Market Overview

The Qatar aircraft micro turbine market is valued at USD ~ in 2025, driven by growing demand for lightweight, fuel-efficient propulsion systems across both civil and military aviation sectors. The expanding utilization of UAVs (unmanned aerial vehicles) and the increasing adoption of micro turbines for auxiliary power units (APUs) in commercial aircraft contribute significantly to market growth. Additionally, advancements in turbine technology, along with strong government initiatives to modernize defense aviation and the rise of sustainable aviation fuels (SAF), are expected to fuel future growth in the sector.

Qatar is a key player in the aircraft micro turbine market due to its substantial investments in defense and civil aviation infrastructure. Cities like Doha, which houses major aviation hubs such as Hamad International Airport, contribute significantly to the demand for advanced turbine engines. The dominance of Qatar is also influenced by the country’s strategic location in the Gulf region, which serves as a gateway for international aviation networks, and its growing emphasis on technological innovation within the aerospace sector, further supported by substantial government defense budgets.

Market Segmentation

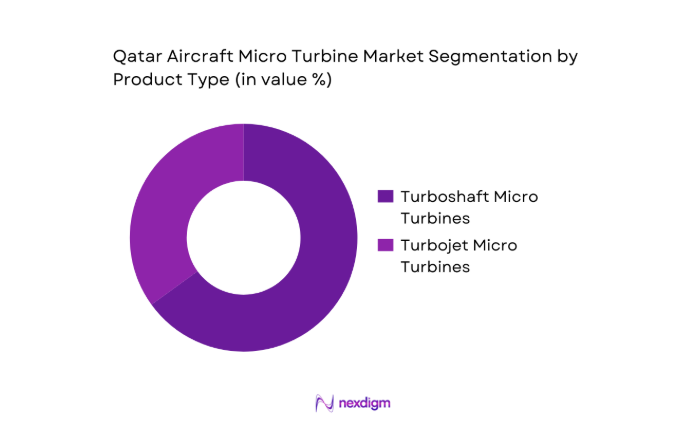

By Product Type

The Qatar aircraft micro turbine market is segmented by product type into turboshaft micro turbines and turbojet micro turbines. Among these, turboshaft micro turbines dominate the market due to their widespread use in both military and civilian rotorcraft, as well as UAVs. Their high power-to-weight ratio and fuel efficiency make them ideal for applications requiring reliable, compact turbines, contributing to their market share dominance. Additionally, advancements in lightweight turbine technology are further propelling the growth of the turboshaft segment, especially with the expanding use of UAVs for military and commercial purposes.

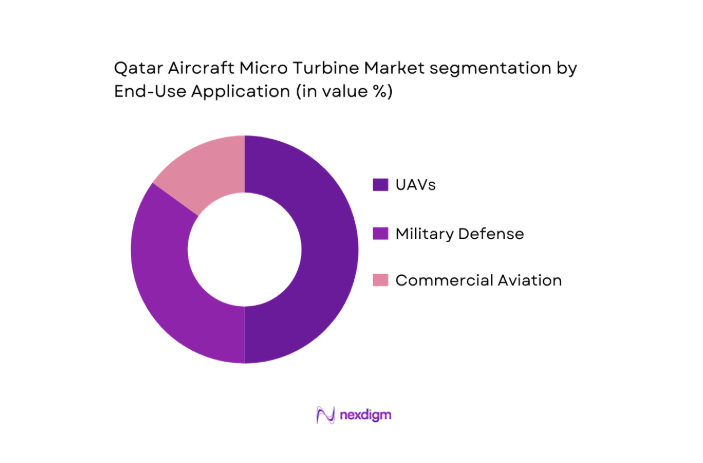

By End-Use Application

The market is also segmented by end-use application, which includes commercial aviation, military defense, and unmanned aerial vehicles (UAVs). The UAV segment holds a dominant share in Qatar due to the country’s growing focus on defense and surveillance UAVs. Qatar’s strategic military initiatives, coupled with the increasing demand for surveillance drones, are driving the substantial growth of the UAV sub-segment. Furthermore, advancements in UAV technology, particularly in terms of payload capabilities and flight duration, make micro turbines an ideal propulsion solution, further solidifying the UAV segment’s dominance in the market.

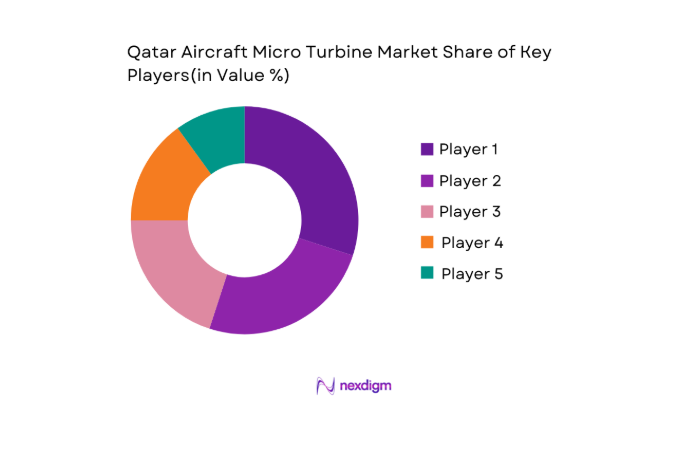

Competitive Landscape

The Qatar aircraft micro turbine market is competitive, with both global turbine manufacturers and regional players offering a range of products. The market is dominated by key international turbine manufacturers like Rolls-Royce, Honeywell, and General Electric, who bring decades of experience and established reputations for reliability. Additionally, local companies like Qatar Aeronautical College and Qatar Airways’ Engineering Division have started to establish a footprint in the maintenance, repair, and overhaul (MRO) sector, further enhancing their competitive presence.

| Company | Establishment Year | Headquarters | Technology | Market Focus | Product Portfolio | Strategic Alliances | Aftermarket Services |

| Rolls-Royce | 1904 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| General Electric | 1892 | United States | ~ | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| PBS Group | 1993 | Czech Republic | ~ | ~ | ~ | ~ | ~ |

| Kratos Defense | 1994 | United States | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Micro Turbine Market Analysis

Growth Drivers

Fleet Modernization

Fleet modernization is a key driver in the Qatar aircraft micro turbine market, primarily driven by Qatar’s continuous investment in upgrading its military and commercial aviation fleets. According to the International Civil Aviation Organization (ICAO), Qatar’s aviation sector has seen a ~ year-over-year increase in fleet expansions as of 2024, including new aircraft and upgrades to older fleets. Additionally, Qatar’s military sector is also actively modernizing its fleets, supported by a USD ~ billion allocation for defense in the 2024 national budget, as reported by Qatar’s Ministry of Finance. This is expected to fuel demand for high-efficiency turbine engines that are essential for modern, fuel-efficient aircraft operations. The market will continue to see strong growth as fleet upgrades emphasize reduced environmental impact and improved operational efficiency.

UAV Defense Programmes

The growing investment in UAV defense programs in Qatar is significantly contributing to the demand for micro turbines. Qatar’s defense budget for 2024 is approximately USD ~, with a focus on enhancing its UAV fleet capabilities. The Qatar Armed Forces are expected to significantly expand their UAV deployment in surveillance and defense roles. The Qatar National Defense Strategy (2024-2029) allocates over 25% of the defense budget to unmanned aerial vehicle (UAV) technologies, including research and procurement of UAV-specific propulsion systems. This ongoing military investment will drive the demand for lightweight, durable, and fuel-efficient micro turbines that are integral to UAV operations, increasing market requirements for compact and powerful turbines.

Market Challenges

Supply Chain Bottlenecks

Supply chain challenges are a significant hurdle in the aircraft micro turbine market in Qatar, primarily due to global disruptions in turbine parts and materials sourcing. The COVID-19 pandemic caused major delays in turbine component production, and although recovery efforts have been made, the World Bank reports ongoing challenges in the logistics and transportation sectors, with freight costs having increased by ~ in 2024 compared to pre-pandemic levels. Additionally, the global semiconductor shortage has delayed turbine component production, impacting the timely supply of micro turbines. These bottlenecks contribute to slow production times, which can delay aircraft deliveries and increase operational costs.

Certification Hurdles

The certification process for new turbine engines in Qatar’s aviation market remains a complex challenge. Regulatory hurdles within the Qatar Civil Aviation Authority (QCAA) lead to extended delays in the approval of new turbine technologies. According to the QCAA’s annual report for 2024, it can take up to 18 months for new turbine technologies to receive the necessary approvals for operational use, compared to the global average of 12 months. These delays not only hinder the adoption of advanced turbine technology but also disrupt the introduction of innovative products that could increase efficiency and reduce carbon emissions.

Market Opportunities

Public-Private Co-Development

Public-private partnerships (PPPs) are emerging as a critical opportunity in the Qatar aircraft micro turbine market. The Qatari government’s push towards technological innovation is creating an environment conducive to collaborations between defense agencies and private sector turbine manufacturers. For example, in 2025, the Qatari government allocated USD ~ towards joint ventures focusing on sustainable aviation technologies, including turbine development for UAVs. The establishment of these PPPs is expected to accelerate technological advancement and help achieve Qatar’s long-term aviation modernization goals. This trend will foster innovation and significantly boost the market for micro turbines used in both civilian and military applications.

MRO Expansion, Tech Licensing

The expansion of Maintenance, Repair, and Overhaul (MRO) services in Qatar presents a significant market opportunity for micro turbine manufacturers. Qatar Airways’ fleet modernization efforts have led to an increase in the demand for local MRO services, which, in turn, has created opportunities for turbine repair and aftermarket services. The Qatari government’s aviation strategy for 2024 emphasizes expanding MRO capabilities within the country, with over USD 200 million allocated for the development of new MRO facilities at Hamad International Airport. Additionally, technology licensing in turbine development for local MRO providers is another avenue for future market growth, as Qatar aims to reduce dependence on foreign turbine manufacturers.

Future Outlook

Over the next decade, the Qatar aircraft micro turbine market is poised for substantial growth, primarily driven by continued defense sector investments, the expanding UAV market, and the rise of sustainable aviation initiatives. The market will see continued technological advancements, especially in the efficiency and sustainability of micro turbine engines. Moreover, as global aviation transitions towards cleaner fuels and more energy-efficient systems, Qatar’s demand for lightweight, high-performance turbines is expected to increase. Innovation in hybrid-electric propulsion and the increasing application of micro turbines for small aircraft and UAVs will also play a significant role in shaping the market’s future.

Major Players

- Rolls-Royce Holdings

- General Electric

- Honeywell International Inc.

- PBS Group

- Kratos Defense

- Safran S.A.

- Elliott Company

- Williams International

- Turkish Aerospace Industries

- Pratt & Whitney

- PowerJet

- Textron Systems

- United Technologies Corporation

- Microturbo

- ZN Technologies

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace OEMs

- Military and Defense Procurement Agencies

- UAV Manufacturers

- Airline Operators

- Turbine Component Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and mapping all the key variables affecting the Qatar aircraft micro turbine market. This is done through extensive desk research and secondary data analysis, supplemented by industry interviews with key stakeholders in the aviation and defense sectors. The goal is to understand the market’s foundational elements, such as end-use applications, regional dynamics, and product preferences.

Step 2: Market Analysis and Construction

This phase focuses on compiling historical data for market analysis. It includes understanding the market’s penetration across various sectors like military, UAV, and commercial aviation. Service quality metrics, including turbine performance, reliability, and operational efficiency, are gathered to create a robust foundation for future projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends and growth drivers are validated through in-depth interviews with industry experts and manufacturers in the aircraft propulsion domain. This ensures the accuracy and relevance of assumptions made during the initial market construction phase.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the research findings and validating the conclusions by cross-referencing with industry reports and expert feedback. This phase ensures that the final analysis is comprehensive, backed by data, and provides actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth drivers

fleet modernization

UAV defense programmes

auxiliary power demand - Market challenges

supply chain bottlenecks

certification hurdles

geopolitical risk - Opportunities

public‑private co‑development

MRO expansion, tech licensing - Trend analysis

hybrid electric propulsion

digital twin diagnostics - Government policy & regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Installation Type (In Value %)

OEM production

Aftermarket retrofit & replacement - By End‑Use Platform (In Value %)

General aviation

Unmanned Aerial Vehicles

Auxiliary Power Units for commercial jets

Military/defense applications - By Engine Type (In Value %)

Turbojet micro turbines

Turboshaft micro turbines

Turboprop micro turbines

Hybrid micro turbine integration - By Horsepower Class (In Value %)

Below 50 HP

50–100 HP

100–200 HP

Greater than 200 HP - By Fuel Type (In Value %)

Jet fuel

Sustainable aviation fuels adoption indicators

Multi‑fuel capable systems

- Market Share and Positioning

- Cross‑Comparison Parameters (OEM vs Aftermarket revenue mix, Average unit price by engine class, Market penetration by end‑use platform, Service network coverage in GCC, Product reliability)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Rolls‑Royce Holdings plc

Honeywell International Inc.

General Electric

Pratt & Whitney

Safran S.A.

Kratos Defense & Security

PBS Group

Elliott Company

Williams International

Turkish Aerospace Industries

Zavod & Co.

Smiths Aerospace

PowerJet

Safran Helicopter Engines

Local GCC Service Alliance

- Aerospace OEM purchasing criteria

- Defense procurement drivers

- UAV operator value drivers

- Aftermarket service decision factors

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035