Market Overview

The Qatar Aircraft Line Maintenance market is a vital component of the regional aviation ecosystem. With Qatar Airways’ expansion and the increasing number of international flights operating through Hamad International Airport, the demand for aircraft maintenance services is seeing a steady rise. As of 2025, the Qatar Aircraft Line Maintenance market is valued at approximately USD ~, driven by the increasing fleet size and the strategic importance of Doha as a global aviation hub. The dominance of Qatar Airways and its growing fleet, alongside the increasing need for frequent maintenance services, is propelling the market’s growth.

The market is primarily dominated by Qatar, with Doha as the central hub due to the presence of Hamad International Airport and the extensive operations of Qatar Airways. As one of the largest international carriers in the world, Qatar Airways’ rapid fleet expansion and its stringent maintenance requirements drive the demand for top-notch line maintenance services. The geographical advantage of Qatar, situated at the crossroads of major global aviation routes, also positions Doha as a key player in the Middle East’s aviation sector.

Market Segmentation

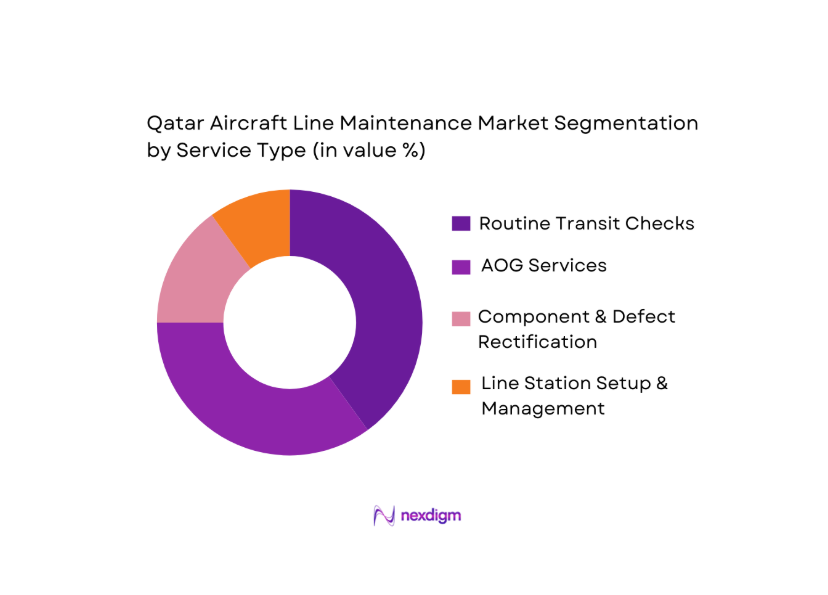

By Service Type

Routine transit checks dominate the Qatar Aircraft Line Maintenance market, accounting for a significant portion of the market share in 2025. The routine transit checks are essential for maintaining aircraft safety standards and ensuring quick turnaround times, making them crucial for high-volume airlines like Qatar Airways. These checks, which include inspections of aircraft components such as engines, landing gears, and electrical systems, are necessary for minimizing downtime and keeping the fleet operational. The high frequency of flights operating through Hamad International Airport, combined with Qatar Airways’ commitment to maintaining a large fleet, drives the demand for routine checks in the market.

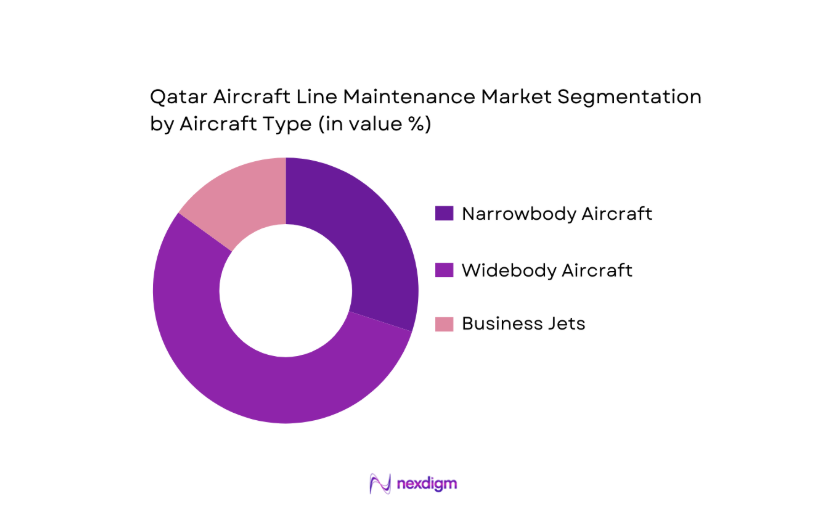

By Aircraft Type

The aircraft type segmentation includes Narrowbody, Widebody, and Business Jets. In Qatar, Widebody aircraft maintenance dominates the segment, as Qatar Airways operates a large fleet of Boeing 777s, Airbus A350s, and similar long-haul aircraft. The complexity and size of these widebody aircraft, combined with the global routes they service, require specialized and regular line maintenance services. These aircraft’s high frequency of service intervals and the increasing demand for longer international flights contribute significantly to the dominance of this sub-segment.

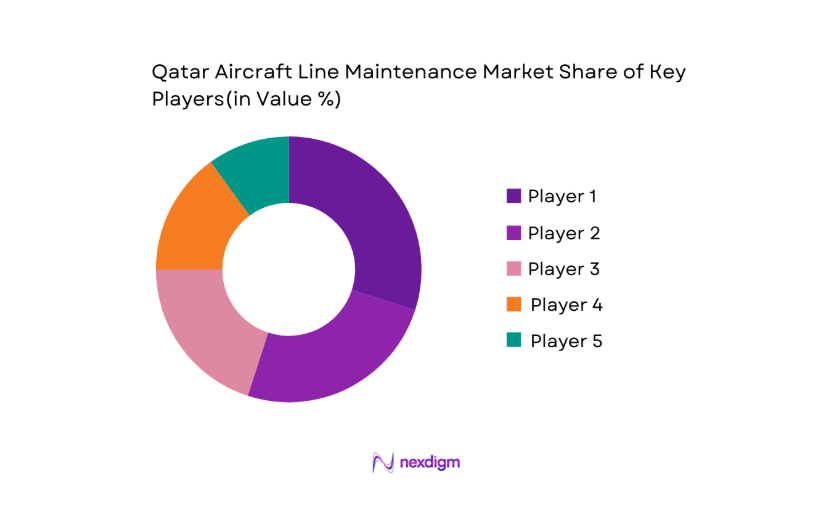

Competitive Landscape

The Qatar Aircraft Line Maintenance market is highly competitive, with major players offering a range of services across line maintenance, AOG, and component repair. The market is dominated by established MRO (Maintenance, Repair, and Overhaul) players, as well as the in-house operations of major airlines like Qatar Airways. Key competitors include:

| Company | Establishment Year | Headquarters | Market Share | Certifications | Fleet Coverage | AOG Response Time | Service Type | Turnaround Time |

| Qatar Airways Engineering | 2004 | Doha, Qatar | ~ | ~ | ~ | ~ | ~ | ~ |

| Gulf Aviation Maintenance Co. | 1989 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1951 | Frankfurt, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| HAECO | 1980 | Hong Kong | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Line Maintenance Market Analysis

Growth Drivers

Fleet Growth of Qatar Airways & Regional Operators

Qatar Airways continues to expand its fleet with a focus on advanced, fuel-efficient aircraft. As of 2024, the airline operates over 200 aircraft, including long-haul widebody models like the Boeing 777 and Airbus A350. The airline’s expansion plans are driven by its strategic growth in global markets and increasing demand for international air travel. The fleet growth is part of a broader trend in the Middle East, where the aviation industry is expanding rapidly. In 2025, Qatar Airways is expected to add over 20 new aircraft to its fleet, enhancing its capability to meet growing passenger demand. The fleet expansion supports increased demand for maintenance services at Hamad International Airport, positioning Qatar Airways as a key player in the region’s aviation maintenance market.

Rising Air Traffic Demand & Gate Turn Requirements

Air traffic in the Middle East is projected to grow by more than ~ annually, with Doha serving as a primary hub for international travelers. As of 2024, Qatar’s Hamad International Airport handles approximately ~ passengers annually. This growth in air traffic places significant pressure on ground services, including gate turn requirements. The rise in passenger numbers drives the demand for efficient line maintenance services to reduce turnaround times and ensure that aircraft are ready for flight on time. As of 2025, global air traffic is projected to reach ~ passengers across Middle Eastern airports, reinforcing the need for improved infrastructure and line maintenance solutions.

Market Challenges

Operational Cost Intensity

The operational cost of maintaining aircraft is escalating due to the rising price of aviation fuel, labor, and maintenance parts. In 2024, Qatar Airways’ operational expenditure for its fleet is expected to increase by approximately USD ~ due to rising fuel prices and higher labor costs associated with skilled aviation technicians. The pressure on MRO providers is heightened by the demand for highly specialized maintenance services, which requires significant investments in technology and training. The Middle Eastern aviation sector is particularly sensitive to these cost increases, with Qatar Airways allocating more resources toward maintaining its fleet and ensuring efficient operations in an increasingly competitive market. As per the International Air Transport Association (IATA), fuel prices are expected to rise by 5% in 2025, further exacerbating these costs.

Regulatory Compliance Burden

Aircraft maintenance providers in Qatar face stringent regulatory requirements, including compliance with Qatar Civil Aviation Authority (QCAA) standards and international regulations set by the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA). The regulatory environment necessitates regular audits, certifications, and the implementation of costly maintenance protocols to ensure safety and airworthiness. In 2025, Qatar’s aviation sector will continue to experience rigorous oversight, with the QCAA conducting multiple audits and requiring updates to Part-145 certification processes. The compliance burden often results in higher operating costs for maintenance providers, particularly smaller MRO players who may struggle to keep pace with these ever-evolving regulations.

Market Opportunities

Expansion of Line Stations Beyond Doha

As Qatar Airways continues to expand its global footprint, there is a growing opportunity to establish additional line maintenance stations at international airports to support its vast fleet. Currently, Qatar Airways operates several line stations across major airports in Europe, Asia, and the Americas. This network is expected to expand, with a focus on high-traffic hubs where the airline frequently operates. The expansion of line stations beyond Doha not only supports Qatar Airways’ operational needs but also creates new opportunities for local MRO providers to establish a presence at key global airports. In 2025, Qatar Airways will likely open two new line stations in Europe and Asia, aligning with its growing fleet and route network. The global market for aircraft line maintenance is experiencing significant investment in airport infrastructure, which will further enable this expansion.

Outsourcing Partnerships & Joint Ventures

The increasing cost of in-house maintenance operations is driving airlines in the region, including Qatar Airways, to explore outsourcing opportunities and joint ventures with specialized MRO providers. This trend is particularly noticeable in the Middle East, where airlines are collaborating with global MRO service providers to optimize maintenance efficiency and reduce operational costs. In 2025, Qatar Airways is expected to sign two major outsourcing deals with European MRO service providers, allowing for cost-sharing in parts procurement and labor services. This strategic move is part of a broader trend in the region, where airlines are seeking joint ventures to optimize operational costs. In the coming years, such partnerships will continue to drive market growth as airlines aim to leverage expertise and economies of scale.

Future Outlook

Over the next decade, the Qatar Aircraft Line Maintenance market is poised for substantial growth, driven by the increasing demand for international air travel, particularly from Qatar Airways. The fleet expansion plans of major airlines and the need for more advanced and frequent maintenance services will create new opportunities for MRO providers. With Qatar’s strategic positioning as a global aviation hub and continued investments in Hamad International Airport’s expansion, the line maintenance market is expected to see robust growth. Innovations in predictive maintenance and digital tools will also enhance operational efficiency, further driving market expansion.

Major Players

- Qatar Airways Engineering

- Gulf Aviation Maintenance Co.

- Lufthansa Technik

- HAECO

- Safran Aircraft Engines

- Boeing Global Services

- Airbus Services Qatar

- Rolls-Royce Qatar

- Bombardier Service Center Qatar

- Embraer Executive Care Qatar

- Air France Industries KLM E&M Qatar

- AAR Corp Qatar

- Qatar Aviation Services

- Qatar Aviation Maintenance

- GE Aviation

Key Target Audience

- Aircraft Operators and Airlines

- Aviation Maintenance, Repair & Overhaul Service Providers

- Aircraft Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airports & Ground Handling Companies

- Aircraft Component Suppliers

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify all key variables that impact the Qatar Aircraft Line Maintenance market, including operational costs, fleet growth, and aircraft types in operation. Desk research combined with secondary data sources is used to capture this information.

Step 2: Market Analysis and Construction

This phase involves the collection and analysis of market data, focusing on the growth trends, fleet requirements, and the line maintenance services demand, including transit checks, AOG services, and component rectifications.

Step 3: Hypothesis Validation and Expert Consultation

After constructing the initial hypotheses, we validate them through interviews with industry experts such as MRO service providers, airline operators, and key personnel at regulatory bodies. These consultations provide in-depth insights into the current market dynamics.

Step 4: Research Synthesis and Final Output

This phase involves synthesizing all the findings into a final report, ensuring that all insights from primary and secondary data sources are captured. Industry expert feedback is integrated to validate the findings and ensure accuracy.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Fleet Growth of Qatar Airways & Regional Operators

Rising Air Traffic Demand & Gate Turn Requirements

Digitalization & Predictive Maintenance Integration - Market Challenges

Operational Cost Intensity

Regulatory Compliance Burden

Airport Slot Constraints/Turn Delays - Opportunities

Expansion of Line Stations Beyond Doha

Outsourcing Partnerships & Joint Ventures

GCC Regional MRO Integration - Trends

Data‑Driven Predictive Analytics in Line Maintenance

Mobile Maintenance Stations at Secondary Airports

Outsourcing vs In‑House Service Balance - Government Regulations

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Service Type (In Value %)

Routine Transit Checks

AOG Response & Rapid Turnaround

Component & Defect Rectification

Line Station Setup & Management - By Provider Type (In Value %)

Airline Technical Operations

Independent MRO Providers

OEM‑Affiliated Providers - By Aircraft Type (In Value %)

Narrowbody

Widebody

Business & VIP Jets - By Customer Type (In Value %)

Commercial Airlines

Charter/Private Operators

Government/Defense Fleets

- Market Share of Major Players

- Cross‑Comparison Parameters (Part‑145 Approval Status, Line Check Turnaround Time, Line Station Coverage / Airport Footprint, Fleet Compatibility Index, Digital Line Maintenance Capability Score, Emergency AOG Response Time KPI, Customer Satisfaction / Service Level Score)

- Competitive SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Qatar Airways Engineering

Gulf Aviation Maintenance Company

Qatar Executive MRO

Airbus Services Qatar

Boeing Global Services Qatar

Lufthansa Technik Qatar

Rolls‑Royce Qatar

Safran Aircraft Engines Qatar

Bombardier Service Center Qatar

Embraer Executive Care Qatar

Air France Industries KLM E&M Qatar

HAECO Qatar

AAR Corp Qatar

Qatar Aviation Services

Qatar Aviation Maintenance

- Line Maintenance Decision Drivers

- Econometric Impact of Turnaround Time on Airlines

- End‑User Procurement Drivers

- Customer Retention & Cost Optimization Benchmarks

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035