Market Overview

The Qatar Aircraft Landing Gear Systems market is valued at approximately USD ~million in 2024. This market is driven by factors such as the growth of the aviation sector in the Middle East, particularly the expansion of both commercial and military aircraft fleets. Qatar’s strategic location as a hub for international air travel and its robust investment in infrastructure, including airport expansion projects and military defense, are propelling demand for advanced landing gear systems. Additionally, the increasing trend of refurbishing and upgrading older fleets also contributes to the market’s growth, alongside the demand for technologically advanced landing gear systems.

Qatar, particularly Doha, dominates the Aircraft Landing Gear Systems market in the Middle East due to its strategic investment in aviation infrastructure and growing fleet. Doha’s Hamad International Airport, a major international travel hub, attracts airlines from across the world, increasing the demand for high-quality landing gear systems. The country’s significant defense budget and military modernization plans further boost demand for military aircraft, which in turn drives demand for landing gear systems. Additionally, Qatar’s status as an economic powerhouse in the region enables continuous advancements in its aviation sector, fostering a competitive market for landing gear technology.

Market Segmentation

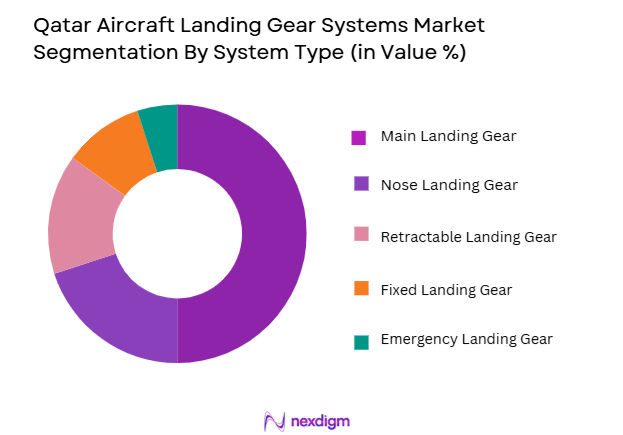

By System Type

The Qatar Aircraft Landing Gear Systems market is segmented by system type into main landing gear, nose landing gear, retractable landing gear, fixed landing gear, and emergency landing gear. Among these, main landing gear dominates the market in terms of both value and volume. This is primarily due to the larger size and heavier weight of commercial and military aircraft, which require robust main landing gear systems to handle the weight and stress during takeoff and landing. The continuous growth of the aviation industry, including the increasing number of commercial flights and military aircraft procurement, further drives the demand for main landing gear systems, which are vital for aircraft safety and operational efficiency.

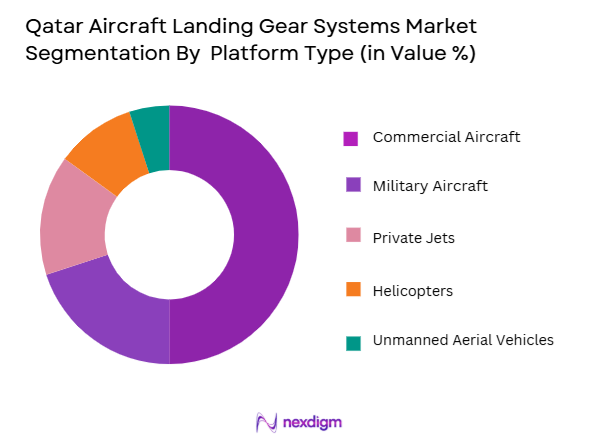

By Platform Type

In terms of platform type, the Qatar Aircraft Landing Gear Systems market is segmented into commercial aircraft, military aircraft, private jets, helicopters, and unmanned aerial vehicles (UAVs). Commercial aircraft hold the largest share of the market. This segment is fueled by the significant growth of international and regional airlines in Qatar, with airlines such as Qatar Airways expanding their fleet with new, larger, and more advanced aircraft. The demand for aircraft landing gear systems in the commercial segment is propelled by the increasing passenger traffic, the replacement of older aircraft, and the continuous investment in the aviation sector, including the adoption of new aircraft technologies.

Competitive Landscape

The Qatar Aircraft Landing Gear Systems market is dominated by a few key players that provide high-quality, technologically advanced products. These players include global leaders in aviation components like Safran Landing Systems, Collins Aerospace, and Honeywell Aerospace, as well as regional players who focus on military and commercial aircraft needs. The market is characterized by significant competition in both product innovation and pricing strategies. As new technological developments, such as smart landing gear systems and lightweight materials, become more prominent, these companies are continually innovating to maintain their competitive edge.

| Company Name | Establishment Year | Headquarters | Market Share | Product Portfolio | Innovation Focus | Client Focus | Regional Reach |

| Safran Landing Systems | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1930 | USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1930 | USA | ~ | ~ | ~ | ~ | ~ |

| Liebherr-Aerospace | 1949 | Germany | ~ | ~ | ~ | ~ | ~ |

| Heroux-Devtek | 1942 | Canada | ~ |

~ |

~ | ~ | ~ |

Qatar Aircraft Landing Gear Systems Market Analysis

Growth Drivers

Urbanization

The rapid pace of urbanization in Qatar is a key driver of the growth in the aircraft landing gear systems market. The urban population in Qatar is expected to reach approximately ~ million people by 2026, up from ~million in 2024. This urban growth is directly linked to the increase in transportation demand, including aviation, fueling the need for advanced aviation infrastructure. Cities such as Doha are seeing infrastructural advancements, with Hamad International Airport receiving a significant upgrade. As urbanization intensifies, there is an increasing need for more reliable, advanced aircraft landing systems to support the growing number of flights.

Industrialization

Qatar’s continuous industrialization is propelling the demand for aircraft landing gear systems, especially in the defense and aviation sectors. Industrial production in Qatar is projected to rise by ~% in 2024, focusing on manufacturing and infrastructure projects that require enhanced logistics, including air transport. The growth of Qatar’s defense budget, which is expected to surpass USD ~billion in 2024, is driving military aircraft procurements. These procurements, along with the expansion of Qatar Airways, are leading to an increased need for efficient and durable aircraft landing gear systems.

Restraints

High Initial Costs

The high initial costs of advanced aircraft landing gear systems represent a significant restraint in the market. The development and manufacturing of specialized landing gear require advanced materials and precision engineering, which come at a steep cost. The cost of high-performance landing gear systems for large aircraft is estimated to be around USD ~million per unit in 2024, and these systems are not easy to replace or repair. With aircraft fleets expanding rapidly in Qatar, these initial costs pose a challenge to airlines and defense contractors that need to balance upgrading their fleets with cost management.

Technical Challenges

The integration of advanced technologies into landing gear systems faces technical challenges. For example, the integration of new materials such as lightweight composites to reduce weight and improve efficiency has proven to be difficult and costly. Additionally, ensuring compatibility with both current and new aircraft models complicates the design and manufacturing process. As Qatar Airways and military forces continue to upgrade their fleets with state-of-the-art aircraft, ensuring the landing gear systems meet the evolving demands of these aircraft presents a significant technical challenge.

Opportunities

Technological Advancements

Technological advancements in materials and automation present significant opportunities for the Qatar Aircraft Landing Gear Systems market. In 2024, the aerospace industry is witnessing a surge in the adoption of lightweight materials such as titanium alloys and carbon fiber composites, which enhance the durability and efficiency of landing gear systems. Additionally, the introduction of smart landing gear, which can monitor structural integrity in real-time, is expected to revolutionize maintenance practices. Qatar’s investment in cutting-edge technologies and the growing role of technology in aircraft manufacturing will drive demand for advanced landing gear systems, creating new market opportunities.

International Collaborations

Qatar’s strategy to expand its influence in the aerospace sector through international collaborations presents a promising opportunity for landing gear manufacturers. Qatar’s involvement in defense partnerships, especially with leading aircraft manufacturers and defense contractors, is increasing. In 2024, Qatar is collaborating with companies such as Boeing, Airbus, and Lockheed Martin on the procurement of new military and commercial aircraft. These partnerships are expected to lead to greater demand for advanced landing gear systems that can meet both local and international standards, driving market growth.

Future Outlook

Over the next decade, the Qatar Aircraft Landing Gear Systems market is expected to show significant growth driven by continuous advancements in aircraft technology, increasing demand for air travel, and Qatar’s growing influence in the aviation and defense sectors. With the expansion of Qatar Airways’ fleet and ongoing military procurement, the market will continue to benefit from the modernization of both commercial and military aircraft. Additionally, the implementation of new, lighter, and more efficient landing gear systems will further enhance operational efficiency and reduce operational costs, creating lucrative growth opportunities for industry players.

Major Players

- Safran Landing Systems

- Collins Aerospace

- Honeywell Aerospace

- Liebherr-Aerospace

- Heroux-Devtek

- UTC Aerospace Systems

- Messier-Bugatti-Dowty

- AAR Corp.

- SKF Aerospace

- JAMCO Corporation

- CIRCOR Aerospace

- Aviation Components

- Triumph Group

- Fokker Technologies

- Meggitt PLC

Key Target Audience

- Aircraft Manufacturers

- Airlines

- Defense Ministries

- MRO (Maintenance, Repair, and Overhaul) Providers

- Aircraft Component Suppliers

- Military Operators

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involves identifying the critical market variables that influence the Qatar Aircraft Landing Gear Systems market. This includes understanding the technological advancements, regulatory changes, and demand from both the commercial and military aviation sectors. The research methodology incorporates extensive desk research, utilizing secondary databases and proprietary sources to map out the key factors shaping market trends.

Step 2: Market Analysis and Construction

In this phase, a thorough analysis is conducted to examine historical market data, including the penetration rate of aircraft landing gear systems, market share among different types, and the ratio of system suppliers to end-users. This data helps build a comprehensive view of the market structure, highlighting the major players and evaluating revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Once market hypotheses are formulated, they are validated through expert consultations with professionals in the aviation and defense sectors. These interviews offer critical insights into market dynamics, providing a ground-level perspective on the factors that influence the demand for aircraft landing gear systems in Qatar.

Step 4: Research Synthesis and Final Output

The final stage of the research synthesizes the data collected, cross-referencing information from various sources to ensure reliability. The study culminates in the production of an actionable market report that provides a clear understanding of the current market scenario and future trends.

- Executive Summary

- Market Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air traffic and fleet expansion

Technological advancements in landing gear systems

Rising demand for advanced military and commercial aircraft - Market Challenges

High maintenance and repair costs

Complexity in regulatory and certification processes

Dependency on international suppliers for components - Trends

Increased integration of smart landing gear systems

Adoption of sustainable materials and designs

Shift towards automated and precision landing gear technologies

- Market Opportunities

Growing demand for lightweight and fuel-efficient landing gear systems

Expansion of MRO services in the Middle East

Strategic partnerships with local and international aircraft manufacturers - Government regulations

Safety standards set by the Qatar Civil Aviation Authority (QCAA)

International Air Transport Association (IATA) standards

Environmental regulations for aircraft noise and emissions reduction - SWOT analysis

- Porters 5 forces r

- By Market Value ,2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Main Landing Gear

Nose Landing Gear

Retractable Landing Gear

Fixed Landing Gear

Emergency Landing Gear - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket

Repair and Overhaul (MRO)

New Aircraft Assembly

Refurbishment - By EndUser Segment (In Value%)

Airlines

Private Aircraft Owners

Military Operators

Air Charter Services

Aircraft Maintenance Companies - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Vendors

Online Marketplaces

Government Contracts

Maintenance Contracts

- Market Share Analysis

- CrossComparison Parameters(Market Share, Price Positioning, Product Innovation, Regional Reach, Customer Satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Safran Landing Systems

Collins Aerospace

Liebherr-Aerospace

GE Aviation

Honeywell Aerospace

UTC Aerospace SystemsMessier-Bugatti-Dowty

Heroux-Devtek

AAR Corp.

SKF Aerospace

JAMCO Corporation

CIRCOR Aerospace

Aviation Components

Triumph Group

Fokker Technologies

- Growing demand for landing gear systems from major airlines

- Increase in private jet fleet requiring advanced landing gear systems

- Military expansion boosting landing gear demand for military aircraft

- Expansion of aircraft maintenance and repair operations in Qatar

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035