Market Overview

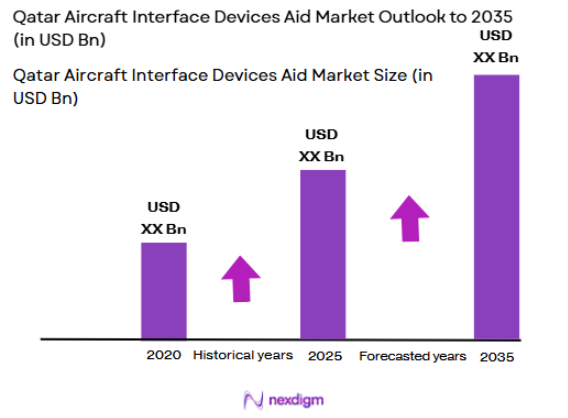

The Qatar Aircraft Interface Devices Aid market is a dynamic and growing segment in the aerospace industry. In recent years, the market has shown robust growth, primarily driven by increasing demand for advanced aircraft systems that improve operational efficiency and safety. The market size is influenced by the technological advancements in aircraft systems and the increasing adoption of advanced interface devices by airlines and military sectors. The expansion of aviation infrastructure in the region and the rising number of aircraft in operation contribute to market growth. In 2024, the Qatar Aircraft Interface Devices Aid market is valued at approximately USD ~ million, with significant contributions from both local and international players, providing a strong foundation for future expansion.

Several key countries and cities dominate the Qatar Aircraft Interface Devices Aid market, with Qatar itself playing a central role due to its advanced aerospace industry and substantial investments in aviation infrastructure. Other countries in the Middle East, such as the UAE and Saudi Arabia, also contribute significantly, with increasing aircraft fleets and airport developments in major cities like Doha, Dubai, and Riyadh. These regions benefit from government support, infrastructure projects, and a growing demand for air travel, contributing to their dominance in the market.

Market Segmentation

By System Type

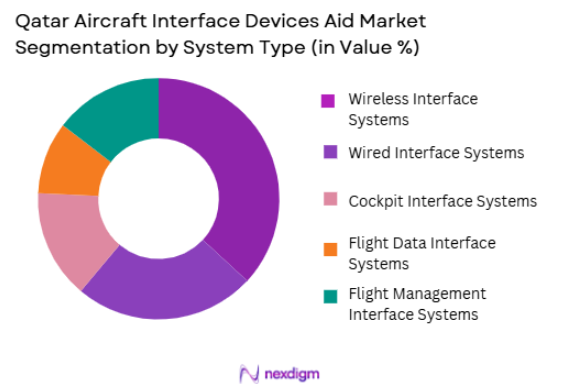

The Qatar Aircraft Interface Devices Aid market is segmented by system type into wireless interface systems, wired interface systems, cockpit interface systems, flight data interface systems, and flight management interface systems. Among these, wireless interface systems dominate the market due to their ease of installation and increasing demand for connectivity and communication in modern aircraft. Wireless systems offer significant advantages, including reducing the weight of aircraft and enhancing communication between aircraft and ground systems. The growing trend of digital transformation in the aviation industry, along with the increasing adoption of the Internet of Things (IoT) in aircraft systems, has driven the demand for wireless systems.

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, military aircraft, general aviation, helicopters, and unmanned aircraft systems (UAS). Commercial aircraft hold a dominant market share due to the increasing number of airlines operating within the region, especially in key hubs like Doha and Dubai. The demand for advanced aircraft systems, including interface devices, is driven by airlines seeking to enhance operational efficiency, ensure compliance with safety regulations, and meet the growing demand for air travel. The rise of low-cost carriers and the expansion of airport infrastructure in the Middle East further contribute to the dominance of commercial aircraft in this segment.

Competitive Landscape

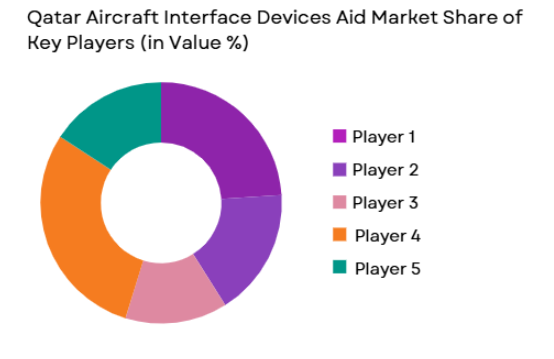

The Qatar Aircraft Interface Devices Aid market is characterized by a few major players, both local and international, contributing significantly to the overall market share. Key players include well-established companies such as Honeywell Aerospace, Collins Aerospace, and Thales Group. These companies have established strong market presence due to their advanced technologies, robust customer support, and ability to provide customized solutions for various aircraft systems. As the demand for advanced aircraft interface devices continues to grow, these players are expected to maintain their dominance in the market. The market consolidation around these key players highlights the influence and importance of a few dominant players in shaping the direction of the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Presence | Product Range | Service Offerings |

| Honeywell Aerospace | 1906 | Morris Plains, NJ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | Charlotte, NC | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | New York, NY | ~ | ~ | ~ | ~ |

| Rockwell Collins (part of Collins Aerospace) | 1933 | Cedar Rapids, IA | ~ | ~ | ~ | ~ |

Qatar Aircraft Interface Devices Aid Market Analysis

Growth Drivers

Urbanization

The rapid urbanization of Qatar and the broader Middle East region is driving an increase in demand for air travel and subsequently for advanced aircraft systems. In 2024, Qatar’s urban population stands at approximately ~% of the total, reflecting a highly urbanized society with modern infrastructure and high levels of connectivity. This urbanization trend contributes to increased demand for air travel, including the need for aircraft interface systems to manage growing air traffic and enhance communication capabilities. Urban centers, particularly Doha, play a central role in the aviation sector’s growth as part of Qatar’s economic diversification efforts. The population density and urban spread require advanced technological solutions for safe and efficient air travel.

Industrialization

Qatar’s industrialization efforts have spurred the development of infrastructure projects, including those in the aviation sector. The country’s industrial output continues to increase, with key sectors such as construction, energy, and manufacturing contributing significantly to the GDP. As of 2024, Qatar’s industrial output growth stands at 3.5% annually. This growth drives the demand for commercial aircraft, maintenance services, and aviation technologies, including aircraft interface devices. The government’s significant investments in infrastructure and aviation projects, such as the expansion of Hamad International Airport, further stimulate the demand for advanced technologies in aircraft systems, including interface devices, which ensure operational efficiency and safety.

Restraints

High Initial Costs

Despite the growth in demand for advanced aircraft interface devices, the high initial cost of such systems remains a significant restraint. Aircraft manufacturers and airlines in Qatar are often hesitant to adopt new technologies due to the large capital required for system integration and installation. For instance, the cost of upgrading avionics systems or retrofitting older aircraft models with modern interface devices can reach millions of dollars. This financial barrier is particularly significant for smaller airlines and private operators. Although operational efficiencies and long-term savings can offset these upfront costs, the initial financial burden presents a challenge for wide-scale adoption. Furthermore, as Qatar’s aviation industry expands, the costs associated with training personnel to operate and maintain these advanced systems add an additional layer of financial strain.

Opportunities

Technological Advancements

Technological advancements in aircraft systems present significant opportunities for growth in the Qatar Aircraft Interface Devices Aid market. In particular, the rise of the Internet of Things (IoT) is revolutionizing the aviation industry by enabling real-time monitoring, predictive maintenance, and improved communication between aircraft and ground systems. In Qatar, this trend is reflected in the country’s investment in “smart” aviation technologies, which is driving the demand for advanced aircraft interface devices. The Qatar government has recognized the importance of these technologies as part of its National Development Strategy and is focusing on integrating cutting-edge technologies into its air traffic management and aviation systems. With the increasing adoption of IoT, Qatar’s aviation sector is positioned for long-term growth, creating substantial demand for modern interface devices.

International Collaborations

International collaborations in the aerospace sector are creating further opportunities for growth in the aircraft interface devices market in Qatar. Qatar Airways has entered into strategic partnerships with global aviation companies to enhance its fleet’s technological capabilities. These collaborations often involve the adoption of advanced aircraft systems and avionics, including interface devices, which are crucial for improving the overall performance of the fleet. In addition, Qatar is looking to strengthen its aerospace industry through collaboration with foreign aircraft manufacturers, technology firms, and research institutions. These collaborations are driving innovation, boosting the integration of advanced technologies, and creating a favorable environment for the growth of aircraft interface devices in the country.

Future Outlook

Over the next 5 years, the Qatar Aircraft Interface Devices Aid market is poised for significant growth, driven by advancements in aircraft systems, increased air travel demand, and a continued focus on enhancing operational efficiency and safety in the aviation industry. Technological innovations such as the integration of IoT, advanced flight management systems, and improved wireless communication will play a crucial role in shaping the future of the market. Furthermore, the ongoing growth of commercial aviation, coupled with the increasing defense sector’s need for advanced aircraft systems, will contribute to the market’s upward trajectory.

Major Players in the Qatar Aircraft Interface Devices Aid Market

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- L3 Technologies

- Rockwell Collins

- Safran Electronics & Defense

- Ametek Inc

- Moog Inc

- Parker Hannifin Corporation

- Garmin Ltd

- Sagem Avionics

- Boeing

- Airbus

- GE Aviation

- Bombardier

Key Target Audience

- Airlines and Aviation Operators

- Aircraft Manufacturers

- Maintenance, Repair, and Overhaul (MRO) Companies

- Military and Defense Organizations

- Unmanned Aircraft Systems (UAS) Operators

- OEMs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all key variables affecting the Qatar Aircraft Interface Devices Aid market. This is achieved through extensive desk research and secondary data collection from aerospace reports, government publications, and industry-specific databases. By defining these critical variables, we can establish the foundation for deeper market analysis.

Step 2: Market Analysis and Construction

In this phase, historical data on the Qatar Aircraft Interface Devices Aid market is gathered and analyzed, focusing on trends such as technological advancements, key market drivers, and major stakeholders. This analysis forms the basis for projecting future market trends and helps in understanding the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in Step 2 are validated through consultations with industry experts, including key players in the aerospace sector and regulatory bodies. These consultations provide practical insights that help refine and validate the market data and forecasts.

Step 4: Research Synthesis and Final Output

The final phase integrates all collected data to synthesize a comprehensive market report. Engagement with manufacturers and service providers ensures that the final output is accurate and reflective of the most current market conditions, allowing for a detailed market forecast and strategic insights.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Aircraft Fleet Size

Rising Air Traffic and Airline Operations

Technological Advancements in Aircraft Interface Systems - Market Challenges

High Cost of Advanced Interface Devices

Complex Regulatory Compliance Requirements

Integration Issues with Older Aircraft Systems

- Trends

Digital Transformation in Aviation Industry

Focus on Automation and Connectivity

Integration of IoT in Aircraft Systems

- Market Opportunities

Emerging Demand for Military Aircraft Interface Solutions

Growth in UAV Interface Technologies

Increasing Demand for Retrofit Systems in Older Aircraft - Government regulations

Aviation Safety Standards and Protocols

Environmental Compliance and Emission Standards

Air Traffic Control Integration Regulations - SWOT analysis

- Porters 5 forces

Threat of New Entrants: Moderate

Bargaining Power of Suppliers: High

Bargaining Power of Buyers: Moderate

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Wireless Interface Systems

Wired Interface Systems

Cockpit Interface Systems

Flight Data Interface Systems

Flight Management Interface Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation

Helicopters

Unmanned Aircraft Systems - By Fitment Type (In Value%)

Line Fit

Retrofit

OEM

Aftermarket

MRO - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Maintenance Service Providers

Military and Defense Organizations

Unmanned Aerial Vehicle (UAV) Operators - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Distributors

Third-party Suppliers

Online Procurement

OEM Contracts

- Market Share Analysis

- CrossComparison Parameters(Pricing Strategies, Market Penetration, Product Innovation, Supply Chain Strength, Customer Satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Collins Aerospace

Thales Group

L3 Technologies

Garmin Ltd

Rockwell Collins

Safran Electronics & Defense

Ametek Inc

Parker Hannifin Corporation

Kollmorgen

Sagem Avionics

Moog Inc

Boeing

Airbus

GE Aviation

Bombardier

- Adoption by Airlines for Operational Efficiency

- Focus on Retrofit Solutions for Older Aircraft

- Increasing Interest from Military for Secure Communication Systems

- Emerging Adoption of UAV Interface Systems

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035