Market Overview

The Qatar Aircraft Lighting market is valued at USD ~million, supported by the increasing demand for modern, energy-efficient lighting solutions in aircraft. As the aviation sector expands, the need for sophisticated lighting systems, such as LED and OLED technologies, has surged. These systems contribute to enhanced passenger experiences and safety, thus propelling market growth. Additionally, increasing air travel and airport modernization initiatives are expected to support the demand for advanced lighting solutions in the coming years.

Qatar and the broader Middle East region dominate the aircraft lighting market due to the significant growth of the aviation sector. Qatar’s airline industry, spearheaded by Qatar Airways, is among the largest globally, driving high demand for state-of-the-art aircraft lighting solutions. Moreover, the country’s ongoing infrastructure projects, such as the expansion of Hamad International Airport, provide opportunities for lighting manufacturers to expand their market share. The economic prosperity of Qatar and its strategic position as a global aviation hub make it a leader in the aircraft lighting market.

Market Segmentation

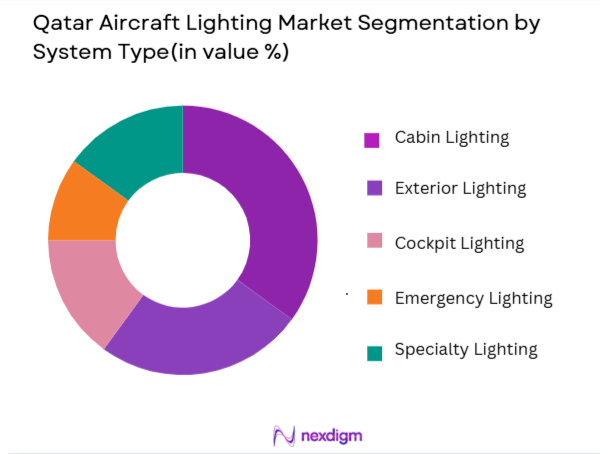

By System Type

The Qatar Aircraft Lighting market is segmented by system type into cabin lighting, exterior lighting, cockpit lighting, emergency lighting, and specialty lighting. Among these, cabin lighting dominates the market due to the increasing demand for comfort and ambiance in passenger cabins. Advanced LED lighting solutions are being increasingly integrated into cabin designs, offering better energy efficiency, customization options, and improved passenger experience. Additionally, regulatory standards focusing on passenger safety and comfort further enhance the demand for high-quality cabin lighting solutions. Qatar Airways and other regional airlines invest significantly in modernizing cabin interiors, including upgrading lighting systems to meet passenger expectations.

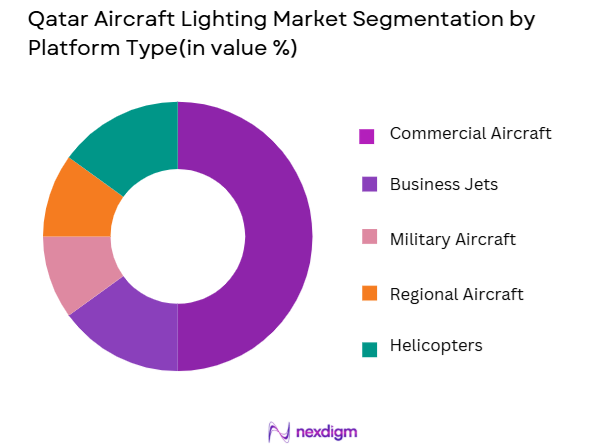

By Platform Type

The Qatar Aircraft Lighting market is also segmented by platform type, with the main subsegments being commercial aircraft, business jets, military aircraft, regional aircraft, and helicopters. Commercial aircraft dominate the market, driven by the large number of international and regional airlines operating within and outside Qatar. Qatar Airways, one of the world’s leading carriers, plays a central role in shaping the demand for advanced aircraft lighting solutions. These aircraft require high-quality lighting systems for both passenger comfort and operational efficiency. Furthermore, the growing fleet sizes of Middle Eastern airlines contribute significantly to the demand for lighting solutions, especially in new aircraft.

Competitive Landscape

The Qatar Aircraft Lighting market is characterized by the presence of both established global players and regional suppliers. The competition is intense, with key players vying for dominance through technological innovation, partnerships, and regulatory compliance. Companies such as Safran and Honeywell lead the market with their advanced lighting systems that meet both commercial and military standards. Local players, too, have carved out their share by providing tailored solutions that cater to the specific needs of airlines operating within the region.

| Company | Establishment Year | Headquarters | Technological Innovation | Market Focus | Product Portfolio | Regulatory Compliance | Partnerships | R&D Investment | Customer Base |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| United Technologies | 1934 | Hartford, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Astronics | 1968 | Everett, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Lighting Market Analysis

Growth Drivers

Urbanization

Urbanization plays a crucial role in the expansion of the aircraft lighting market as urban areas continue to grow, driving demand for efficient and advanced infrastructure. According to the United Nations, more than ~% of the world’s population lives in urban areas, and this percentage is expected to rise to ~% by 2050. This shift towards urbanization creates a need for modern transportation systems, including aircraft, which require advanced lighting systems for both safety and comfort. Qatar, being a rapidly developing country, is expected to see substantial growth in urbanization, which directly impacts the demand for sophisticated lighting solutions. Increased urban population growth is reflected in infrastructure projects like airports, driving market expansion in the region.

Industrialization

Industrialization significantly contributes to the demand for aircraft lighting systems as the aviation sector expands to support manufacturing and logistics. Qatar’s industrial growth is a key factor driving demand, with the World Bank reporting Qatar’s industrial output growth of ~% in 2024. Industrialization in the Middle East has led to increased investments in infrastructure, including airports, logistics hubs, and aircraft fleets, which require sophisticated lighting systems. The rapid industrialization of countries like Qatar is fueling the need for both commercial and military aircraft, directly impacting the lighting systems market. As industries expand, the requirement for advanced lighting solutions in both private and public sectors is growing.

Restraints

High Initial Costs

The high initial costs associated with upgrading aircraft lighting systems pose a significant restraint to market growth. LED and OLED lighting technologies, which are increasingly being adopted by airlines, have a higher upfront cost compared to traditional lighting systems. For instance, the initial cost of installing an LED lighting system in an aircraft can be up to ~% higher than using conventional lighting. Despite the energy savings in the long run, the significant capital expenditure required for such installations can deter smaller airlines or those operating older fleets from investing in new lighting technologies. This financial barrier is particularly evident in emerging markets, where budget constraints limit the adoption of advanced lighting systems.

Technical Challenges

Technical challenges related to the compatibility of new lighting systems with existing aircraft technology are a major constraint. While advanced lighting solutions like OLED and LED offer better energy efficiency and longer lifespans, integrating these systems into older aircraft models can be difficult. Qatar’s fleet, which includes both newer and older aircraft, faces compatibility issues when attempting to retrofit older models with the latest lighting technology. The need for specialized technical expertise and modification of existing infrastructure can lead to higher installation costs and longer downtimes, which may deter airlines from upgrading their lighting systems.

Opportunities

Technological Advancements

Technological advancements in lighting systems present significant opportunities for market growth. As Qatar continues to modernize its aviation sector, the adoption of smart, adaptive lighting technologies in both commercial and military aircraft is growing. Qatar Airways has already started implementing lighting systems that adjust based on passenger comfort and external lighting conditions, which enhances the flying experience. Technological innovations like integration with IoT (Internet of Things) allow for improved energy efficiency and better maintenance management, leading to reduced operational costs. The market for intelligent and connected lighting systems in aircraft is expected to grow as these technologies become more affordable and widely accepted.

International Collaborations

International collaborations in the aerospace sector offer substantial growth opportunities for aircraft lighting manufacturers. Qatar’s partnerships with global aerospace companies such as Boeing and Airbus provide an avenue for implementing cutting-edge lighting technologies in new aircraft designs. These collaborations are helping bring the latest innovations in energy-efficient and adaptive lighting to market. For instance, the ongoing collaboration between Qatar Airways and Airbus on fleet upgrades includes the integration of next-generation lighting systems, which are expected to reduce energy consumption. These collaborations offer significant market opportunities as new aircraft and retrofit projects continue to grow.

Major Players in the Market

- Safran

- Honeywell

- Thales

- United Technologies

- Astronics

- Luminator Technology Group

- Signify

- LEDtronics

- GE Aviation

- B/E Aerospace

- Lufthansa Technik

- Diehl Aerospace

- Rockwell Collins

- Collins Aerospace

- Zodiac Aerospace

Key Target Audience

- Airlines

- Aircraft manufacturers

- MRO (Maintenance, Repair, and Overhaul) service providers

- Aircraft lighting system suppliers

- Investment and venture capitalist firms

- Government and regulatory bodies (Qatar Civil Aviation Authority, FAA, EASA)

- Airport operators

- Commercial aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying all critical variables that impact the Qatar Aircraft Lighting market. This will include understanding the technological, regulatory, and economic factors that influence the market. Extensive desk research is conducted, using proprietary databases to gather data on historical market trends, demand-supply dynamics, and consumer behavior.

Step 2: Market Analysis and Construction

In this phase, we will analyze historical data, including aircraft sales figures and lighting system adoption rates. The goal is to estimate the market size and forecast growth based on factors like fleet expansion and airline investments. A comprehensive review of industry data will also be carried out to assess the competitive landscape and key market trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated by conducting consultations with industry experts. These experts, including airline executives and manufacturers, will provide insights into operational challenges, technological advancements, and market opportunities. Telephone interviews and surveys will be employed to gather this expert feedback.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research findings into a comprehensive report. This will include finalizing the market segmentation analysis, competitive landscape, and growth projections. Direct engagement with aircraft manufacturers and lighting system suppliers will help refine the findings and ensure accuracy.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for aircraft modernization and retrofit

Expansion of airline fleets in the Middle East

Technological advancements in energy-efficient lighting systems - Market Challenges

High initial installation costs

Stringent regulatory standards for lighting systems

Dependence on aircraft production rates - Trends

Shift towards advanced LED lighting solutions

Focus on enhancing passenger experience through lighting

Adoption of smart and connected lighting systems in aircraft

- Market Opportunities

Rising demand for sustainable and eco-friendly lighting solutions

Technological innovation in LED and OLED lighting

Growing air travel and tourism in the Middle East region - Government regulations

Civil aviation regulations related to aircraft safety

Certification standards for lighting systems from EASA and FAA

Regulatory guidelines on energy efficiency and environmental standards - SWOT analysis

Strength

Weakness

Opportunity

Threat - Porters 5 forces

Threat of new entrants

Bargaining power of suppliers

Bargaining power of buyers

Threat of substitutes

Industry rivalry

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

By System Type (In Value%)

Cabin Lighting

Exterior Lighting

Cockpit Lighting

Emergency Lighting

Specialty Lighting

- By Platform Type (In Value%)

Commercial Aircraft

Business Jets

Military Aircraft

Regional Aircraft

Helicopters

- By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Replacement Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Commercial Airlines

Private Operators

Military & Defense

OEMs

MRO Service Providers - By Procurement Channel (In Value%)

Direct Sales

Distributors

E-commerce

B2B Platforms

OEM Sourcing

- Market Share Analysis

- CrossComparison Parameters(Price competitiveness, technological advancements, market reach, customer service, certification compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Safran

Rockwell Collins

Honeywell

Thales

United Technologies

Luminator Technology Group

Zumtobel Group

Signify

Astronics

LEDtronics

Astronics Corporation

GE Aviation

B/E Aerospace

Lufthansa Technik

Diehl Aerospace

- Demand driven by commercial airlines expanding fleets

- Private operators seeking advanced lighting for business jets

- Military and defense sectors investing in specialized lighting systems

- MRO service providers focusing on retrofitting and upgrades of existing systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035