis

- CrossComparison Parameters (Hydraulic LRU portfolio breadth, Local MRO and test capability, Certification and traceability compliance, Lead time and AOG logistics support, Total cost of ownership and PBH pricing, Fleet coverage across platforms)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Safran Landing Systems

Parker Aerospace

Eaton Aerospace

Collins Aerospace

Honeywell Aerospace

Moog Aircraft Group

Liebherr-Aerospace

Meggitt Aircraft Braking Systems

Kawasaki Precision Machinery

Triumph Actuation Systems

Woodward Aerospace

Marotta Controls

Ametek MRO Solutions

Senior Aerospace (Hydraulics)

HAECO Component Overhaul

- Commercial operators prioritize dispatch reliability, rapid AOG support, and high-availability rotable pools for critical hydraulic LRUs

- MRO providers differentiate via certified test capability, contamination control processes, and turnaround time for actuators, pumps, and servo valves

- Government and special-mission fleets emphasize ruggedization, supply assurance, and configuration control for bespoke hydraulic architectures

- Business aviation users favor premium OEM-aligned support, quick replacement logistics, and high-quality seals/hoses to minimize downtime

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035