Market Overview

The Qatar Aircraft Manufacturing market is a key component of the regional aerospace sector. As of 2024, the market size is valued at approximately USD ~, reflecting Qatar’s growing presence in the global aviation manufacturing ecosystem. The primary drivers of the market include government support, infrastructure investments, and a robust supply chain network. Qatar Airways’ expansion and its increasing fleet of commercial and cargo aircraft further stimulate demand. Additionally, the country’s focus on diversifying its economy, coupled with the development of aviation-related technologies, accelerates the growth of the aerospace manufacturing sector.

Qatar is home to some of the most prominent players in the aircraft manufacturing sector, with Doha emerging as a major aviation hub. The strategic location of Hamad International Airport, along with the country’s investments in cutting-edge manufacturing and research facilities, enables Qatar to dominate in the aircraft manufacturing space. Other dominant players in the market include global aviation powerhouses such as the United States, France, and the United Kingdom. These nations have maintained dominance due to their advanced technological capabilities, strong government support, and established aerospace ecosystems that serve as the backbone for global aircraft manufacturing.

Market Segmentation

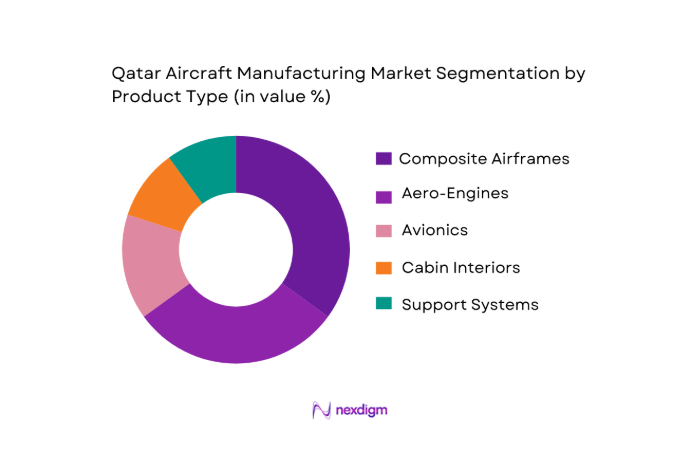

By Product Type

The Qatar Aircraft Manufacturing market is segmented into several product types including composite airframes, aero-engines, avionics, cabin interiors, and support systems. Among these, composite airframes dominate the market share in 2024, as manufacturers increasingly prioritize lightweight, fuel-efficient materials to reduce operational costs and environmental impact. Composite materials are being adopted at a rapid pace due to their ability to offer higher performance and corrosion resistance, essential for modern commercial aircraft. Global players like Boeing and Airbus continue to invest in the research and development of composite airframe technologies, solidifying their dominance in the aerospace industry.

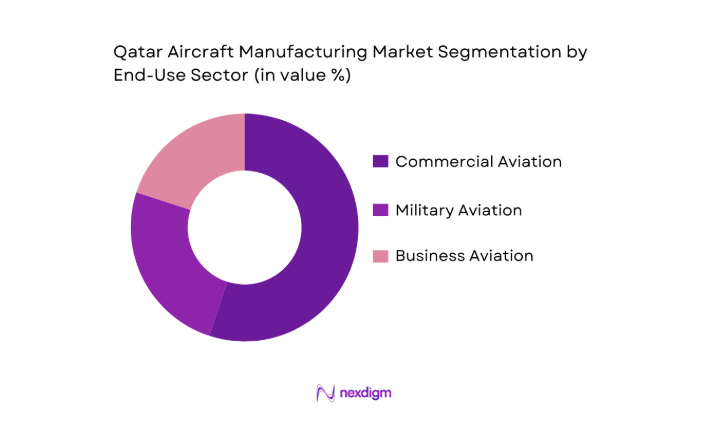

By End-Use Sector

The market is also segmented by end-use sector, which includes commercial, military, and business aviation. The commercial aviation segment holds the largest share, driven by the continuous growth of global air traffic and the expansion of airlines like Qatar Airways. This segment benefits from Qatar’s role as a key transit hub in the Middle East, connecting passengers globally. The demand for commercial aircraft is augmented by the rise in international and regional travel, and increasing fleet sizes as airlines upgrade to newer, more efficient models.

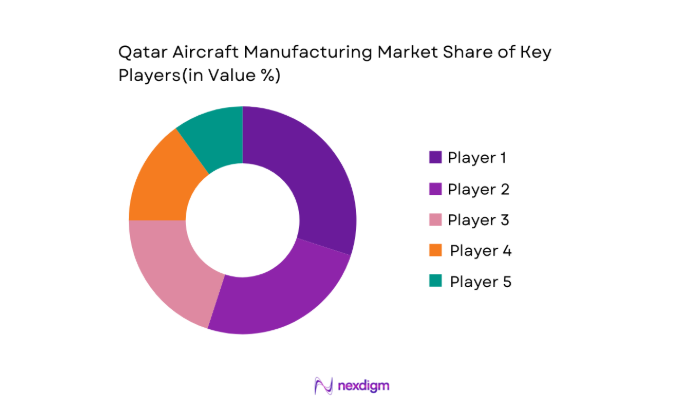

Competitive Landscape

The Qatar Aircraft Manufacturing market is dominated by a few key players, both local and global. Qatar Airways, in conjunction with its engineering and maintenance division, plays a significant role in driving the demand for aircraft manufacturing within the region. Global OEMs such as Boeing, Airbus, and Rolls-Royce also have a strong presence, owing to their comprehensive product portfolios and technology leadership. These players have built a strategic presence in Qatar due to the country’s aviation infrastructure, investment in aerospace R&D, and competitive manufacturing environment.

| Company Name | Establishment Year | Headquarters | Product Focus | Technological Capabilities | Annual Revenue (USD) | Market Presence |

| Qatar Airways Engineering | 1997 | Doha, Qatar | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1904 | Derby, UK | ~ | ~ | ~ | ~ |

| Safran Group | 2005 | Paris, France | ~ | ~ | ~ | ~ |

Qatar Aircraft Manufacturing Market Analysis

Growth Drivers

Fleet Expansion

The expansion of fleet capacity is one of the primary growth drivers for the Qatar Aircraft Manufacturing market. Qatar Airways, for example, has committed to expanding its fleet to 275 aircraft by 2025, from 230 aircraft in 2023. This expansion is supported by the increasing demand for air travel, with global air traffic projected to increase by ~ annually between 2024 and 2025 according to the International Air Transport Association (IATA). As air traffic growth continues, airlines in Qatar and other regions are increasingly opting for new, more fuel-efficient aircraft. Qatar’s investment in its fleet is aligned with its goal to become a global aviation leader, particularly in the Gulf Cooperation Council (GCC) region. The growing need for aircraft manufacturing and components directly correlates with fleet expansion strategies, especially in terms of long-haul aircraft like the Airbus A350 and Boeing 787.

Global Traffic Growth

Global air traffic growth remains a significant driver for the aircraft manufacturing market. The global aviation industry is projected to reach ~ passengers by 2025, up from ~ in 2024, a steady increase driven by economic recovery, particularly in emerging markets. The International Civil Aviation Organization (ICAO) estimates that by 2025, the total volume of air cargo handled will surpass ~ globally, up from ~ in 2024. Qatar Airways is a key player benefiting from this trend, as it bolsters its operations in both the passenger and cargo segments. As global traffic grows, the demand for new aircraft to meet rising capacity requirements further accelerates market development.

Market Challenges

High Capex

The high capital expenditure (capex) required for aircraft manufacturing presents a significant challenge to market players in Qatar. Aircraft manufacturing involves substantial investment in research and development, advanced materials, and manufacturing infrastructure. According to the World Bank, the average investment required for the development of new aerospace technologies and aircraft is upwards of USD ~ for large-scale OEMs. The financial commitment from both local manufacturers and international firms operating in Qatar is immense. For instance, the development of an aircraft such as the Boeing 787 or Airbus A350 can take over a decade and requires millions of dollars in production costs, testing, and regulatory approvals. This results in lengthy return-on-investment periods, which could inhibit the pace at which smaller and new market entrants can establish themselves within the Qatari aerospace industry.

Raw Material Volatility

Volatility in raw material prices poses a considerable challenge to the aircraft manufacturing market. Materials like titanium, aluminum, and carbon fiber, which are integral to aircraft production, face price fluctuations due to supply chain disruptions, geopolitical tensions, and shifts in global demand. For instance, titanium, which is critical for aircraft fuselage components, saw a price increase of nearly ~ in 2024. The U.S. Geological Survey (USGS) reported that the global supply of titanium mineral concentrates remains volatile, and the price of raw aluminum has also been subject to significant variation due to ongoing trade disputes and supply constraints. Manufacturers in Qatar, like elsewhere, face heightened production costs due to these fluctuating prices, making it difficult to predict manufacturing costs over time.

Market Opportunities

Localizing Aerospace Supply Chains

One of the most prominent opportunities in the Qatar Aircraft Manufacturing market is the push toward localizing aerospace supply chains. The Qatari government is incentivizing the localization of aircraft parts manufacturing, as part of its broader diversification goals under the Qatar National Vision 2030. With the global aerospace supply chain facing disruptions, Qatar aims to become a self-sustaining hub for manufacturing key components such as turbine engines, avionics, and landing gears. By fostering partnerships with local suppliers and international manufacturers, Qatar can reduce dependency on foreign imports and control its production costs. This initiative also benefits from Qatar’s robust infrastructure, including Hamad Port, which supports efficient logistics for raw material importation. This push aligns with the global trend of reshoring manufacturing activities to localize production, increasing resilience against external shocks and securing long-term growth.

Export Hubs

Qatar’s development as an aerospace export hub represents another significant growth opportunity. The strategic location of the country, with proximity to major international markets in Europe, Asia, and Africa, positions it well to serve as a regional export center for aircraft and components. As global demand for air travel continues to rise, Qatar can leverage its strong manufacturing base to cater to emerging markets in Asia and Africa. The export potential is also bolstered by Qatar Airways, which can serve as both a customer and a logistics partner in distributing aircraft and spare parts globally. Qatar’s government is investing heavily in air cargo infrastructure, aiming to strengthen its position as a global air transport hub for both passengers and freight.

Future Outlook

Over the next decade, the Qatar Aircraft Manufacturing market is expected to experience sustained growth driven by technological advancements and continuous government support for aerospace initiatives. Qatar’s focus on becoming a global aviation hub, along with its investment in state-of-the-art manufacturing facilities, will strengthen its position in the global market. With the growing demand for eco-friendly aircraft, innovations in materials and propulsion systems, and a focus on digitization and automation, the sector is expected to see significant technological upgrades, increasing its global competitiveness.

Major Players

- Qatar Airways Engineering

- Boeing

- Airbus

- Rolls-Royce

- Safran Group

- Honeywell Aerospace

- General Electric Aviation

- Collins Aerospace

- Lufthansa Technik

- Embraer

- Bombardier

- Thales Group

- MTU Aero Engines

- Pratt & Whitney

- Lockheed Martin

Key Target Audience

- Government Agencies

- Aerospace Manufacturers

- Military and Defense Contractors

- Investments and Venture Capitalist Firms

- Aircraft Component Suppliers

- Airlines and Aviation Operators

- Regulatory Bodies

- Aerospace Research & Development Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining key stakeholders within the Qatar Aircraft Manufacturing market. This includes analyzing market drivers such as government support, technological innovation, and infrastructure development. Desk research, secondary databases, and interviews with industry experts are conducted to identify critical variables influencing the market.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to assess market size, growth trends, and future forecasts. This phase also includes a review of market penetration, the share of key segments, and how different product categories are evolving. Additionally, regional and international data is factored in to build an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

The research hypothesis is validated through interviews with industry experts, including manufacturers, regulators, and end users. Their insights help refine market data and ensure the reliability of the findings. This expert consultation serves to validate assumptions and adjust the market projections accordingly.

Step 4: Research Synthesis and Final Output

Final insights are synthesized by collecting data from multiple sources, including manufacturers, aviation bodies, and academic institutions. This data is then integrated into a comprehensive analysis, providing actionable insights for decision-makers and stakeholders in the Qatar Aircraft Manufacturing market.

- Executive Summary

- Research Methodology (Definitions & Assumptions; Abbreviations; Market Sizing Approach; Consolidated Research Framework; In‑Depth Industry Interviews; Primary & Secondary Research Approach; Limitations & Future Outlook)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth drivers

fleet expansion

global traffic growth

strategic investments - Market challenges

high capex

raw material volatility

regulatory compliance - Market opportunities

localizing aerospace supply chains

export hubs - Market trends

advanced materials

composites uptake

autonomous systems - Government regulations & certification frameworks

- SWOT analysis

- Porter’s Five Forces

- By value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type (In Value %)

Composite airframes

Aero‑engines & propulsion systems

Avionics & onboard electronics

Cabin interior systems - By End‑Use Sector (In Value %)

Commercial

Military

Business - By Supply Chain Tier (In Value %)

OEM final assembly

Tier‑1 integrators

Tier‑2/3 sub‑components - By Technology Adoption (In Value %)

Additive manufacturing

digital twin

IoT & AI in production - By Manufacturing Mode (In Value %)

In‑house

contract manufacturing

co‑development

- Market share analysis of major players

- Cross‑Comparison Parameters (Production capacity (parts/aircraft), Technology maturity , Local content ratio, Quality certification & audit performance, Lead time efficiency, Supply chain resilience, Cost per unit & margin profile, Aftermarket support readiness)

- SWOT analysis of key competitors

- Pricing analysis

- Competitive Profiles of Major Players

Qatar Airways Engineering

Airbus

Boeing

Rolls‑Royce plc.

Safran Group

GE Aerospace

Lufthansa Technik

Bombardier / Airbus Business Jets

Embraer

Honeywell Aerospace

Collins Aerospace

MTU Aero Engines

Thales Group

COMAC

Local Qatar OEM partners / Tier‑2 suppliers

- Commercial airlines fleet procurement criteria

- Defense & government acquisition priorities

- Business aviation preferences

- MRO integration preferences

- By value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035