Market Overview

The Qatar Aircraft Insulation market has witnessed a robust growth trajectory due to increasing demand for improved passenger comfort, safety, and fuel efficiency in aviation. The market is valued at approximately USD ~million, with growth driven by the expansion of the aviation sector, particularly in commercial and defense aircraft. Growing passenger air traffic, coupled with stringent noise and heat insulation regulations, propels the demand for advanced aircraft insulation solutions. Moreover, government initiatives to bolster aerospace capabilities and improve infrastructure are contributing to the overall market expansion.

Qatar’s aircraft insulation market is largely influenced by the presence of Doha, the nation’s capital, which serves as a hub for both commercial and military aviation. Qatar Airways, one of the world’s leading airlines, plays a significant role in driving demand for aircraft insulation as it continues to expand its fleet of long-haul aircraft. Additionally, the country’s strategic investments in defense and aerospace capabilities further amplify the demand for high-performance insulation materials, particularly in military aircraft. The nation’s ambition to enhance its aerospace infrastructure makes Doha and other metropolitan areas key players in the market’s dominance.

Market Segmentation

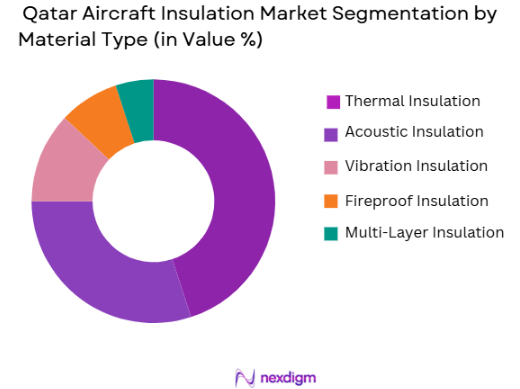

By Material Type

The Qatar Aircraft Insulation market is segmented by material type into thermal insulation, acoustic insulation, vibration insulation, fireproof insulation, and multi-layer insulation. Among these, thermal insulation has gained the largest market share in recent years. This is due to the rising emphasis on temperature regulation in aircraft, which is essential for ensuring passenger comfort and fuel efficiency. Thermal insulation is integral to maintaining temperature stability in aircraft, contributing to improved energy efficiency and reduced operational costs. Aircraft manufacturers and MRO service providers are increasingly adopting advanced thermal insulation materials to comply with safety and environmental standards, driving the segment’s dominance.

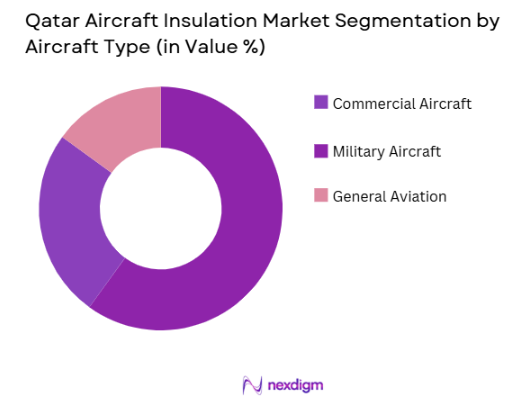

By Aircraft Type

The aircraft insulation market in Qatar is also segmented by aircraft type, including commercial aircraft, military aircraft, and general aviation. Commercial aircraft dominates the segment due to the consistent growth in global air travel. With airlines, particularly Qatar Airways, investing in expanding their fleets and upgrading older models, the demand for insulation in these aircraft is significant. Furthermore, regulatory requirements surrounding noise and heat reduction in passenger cabins have led to an increased use of insulation materials. As Qatar continues to enhance its airline infrastructure, the commercial aircraft segment remains the leading driver of the aircraft insulation market.

Competitive Landscape

The Qatar Aircraft Insulation market is characterized by a mix of global players and regional companies that dominate through strong production capabilities, extensive distribution networks, and technological innovation. Major international players such as 3M, Honeywell, and DuPont have a significant presence, alongside regional firms like Hindustan Aeronautics Limited and Safran. These companies leverage their expertise in aerospace materials and advanced insulation solutions to secure a competitive edge in the market.

| Company Name | Establishment Year | Headquarters | Material Type Focus | Production Facilities | R&D Investment | Strategic Alliances | Revenue |

| 3M Company | 1902 | USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell International Inc. | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| DuPont de Nemours, Inc. | 1802 | USA | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | India | ~ | ~ | ~ | ~ | ~ |

| Safran SA | 2005 | France | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Insulation Market Analysis

Growth Drivers

Urbanization

The urbanization in Qatar is rapidly transforming its infrastructure, with the population of Doha increasing at a significant rate. Qatar’s population reached ~million in 2023, with a large portion of this growth attributed to urban migration, particularly to cities like Doha, which serve as hubs for business, trade, and air travel. This influx of people leads to higher demand for air travel, thereby increasing the need for modernized fleets and energy-efficient aircraft. Consequently, Qatar’s growing urban population directly drives the demand for advanced aircraft insulation solutions that promote energy efficiency and passenger comfort in these high-demand cities.

Industrialization

Qatar’s industrial expansion is a key factor stimulating growth in the aircraft insulation market. As part of its National Vision 2030, Qatar has been diversifying its economy by boosting its manufacturing and aviation sectors. This shift has led to the creation of various aerospace manufacturing hubs and maintenance facilities. Qatar is positioning itself as a regional leader in defense and aerospace industries, encouraging the construction of infrastructure that caters to both commercial and military aviation. This growth will increase the demand for high-quality insulation materials in aircraft, particularly for temperature regulation, noise reduction, and fire safety.

Restraints

High Initial Costs

The upfront costs of high-performance insulation materials are a significant barrier to market growth in Qatar. As aircraft insulation materials are generally expensive due to advanced manufacturing processes and raw materials, the initial investment required by airlines and manufacturers is considerable. For instance, the cost of materials like advanced thermal insulation and fire-resistant materials for high-performance aircraft insulation can be prohibitively high, affecting the adoption rate of these technologies in the region. While long-term benefits include energy savings and increased aircraft lifespan, the high initial cost remains a challenge.

Technical Challenges

The integration of advanced insulation materials into aircraft presents significant technical challenges. These materials require specialized installation techniques and rigorous testing to meet both domestic and international aviation standards. In 2024, the industry continues to face challenges related to the compatibility of insulation materials with various aircraft types, such as narrow-body and wide-body aircraft. Ensuring seamless integration without compromising performance or safety is a critical hurdle for manufacturers, and it requires ongoing research and development efforts to overcome.

Opportunities

Technological Advancements

Technological innovations in insulation materials are creating vast opportunities for the Qatar aircraft insulation market. As Qatar invests in next-generation aircraft, such as the Airbus A350 and Boeing 787, which require lightweight, efficient insulation solutions, new materials like composite and hybrid systems are gaining traction. These advancements not only contribute to lower weight and better fuel efficiency but also enhance acoustic and thermal performance. As the aviation sector in Qatar continues to evolve, demand for these cutting-edge insulation technologies is expected to increase, providing a robust growth opportunity for market players.

International Collaborations

Qatar’s growing role in the international aerospace community provides a unique opportunity for international collaborations in the aircraft insulation sector. The country’s ongoing partnerships with global defense contractors and aerospace giants like Boeing and Airbus open avenues for the adoption of advanced insulation technologies tailored to the needs of the Qatari aviation market. As Qatar’s aerospace sector continues to expand through these partnerships, the demand for specialized insulation solutions is poised to rise, further driving growth in the insulation materials sector.

Future Outlook

Over the next decade, the Qatar Aircraft Insulation market is expected to experience steady growth. This growth will be fueled by continuous advancements in insulation materials, including the development of lightweight, environmentally friendly solutions. The demand for insulation is also poised to increase due to the rising number of aircraft in Qatar’s fleet and the strategic importance of improving fuel efficiency and passenger comfort. The government’s ongoing investments in the defense and aerospace sectors will further propel market growth. Furthermore, technological innovations such as smart insulation materials and composite solutions will provide new opportunities for growth.

Major Players in the Qatar Aircraft Insulation Market

- 3M Company

- Honeywell International Inc.

- DuPont de Nemours, Inc.

- Hindustan Aeronautics Limited

- Safran SA

- Rockwool International A/S

- Saint-Gobain

- Thermotech Insulation Systems

- Armacell International

- Huntsman International LLC

- BASF SE

- Morgan Advanced Materials

- Parker Aerospace

- GE Aviation

- Eaton Aerospace

Key Target Audience

- Aircraft Manufacturers

- MRO (Maintenance, Repair, and Overhaul) Service Providers

- Government Defense Agencies (Ministry of Defense – Qatar)

- Aerospace Component Suppliers

- OEMs (Original Equipment Manufacturers)

- Investments and Venture Capitalist Firms

- Aviation Regulatory Bodies (Civil Aviation Authority – Qatar)

- Airlines and Aircraft Operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables influencing the Qatar Aircraft Insulation market. This includes conducting thorough desk research using secondary data sources such as industry reports, government publications, and company websites. The goal is to map the major stakeholders, product categories, and market trends.

Step 2: Market Analysis and Construction

Historical data pertaining to Qatar’s aircraft industry will be compiled and analyzed. This includes examining the penetration of insulation materials across different types of aircraft, as well as understanding the distribution networks for insulation products. This phase helps build the foundation for understanding market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

To validate hypotheses, interviews will be conducted with industry experts, including stakeholders from aircraft manufacturers, insulation material suppliers, and government defense agencies. These consultations help refine market insights and validate assumptions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from various sources and validating the findings through direct consultations with major aircraft manufacturers and insulation solution providers. This ensures the comprehensive and accurate representation of the Qatar Aircraft Insulation market.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions; Aircraft Insulation Procurement Cycle Mapping; Data Sources & Validation; Supply Chain Primary Interviews; Market Modelling & Forecasting Logic; Limitations; Validation with Aircraft OEMs and End-Users)

- Definition and Scope

- Market Genesis & Policy Evolution

- Historical/Technological Timeline

- Aircraft Insulation Value Chain Analysis

- Regulatory & Standards Framework

- Growth Drivers

Rising Demand for Aircraft Comfort and Noise Reduction

Increased Air Travel and Aircraft Fleet Expansion

Government Initiatives in Aviation Infrastructure Development

Advancements in Insulation Technologies - Market Challenges

High Raw Material and Production Costs

Regulatory and Certification Complexity

Limited Availability of Sustainable Insulation Materials

- Trends

Use of Composite Materials for Aircraft Insulation

Innovations in Acoustic Insulation

Integration of Smart Insulation Systems with IoT

- Opportunities

Sustainable and Eco-Friendly Aircraft Insulation Solutions

Growth in Military and Defense Aviation

Adoption of Lightweight Insulation Materials for Fuel Efficiency

- Government Regulations

Certification Standards for Aircraft Insulation

International Safety and Environmental Regulations

Aircraft Noise and Heat Regulation Compliance - SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Installed Base, 2020-2025

- By Material Type, 2020-2025

- By Material Type (In Value %)

Thermal Insulation

Acoustic Insulation

Vibration Insulation

Fireproof Insulation

Multi-Layer Insulation - By Aircraft Type (In Value %)

Commercial Aircraft

Military Aircraft

General Aviation

Helicopters and Rotorcraft - By End-User (In Value %)

OEM

Aftermarket and MRO - By Aircraft Segment (In Value %)

Narrow-Body Aircraft

Wide-Body Aircraft

Regional Aircraft - By Region (In Value %)

Doha

Al Rayyan

Al Wakrah

Northern Qatar

- Market Share Analysis

- Cross-Comparison Parameters (System Integration Capability, Platform Compatibility, MoD/International Certifications, R&D Intensity, Production and Maintenance Ecosystem, Aftermarket Support Network, Strategic Alliances & Local Partnerships)

- SWOT Analysis of Major Players

- Pricing & Procurement Analysis

- Major Players

3M Company

Honeywell International Inc.

Rockwool International A/S

Saint-Gobain

DuPont de Nemours, Inc.

Thermotech Insulation Systems

Armacell International

Huntsman International LLC

Hindustan Aeronautics Limited

SABIC

BASF SE

Morgan Advanced Materials

Safran SA

Parker Aerospace

General Electric Aviation

- Air Force Operational Demand and Insulation Requirements

- Commercial Aviation Demand for Acoustic and Thermal Insulation

- Budget Allocations for Aircraft Fleet Modernization and Maintenance

- Decision-Making Process in Aircraft Insulation Procurement

- Regulatory & Compliance Needs for Aircraft Operators

- By Value, 2026-2035

- By Volume, 2026-2035

- By Installed Base, 2026-2035

- By Material Type and Technology Adoption, 2026-2035