Market Overview

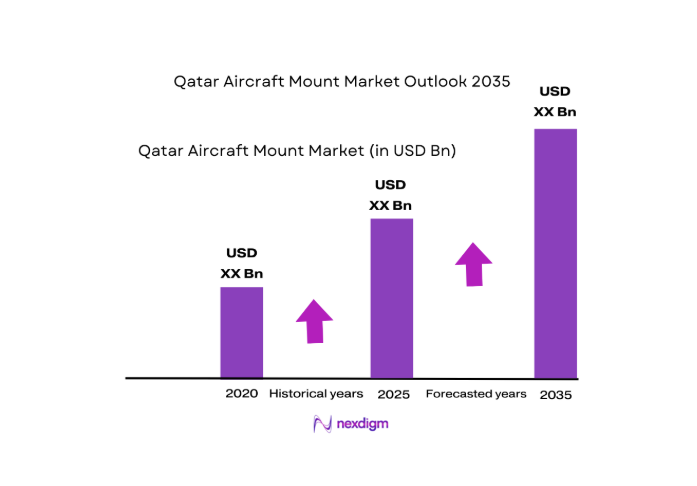

The Qatar Aircraft Mount Market is a vital segment within the broader aerospace and aviation industry, primarily driven by the increasing demand for aircraft maintenance, repair, and overhaul services, as well as the growing need for durable and high-performance components and is valued at USD ~. With the expansion of Qatar’s aviation sector, particularly through Qatar Airways and local military aviation fleets, the demand for aircraft mounts has surged. The market size is influenced by factors such as technological advancements in mount materials, the rise in passenger traffic, and Qatar’s position as a global aviation hub, bolstered by strategic infrastructure investments like Hamad International Airport. Additionally, regulatory standards and certifications are essential drivers for ensuring safety and quality in aircraft mount production and usage.

Qatar, specifically Doha, is a central player in the Aircraft Mount Market, due to its expansive air travel industry and strong local aviation base. The country’s capital, Doha, is home to Qatar Airways, one of the world’s largest and most technologically advanced airlines, and a major driver of demand for aircraft components, including mounts. Qatar’s investment in infrastructure, such as world-class airports and military aviation systems, strengthens the demand for high-quality aircraft mount solutions. Furthermore, the country’s strategic position as a hub for international air traffic between Europe, Asia, and Africa amplifies its dominance in the market.

Market Segmentation

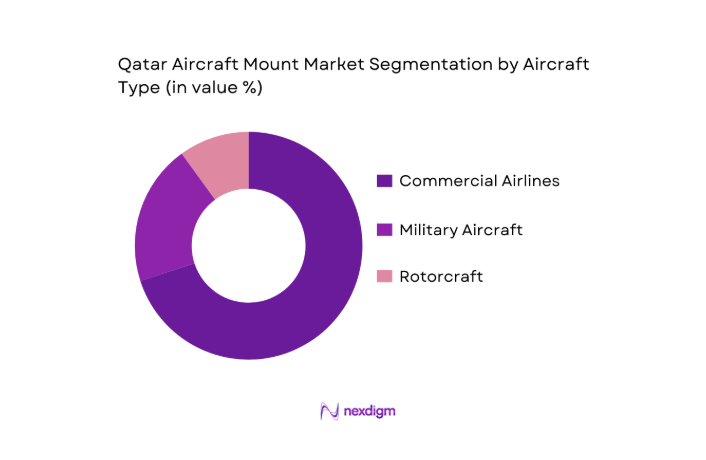

By Aircraft Type

The Qatar Aircraft Mount Market is segmented by aircraft type into commercial, military, and rotorcraft. Commercial aircraft, particularly narrowbody and widebody jets, dominate the market due to Qatar Airways’ extensive fleet and consistent growth in passenger air traffic. Commercial airliners require high volumes of aircraft mounts for engine installation, structural integrity, and avionics housing. The increasing demand for long-haul flights and fleet modernization projects contributes to the dominance of this subsegment. Qatar’s role as a major transit hub also drives this segment’s growth, as it services international flights requiring advanced and high-performance mounts.

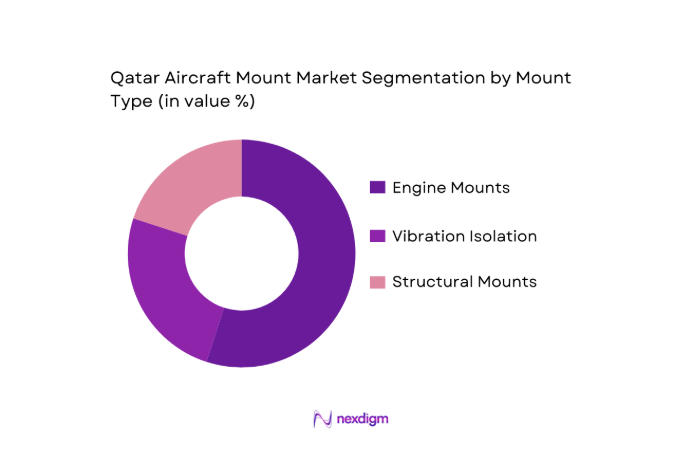

By Mount Type

The Qatar Aircraft Mount Market is also segmented by mount type, which includes engine mounts, vibration isolation mounts, and airframe structural mounts. Among these, engine mounts hold the largest market share, driven by their crucial role in engine integration and stability within commercial and military aircraft. The increasing emphasis on engine performance and noise reduction in the aviation sector, especially in commercial aircraft, is a key factor propelling the growth of engine mounts. Engine mounts’ reliance on robust material composites and precision manufacturing techniques makes this subsegment the largest contributor to the market.

Competitive Landscape

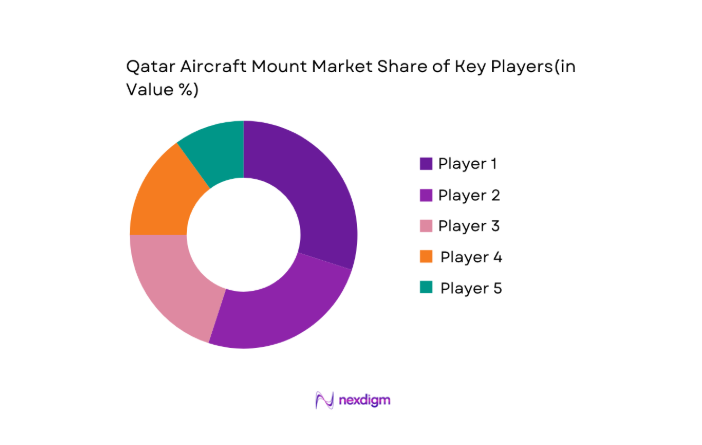

The Qatar Aircraft Mount Market is dominated by a few major players, reflecting a consolidated landscape. These players include both local and global companies that provide a range of innovative solutions in aircraft mount design and manufacturing. The industry is shaped by leading firms such as Eaton Corporation, Moog Inc., and Trelleborg Group, whose technological advancements, industry experience, and strong local partnerships make them the primary competitors in Qatar’s growing aviation sector. These companies benefit from advanced manufacturing capabilities, R&D in materials, and local MRO facilities, further enhancing their competitive position.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Reach | Local MRO Facilities | R&D Investments | Certification Standards |

| Eaton Corporation | 1911 | Ireland | ~ | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | USA | ~ | ~ | ~ | ~ | ~ |

| Trelleborg Group | 1905 | Sweden | ~ | ~ | ~ | ~ | ~ |

| LORD Corporation | 1924 | USA | ~ | ~ | ~ | ~ | ~ |

| Meeker Aviation | 1950 | USA | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Mount Market Analysis

Growth Drivers

Air Traffic Expansion

Qatar’s air traffic growth remains a significant driver for the aircraft mount market. With Hamad International Airport (DOH) seeing over ~ passengers in 2024, and Qatar Airways expanding its fleet with more than 50 aircraft additions in 2024, the demand for aircraft components such as mounts is directly linked to this rise in passenger and cargo transport. The global rise in air travel, particularly in the Middle East, has spurred infrastructure developments, which supports the continuous increase in air traffic. The global air passenger numbers are also expected to reach ~ by 2025, further supporting demand.

Fleet Modernization

Qatar Airways has aggressively pursued fleet modernization with a commitment to acquiring advanced aircraft like the Boeing 787 and Airbus A350, enhancing its fleet’s efficiency and capacity. This fleet modernization trend is expected to intensify, with Qatar Airways continuing to focus on replacing older aircraft models to reduce operational costs and increase performance. Qatar Airways’ fleet reached a total of ~ aircraft in 2024, with ongoing expansion plans aimed at improving efficiency and reducing carbon emissions. As fleets modernize, the demand for upgraded components like mounts will continue to rise.

Market Challenges

Regulatory Certification

The rigorous certification process for aircraft components, including mounts, poses a significant challenge to the market. Each mount must comply with stringent safety standards set by aviation authorities like the FAA (Federal Aviation Administration) and EASA . In 2024, the FAA certified over ~ aircraft components, but only a fraction were approved for integration into new aircraft. The complex certification process, including materials testing and performance validation, often delays the availability of new mount technologies. Moreover, regulatory standards are becoming more stringent with time, increasing operational costs for manufacturers.

Supply Chain Localisation

As Qatar aims to reduce its dependency on imports, the need for local supply chain development is becoming critical. Currently, over ~ of aviation-related parts and components, including aircraft mounts, are sourced from abroad. However, Qatar’s National Vision 2030, which emphasizes industrial diversification and local manufacturing capabilities, is pushing for supply chain localization. By 2024, the Qatari government is investing approximately ~ in the development of local manufacturing infrastructure. As such, the transition to locally sourced components will be essential for reducing costs but may take years to fully implement, posing challenges in the short term.

Market Opportunities

Localized MRO Mount Production

Qatar’s push towards localized MRO operations presents an opportunity for growth in the aircraft mount market. As part of its Vision 2030, Qatar is investing heavily in developing domestic MRO capabilities, which currently handle about ~ of the country’s aircraft maintenance needs. By 2024, the Qatar government plans to further develop this sector, targeting a significant increase in local MRO operations by 2026. This local capability could drive the demand for domestically produced mounts, offering a sustainable growth opportunity for local manufacturers.

Composite Adoption

The adoption of advanced composite materials is rapidly reshaping the aircraft mount sector. In 2024, the global aerospace industry is anticipated to use over ~ metric tons of carbon fiber-reinforced polymers, highlighting the shift towards lightweight yet durable materials in aircraft components. In Qatar, this trend is being accelerated with the growth of Qatar Airways’ fleet, particularly with the adoption of the Airbus A350, which features extensive use of composites. The use of these materials in aircraft mounts not only improves fuel efficiency but also reduces the wear and tear on components, creating a growing demand for advanced composite-based mounts in Qatar’s aviation sector.

Future Outlook

Over the next decade, the Qatar Aircraft Mount Market is expected to experience significant growth. This growth will be driven by the continued expansion of Qatar’s aviation sector, with increasing investments in both commercial and military fleets. The country’s strong economic performance, strategic location as an aviation hub, and sustained demand for maintenance, repair, and overhaul services will further fuel the need for high-quality aircraft mounts. Additionally, advancements in composite materials, vibration reduction technologies, and the increased focus on environmental sustainability will play key roles in shaping the future of the market.

Major Players

- Eaton Corporation

- Moog Inc.

- Trelleborg Group

- LORD Corporation

- Meeker Aviation

- Hutchinson Aerospace

- Cadence Aerospace

- Vibration Isolation Products, Inc.

- Airloc Ltd.

- Shock Tech, Inc.

- GMC Rubber-Metal-Technic Ltd.

- Parker Hannifin

- SKF Aerospace Solutions

- Honeywell International Inc.

- Mayday Manufacturing

Key Target Audience

- Aircraft Manufacturers

- Aerospace Component Suppliers

- Maintenance, Repair, and Overhaul Service Providers

- Engine Manufacturers

- Government and Regulatory Bodies

- Investment and Venture Capital Firms

- Aviation Industry Consultants

- Aviation Equipment Buyers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining key market drivers, including the size of the aviation fleet, local manufacturing capabilities, and supply chain characteristics. Secondary research is used to gather historical market data, while industry reports and databases help shape the research framework.

Step 2: Market Analysis and Construction

Market dynamics are studied in detail, using primary research with industry leaders to assess factors like market share, product demands, and the competitive landscape. Revenue estimates are also validated against industry benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with key stakeholders such as aircraft manufacturers, engine suppliers, and MRO service providers. This phase ensures that the findings are based on real-world insights from experts in the field.

Step 4: Research Synthesis and Final Output

In the final phase, the data is synthesized into actionable insights, with findings reviewed against historical trends. The results are cross-checked to ensure the final report reflects the latest developments and accurately forecasts future market trends.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Air Traffic Expansion

Fleet Modernization

Material Innovation - Market Challenges

Regulatory Certification

Supply Chain Localisation - Market Opportunities

Localized MRO Mount Production

Composite Adoption

Predictive Maintenance Integration - Key Market Trends

Lightweight Structures

Digital Twin & Health Monitoring Integration

Regional Aviation Hubs Influence - Government Regulations & Aviation Certification Standards

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By volume, 2020-2025

- By average price, 2020-2025

- By Aircraft Type (In Value %)

Commercial Airlines

Business & Private Jets

Military & Government Fleets

Helicopter & Rotorcraft - By Mount Type (In Value %)

Engine Mounts

Vibration Isolation & Shock Mounts

Airframe Structural & Landing Assemblies

Avionics & Systems Mounts - By Material Composition (In Value %)

Metallic Alloys

Composite & Advanced Polymer Solutions

Rubber & Elastomeric Components

Hybrid Integrated Materials - By Application (In Value %)

Structural Load Transmission

Vibration Damping & Shock Isolation

Avionics Housing & Support - By End‑Use (In Value %)

OEM Contracts

Aftermarket Replacement

Retrofit & Upgrades

- Market Share of Major Players

- Cross Comparison Parameters (Mount System Reliability, Material Strength‑to‑Weight Ratio, Certification Compliance Levels, Price Performance Index, Aftermarket Support Capability)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

Hutchinson Aerospace GmbH

Cadence Aerospace

MAYDAY Manufacturing

Eaton Corporation

Vibration Isolation Products, Inc.

GMC Rubber‑Metal‑Technic Ltd.

Trelleborg Group

Lord Corporation

Airloc Ltd.

Meeker Aviation

Shock Tech, Inc.

Moog Inc.

Honeywell International Inc.

Parker Hannifin

SKF Aerospace Solutions

- Performance & Safety Certification Requirements

- Lifecycle Cost & Maintenance Economics

- Compatibility & Integration with Host Platforms

- Local Aviation Policy & Fleet Strategy

- By Value, 2026-2035

- By volume, 2026-2035

- By average price, 2026-2035