Market Overview

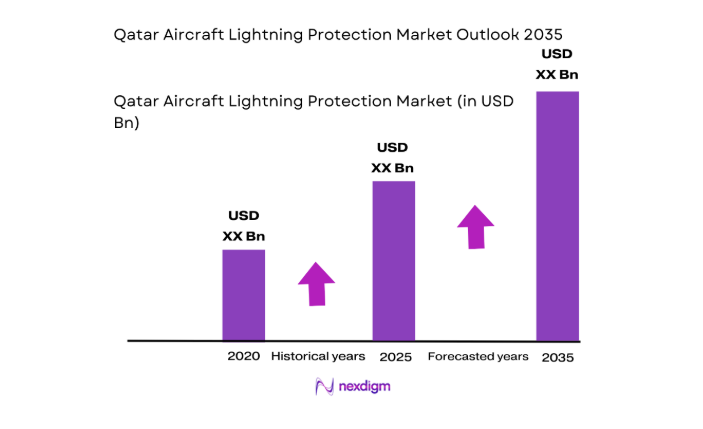

The Qatar Aircraft Lightning Protection market is valued at USD ~, supported by a growing need for enhanced safety measures in aviation. This demand is driven by Qatar’s expanding commercial aviation sector, which includes both local and international flight operations, and its commitment to safety and international regulatory standards. In particular, the need for high-tech lightning protection solutions in both new aircraft and retrofitting programs drives the demand. The presence of a strong regulatory framework, such as Qatar Civil Aviation Authority’s (QCAA) stringent requirements, plays a crucial role in pushing the market for lightning protection systems forward.

Qatar’s dominance in the Aircraft Lightning Protection market is driven by its status as a hub for international aviation, with Hamad International Airport being one of the busiest in the region. Additionally, the increasing fleet size of Qatar Airways, known for its state-of-the-art aircraft, further boosts demand for advanced lightning protection systems. The country’s strategic location as a transit point for global flights enhances the need for lightning protection technology to meet international safety standards and support Qatar’s growing fleet of modern, composite-bodied aircraft. The favorable business environment, coupled with an increasing number of aircraft being retrofitted, strengthens the market’s position.

Market Segmentation

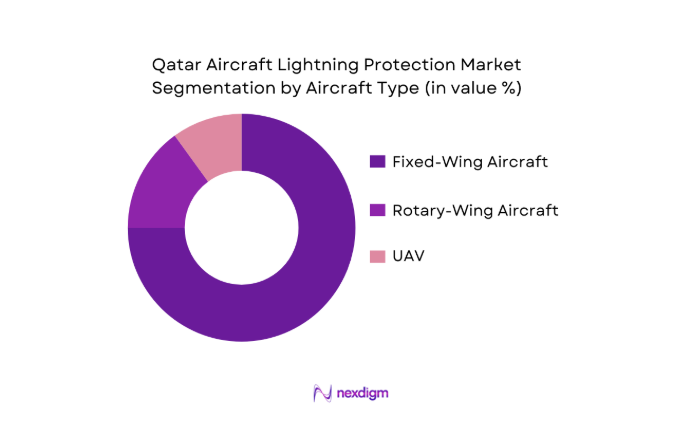

By Aircraft Type

The market is segmented by aircraft type into fixed-wing, rotary-wing, and unmanned aerial vehicles (UAV). Among these, fixed-wing aircraft dominate the segment, primarily due to their higher usage in both commercial and military aviation. Within this segment, the increasing demand for composite materials in aircraft structures, which are more susceptible to lightning strikes, boosts the need for specialized lightning protection systems. The growing number of new aircraft models entering Qatar’s commercial aviation sector, including models from Boeing and Airbus, requires advanced and customized lightning protection systems for effective safeguarding.

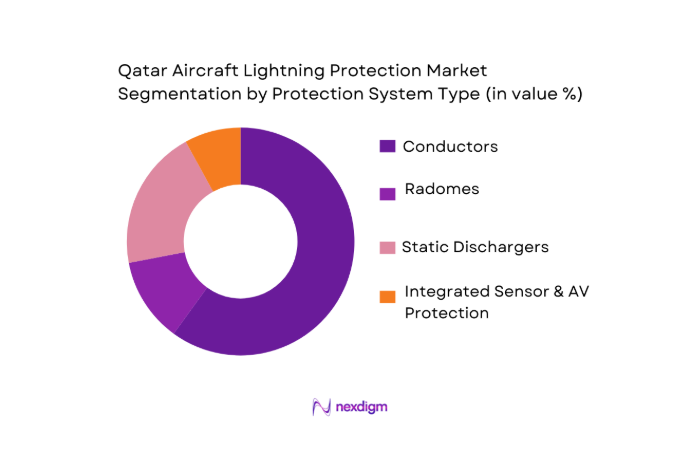

By Protection System Type

The market is further segmented by protection system type into conductors, radomes, static dischargers, and integrated sensor & AV protection. Conductors hold the largest market share due to their fundamental role in protecting aircraft by diverting lightning strikes and distributing the charge over the aircraft’s structure. This technology is increasingly used in modern aircraft, where composite materials have become more common, and systems such as lightning strike diversion are critical. The adoption of lighter, more durable conductors helps aircraft maintain structural integrity, thus improving the overall safety profile.

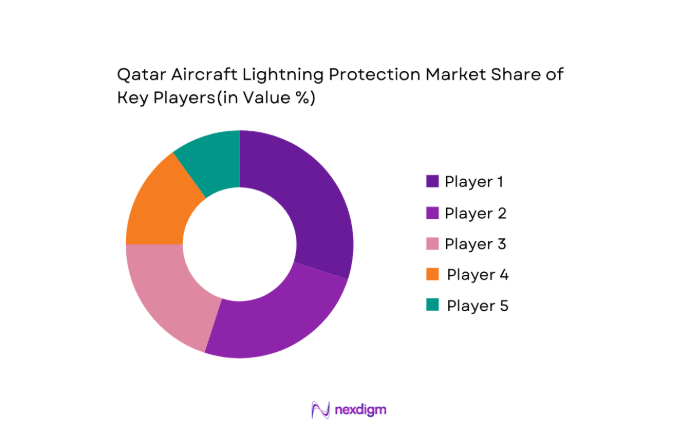

Competitive Landscape

The Qatar Aircraft Lightning Protection market is dominated by a few major players, including global leaders in aerospace and defense technology. These companies offer a wide range of lightning protection systems, including both OEM and retrofit solutions. Their market presence is largely defined by strong R&D investments, regulatory compliance, and strategic partnerships with aircraft manufacturers. Major players like Honeywell and Parker Hannifin have successfully penetrated the market due to their technological expertise and the ability to provide comprehensive solutions for Qatar’s expanding fleet.

| Company | Establishment Year | Headquarters | Market-Specific Parameter 1 | Market-Specific Parameter 2 | Market-Specific Parameter 3 | Market-Specific Parameter 4 | Market-Specific Parameter 5 | Market-Specific Parameter 6 |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1918 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Cobham Limited | 1934 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| TE Connectivity Ltd. | 2007 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Lightning Protection Market Analysis

Growth Drivers

Air Traffic Expansion

Air traffic in Qatar has seen significant growth, with Hamad International Airport in Doha ranking as one of the busiest airports in the Middle East. The airport experienced a ~ increase in passenger traffic in 2024, with ~ passengers passing through. This growth supports an increase in the demand for aircraft, driving the need for enhanced safety systems like lightning protection. Qatar Airways, the national carrier, continues to expand its fleet, acquiring new aircraft from Boeing and Airbus, increasing the overall demand for sophisticated lightning protection systems. The consistent growth in aviation traffic across the region is a key driver for the expansion of the aircraft lightning protection market.

Composite Airframes Demand

The global shift towards the use of composite materials in aircraft manufacturing is accelerating, and Qatar is no exception. By 2024, it is estimated that over ~ of the new aircraft built in Qatar will feature composite airframes, which are more susceptible to lightning strikes due to their non-metallic nature. The demand for composite materials in aircraft is growing at a rapid pace, as composites offer benefits like weight reduction, which leads to improved fuel efficiency. This trend is supported by the increasing adoption of the Boeing 787 and Airbus A350, both of which use composite materials extensively. The shift to composite airframes is driving the need for more advanced and reliable lightning protection systems.

Market Challenges

Cost Barriers

The high cost of advanced lightning protection systems is one of the primary challenges faced by the Qatar Aircraft Lightning Protection market. Aircraft manufacturers and operators must bear the cost of integrating these systems into their fleets. With aircraft prices already high due to increasing demand for new models, the added expense of lightning protection technology can be a significant barrier. The average cost of a single lightning protection system for an aircraft can exceed USD ~, and retrofitting existing fleets can result in higher costs due to labor and parts. This makes cost a critical challenge, particularly for smaller airlines or operators seeking to upgrade their fleets.

Integration Complexity

The integration of lightning protection systems in aircraft, particularly in composite airframes, presents technical challenges. The complexity arises from the need for systems that do not interfere with the aircraft’s performance or design. Aircraft manufacturers in Qatar must ensure that these protection systems are compatible with existing technologies, including avionics and structural components, which can involve extensive customization. The retrofit process for older aircraft can be even more complicated due to the variations in airframe design and the need for compliance with evolving safety standards. This complexity not only increases the time required for integration but also raises the cost of implementation.

Opportunities

UAM/eVTOL Growth

Urban Air Mobility (UAM) and electric vertical take-off and landing (eVTOL) aircraft represent a growing opportunity for the aircraft lightning protection market. In Qatar, where urbanization and technological adoption are progressing rapidly, there is significant interest in developing and deploying eVTOLs. Qatar Airways, in collaboration with local startups, is exploring eVTOL technologies for city-wide air transportation solutions. As eVTOL aircraft often use composite materials and lightweight structures, they are highly susceptible to lightning strikes, creating a growing demand for specialized lightning protection systems. The expansion of these technologies in Qatar presents a promising growth area for the market.

Localized Production Incentives

Qatar’s government has been actively encouraging local production of aerospace components, including lightning protection systems, to strengthen its aerospace industry. The country’s economic diversification plan, led by the Qatar National Vision 2030, aims to reduce dependency on imports and encourage domestic manufacturing. With this initiative, local suppliers are incentivized to develop advanced lightning protection systems, which could not only serve Qatar’s rapidly growing aviation sector but also offer opportunities for exports to neighboring regions. This push for localized production is expected to drive market growth by lowering costs and improving the supply chain efficiency for lightning protection systems.

Future Outlook

Over the next decade, the Qatar Aircraft Lightning Protection market is expected to experience significant growth. This is driven by the continuous expansion of Qatar Airways’ fleet, which will demand enhanced protection systems, particularly for aircraft incorporating newer composite materials. With an increasing number of international airlines looking to retrofit existing fleets with advanced lightning protection systems, the market is set to grow further. Additionally, technological advancements in lightning protection systems, including intelligent, sensor-integrated solutions, will play a crucial role in shaping the market’s future growth trajectory. The QCAA’s consistent regulatory push for enhanced safety standards will also support long-term market expansion.

Major Players

- Honeywell International

- Parker Hannifin

- Cobham Limited

- TE Connectivity Ltd.

- L3Harris Technologies

- Avidyne Corporation

- Microsemi/Microchip Technology

- Dayton‑Granger, Inc.

- Saab AB

- PPG Industries

- LORD Corporation

- Northrop Grumman

- Raytheon Technologies

- Rockwell Collins

- Boeing

Key Target Audience

- Aircraft Manufacturers

- Aerospace & Defense Contractors

- Aircraft Operators

- Government & Regulatory Bodies

- Aircraft Maintenance & Repair Organizations

- Investments and Venture Capitalist Firms

- Military Aviation Authorities

- Insurance & Risk Management Firms

Research Methodology

Step 1: Identification of Key Variables

In this step, we construct a detailed ecosystem map of key stakeholders within the Qatar Aircraft Lightning Protection market, using secondary research from industry reports, regulations, and historical data. This phase identifies and defines the major market drivers, including aircraft technology, regulatory influence, and demand for retrofitting solutions.

Step 2: Market Analysis and Construction

We analyze historical data on the Qatar Aircraft Lightning Protection market, including aircraft fleet size, retrofitting rates, and technological adoption. By studying data from reputable sources such as QCAA and aerospace industry reports, we build an understanding of the market’s structure, segmentation, and growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including aviation manufacturers, maintenance providers, and government representatives. These consultations help refine the key market drivers and validate assumptions related to product technology and regional adoption rates.

Step 4: Research Synthesis and Final Output

The final phase involves verifying the insights and consolidating them into a cohesive analysis. This includes discussions with aircraft manufacturers to validate system requirements, the impact of regulatory changes, and the future outlook for the market. Comprehensive analysis of market share, competitive dynamics, and technology adoption is performed to ensure a robust and actionable report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth drivers

air traffic expansion

composite airframes demand

safety rules

- Market challenges

cost barriers

integration complexity

- Opportunities

UAM/eVTOL growth

localized production incentives

- Trends

smart AV protection

AI predictive strike models

- Government & aviation authority regulations

- SWOT analysis

- Porter’s 5 Forces

- By Value, 2020‑2025

- By Volume, 2020‑2025

- By Average Price, 2020‑2025

- By Aircraft Type (In Value %)

Fixed‑Wing

Rotary‑Wing

UAV/drones

eVTOL/AAM platforms

- By Protection System Type (In Value %)

Conductors

Radomes

Static Dischargers

Integrated Sensor & AV Protection

- By Fit Type (In Value %)

Line‑Fit

Retrofit

- By End User (In Value %)

Commercial aviation operator fleets

Defense & government aircraft

- By Material Technology (In Value %)

Metallic meshes

Embedded composites

- Market share of major players

- Cross Comparison Parameters (Lightning strike attenuation efficiency, System weight per functional unit, Composite integration compatibility, Certification compliance score, Mean Time Between Replacement, OEM partnership depth, Warranty & Field Support footprint)

- SWOT analysis of key players

- Pricing analysis of major players

- Detailed Profiles of Major Players

Honeywell International Inc.

Parker Hannifin

TE Connectivity Ltd.

Amphenol Corporation

L3Harris Technologies

Cobham Limited

Saab AB

Dayton‑Granger, Inc.

PPG Industries/Engineered Materials

Pinnacle Lightning Protection LLC

Avidyne Corporation

National Technical Systems, Inc.

Microsemi/Microchip Tech

Halcon Systems

Regional OEM/AMO supply houses

- Cost of ownership implications

- Fleet modernization decision drivers

- Operator safety & certification thresholds

- Procurement cycle behaviors

- By Value, 2026‑2035

- By Volume, 2026‑2035

- By Average Price, 2026‑2035